Good morning!

DX (Group) (LON:DX.)

Share price: 81p (down 0.6% today)

No. shares: 200.5m

Market cap: £162.4m

Results y/e 30 Jun 2015 - the figures announced today look quite good to me, considering the low valuation on the shares. This is a delivery company, of mail, parcels & freight.

- Turnover of £297.5m (down 4.6%)

- Operating profit of £25.3m (down 6.6%)

- EBITDA flat at £33.7m

- Adjusted EPS 1.9% at 10.9p

- 4p final divi, total for the year 6p = yield of 7.4%

Note that the PER comes out at only 7.4 (based on a share price of 81p, and adj EPS of 10.9p)

Let's cut to the chase - why is it so cheap? After all, it's rare these days to find a share where the PER = divi yield, which is the case here, with both at 7.4. Is the balance sheet ropey?

Balance Sheet - businesses that are floated by private equity owners are usually left with too much debt, but in this case it looks fine - net debt was only £1.8m at 30 Jun 2015 - negligible really, for a business this profitable.

Net assets of £194.2m is dominated by intangibles of £199.3m, so writing that off takes NTAV down to negative -£5.1m. That's not a concern, given the high level of profitability, and the favourable cashflow - customers seem to pay up-front, since there is deferred income of £23.9m shown in current liabilities - i.e. the business is partially financed by customers paying up-front, which is fine if you can keep that rolling.

The current ratio of 0.74 looks weak, but that is largely because customers are paying up-front, so it's skewed by deferred income - again, not a concern for such a strongly profitable company with minimal net debt.

You can't look at the balance sheet in isolation, it has to be seen in the context of how profitably & cash generative a company is. So whilst this is not a particularly good balance sheet, it's absolutely fine overall due to the strong profits.

Note also the large upcoming capex of £35m (net of property disposals) for a new Midlands distribution site of 44 acres. The new site should be operational by Q2 2017, so there might be some disruption to operations when that move goes ahead. Although the company is only a box-shifter, so it really should be a fairly straightforward matter to move premises. Net debt will increase no doubt, but not to problem levels in my view.

Outlook - these comments sound mixed, but OK overall, given that we already know parcel delivery is a very competitive sector;

We have a solid strategy supported by a robust balance sheet. Trading conditions continue to be tough but we are well placed to take advantage of any improvement and we have started the year in a positive manner. The Board remains confident of our strategy to deliver long term growth.

My opinion - so circling back to the key question - why is this stock so cheap, on a PER of 7.4, and a divi yield of 7.4%? There's only one reason stocks are that cheap - because the market doesn't believe profits are sustainable.

I've looked at this company a number of times, and cannot understand how it manages to make an operating profit margin of 8.5%, in a sector which is so highly competitive, where margins for many other companies are minimal - indeed City Link couldn't make any margin at all, and went bust - as an aside, DX picked up some assets and staff from it.

The only conclusion which makes sense to me, is that the core DX Exchange business must still be highly profitable. Although of course it is in long-term structural decline, as documents are increasingly being dealt with via email, rather than physically posted using the DX service, which solicitors in particular used to make great use of. The solicitors I've spoken to say that they use DX a lot less these days.

DX also has contracts such as the secure Passport delivery, and credit cards, both of which require more secure delivery to combat fraud. Again, I suspect this work is probably quite lucrative, but will it still exist in 20 years' time? Probably not.

I've not been able to find a proper breakdown of where the company's profits actually come from. A turnover split is given between mail, and parcels, but no profit split by activity is given. Therefore the suspicion remains that the DX Exchange is a highly profitable, but declining business, and that's what the valuation is telling us too.

If I could get a better handle on what the profit elements are, and how this group manages to achieve an 8.5% operating margin in a sector where many cannot get much above breakeven, then I could approach it with a bit more confidence. At the moment though, there isn't adequate transparency on the business model.

