Good morning!

Software Radio Technology (LON:SRT)

Advance notice that I am, tomorrow (Weds 21 Oct 2015) doing my next CEO interview, with Simon Tucker of SRT. I'll be asking the one obvious question - when are sales finally going to take off? If you have any other pertinent questions, then please leave a comment below this article, and I will try to include that in the questions i put to him tomorrow.

International Greetings (LON:IGR)

Share price: 134.75p (up 0.6% today)

No. shares: 58.8m

Market cap: £79.2m

(at the time of writing, I hold a long position in this share)

Trading update - this company describes itself as, "one of the world's leading designers, innovators and manufacturers of gift packaging and greetings, social expression giftware, stationery and creative play products".

Checking back through the archive here, to refresh my memory, I last wrote positively about this company on 26 Aug 2015 here, summarising the main points. The company issued an in line with expectations update then, and there's another one today.

The update today covers H1, i.e. the six months to 30 Sep 2015, and gives a number of upbeat-sounding bullet points. The key one says;

The Board is pleased to confirm trading for the six month period to 30 September 2015 is in line with expectations.

On the full year outlook, the company says;

Sales revenue in the year to date, together with a solid order book underpins our expectations for full year revenue.

Net debt is also flagged (important, as this has been an issue in the past);

Our seasonal working capital build in the run up to Christmas has recurred in line with expectations. However, we anticipate reporting H1 net debt significantly lower than at the same period last year.

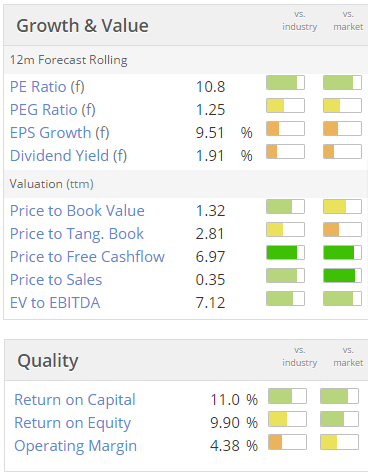

Valuation - despite the shares having had a good run, it still looks quite good value, and note that the StockRank is 99.

My opinion - there seems to be a decent turnaround underway at this company. Gervais Williams rates management here too - he was enthusiastic about this company a few months ago at Mello Peterborough.

The balance sheet has been inefficient in the past - with high inventories, funded with too much debt, but that seems to be improving.

All in all, I like it. If the turnaround continues, then I wouldn't be surprised to see these shares have another push upwards (maybe to 200p-ish, with a 1-2 year view)? Not madly exciting, but if I'm right about that, then a 50%-ish capital appreciation is not to be sniffed at.

I quite like the chart too (see below) - it's had a bit of a retrace, and seems to be finding support around here (in the 130-135p range).

GB (LON:GBG)

Share price: 252p (up 4% today)

No. shares: 123.1m

Market cap: £310.2m

Trading update - this "identity intelligence specialist" updates today on its H1 performance to 30 Sep 2015, as follows;

Group Trading Performance

Revenue is expected to be approximately £32.3 million (2014:£23.2 million) representing a year-on-year growth of approximately 39% (2014: 28%) and includes strong organic growth of 18%.

The Group expects to show adjusted† operating profit of £4.5 million (2014: £3.7 million), an increase of over 21% on last year after investing an additional £1.3m during the period in product and business development to drive future growth.

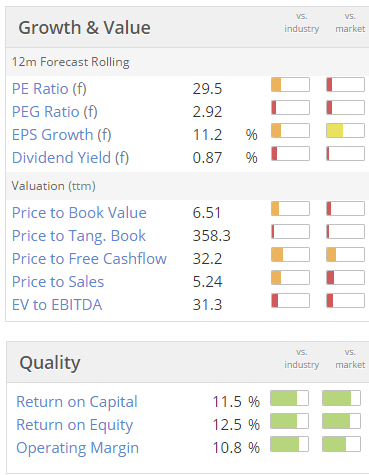

Sounds good, but is the company really worth £310m? The rating is looking very punchy indeed, so I do wonder where does it go from here?

My opinion - personally I would want to see more than 18% organic growth to persuade me to consider paying a fwd PER of 29.5.

One of my largest positions, Boohoo.Com (LON:BOO) for example has just delivered 35% organic growth, but (ex-cash of 6p per share) is on a fwd PER of 20. That strikes me as a better growth/value proposition.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.