Good morning!

It's very quiet for results/updates today too.

Ed's webinar starts at 12:30 today. These are always very intereting, often pointing out useful features within Stockopedia that I didn't know were there! The focus today is on the thousands of new international shares that have just been added to the site.

United Carpets (LON:UCG)

Share price: 13.0p (up 16.9% today)

No. shares: 81.4m

Market cap: £10.6m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 31 Mar 2016. This company describes itself as:

United Carpets Group plc, the second largest chain of specialist retail carpet and floor covering stores in the UK

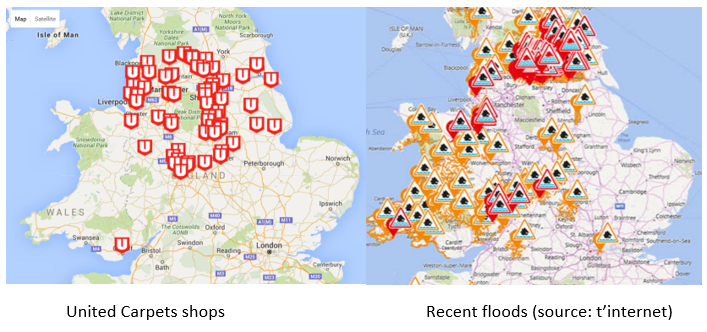

As the map on its website shows, its shops are clustered mainly in the Midlands, and North of England. Apart from one shop which seems to have escaped to South Wales. Note that the areas recently hit by flooding seem to be reasonably near to UCG's stores, so perhaps it has received some benefit from customers having to replace flood-damaged carpets?

Trading has been good:

...pleased to announce that the improved trading performance seen in the first half of the financial year ending 31 March 2016 continued into the second half of the financial year. On a like for like basis, sales for the second half increased by 6.4% against the comparable period last year.

As a result, the Board now expect its final results for the year ended 31 March 2016 to be ahead of market expectations.

Excellent stuff.

Valuation - it looks cheap to me. The house broker has today upped its forecast for y/e 31 Mar 2016 to 1.43p. That values the company at a PER of 9.1 - which looks good value for a small, growing company, which is trading well.

Balance sheet - the house broker also notes that UCG has £1.5m in net cash, about 14% of the market cap.

Dividends - note that the business has been decently cash generative of late, and came storming back onto the dividend list in 2015, after a hiatus of not paying divis since 2011.

A special divi of 1p was paid in Jun 2015, then 0.75p paid in Oct 2015, and another 0.125p in Jan 2016. So shareholders have received 1.875p in divis in the last year - that's a yield of 14.4%!

Broker forecast is for only 0.4p in divis this year, which looks unduly pessimistic to me - there should be scope for more special divis, I suspect.

Note that Directors own about 66% of the company, so we're very much in their hands. Although the big divis suggest interests are well aligned.

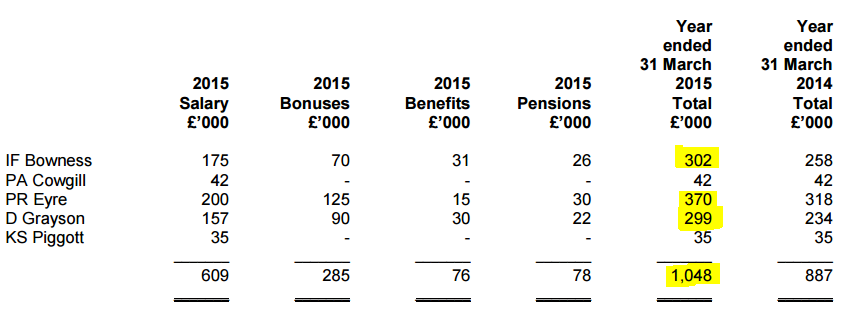

Director remuneration - on checking the last annual report, I feel that the Director remuneration is excessive for the size of company, so this is an issue. I would rather see remuneration reined in, and instead divis further increased. If you already own two thirds of a business, paying yourself a hefty remuneration package seems unnecessary, seeing as you're going to pocket two thirds of the divis too:

Operating profit for y/e 31 Mar 2015 was £1,207k. This is stated after charging £1,048k Director remuneration. So operating profit before Director remuneration was £2,255k. Therefore the Directors actually took 46.5% of the company's profits as their remuneration! That's an astonishingly high proportion. Surely some moderation is needed here?

Or put another way, Director remuneration last year was 9.9% of the current market cap! That must be a record.

My opinion - it's good to see the company trading well, beating market expectations, yet the PER remains in single digits. This is despite having a strong balance sheet, with net cash, and an excellent recent record of divis paid.

The house broker reckons the shares are "significantly undervalued", and I agree. Perhaps this is due to lingering worries given that the company went bust in the last recession, having taken on onerous leases. Hopefully this time around the experienced management team won't make the same mistake again.

Anyway, so far so good.

Obviously, as the free float is so tiny, it's an extremely difficult share to trade. So that introduces further problems, such as having to pay a wide bid-offer spread, and not being able to buy in any decent size most of the time.

I've held for about 2 years now, and am delighted with the share price

performance, and the divis. It's a small position, in the "tuck away &

forget part of my portfolio". Note that this stock also has a

terrific StockRank of 98.

Lakehouse (LON:LAKE)

(at the time of writing, I hold a long position in this share)

CEO resigns - not really a surprise, this. The announcement says he's given 6 months notice, as contractually required to, but my guess is that he'll be put out to pasture very quickly.

The Board has started looking for a new CEO.

So there we go,

Slater Investments & Steve Rawlings have succeeded in their aims to take

control of the company. Let's hope they can restore some shareholder value.

Corero Network Security (LON:CNS)

£8m placing - the company must have a good story to tell, for its anti denial-of-service product. The 22p placing looks a nasty discount, but that's only really because the market price had spiked up in the last few days. The placing would have been arranged when the price was lower, as these things take a few weeks to do.

Just in the nick of time too, as the company is pretty much out of cash.

Results for y/e 31 Dec 2015 look horrendous - a loss before tax of $11.6m, on turnover of only $8.3m.

The narrative does however contain upbeat information about contract wins, etc. for its flagship SmartWall TDS product.

I try not to invest in anything jam tomorrow these days, as the success rate is so poor. It's like searching for a needle in a haystack. Good luck to people who are punting on this being a success.

Torotrak (LON:TRK)

Trading update - Just the usual jam tomorrow stuff. This company really is a complete joke. It has spent donkey's years trying to commercialise various automotive projects, and has effectively got nowhere.

One of its 3 projects called bus KERS is effectively being abandoned, as lower fuel prices have stifled demand.

The market cap still looks far too high, at c.£26m at 4.8p per share. I say this because history suggests that the company is likely to just burn through its cash pile, achieving nothing of commercial value, just like it has done throughout its entire history.

Mporium (LON:MPM)

2015 results - I've had a quick look at the figures, and put it straight on the Bargepole List.

This type of mobile marketing business hardly ever reaches commercial success. It's got the remnants of MoPowered in it, if you remember that disastrous IPO.

All done for today. What a ragtag of mostly rubbish companies reporting today!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.