Good morning! When I first started investing, an old friend taught me that you have to ask one key question before relying on a PE multiple to value any company - "are earnings sustainable?". If the answer to that question is yes, then you have to try to accurately guess what sort of upward trend in earnings is the most likely to happen, and value the company accordingly. The faster, and more certain the earnings growth, then the higher the PER that can be justified, within reason.

The good news is that, at this stage of the economic cycle, most people (including brokers making forecasts) tend to under-estimate the effect of operational gearing, and hence companies tend to out-perform against forecasts in an economic recovery.

That means two things - that if you spot a good company with decent management on a reasonable rating, then you might well get a pleasant surprise on results day. The opposite also being true - that if you over-pay for a company that does not deliver strong profits growth, then you'll get a nasty shock on results day as the share price will open a lot lower. In a bull market investors often over-pay for growth stocks, and that is very much the case at present - I can foresee many of today's extremely expensive growth stocks leaving investors heavily out of pocket once reality dawns on people. Momentum doesn't carry on forever. However, the odd one will do very well.

So with the market for smaller caps generally quite expensive at the moment, there are going to be a lot of banana skins around this year, as those hefty PERs come down to earth with a bump for companies that fail to deliver strong earnings growth. So you have to be very, very sure that a company is indeed going to perform well, before paying an expensive earnings multiple for the shares.

Fairpoint (LON:FRP)

At the opposite end of the valuation spectrum is Fairpoint (LON:FRP) which is a debt management company, helping consumers recover from severe over-indebtedness. They seem to operate ethically, from what I can ascertain.

At the opposite end of the valuation spectrum is Fairpoint (LON:FRP) which is a debt management company, helping consumers recover from severe over-indebtedness. They seem to operate ethically, from what I can ascertain.

I listened in on a conference call with management last year, and asked a few questions, and they sounded competent.

This whole sector was cleaned up a few years ago when protocols were agreed with the Banks on fees. So it's a call centre based model, that works well.

However, this comes back to my original question above, "are earnings sustainable?" My worry is that the credit cycle was such that the Banks threw money at people up until 2008, leading to a lot of problem borrowers needing to IVAs, but the taps were then turned off in 2008. So inevitably the pipeline of problem borrowers must be shrinking.

On the other hand, there are numerous zombie households just about managing to make their mortgage payments with interest rates ultra-low, who will get into difficulties once rates rise, which I think will happen a good bit sooner than most people think - or should do anyway - later this year in my view.

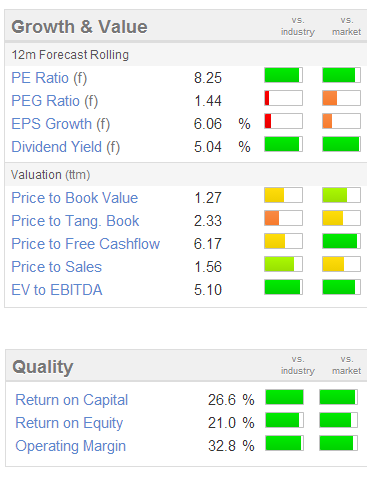

Anyway, as you can see from the Stockopedia valuation graphic above, it's a sea of green with a low forward PER of just 8.25,a nd an excellent dividend yield of just over 5%. Margins & ROCE/ROE are all very strong too. So it's purely a question of how sustainable those earnings are.

They have diversified into PPI claims management against the Banks for customers, but that again is a waning supply of earnings. Their trading update this morning sounds good though - adjusted profit before tax for 2013 is in line with expectations. However, their core IVA services have "remained challenging", requiring cost reductions. Interestingly though they are boosting the shortfall in IVAs by acquiring book of existing debt management plans, for cash up-front. So it's an interesting business model where they can buy in growth to replace waning new business, if I understand things correctly.

So the number of plans they manage has increased considerably (by 9,000 new cases) since the year end, taking the total to 24,000 plans. So that should underpin earnings for 2014 I hope. They had net cash of £2.8m at the year end, but have paid out £4m since then to acquire more portfolios of payment plans to manage, and have bank facilities of £13m available.

I hold a small number of these shares personally, and on this valuation am happy to continue holding. The company's strategy to use its surplus cash to buy up similar assets, and thus maintain earnings, looks sound. Although I have a general dislike of any ambulance chasing type businesses, although in this case they are helping people resolve high levels of indebtedness, so are actually doing good.

