Good morning!

I so enjoyed the documentary on TV last night about the problems within the Labour Party. It's even worse than the militant tendency infiltration of the 1980s. Much, much worse. The resulting schadenfreude gave me a surge of energy, which I put to good use by writing up 6 new company sections in yesterday's SCVR.

Here is the link to yesterday's full report.

These are the companies I commented on yesterday evening;

SKIL Ports & Logistics (LON:SPL) - total car crash - yet another overseas AIM company craps out. Foolishly, I got caught on this one, breaking my own rule on not buying overseas AIM stocks.

7Digital (LON:7DIG) - poor results, and running out of cash. Fundraising coming, probably.

DP Poland (LON:DPP) - poor interims. Still loss-making. Painfully slow progress. But good LFL sales growth. Bonkers market cap, for such a poor roll-out. Forecast to reach breakeven in 2018!

Adgorithms (LON:ADGO) - awful interim results, but pots of net cash. Shares at a discount to net cash, but beware - it's overseas & AIM.

Styles and Wood (LON:STY) - interims are nothing special, but it has heavy H2-weighting to trading. Shares have had a great run, but price looks up with events now.

Spectra Systems (LON:SPSY) - strange little company. Lacklustre interims, but optimistic noises about future potential. Cash-backed balance sheet. Has delivered nothing in last 5 years, so could just be more of the same?

Right, on to today's news.

French Connection (LON:FCCN)

Share price: 40.5p (down 7.2% today)

No. shares: 96.3m

Market cap: £39.0m

(at the time of writing, I hold a long position in this share)

Interim results, 6m to 31 Jul 2016 - bit of a mixed bag here, there's something for both bulls and bears. This is a strongly H2-weighted business (relying on big sales of party dresses for Xmas), so the interims are always ropey.

This time the loss before tax is flat against last year, at £7.9m, on turnover down 8.7% to £69.2m. Falling turnover is not necessarily a problem here, because it's a special situation where a massively loss-making retail division needs to be down-sized, to eliminate the losses.

Whilst licensing & wholesale divisions are good, profitable businesses. Therefore understanding FCCN means realising that it is 3 connected, but distinctly different divisions.

I've written mountains of stuff on this company, so if you want all the background, here is the archive.

I recommend having a look at an excellent open letter published recently by an 8% shareholder in FCCN, called Gatemore. This nicely summarises what's wrong with the business, and how to fix it. This echoes some of the points I've made about the substantial underlying value locked up within this company.

Stephen Marks, FCCN's founder CEO/Chairman has reinforced his reputation for pig-headedness by apparently refusing to meet with Gatemore. Trouble is, he owns 41.7% of the company, making it almost impossible to get rid of him. That size shareholding allows him to treat the company like a private company unfortunately.

I don't like arrogance in business leaders, but it can be tolerated if they perform outstandingly well. The problem here is that we've got stand out hubris, combined with dismal performance. This is only possible by virtue of a near-controlling shareholding. It's not good enough.

Retail division

You may ask, why can't FCCN just close down its loss-making shops? It would, if it could. The problem is that typically 15-year (from inception) leases often cannot just be surrendered or assigned. FCCN's financial strength has been its achilles heel, as landlords would rather keep FCCN as a tenant, and know they're going to get the rent, than allow FCCN to assign the shop to someone else with a weaker covenant.

However, over time leases expire and can be handed back to the landlord. Some leases can be sold or surrendered for a nice premium, e.g. FCCN's Regent Street shop was surrendered for a cracking premium - FCCN were paid £2.4m to get out of what was almost certainly a heavily loss-making shop. I think its Oxford Street shop (which is probably haemorrhaging cashflow due to massive rent & rates costs) could be worth millions, as it's on the other corner from Selfridges.

The good news is that there are signs of life in the problem retail division. Losses have been stemmed by £2.9m compared with H1 of last year;

The loss of £8.2m in retail was an improvement of £2.9m compared to prior year. This was made up of positive LFL sales of £1.9m, store closures of £1.1m and offset by a £0.1m currency impact.

Positive LFL sales of 6.5% in H1 is very good, but is flattered by very weak comparatives in H1 of 2015 at -10.7%. So at least some progress is being made here, which I find encouraging.

Ecommerce is included within the retail division, and it's doing well, rising from 22.3% to 26.5% of total retail revenue. I think that's good news.

To my mind, the future for this company is clearly to sell mainly online, and through third parties (via wholesaling), as it's really not very good at conventional retailing. I think the brand is too expensive & niche to work generally as standalone High Street shops. But it clearly does work online & within department stores.

Note that one of the relatively new NEDs is formerly from Asos, so should be having useful input in helping FCCN develop its online strategy. Another recent NED was a top product sourcing person from Next. So, for all his faults, at least Stephen Marks does seem to be bringing in people with the right experience.

Wholesaling

This division performed very poorly in H1.

Operating profit from this division dropped from £5.5m in H1 of 2015, to £3.0m this year.

