Good morning! Twenty-two minutes late, wrong type of leaves on the line at Aldrington. Regulars will know that I've been circling around a stock called Ubisense (LON:UBI) for some time now - it's an interesting technology company which provides systems that enable customers to track the location of people and things in real time. I don't pretend for one minute to understand the technology, but from what I have seen, it looks interesting, i.e. it has obvious potential & usefulness. More importantly than what I think, it is selling to big name customers, and that's what counts.

The problem with growth companies is that they're usually (especially at the moment in this bull market) too expensive, based on historic numbers, so any purchase is a leap of faith about future performance. Investors often collectively over-pay for growth, just assuming that growth will carry on forever, and ignoring the real world issues such as competitors emerging & chipping away at any competitive advantage that a growth company might have.

Anyway, rightly or wrongly, I decided to push the button & have bought a small quantity of shares in Ubisense (LON:UBI) this morning, on the back of this announcement, which announces an order of E0.7m from a large European automotive manufacturer for a Ubisense Smart Factory System. That order in itself is not material to their results, but what interests me is this part of the announcement:

The order, valued at approximately €0.7m, is part of a global framework agreement with the manufacturer that covers more than 100 sites and this represents the fourth installation since production acceptance was granted in July this year.

So that sounds like there could be considerably more orders in the pipeline.

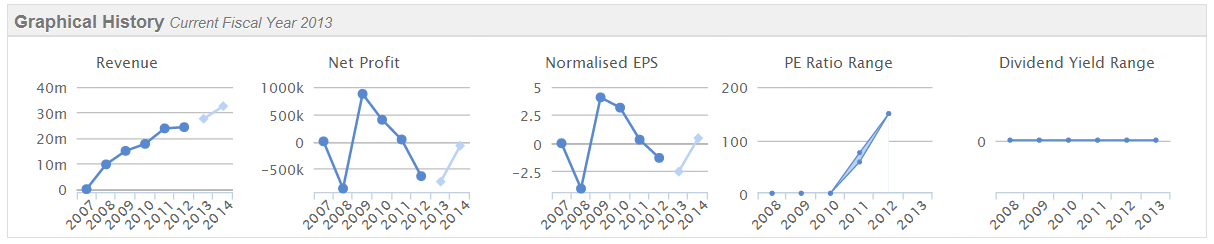

These shares have edged up about 5% to 205p this morning, which values the company at about £45m, which is certainly not cheap by any means, as you can see from a generally poor performance over the last few years (other than steadily rising turnover):

So I will quite understand if regulars here come to the conclusion that I've taken leave of my senses, paying up for a speculative £45m market cap which doesn't really make any profit, and doesn't pay a dividend. But we are in a bull market, and growth stocks are rising very strongly at the moment, so good newsflow could possibly take this higher? It's not a big position, and is clearly pretty speculative, but anyway I've decided to take the plunge with it, in a small way.

As always, this is absolutely NOT any kind of recommendation, and all the usual wealth warnings apply - above all please always DYOR, which is the whole ethos of this site.

Just also to say that Ubisense is horribly illiquid, so I found it difficult to buy even a small amount of shares this morning. Therefore the price is likely to be volatile, and the bid/offer spread can be quite nasty too.

Next, French Connection (LON:FCCN) has issued an IMS covering the 16 week period from 1 Aug to 20 Nov 2013. I've written a lot about this company in the past, so won't cover old ground again, just search the archive here if you want more background views from me.

This morning's statement is the first time in ages I can remember them saying something positive. The disastrously performing UK/Europe retail division reports LFL (Like-For-Like) sales up 2.1% against last year. UK/Europe wholesale was in line with last year. The spring 2014 order book is "slightly ahead" of last year. Trading in the rest of the group is in line with expectations, they say.

Net cash, at a cyclical low point in the year, is currently £10.0m (only down £0.6m on last year). I estimate that should have risen to £20-30m by their year-end of 31 Jan 2014. They do not comment on full year results, other than to say they will be dependent on the crucial Xmas trading period, which is normal, as FCCN specialises in womenswear, especially party frocks.

Overall I'm pretty encouraged by this. The company seems to be stabilising things, and in my opinion the losses this year should not be so bad that the solvency of the company is under any immediate threat. As always, a strong Balance Sheet gives management time to turn any company around, and like him or loath him (and the latter seems to be virtually the universal view), founder Stephen Marks does seem to be serious about turning this company around. If they can get out of their problem leases over time, then that alone should slowly drag them back into profit. If they can really get their brand & product right, then we could have a significant success on our hands, who knows?

The market cap is only about £40m, so it's very cheap on a Balance Sheet basis, although being loss-making it cannot be valued on a PER basis, and doesn't pay any dividends. Not one for the feint-hearted! (but there again stocks are always loathed when they are at their cheapest, that's why they are cheap!)

A friend who holds shares in airline, holidays & haulage group Dart (LON:DTG) told me a while ago that he reckoned there was more fuel in the tank for their share price, despite it having risen very strongly in recent years, and it looks like he was right. Their interim figures today are impressive.

Turnover is up 35% to £787m, and an impressive 10.3% operating profit margin has been generated, at £81.2m. That drops through to EPS up 38% to 41.5p. Caution is needed here, in that their half year to 30 Sep 2013 is the seasonally strong period, and they traditionally make losses over the winter months.

Even so, an 11.4p improvement in EPS against last year's H1 is impressive stuff. They did 21.4p EPS for the full year last year, so if H2 is the same this year, then surely something like 30p EPS is likely this time for the year ended 31 Mar 2014? But broker consensus is only for 21.9p this year, and 23.9p next year, which look far too low to me, unless I've missed something.

Ah OK, I've found it! The outlook statement tempers my enthusiasm;

Whilst the Group's trading performance during the first six months of the year has been satisfactory, our leisure travel operations are becoming increasingly seasonal as we continue to grow the business and winter losses are expected to increase materially. Accordingly, with the important winter booking period still to come, the Board remains cautiously optimistic in relation to profit growth for the financial year ending 31 March 2014.

So in view of the above, perhaps it's best to stick with broker consensus of 21.9p for the full year.

Even so, at 229p this morning (up 12.5p) these shares don't look at all expensive on a PER of 10.5. The dividend yield is poor, at just 1%. Their Balance Sheet is OK these days, although don't get excited about the £250.8m cash balance, because that almost all belongs to customers who have paid up-front for flights (see £224.7m deferred income). Still, it's worth bearing in mind that when interest rates rise, the interest income on that cash should give a decent boost to profits.

I can't bring myself to buy these shares, as I originally held them when they were about 50p, but got bored & sold up when they seemed anchored at that level. Also I note that this stock has a very high "StockRank" on Stockopedia of 99, based on very high scores for Value and Quality, and a medium-high score for Momentum.

Having looked through some other announcements, nothing much looks of interest today, so I'll sign off for the day.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in UBI and FCCN.

A small caps fund to which Paul provides research, also has a long position in FCCN)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.