Good morning!

Tangent Communications (LON:TNG)

Share price: 7.5p

No. shares: 277.1m

Market Cap: £20.8m

From what I can make out, this is basically a company that prints marketing material, through its websites. Today's announcement has derailed the bull case, with the shares currently down about 20% on the day.

General comments on profit warnings - Profit warnings are fairly frequent with small caps - it's an occupational hazard unfortunately, as small companies are usually reliant on a small number of key clients, contracts, products & staff. Whereas larger caps have a more diversified spread of business, which smooths out bumps in the road at any individual part of the group.

This high risk of profit warnings is why it's such a bad idea for investors to use gearing, or to over-concentrate one's portfolio with small caps. Been there, done that. In my view, little to no gearing, and a reasonable degree of diversification is the only way to go with small caps investing. Together with a focus on strong Balance Sheets of investee companies (so that they can survive & recover from profit warnings).

Therefore I always look at profit warnings as potential opportunities - especially in a bull market this can often be your only chance to buy into a good company at a reasonable price. Also, profit warnings tend to be forgiven much more quickly in a bull market - in a few weeks the share price can be recovering again.

However, it all hinges on separating out the good companies from the bad. Also, the old adage that profit warnings come in threes has to be borne in mind - i.e. management usually don't give the full picture at the first profit warning, there is very often more bad news to come.

So weighing up all these factors is just as much an art as a science - interpreting the wording, and assessing how open & honest management are, matters just as much as the figures. I will usually only buy if the valuation still stacks up if another 20% fall in earnings (beyond what has been reported at the current profit warning) can be comfortably absorbed.

Profit warning from Tangent - today's trading update covers the six months to 28 Aug 2014, so it's a week early, as presumably the company has tried to recoup the shortfall but now realise it's too late. The key part says;

Group underlying operating profit for the year to 28 February 2015 is now expected to be comparable with the prior year. Net cash at year end is expected to be £2.5m.

Looking back at last year's results, underlying operating profit was up 53% to £2.5m, but last year's growth seems to have been flattered by an acquisition, since they say up 20.4% on a like for like basis. So matching last year's strong results doesn't seem so bad for this year. Maybe this is a buying opportunity?

Next we need to understand the causes of the profit warning, and interpret that - crucially, are they transitory factors, or more structural problems? (the latter clearly being more of a concern).

Tangent generates the majority of its sales and profits from its Online business. However poor trading at our Agency, Tangent Snowball will see group profits in the first half below market expectations.

That sounds encouraging if the shortfall is just down to a smaller, non-core part of the business. So the main part of the business (online) is trading alright then?

Online sales are expected to grow by 10% to £8.7m with underlying operating profits comparable to the prior year.

Hmmm, so turnover is up, but profits are flat. That sounds as if the business is under pricing pressure from competitors, and/or has cost increases that it's had to absorb. Maybe both. It's not good though - it suggests to me that this is a business with little pricing power, chasing turnover growth. Hence profits may permanently be under pressure from competitive pressures - not really the type of business that I like investing in usually.

As regards the agency business that is blamed for most of the profit warning, Tangent says;

Agency sales are expected to decline by 20% to £4.5m with underlying operating profits £0.45m lower than the prior year.

Tangent Snowball revenues were affected by budget cuts from two key clients, and the previously announced divestment of operations in Australia. Headcount has been reduced, at a one off cost of £0.25m, and resources re-channelled into our online print businesses.

Tangent Snowball has been downsized and is now a leaner and more agile business.

This chimes with my earlier comments about small caps often being dependent on a few key clients. This is why we should not overpay for these stocks. They should be on low PERs, to reflect the higher risk, unless growth is stellar, when a premium rating can be justified. I think a lot of small caps are over-priced at the moment.

Overall the above sounds worrying, and maybe the numbers for Snowball should be stripped out of the valuation altogether? Or even a negative value put on it, to reflect possible further restructuring costs?

Let's have a picture, to break up the text - I'm conscious that this is rather long-winded, but I'm trying to talk readers through my process of assessing a profit warning;

Valuation - Looking at EPS, last year's results show underlying EPS of 0.62p (underlying). Stockopedia shows a forecast for this year of 0.78p. So presumably that will now be revised down to 0.62p, or possibly lower, as it looks as if there have been more shares issued. Ignoring that for the moment, then a share price of 7.5p is a PER of 12.1 times 0.62p EPS - doesn't seem particularly cheap to me.

Dividends - Unusually, the company has paid a 0.2p dividend for the last 7 years in a row. That's great for consistency, but it's not a particularly appealing yield, at 2.7%. Moreover, you'll pay about that just in the bid/offer spread, so for income seekers it's better to go for higher (5%+) yields on large caps, where you give away virtually nothing in the bid/offer spread.

Balance Sheet - Today's announcement says;

Net cash at year end is expected to be £2.5m.

