Good morning! The modest bounce in small caps continues, with FTSE Intl-aim All Share Index (FTSE:AXX) having bottomed out last week on 16 Oct 2014 at 676, and now having risen to 698 at the time of writing, a rebound of 3.3%. Although that is still down over 22% from the peak on 6 Mar 2014.

Whatever the overall market does, the only thing that really matters to me is the performance of the companies that I've invested in. So it's the year end trading updates in Dec/Jan, and the results (mostly being released in Feb/Mar 2015) that will really determine whether our portfolios out-perform or not. Not whether a particular magazine or journalist has tipped something, or if momentum traders are creating their own buzz around a stock, which is all just background noise in the long run.

Not much to report on today, there's very little news under my remit.

Seeing Machines (LON:SEE)

Share price: 6.25p

No. Shares: 827.6m

Market Cap: £51.7m

AGM update - there's an update for the year ended 30 Jun 2014 published today. It says turnover for the year was A$17.7m (that's Australian dollars, equivalent to £9.6m). Looking at a recent Edison note, forecast was for A$16.8m, so it seems that the company has come in usefully ahead of forecast in turnover anyway.

No information is given on profit/(loss) for the year, although the Edison note suggests a loss of A$2.6m (£1.4m) is expected. Although note that losses are expected to balloon to A$9.5m (£5.2m) in the current year due to the company having adopted an accelerated expansion plan, with the workforce having been doubled in size following a big fundraising in early 2014.

The current exchange rate is £1 = A$1.84.

My opinion - this is a difficult company to value at the moment, as nobody really knows how successful the company will be in extending its market reach from the mining sector into the wider transport sector. However, the way I look at it, is that their product (a warning system for drivers, which monitors their eyes and sounds an alarm if they are not giving the road sufficient attention, e.g. if they are nodding off behind the wheel) definitely works - because it is being sold successfully to the mining sector via Caterpillar agents.

Therefore it is not a leap of faith at all to suppose that a lower cost version of this technology could also be sold into the road transport sector, for coaches & trucks, plus rail & aviation. It's just a question of what the take-up rate will be. Hopefully it might be high, since insurers may force the pace, requiring these devices to be fitted to high risk cargoes, etc.

The company is also working on versions of their eye-tracking technology for consumer electronics.

I've no idea how to value it at the moment, but there's enough excitement in the pipeline, and real sales already occurring, that in my view you can justify the current valuation without too much difficulty, but that's just my opinion, other people have to make up their own minds.

These shares didn't sell off much in the recent correction, which suggests to me that it has solid support from existing shareholders. Therefore providing nothing goes wrong, I'm leaning more towards the price going up, than going down, but we'll see. It's always very difficult to value loss-making companies, which relies on sentiment and future expectations more than the actual figures today.

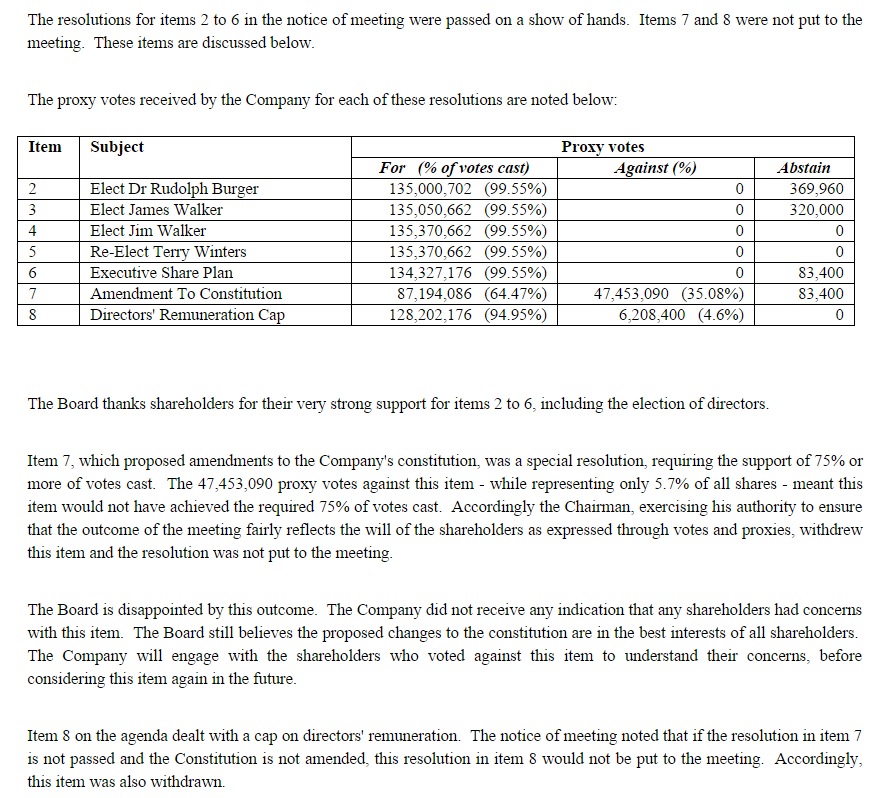

Result of AGM - there is an interesting second announcement from Seeing Machines (LON:SEE) today, concerning the AGM resolutions. Proxy votes were insufficient to pass the special resolution (item 7) which requires support of 75% of the votes cast.

Note that only a small number of the 827.6m total shares were voted at all. I'm not sure what the company Directors were trying to do in this failed attempt to change the company's constitution, so that might be worth looking into.

I firmly believe that shareholders need to start thinking more like owners, and engaging with companies. Whereas as you can see from the small number of shares voted here, most shareholders are either disenfranchised, or just not interested in exercising any control over the company.