However, all is not, as some credible reasons are given;

- Poor performance from USA Dept stores (a large part of this division's business)

- Difficult UK High Street environment (so why did FCCN's own retail division do OK then?)

- Lower level of in-season (i.e. repeat) orders.

- Knock-on impact on gross margins, with more discounting required to clear excess stock.

- Change of phasing of deliveries, with some moving from H1 to H2. This makes sense to me, as warmer late summer, early autumns in recent years means that autumn ranges may well be pushed out into Aug or Sep, rather than the July interim period end.

Encouraging noises are made about current wholesale trading;

Historically we have seen the wholesale business lag behind the performance of retail given the buying cycle, and this is reflected in an improvement now being seen in our wholesale performance in recent weeks.

Overall then, a rather disappointing H1 for wholesale, but based on the above, I think they should catch up to some extent in H2.

Licence income

This is the part of the business which demonstrates the considerable hidden value in the brand name. People pay FCCN to stamp their name & logo on various products, including perfumes, spectacles, accessories (e.g. handbags/purses), even sofas (through DFS).

There have been a few hiccups in H1 in this division too;

Licence income of £2.4m was generated during the period, a reduction of 20.0%.

Newer licensees again performed strongly, particularly the furniture licence with DFS.

We have moved our global fragrance licence to Inter Parfums in the period and while this is a significant move for the future it has caused a short term shortfall in income.

Also in the period our US based shoe licensee filed for bankruptcy, which required us to be conservative in our income recognition.

A mixed bag there, so you can either see it half full, or half empty.

The way I look at things, the licensing revenue is proof of the brand value, and even at H1's lower level, it still covered the costs of about half the group's central overhead. Last full year, at £7.3m (profit) it covered the bulk of the central overhead of £9.3m. That's a very nice position to be in. If they can just make wholesaling work better, and retail work at all, then the shares would multibag.

Dividends - there aren't any. Last one was paid in Jul 2012. So management keep getting paid their salaries, but shareholders get nothing. Hmmmm.

Balance sheet - remains very strong, although one has to keep an eye on that depleting cash pile - down to £7.7m at 31 Jul 2016. Although that will be a seasonal low, and exacerbated by the slower wholesale deliveries pushing into H2, mentioned above.

Bottom line, as things stand now, there are no solvency issues. That could change though, if trading falls off a cliff, but for now it looks fine.

Outlook - sounds OK, although I think the choice of works isn't quite right. You can hardly call a £7.9m loss in H1 a strong performance as a starting point;

Continued strong performance in the first six weeks of the second half

The Chairman/CEO sounds upbeat in his comments, and in my view he generally tends to tell it how it is in the results statements, so this can be relied upon to some extent (although obviously the future is always uncertain);

"Although the overall performance for the first half has been disappointing, the retail result has been particularly pleasing when compared to last year in what has been a difficult retail environment. Performance in wholesale and licensing has been more challenging but we have started to see an improvement recently and expect to see a recovery in the second half.

There is still much work to do in the rest of the year to move the business forward significantly but we believe the team we have in place and momentum we are seeing will help us to achieve this. As ever, the overall result will be dependent on the Christmas trading period but the second half of the year has started well."

My opinion - it's a given that performance is poor, and needs to dramatically improve to make this share go up a lot. However, it's a special situation, which requires deeper analysis.

It sounds as if there are good reasons to expect H2 to be better than last year, which should mean that the overall loss for 2016/17 seems to be heading for around the £2-4m loss level, I reckon. That's bad, but doesn't put the group under any solvency pressure. It gives the company more time to eliminate more loss-making shops, which is the key to unlocking value here.

I think risk:reward here remains good. The downside is protected by the balance sheet, and the brand value. Retail losses are at long last reducing, and the glitches in the wholesale & licensing divisions in H1 of 2016/17 don't look serious to me.

Overall then, I'm happy to hold, and remain of the view that, at some point shareholders might get a big payday here. Although we may have to be patient, and it does tie up money that could be put to use elsewhere.

This share tends to polarise views, which is fine, that's what makes a market! Shareholders have to be ready to tolerate a bumpy ride too, as you can see from the 2-year chart below. That dip to 22p in Sep/Oct 2015 was a fabulous buying opportunity! I flagged up this opportunity in my report of 21 Sep 2015, concluding that it was worth buying more at 25.75p, which I did. Although as with a lot of bargain buys, it's very difficult to do at the time, because everyone keeps telling you what an awful thing averaging down is.

Judges Scientific (LON:JDG)

Share price: 1285p (down 9.5% today)

No. shares: 6.1m

Market cap: £78.4m

Interim results, 6m to 30 Jun 2016 - Judges last updated the market in July, which I reported on here, with a puzzling update which seemed to be a full year profit warning, and also mentioned disappointing Q1 order intake. So we've already been warned that H1 2016 results will be below H1 2015.

In that context, the H1 figures announced today don't look to bad to me, if you accept the adjusted figures;

- Adjusted pre-tax profit down 11.4% to £3.0m for the half year.

- Adjusted basic EPS down 19.2% to 33.2p.