I'm wondering whether this is a typo, and they meant to say at the half year end (of 31 Aug 2014)? Seems strange to be reporting an expected cash figure six months in advance (the year end is 28 Feb 2015). I have just called the company & left a message, to clarify this point. Will update this article if/when they reply.

Overall, looking at the last Balance Sheet from 28 Feb 2014, it looks fine to me. Working capital is good, with current assets being a very healthy 194% of current liabilities. There are negligible long term creditors, which is good, so no concerns there at all - it passes my Bal Sheet testing with flying colours.

My opinion - I wouldn't buy at the current price, as it's not cheap enough yet to reflect that this is not a great quality business, and that profit growth has now stalled. However, it will be one to monitor, and see if there is better future potential in the pipeline. I'm not keen to get into this sector - it's low margin work, with lots of competition. I saw management at an investor presentation a few months ago, and thought the CEO seemed OK.

Office2office (LON:OFF)

Share price: 49p

No. shares: 36.3m

Market Cap: £17.8m

I imagine that shareholders in this financially distressed office supplies company are delighted, and breathing a huge sigh of relief this morning at a 51p recommended cash offer for the company. That's a remarkable 85% premium to last night's closing price.

Does this mean that it was wrong to avoid these shares? Absolutely not. Risk:reward was bad, due to the company's diabolical Balance Sheet, and excessive debt. Investing in companies with such poor finances will deliver many 100% losses over the long term. However, in this case it has worked out well for shareholders that bought in the last year (who frankly need their heads examining for doing so!), but not so well for shareholders who held previously, as this five year chart shows;

If I were a shareholder here, I'd grab the money now & get out, foregoing the 2p bid premium that's left in the market price, to have certainty of receiving the money. A very lucky escape in my view!

SkyePharma (LON:SKP)

Share price: 249p

No. shares: 104.8m

Market Cap: £261m

This company is larger than usual for me, and is also in a sector I don't normally cover, pharmaceuticals. However, it was a share I held on & off pre credit crunch, so decided to reacquaint myself with the numbers today, to see if things have moved on. They certainly have, and it looks rather interesting now, in my completely non-expert view.

The company seems to make oral drug delivery products. I don't understand the products, but am intrigued by the figures, as follows;

Interim results - for the six months ended 30 Jun 2014 are published today. The share price has only moved slightly, down 1.7% today, so the figures must be roughly what investors expected. Revenues are up 10% to £34.4m, and operating profit is up 187% to £13.2m. So it's a proper company now, making sales & decent profits.

I don't have time to go into the detail today, but just to flag up what looks potentially interesting to me;

- The Balance Sheet has been fixed, with a £112m capital raising. So it now has net debt of only £2.9m

- Revenues from products launched since March 2012 comprised 62% of total revenues, up from 51% in H2 2013 - this sounds bullish to me.

- Products are being launched in additional countries - again sounds bullish for growth.

- Outlook - sounds positive (see below)

Prospects for the year remain in line with the Board's expectations. Revenues in H2 2014 are forecast to grow compared with H1 2014 driven by increasing momentum from products launched in the last 2½ years

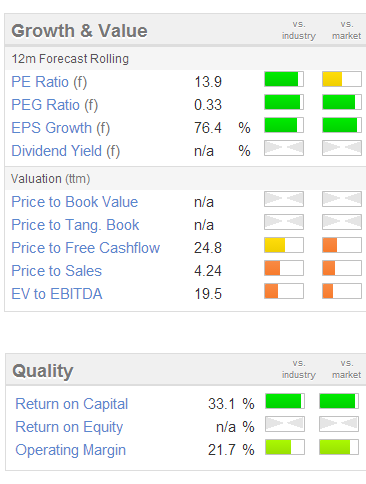

Valuation - See the usual Stockopedia graphic below - it shows a great combination of modest forward PER, with an excellent growth rate, so very low PEG (very positive). Also note the high quality scores as well - so this could be a rare growth at reasonable price (GARP) stock?

My opinion - More research is necessary, but from an initial very quick review, I think this could be potentially interesting as a GARP stock - hence me throwing the idea over to readers, for you to have a look. Please do come back with any feedback, especially if it's a company you know well, as I'm interested in readers' views.

Before signing off, here is one more quick comment;

Cloudbuy (LON:CBUY) - Impressive story, but the interim figures today look weak. Operating loss of £1.6m in H1, and only £2.3m in the kitty, so will need another Placing soon by the looks of it. I wasn't at all impressed when I met management, and the business model seems to hinge on a tiny rebate from VISA for customer transactions that are converted by CBUY onto payment by company credit cards. I'm sceptical about this one. Maybe it will work, but at 40p the market cap is nearly £45m, which looks very aggressive to me.

Got to dash, off to the opticians.

See you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SKP)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.