Good morning!

US markets - buying the dip?

Things are getting very interesting. I was following the US market last night, and there was a real sense of fear, and unrelenting selling, resulting in the Dow dropping 358 points, the S&P 500 down a similar percentage (-2.1%), and NASDAQ worst, down -2.83%. Those are big drops for such large indices. Necessary correction, or the start of a bear market? No idea, but I want to be prepared for either.

Incidentally, just to point out to a CNBC commentator last night who said he's been a market professional for 35 years, the singular of "indices" is "index", not "indice". I stopped listening to him after that. If people don't get the basics right, are they going to be any good on more complex things?

Apparently 125 of the S&P 500 stocks are now in a bear market (down 20%), according to another commentator, which is a bit scary. Although to my mind, the US market is the most obviously over-valued market, so it needs a correction to bring valuations down to more sensible levels. Also I bet a lot of those are resources stocks.

I'm starting to worry, so am feeling less sanguine about markets overall than I was a few days ago. My main worry is that "buying the dip" is going to fail at some point. We don't know when, but when it does fail, I think the aftermath could be very scary - a market crash basically.

Looking at the 10-year chart above, of the S&P 500 it shows what an amazingly successful strategy buying the dip has been since early 2009. It is now totally ingrained in the mindset of US investors that you buy the dips. However, look how the Index has repeatedly failed to make new highs this year. It's starting to look like the market has made a high it can't break beyond. So my worry is that, with many US stocks now over-valued, some grotesquely so, then the path of least resistance could become downwards. Where the US leads, the UK follows.

Relentless buying of the dips (and ignoring fundamentals) is bound to cause a market crash eventually, as it has driven some US valuations sky-high, and the risk is that everyone will simultaneously try to sell, when key levels are broken. It's similar to the conditions that caused the 1987 crash - when algorithmic trading resulted in a stampede for the exit, also when valuations were stretched.

Portfolio hedging

There seemed real fear in the US market last night, and the selling developed across the board. I've been keeping a list of (what I think are) wildly over-priced US large caps, so have been waiting for the right time to put on some shorts, so I did that early last night - follow me on Twitter if you're interested in that kind of thing, as I don't talk about short positions or shorter term trading here on Stockopedia - these articles are mainly for small cap, longer term value/GARP investing, and general market comments.

Generally speaking, it's too risky to short small caps, in my view. So I only tend to put short positions on large caps occasionally, and they act as a nice hedge to my illiquid small caps in turbulent markets. Or shorting Indices, or using Options, are other ways to hedge a portfolio. The trouble is, by the time it becomes obvious that you need a hedge, it's usually too late! Also, hedges are generally quite expensive - e.g. options become a lot pricier when volatility rises, and they usually expire worthless.

So as things stand now, I've pruned my geared account, and have slung out anything that I have less conviction about, plus opened some large cap shorts as hedges, so reckon that I'm now in good shape for whatever the market can throw at me!

Gearing

Talking of gearing, memories of 2007-8 are burned into my memory, and having learned my lessons the (very) hard way back then, I'm keen to warn other people of the dangers of gearing, and of course I won't be making those same mistakes again. In a nutshell, gearing is catastrophic in a big market downturn.

The safest way to approach things is to not use any gearing at all. However, if you absolutely must, then I think the following points are vital;

- Gearing is best applied to relatively safe shares, NOT blue sky things which could drop enormously on bad news.

- A geared portfolio should not be too concentrated into any one particular stock, or sector.

- Liquidity can dry up in a market downturn, so geared positions must be sized so that you can get out easily, even in a bad market.

- At the first sign of general market trouble, it's best to cut the gearing right back, so that you can survive any further market falls. Don't become a forced seller on margin call, later on.

- I've found that gearing up a diversified portfolio to say 1.5x equity is usually survivable (largely uscathed) in a market correction, but any more than that is getting into dangerous territory. Certainly 2.0x equity or more is a very risky level of gearing, when markets are falling (especially if you're in speculative stocks, which drop the most in a downturn).

- Geared accounts need constant monitoring, as the gearing can easily escalate way beyond what you intended.

