Good morning!

Ubisense (LON:UBI)

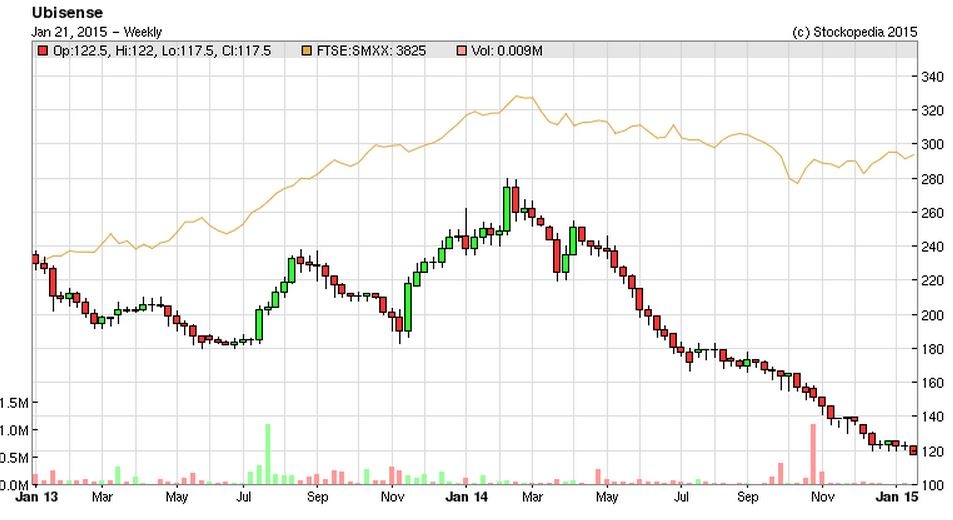

Share price: 117.5p (down 2.5p today)

No. shares: 25.1m

Market Cap: £29.5m

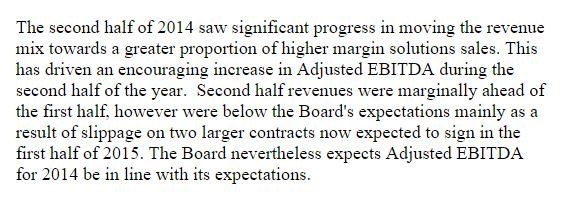

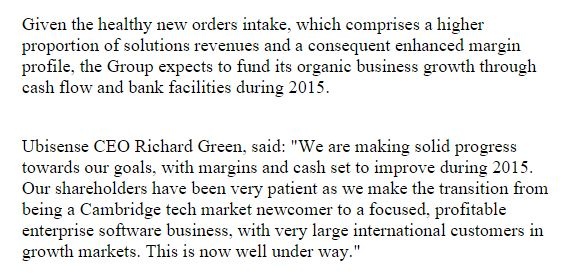

Trading update - this sounds a bit mixed - turnover below expectations, but higher margins offset that, to deliver adjusted EBITDA (yuk!) in line with expectations for calendar 2014.

Mention is made of some restructuring costs (£0.7m - to be reported as exceptional) and goodwill write-off of £1.2m (fine, as it's non-cash).

Net debt - reported as £3.2m at y/e, down from net cash of £0.75m at the half way point. This is explained as being due to unusually high debtors (up by £4.5m), which is expected to reverse in Q1.

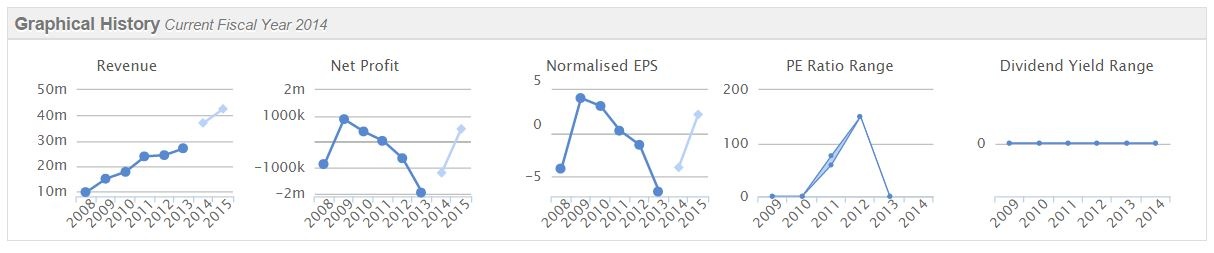

My opinion - a year end spike in debtors is a big red flag - so that would need careful scrutiny. It's good to see margins improving. This company has delivered decent turnover growth (see graphs below), but not gained any traction on profitability, in fact it's gone backwards after making small profits in from 2009-2011, to being loss-making again. That makes me question whether they have a viable business model?

Whilst the product sounds good, there must be plenty of other companies doing a similar thing (tracking movement of parts in factories, etc), and the bottom line is that if you can't make a sustainable profit, then something is wrong - maybe lack of scale, and/or lack of pricing power? I'm also not keen on loss-making companies having debt - as it makes a dilutive Placing much more likely if the bank decide they are not comfortable.

As I mentioned in my report on 16 Jun 2014 (when the shares were 192p), I'd be looking for a sub-100p entry price. It's almost got there now, but I can't say this share strikes me as a bargain even now. There's not really enough red meat in this outlook statement today, although the "healthy new orders intake" mentioned in the first line below is positive. Overall, I remain agnostic on this share.

Intercede (LON:IGP)

Share price: 114p (down 20p today)

No. shares: 48.4m

Market Cap: £55.2m

Trading update - it's a profit warning. Yet another situation where a company had a disappointing H1, but said it hoped to make up the shortfall in H2, but then fails to do so. The year end is 31 Mar 2015. The company says;

The company only did £9.8m turnover last year, and made a small profit of £0.8m. So as 2014/15 is showing no growth, how on earth does a £55.2m market cap make sense? It looks way, way too high to me.

A £1m loss is forecast for the year, but it does have £5m in cash, so no issue over solvency.

My opinion - the outlook statement talks up the future potential, but on the basis of figures achieved so far, I'd say a price of about 30p per share would look more reasonable than the current 114p. Therefore a market cap that looks about a quarter reality, and three quarters hope for future growth, strikes me as something I would rather avoid.

SafeCharge International (LON:SCH)

Trading update - not a company I've looked at before. It seems to be another payment processing company. An update today sounds good;

I haven't got time to crunch the figures today, as I've got meetings in London this afternoon, and am still in Hove! However, am just flagging it up to readers, as it's always worth checking the numbers for a company that reports being ahead of market expectations, as you can sometimes find the odd overlooked gem that way.

Actual Experience (LON:ACT)

This company has a very interesting story, but the figures today show hardly any commercial progress at all - turnover for the year ended 30 Sep 2014 is only up a little to £567k! The loss before tax & before exceptionals (such as AIM IPO costs) was £1.1m.

The market cap is £52.9m, so it's all about future hope, rather than current performance.

The narrative is too vague, and reads to me like a list of buzzwords & phrases, with very little specific. That said, I've been told the company has exciting technology. I'll look closer when the figures are exciting too, which they are not at this stage.

Gotta dash, see you tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.