Clearly not very good, but not a disaster either, and we had been previously warned to expect a weak H1.

Profit warning - however, there's another full year profit warning;

"This has been a period of contrast, with success in the pursuit of earnings-enhancing acquisitions and frustration in respect of short-term trading performance.

At this stage, the Board therefore believes that the full year results will be significantly below market expectations."

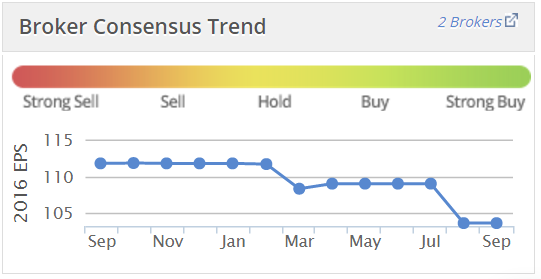

Looking at Stockopedia's terrific little graph that shows the last 12 month movement in broker EPS consensus forecasts, you can see that there have already been a series of reductions. So today's update means a further reduction in forecasts is on the way;

Broker update - W H Ireland has reduced its earnings forecasts quite considerably today. 2016 EPS is now forecast to be 82.8p - that's a 17% reduction from its previous forecast of 100p EPS. Quite a big drop.

WHI has also reduced its 2017 EPS forecast by a similar percentage.

I wonder why the market has been so unperturbed to only reduce the share price by 9.5% today? It seems to me that a 20-30% share price fall would have been more appropriate.

Order book - is down on last year, closing at 10.7 weeks, versus 11.7 weeks last year. This doesn't exactly suggest a bumper H2 is on the cards.

Dividends - the interim divi is up from 8.1p in 2015, to 9.0p this year, so that's good. Although note that the divi yield is quite modest, at c.2%.

Outlook - ah, this looks to be the reason that the market is giving the company the benefit of the doubt - there are some quite positive outlook comments. Although once again, as with the 20 July 2016 update, it ends with a bombshell in the last sentence;

The Group's business environment remains uneven.

The long term effect of Brexit is difficult to gauge but, in the short term, the Group benefits from the most favourable global exchange rates since 2009.

Although exports represent a vast majority of the Group's sales, the UK is not an insignificant market and it may remain adverse until the Brexit negotiations are concluded.

China has been an important source of growth and its continued appetite for education and research investment remains an important factor in the Group's development.

The Group remains convinced of the long term growth of the sector, however the Board believes that medium term growth is dampened by its dependence on public funds. As a result the Group is currently more vulnerable to short-term performance fluctuations.

Positively, this has not affected the pursuit of our business model as seen through our continued completion of value enhancing acquisitions.

Order intake in the third quarter continued the more positive trend observed in June and organic order intake since the beginning of the year is now ahead of the comparative period in the prior year.

A satisfactory outcome for the year still depends on this improvement being sustained and on a continued revival of Armfield's market and on the resolution of the aforementioned production issues. At this stage, the Board therefore believes that the full year results will be significantly below market expectations.

Overall then, I find that somewhat confusing. It sounds as if things are improving, so why does the narrative then conclude by saying full year results will be significantly below market expectations (which have already been lowered in July)?

Balance sheet - not great, but probably OK overall, providing profits don't slip any further, is my overall view.

NAV of £21.9m becomes negative NTAV of -£1.7m when you write-off intangible assets.

I wouldn't want to see the company take on much more debt.

My opinion - earnings expectations for this have fallen a lot - starting at 111.9p a year ago, to 82.8p today. Therefore, my inclination would be to steer clear. Or not pay more than a PER of say 10.

So for me, this share would only start to get interesting if the price fell by about another 35%.

As WH Ireland concluded today, the company needs to earn back the right to have a premium rating, after a series of disappointing updates this year.

A few quickies to round off with:

Fastjet (LON:FJET) - the new CEO is desperately trying to salvage something from this mess. Fleet size is to be downsized from 5 to 3 aircraft, which are then going to be replaced with 3 smaller, leased aircraft. That's presumably in order to realise the cash from selling owned aircraft in order to burn up that cash too.

Amazingly, "investors" put another $20m into this crock in Aug 2016.

The H1 2016 figures are just a joke;

- Revenue $33.1m

- Operating loss (continuing activites) $31.0m.

Balance sheet - NAV of minus $10.7m at 30 Jun 2016. This will have been helped (temporarily) back into surplus with the c.$20m raised in Jul/Aug 2016.

My opinion - this company has been a gigantic value destruction machine - it's cumulative losses are a staggering $280.2m (retained earnings, on the reserves section of the balance sheet).

I simply cannot understand why any fund manager would have thrown their investors' money away, by participating in the various placings. I bet few (if any) put their own personal money into FJET shares. It's been obvious for several years that this company was going nowhere fast. If simple bloggers like me (and others) can spot the obvious flaws, why can't the fund managers?

I'd be amazed if this company still exists in a year's time. It's going to zero in my view.

Pittards (LON:PTD) - confident for full year, but interims unremarkable.

All done for today. See you in the morning!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.