Why did the previous PE owners want to sell, and were prepared to do so at such an apparently cheap valuation? Again, it points towards profits being unsustainable.

That said, a PER of 7.4 and divi yield of 7.4% are very attractive, especially as these results show profits were fairly resilient, and the outlook sounds reasonable. So I'm quite tempted to have a dabble here. Although the chart looks pretty miserable. It looks like there might be a selling overhang - so it would be worth checking the "Holding in company" RNSs to see if there is a persistent seller, and if so, how many shares they have left:

Spaceandpeople (LON:SAL)

Share price: 80.6p (down 7.9% today)

No. shares: 19.5m

Market cap: £15.7m

(at the time of writing, I hold shares in this company)

There are two announcements from this niche promotions company.

Expansion into France - at the moment SAL's main operations are in the UK and Germany. Management are very careful about overseas expansion, as they're not prepared to incur significant start-up losses, hence why France has been rejected in the past - well that, and the bureaucracy & high taxes.

A neat solution has been found, with this pilot contract to operate the new Mobile Promotional Kiosks ("MPKs") in three French shopping centres. The man on the ground in France is someone local that SAL already know. Everything else will be run from Glasgow, using French-speakers, so this venture is low risk, and won't involve the formation of a French subsidiary company, an approach that I very much like - so minimal costs & admin, to test the water in a potentially important new territory. Canny Scots!

Interim results to 30 Jun 2015 - turnover was down 15.5% to £6.0m in H1, due to a non-repeating large contract in the promotions division. However, profitability slightly improved. Remember that, in common with lots of retail-based businesses, SAL makes its profit in H2, since that includes the Xmas seasonal spending spree, so the H1 figures are not indicative of the full year.

Profits - H1 was close to breakeven, an operating loss of £23k (slightly improved from an £86k pre-exceptional loss last time). Note that there are no non-recurring items this year, which is good - the restructuring is now out of the way, and the company operating from a leaner cost base.

Outlook - several points are mentioned, but the key point is that full year 2015 is expected to be in line with expectations;

The autumn months of each year are a very important time for our business. Both retail and promotional customers increase activity in the lead up to the Christmas period and along with the continued roll-out of MPKs in the UK and Germany and the seamless delivery of business on our new contracts, is our primary focus.

With substantial new contracts commencing in the final quarter of the year, we have been augmenting and developing our sales and administration teams over the last few months to ensure that we deliver a full service of the highest standard to these clients from the very start. As such, the Group is committing significant resources ahead of these commencement dates. These set-up costs incurred in the current year will enable us to deliver the best possible outcome for the duration of these contracts.

Overall, we believe full year 2015 will be in line with expectations.

It's important to understand that the "significant resources" mentioned above (in particular for the significant Network Rail contract win) are being absorbed within the existing profit forecast, and we're not talking massive fixed costs, but instead a dedicated team of staff to manage the contract, some of whom are existing people employed by the group. So think in terms of some incremental, variable costs, rather than anything more onerous.

Growth - the company has good growth in the pipeline from the MPKs, the roll-out of which is going well, and these flexible units, which are rented out by the week to many different clients, are higher margin, and popular with clients.

Also of course the Network Rail contract really should be highly material to profits from 2016 onwards. I'm quite excited about that, and think it could give the figures a big boost from next year.

Valuation - following a problematic year in 2014, with two profit warnings, the company is now being ultra-conservative with all budgeting. They're on track to meet or beat the 4.97p consensus EPS forecast for 2015.

Consensus for 2016 is only a small uplift, to 6.33p - which really should be seen as the base case. There's plenty of upside over that figure, and personally I'm looking for 8-10p EPS as the sort of level I'd be happy with in 2016. That should be do-able with the Network Rail contract up & running in late 2015, hence contributing strongly to 2016 and beyond.

Note that the StockRank of 88 is favourable.

Balance Sheet - for the small size of the business, I think the balance sheet is OK - not strong, but not weak either.