Here is the link to my spreadsheet for managing overall exposure in a geared account, which several people have told me is very useful (just save it into your own Google Drive under a different name, then put in your own data), so feel free to use it if you wish.

Overall, arguably the best way to hedge a portfolio is just to sell anything you're not 100% comfortable with, and hold some cash. I've done that in the last few days, chucking out some small positions in things that I don't have much conviction in. That frees up cash to buy good stocks on sharp falls, which you can often get with small caps, in low volume trading such as we have now.

Indices - sectors

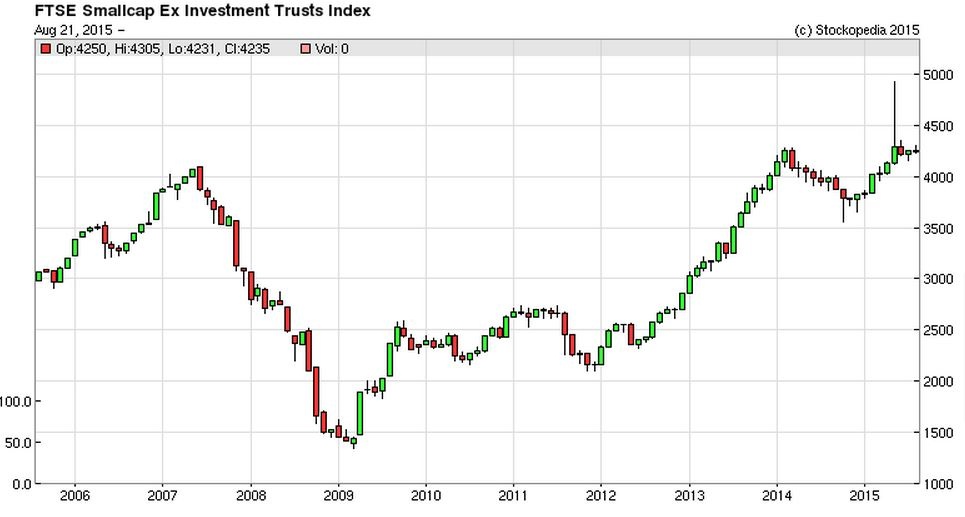

The big Indices, like the S&P500, Dow, and over here the FTSE100, have dropped heavily, but a lot of that is due to the sell-off in the Resources sector. I see that lots of small cap investors/traders on Twitter are bragging about how they're doing quite well at the moment. That's to be expected, as UK small caps actually haven't had much of a sell-off at all so far, indeed FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX) is looking rather healthy, and is just shy of a multi-year high (see 10-year chart below).

Although personally I think a lot of fully listed (as opposed to AIM) small caps are now quite expensive, so I doubt SMXX has the ability to go up much further from here in the short term anyway:

Turning to AIM, it has lots of resources stocks in it, plus a lot of very flaky (i.e. rubbish!) companies, so it has been a relatively poor performer - see how it has badly lagged fully listed small caps (the beige comparison line) below, especially since the highs of Mar 2014:

Anyway, let's see what happens. The key thing is to watch what the US markets do. If "buy the dip" works again, then we're fine for the time being. But at some point it will stop working, then there will be trouble!

Conclusion

So my mindset with small caps now is to really question the valuation of everything I'm invested in. If it looks fully priced, then from now on, I'll be selling. Although thinking about it, that's what I do all the time already.

Although I'm now looking at every share in my portfolio, and saying, would I be happy to continue holding if it dropped 10%, or 20%, or 30%? Are the fundamentals good enough? Is the valuation reasonable? Would I buy more after those kind of drops? If the answers are no, then it's probably better to sell now, rather than waiting for it to fall, and then selling.

Also, I think most of the fall in the Indices has been due to the carnage in the resources sector. Although I'm watching closely to see if it triggers a more general market sell-off, which seemed to be happening in the US yesterday. Should selling of over-valued US stocks really matter to me, given that I invest in reasonably-priced UK small caps? It will cause collateral damage, that's the trouble, but ultimately shares are valued on the fundamentals, and everything else is background noise in the long run.