The shares have done very well in the last two years, out-performing the small caps index, as you can see from the (I've tried to make the beige comparison line more bold, but can't see any presentational options at all, so this is just how it comes I'm afraid!);

Mission Marketing (LON:TMMG)

I also like the trading update this morning from Mission Marketing (LON:TMMG). It's a stock I highlighted last year, which has since risen about 50%. In a short and sweet update today, the company says that H2 was strong, and hence they expect to be in line with market expectations for 2013 as a whole. Gearing has further reduced. I had a meeting with their FD last year, and was impressed with what they have done to get on top of previously problem bank borrowings, which are now under control.

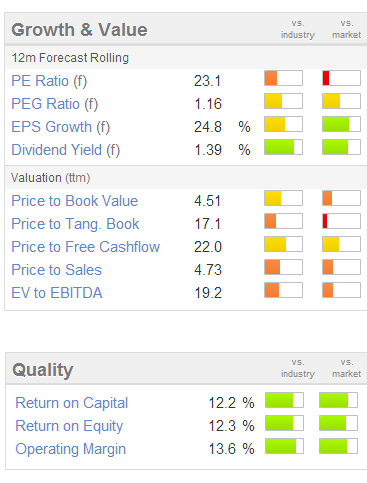

The PER is looking cheap here, although remember to factor in the debt too! Although I am increasingly amazed at how many investors are completely ignoring debt at the moment. That's madness, but if people are willing to keep buying low PER shares and ignore the debt, then to a certain extent I can see the logic for anticipating price rises, and being flexible with my investing approach.

The PER is looking cheap here, although remember to factor in the debt too! Although I am increasingly amazed at how many investors are completely ignoring debt at the moment. That's madness, but if people are willing to keep buying low PER shares and ignore the debt, then to a certain extent I can see the logic for anticipating price rises, and being flexible with my investing approach.

The key thing is to avoid shares where the debt looks likely to bring the company down, although you can never be sure - e.g. Silverdell imploded without warning, but didn't seem to have problem levels of debt.

There's no doubt that we're in a decent economic recovery now, so marketing companies are an excellent (and still reasonably priced) sector to be looking at, in my opinion. There is plenty of scope for operationally geared rises in earnings, as previously under-utilised people now begin to pull in more business. Although staff will also be demanding pay rises now as well, so overheads will also be rising.

Personally I am happy to pay 5-10% more for a share immediately after a positive trading statement, because it de-risks the share in the short term anyway. If you buy before knowing what current trading is like, then you're taking the risk of a profits warning, which could wipe 30% off the share price instantly. Why take that risk? Hence one of my golden rules is to always try to buy shares after positive trading updates or results, providing the valuation is still reasonable.

IQE (LON:IQE)

This company has issued an interesting trading update today. I don't know anything about this company, but it describes itself as a leading global supplier of advanced wafer products and wafer services to the semiconductor industry.

Revenue for 2013 has grown 43% to be "at least £126m", although this seems to have been driven by a large acquisition (of Kopin Wireless) made in Jan 2013, that was financed by a mixture of cashflow & debt. Net debt is now £35m at 31 Dec 2013, although this looks just about OK, given the cash generation here - EBITDA is reported as at least £24.5m for 2013.

Based on the figures alone, as I have zero understanding of their sector, this looks potentially interesting. Adjusted fully diluted EPS for 2013 is reported at 2p (2012: 1.51p), so with the share price up 6% today to 27.5p, that looks like a PER of 13.7.

There is also some other debt, being deferred consideration. So all in all, perhaps it's priced about right? That depends on the outlook, which sounds pretty positive;

The Board remains confident that the Group can continue to deliver increased free cash flow over the coming year and beyond, asthe business continues to diversify, and cost synergies from recent acquisitions are realised...

We look forward to further increasing cash flows and earnings during the current year and beyond as we maintain our strong position in wireless and continue to leverage opportunities to exploit our products in other high-growth markets.

Restore (LON:RST)

Document storage company Restore (LON:RST) has issued its year end trading update for 2013. It says trading was in line with expectations. On the outlook they say;

We have a strong position as a supplier of key services to UK offices, a stable, growing customer base, particularly of larger entities across both the private and public sector, and strong visibility of earnings. Our markets remain robust, and we continue to have an excellent platform for profitable growth.

Looking at valuation, the shares have today come off almost 5% to 165p, which values the company at about £123m. That's a pretty high multiple of sales (forecast at £55m for 2013), but I note that the net profit margin seems to be rising rapidly, on the forecasts for 2013 and 2014.

EPS is forecast at 7.6p for 2013 and 9.1p for 2014 on Stockopedia, but another website gives 10.5p and 12.2p EPS forecasts respectively. Sometimes differences in the data arise because one is the adjusted figure, and the other is the reported figure. So where forecasts differ, it's best to try to get hold of the actual broker notes.