NTAV is positive, at £1.1m, and the current ratio of 0.98 is adequate, given that cashflow works quite well - with kiosk operators banking cash via SAL, as I understand it.

It looks as if the drawdown on bank facilities increased from £500k a year ago, to £750k at end Jun 2015. This was more than offset by cash of £1.0m, so overall looks fine.

Note that capex has increased, due to the roll-out of the MPKs, but that seems to be capable of being financed from internal resources, which is encouraging.

My opinion - my decision to stick with this company after last year's disappointments was definitely the right thing to do, as the shares have almost doubled from the lows.

There's nothing of any concern to justify today's 6p fall in price, but it's within the usual bounds of normal market volatility. The shares have had a good run recently, so it's understandable that some people will want to bank some gains along the way.

My view is that management have fixed the problems they ran into last year, and now have two strong drivers for profit growth - the MPK roll-out, and the Network Rail contract. Other new business, such as the French pilot, is nice to have, and might provide longer term growth potential.

Management here are entrepreneurial, and have big personal shareholdings, so are fully committed - in their own words, "We don't have a Plan B!". I like to invest in situations like that, as it means management are in for the duration, and will fix any problems that arise, doing whatever needs to be done, as happened here in the last year.

My personal price target is 50% upside in the next year, to 120p, with growing divis along the way, and hopefully more longer term. Although as with any micro cap, things can go wrong, so one needs a strong constitution to invest at this end of the market, and a preparedness to look through short term disappointments. When other people are selling in disgust, that's the time to be buying shares like this, in my view.

The chart suggests more recovery potential, if we're patient. Note that these shares can be very illiquid, and the spread can widen on quiet days, so it's not a share to try to time the market, in my view, it's more a "buy on the dips and then forget for a year or two" type of share, in my eyes.

French Connection (LON:FCCN)

Share price: 25.75p (down 8% today)

No. shares: 96.2m

Market cap: £24.8m

(at the time of writing, I hold a long position in this share)

Interim results to 31 Jul 2015 - you can always rely on FCCN delivering awful interim figures, and they've come up trumps again today! In fairness, the company did warn on profits in Apr 2015, with the disastrous retail division once again being the main problem area (as opposed to the decently profitable wholesale & licensing divisions).

In April 2015 the company said;

The challenging conditions in our Retail trading reported at the year end have continued through the completion of the Easter period. H1 retail sales performance is now forecast to be materially lower than expected.

Wholesale performance is in line with expectations, with forward orders up year on year. Licensing continues to perform strongly.

The financial performance for the year is now expected to be below the current market expectations.

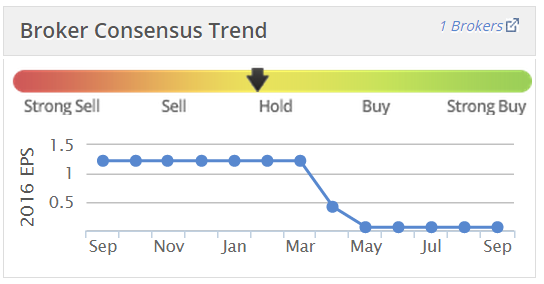

Broker forecasts were lowered, to about breakeven for the full year, as you can see from the usual Stockopedia graphic below;

H1 figures -

- Turnover down 9.8% to £75.8m

- Loss before tax of £7.9m (£4m worse than H1 last year)

- Licensing is doing well - sales growth of 3.4% (this bit is highly profitable remember)

- Retail has been terrible - LFL sales down 10.7% in H1

- Retail gross margins held up surprisingly well, at 57.4% (2014: 57.9%)

- Ecommerce is quite significant, at 22.3% of retail turnover (2014: 22.4%)

- 6 store closures in H1, more closures planned for H2

- Wholesale not so bad, with H1 sales down 2.6%, but margins down from 32.6% to 31.6%

Divisional split - once again, there is a staggering difference between the absolutely disastrous performance of the retail division, which made a £11.1m underlying loss in H1, and the profitable wholesale division, which made £5.5m (2014: £6.2m).