What do readers think? Are you getting nervous and cutting positions, or are you going to ride out any downturn? If you're holding cash, will you buy the dips on specific stocks?

Software Radio Technology (LON:SRT)

Share price: 31.25p (up 6.8% today)

No. shares: 127.5m

Market cap: £39.8m

(at the time of writing I hold a long position in this share)

$5.0m contract win - I don't normally comment on contract win announcements, unless some figures are given, and they look material. And/or, if the company says that performance is over or under market expectations.

Today's announcement sounds material, in the context of market forecast of £10m sales for the current year (ending 31 Mar 2016), so a $5.0m contract win is about £3.2m, so 32% of current year sales (if the contract is all delivered this year).

This $5.0m contract is;

...the initial phase of a long term programme with additional phases expected in the future.

So even more encouraging, that this is the "starter for ten"! The statement does not reveal the identity of the customer, other than that it's a "national authority".

SRT's CEO, the affable Simon Tucker, has also confirmed in today's announcement that their "sales pipeline opportunities" total c.£200m - many multiples of current turnover forecasts, so if they start seriously converting opportunities into sales, then it could be very positive.

My opinion - the problem with SRT is that it's been a serial disappointer. The technology sounds great, and they claim to be the major player globally in a niche with little credible competition. Yet converting opportunities into actual sales has been frustratingly slow, and erratic - with good and bad years seemingly alternating, as you can see from the Stockopedia graphs below;

Today's announcement sounds good, and maybe there's a chance that sales could really start to snowball, at long last? Mind you, people have been saying that for years now!

Perhaps the market cap of nearly £40m already prices-in the upside? I'm not sure that buying a few this morning was a good idea, but I did it anyway. I'm hoping that there might now be continued good newsflow, and possibly broker upgrades? Although equally the £40m mkt cap arguably already factors some of that in. Hmmm, I'll have a think about this - it's not something I'll buy heavily, but for the moment as a fun money punt it looks a lot more sensible than lots of other stocks on AIM.

TechFinancials Inc (LON:TECH)

Share price: 20.25p (down 28% today)

No. shares: 68.2m

Market cap: £13.8m

Profit warning - I've not looked at this company before. It only listed on AIM on 16 Mar 2015, and it's warning on profit forecasts just five months later! That's pathetic.

The company is a software developer for online financial markets trading. It today says;

...the Company will not meet market expectations with regard to revenue and profit for the year to 31 December 2015. However, management expects OptionFair to return to a higher level of customer conversion and improved profitability in the next financial year.

Various reasons are given, including increased R&D spend. It seems to have a Cyprus-based subsidiary called OptionFair, if I've understood that correctly, which has been impacted by increased compliance costs, and lower customer conversion.

To have issues like this occurring just five months after listing is unforgivable, so this stock has gone on my Bargepole List.

Also, I think we need to look more closely at which advisers are floating companies that disappoint after listing. In this case, the broker & placing agents were: Northland Capital Partners, and Argento Capital Markets.

I might add a new page on my Bargepole List, to list the advisers who earn the hefty fees from floating overpriced rubbish (if it warns on profits just five months after listing, then it can't be seen as anything else, surely?). That would make interesting reading, as I bet the same names will crop up over & again.

Westminster (LON:WSG)

Share price: 17p (down 11.6% today)

No. shares: 56.5m

Market cap: £9.6m

Update on ferry project - there's been a delay to the launch of a ferry service to be operated by this company in Africa. A propshaft is out of line, and has to be fixed off-site. The repairs are expected to take 15 days, so not a disaster. Operations are now expected to start in Sep 2015.

Looking back at their track record, this really doesn't look like a viable business. It loses money every year. That has been financed by new shares being repeatedly issued - the average number of shares has gone up from 15m in 2009, to almost four times that amount today.

Admittedly they were very unlucky with Ebola last year, but even so, it was losing money before that too. I think you'd have to be an eternal optimist to invest in this company. I've never liked it, thank goodness, as the share price has been a disaster. Why do people buy shares in companies like this?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.