The dividend yield is poor at about 1%. There's net debt of £17.8m at the last reported Balance Sheet date of 30 Jun 2013, so that's nearly 24p per share. I can't get excited about the valuation here, the share price looks pretty much up with events to me. Is a document storage company ever going to attract a premium rating? Investors are always going to worry that long-term, there won't be any need for document storage, as everything goes digital eventually.

Optos (LON:OPTS)

Optos (LON:OPTS) is a maker of equipment for retinal imaging. It had a bumpy year in 2013 (the year end date is 30 September), with at least one profit warning. Results for the year ended 30 Sep 2013 show a sharp drop in turnover & even sharper drop in profit, from $26.3m in 2011/12, to $9.2m in 2012/13 (note they report in US dollars).

However, the market has taken their shares back up again, on the back of a 25% increase in the installed customer base (customers seem to lease or buy machines from Optos), and I presume that Optos sell consumables once the machines are installed?

So their IMS today covers Q1 (i.e. Oct-Dec 2013). It's a rather confusing statement. They state that there has been a 10% year-on-year increase in customers, with the installed base now up to 6,219 machines (up 5% in the last 3 months). They then say that underlying revenue is up 3% for Q1, but headline revenues are down 9.7% to $36.4m for Q1. This has totally confused me, so I can't take it any further - they should have given a much clearer explanation.

Full year guidance is reiterated, but they don't state what that is, just refer us back to a statement in Nov 2013. So I can see why the shares have dropped today - it's just a badly written trading statement that sends mixed messages, with no clear overall pointer on profits vs expectations, which is all that really matters.

Broker consensus seems to be about the equivalent of 11.3p EPS for this year (converted into sterling), so the PER of 17.2 doesn't look good value to me, given the volatility in profits in recent years. On a more positive note, they have reported renewal of bank facilities to Jan 2017, which will be reassuring for shareholders. Net debt is reported at $39.7m at both the year end, and the end of Q1 (31 Dec 2013). The debt is more than matched by receivables from lease customers, so it looks fine to me.

As you can see from the two year chart below, Optos shares have meandered up & down, badly underperforming the small caps index (which has roughly doubled in the last two years! Astonishing isn't it?)

Next Fifteen Communications (LON:NFC)

Another marketing company, this one had a glitch late last year, when the FD fell on his sword after audit adjustments being required at two of their offices. However, as I reported on 5 Nov 2013, the results for year ended 31 Jul 2013 were nowhere near as bad as might have been feared, with adjusted profit down from £9.6m to £7.7m, hardly a disaster.

So I flagged it as a recovery play at 74p, and that was a good call, as it has since recovered to 90p, not a bad return (21%) in less than three months. Their AGM trading statement today reports;

...a good start to the new financial year, largely driven by double digit organic growth and strong overall margins in our Northern American business.

This is significant as it's the bulk of their H1 trading period (five months of it). They report trading in line with management expectations, despite the strength of sterling (against the dollar and Euro) holding back reported revenues and profits.

Several companies have mentioned the stength of sterling as an issue, so I think it would be worth reviewing our portfolios to see which companies are likely to be affected badly by stronger sterling - so mainly companies that are exporting from the UK, and companies which have large overseas earnings that they translate into sterling.

Companies that will benefit from higher margins will be non-food retailers, who import mainly in dollar-denominated purchases. Also consider the impact of currency hedging - as that will delay the impact only, so could lull us into a false sense of scurity! Although the movement in sterling hasn't been huge, so good companies should be able to absorb an adverse currency movement in the normal course of events.

So it all sounds quite positive, and the valuation here looks attractive in my opinion, on a PER of only 9.25, and a dividend yield of 3.36%, reported by Stockopedia's graphics copied on the right here (to follow shortly, my software has crashed, so need to re-start my PC!)

am continuing to write, so please refresh in your browser later - aiming to finish about 2pm today, as there is so much to report on!

Netcall (LON:NET)

It's almost a year since I last reported here on Netcall (LON:NET) when I thought there might be scope for their shares to go a little higher from 37p. They've actually gone a lot higher, rising 68% to 62p today. This looks a very rich valuation to me, so investors buying the stock must either be oblivious to valuation and buying purely on sentiment (which is a big part of the market right now, so don't laugh it off), or they must believe the company can beat market forecasts.

Stockopedia shows 2.5p EPS forecast for the year ending 30 Jun 2014, and 2.8p the year after. Another website shows higher forecasts at 2.69p and 2.95p respectively. So even on the highest consensus forecast for next year, the PER is still over 20. I can't get my head round that. It doesn't seem attractive in risk/reward terms to me - what if there is a glitch along the way?, which often happens with small caps - the share price would take a battering, as both lower earnings estimates and a lower rating would combine, which is why profit warnings are so nasty, because they hit the valuation twice.