Is it any wonder that things go wrong with corporate governance so often, when we have an absentee shareholder class?

Blur (LON:BLUR)

Share price: 71.5p

No. shares: 47.1m

Market Cap: £33.7m

There's a marketing-type announcement from Blur today, mentioning impressive clients such as Tesco and Argos.

The trouble is, it's the gross profit line that is really turnover here, as it transpired that the company was booking the whole value of client projects to turnover, thus overstating the scale of the business. So to take it seriously, I'd want to see gross profit increase by multiples, and losses greatly reduce.

The company raised enough cash in Jun 2014 to take it through to breakeven (so it says). If that is true then it might be one to watch if the losses materially reduce in future perhaps, although I remain highly sceptical based on figures to date.

Cloudbuy (LON:CBUY)

Share price: 37.3p

No. shares: 119.9m

Market Cap: £44.7m

This company is either a lot of hot air, or something really good. I've not managed to work out which, despite having a meeting with the Chairman last year, whose explanation of what the company does can only be described as impenetrable.

It supposedly has software which identifies cost savings within companies' purchase ledgers. Although the more digging I did, it seemed to be the case that the cost savings actually arise from identifying suppliers who will accept payment by credit card, and then sharing an element of a small rebate from VISA by getting customers to pay using a credit card instead of via BACS.

Maybe I've got completely the wrong end of the stick, but if a company can't clearly explain what they do, then there's a problem.

There's also apparently spending analytics software, to identify things that companies are over-paying for.

The announcements on progress always sound fantastic, as indeed does today's announcement, which seems to contain lucrative deals being agreed.

However, the financial figures to date have been lamentable. Interims to 30 Jun 2014 show little growth in turnover to £1.5m for the six months, and an operating loss having shot up from £0.3m in the prior year's H1 to £1.6m in H1 of 2014.

On a more positive note, the company recently raised £4.3m in a Placing that was done at 43p, which was a 13% premium to the prevailing share price - very impressive, as it shows those investors really want to buy in.

Overall then, I've no idea how to assess this. What do readers think?

ASOS (LON:ASC)

Nothing else of interest today, apart from results from ASOS (LON:ASC) which look dreadful to me. Profits down, quite a low operating profit margin, overheads going through the roof. It looks to me like a business that has grown so quickly management have lost control perhaps?

The market is pricing it very aggressively still at £1.9bn market cap (at 2279p per share) - as it's reported today only 44.5p diluted EPS (down 10% from last year), so that puts it on a PER of 51.2 times. At the moment the market seems to believe the company's talk of investing for future growth, but I've got increasing doubts about the margins here, which have been reducing - they were achieving an 8-9% operating margin back in 2008-9, but that has now fallen to only 5%, despite the company being six times bigger. That sounds to me more like increasing competition & a lack of control over costs, rather than short term investment.

People get very excited about online retailing, thinking that it's a licence to print money, because etailers don't have expensive shops to rent & staff. But what people forget is that etailers get a customer returns rate of about 30% for clothing, which leads to mountains of dead stock to dispose of at a loss. Whereas in shops, customers try on the items first, and hence the returns rate is much lower, typically 5-10%.

Also, etailers need huge warehouse capacity, since they have to stock every colour & size option for hundreds, or even thousands of product lines. So instead of being distributed around hundreds of shops, an etailer has to keep all that stock in a massive central warehouse. That still costs money in rent & rates, utilities, and staffing costs. Not as expensive as running a chain of shops, but still pretty expensive.

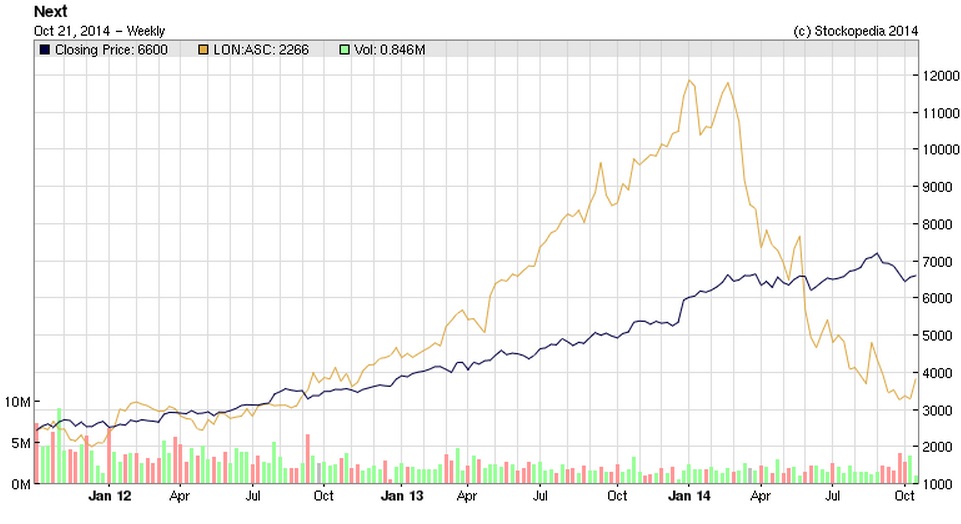

Just look at the operating margin that Next (LON:NXT) achieves, of 20%, and compare that with ASOS (LON:ASC) 5% operating profit margin, and then ask yourself which is the better quality business?

Also note that over the last 3 years, shares in Next have been a much better investment than shares in ASOS! Very much an investing case of the hare & the tortoise?!

On that bombshell I shall sign off for the day.

Best wishes, Paul.

(of the companies mentioned today, Paul has a long position in SEE, and no short positions.

A fund management company with which Paul is associated may have positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.