Stockopedia shows 2.5p EPS forecast for the year ending 30 Jun 2014, and 2.8p the year after. Another website shows higher forecasts at 2.69p and 2.95p respectively. So even on the highest consensus forecast for next year, the PER is still over 20. I can't get my head round that. It doesn't seem attractive in risk/reward terms to me - what if there is a glitch along the way?, which often happens with small caps - the share price would take a battering, as both lower earnings estimates and a lower rating would combine, which is why profit warnings are so nasty, because they hit the valuation twice.

So you would really need to know this company inside-out, and be very confident about its prospects, to pay the current price, in my opinion. Although it does have £ 10m in net cash - some of which is up-front payments from customers.

Netcall only pays a 1.4% forecast dividend yield, so perhaps they are hoarding cash for acquistions? The trading update today sounds upbeat, with the company saying;

The Company has continued to trade comfortably in line with management expectations throughout the first half of the year which has been characterised by strong sales momentum and double digit percentage growth in orders from new and existing customers.

The wonderfully named CEO, Henrik Bang added;

"We have continued to see strong demand for our product suite with double digit new sales order growth from both existing and new customers driven by solid growth for the Group's Liberty ContactCentre platform and Business Process Management solutions ("BPM"). The sales momentum combined with our high levels of recurring revenue has increased revenue visibility and the Board remains confident about a positive outcome to the year."

Maybe they are benefitting from the trend towards onshoring call centres? So, it looks a nice company, but everything has its price, and the price here is too high for me.

Ubisense (LON:UBI)

Ubisense describes itself as a market leader in real time location intelligence solutions, and has issued a trading update for 2013. The key paragraph sounds reassuring (as always, I have added the bolding below);

The Group continued to display considerable momentum in the second half with its converged technology offering, leading to significant contract wins during the period, and expects to deliver results in line with the Board's expectations. The Group achieved record orders for the year totalling £32 million, up 30% on the prior year.

The contract have already been separately announced, so that's not new, which probably explains why the share price has not moved today. At 244p it values Ubisense at about £56m, which is probably about right - it looks expensive on the historic numbers - good turnover growth, but no profits to speak of.

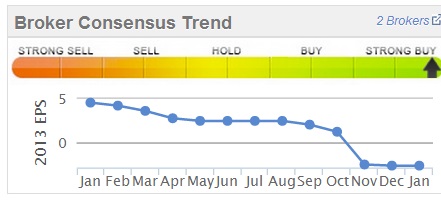

The trend of broker consensus forecasts is poor in the last 12 months too, as this Stockopedia graphic on the right shows. So although I like the product, it probably needs more concrete evidence of future profitability to justify chasing the valuation any higher. But hey, we're in a bull market, and crazy things are happening all around us every day in terms of valuation. Which is fine until there's a panic market sell-off, and then all the highly rated stuff is likely to drop like a stone. Hence why personally I'm keeping my exposure fairly limited to more speculative shares, and not using any gearing on those stocks.

The trend of broker consensus forecasts is poor in the last 12 months too, as this Stockopedia graphic on the right shows. So although I like the product, it probably needs more concrete evidence of future profitability to justify chasing the valuation any higher. But hey, we're in a bull market, and crazy things are happening all around us every day in terms of valuation. Which is fine until there's a panic market sell-off, and then all the highly rated stuff is likely to drop like a stone. Hence why personally I'm keeping my exposure fairly limited to more speculative shares, and not using any gearing on those stocks.

Remember what happened to me in 2007-8, when I had large, geared positions in illiquid stocks - it was a disaster, and I lost approximately £5m of my savings, that I had worked hard to build up in the previous 7 years. So I hope my warnings prevent anyone else making the same mistake in future! Gearing and illiquid/speculative stocks should never be combined, as they are lethal in a market downturn, because you can't get out of the positions, even if you want to. So some very important lessons, learned the hard way, and that's why I play it safe these days.

Promethean World (LON:PRW)

And finally, Promethean World (LON:PRW) has issued a positive-sounding trading update for 2013. Revenue is down 10% to £141m, but adjusted EBITDA of £9m is a big improvement on the prior year's £5.1m. They also report having more than doubled the net cash position to £17.6m.

Their shares have shot up 17% to 29p today, so it might be worth checking out the figures in more detail. I'm too tired to look at it now, having already spent 7 hours on this report!

I'll leave it there for today.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FRP and TMMG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.