So the obvious solution is just to close the retail division. I'm sure they would do, if they could, but the problem is that retailers sign leases which are typically 15 years at inception. So once you're operating from a site, you're locked in, no matter how bad the losses become.

(in some circumstances leases can be assigned, but only if the landlord agrees, and the landlord would rather keep a financially strong tenant like FCCN, than let them assign a lease to someone else. In any case, if the shop rent is above market rent, which it could be significantly, then nobody will want the existing lease unless you pay them a huge incentive to take it on. Even then, leases can bounce back onto the original lessee, if an assignee goes bust. So it's a big problem area, which can only really be fixed with a pre-pack Administration).

It's fairly obvious that French Connection just doesn't work as a standalone retail concept, but it does work in some other countries through franchisees, and from boutiques and Dept Stores, which are the wholesale customers. Plus the brand strength is evidenced by the continued success of Licensing.

Therefore my view remains, as supported by the figures, that this is a valuable, international brand - if it were not, then wholesale & licensing wouldn't be consistently, and quite highly profitable.

I suspect that the Oxford Street, London flagship store probably causes a lot of the losses, as the rent was reviewed up to a staggering figure, and it's a very awkward shape (narrow frontage, but very deep). Although it is close to the Bond Street crossrail site, so they might be able to dispose of this site on acceptable terms once that location becomes even more prime. It's right opposite Selfridges too, so I am hoping that it could be disposed of favourably in the end, but who knows?

All that matters, is that FCCN can keep trading, and not lose so much money that it goes bust. That buys it time to exit the problem leases, and move into profit once those loss-making shops are offloaded gradually. So cash is king, where are we on that?

Balance sheet - net cash of £15.0m is down £4.4m on the comparable figure from 2014, so still plenty of headroom there. That should rise to about £20m by they year end seasonal high, of 31 Jan 2016.

Net current assets are even better, at £36.6m, or 38p per share, and there are negligible long term creditors of £0.2m. So this is an extremely unusual situation where the brand is thrown in for free, and the company is then valued at only two thirds of its own working capital! That is an astonishingly low valuation - which reflects the market's clear lack of faith in management to turn it around.

Outlook - things are looking a little better here. H2 sales (Aug & half Sept) are actually quite encouraging, given that August was a bad month for clothing retail, due to poor weather;

Retail trading over the first 6 weeks of the second half has been stronger; UK/Europe LFLs flat, within that full price LFLs around +6.0% with improved gross margins against the prior year

That's encouraging, and is pointing towards an improved H2 profit. Last year H2 was an underlying profit of £3.1m, so if we estimate a profit of say £4m in H2 this year, then that would offset about half the H1 loss, and generate a full year loss of about £3.9m by my reckoning. That's bad, but not disastrous enough to put the viability of the company in any doubt.

My opinion - this is a special situation, not a normal investment. It's all about the leases expiring on loss-making shops, and this should drive a process whereby a nicely profitable business (wholesale & licensing) will emerge from the wreckage of the retail division in a few years' time.

So far, 2015 has been poor, but not so poor that the company is under any threat of going bust. Therefore to my mind, it's something where I'm more inclined to buy more, on the crushingly negative market sentiment, rather than sell because it's had a bad H1. This is especially true, as the current trading figures are much better than in H1.

This share definitely won't appeal to most people, but it's an interesting risk:reward play which still stacks up quite nicely in my view, if you look at how the figures might be in say 2-5 years' time, once those loss-making shops have been jettisoned.

Norcros (LON:NXR)

(at the time of writing I hold a long position in this share)

Share consoldiation - the company is to imminently consolidate each ten of its existing shares into one new share. So the share price will become c.195p instead of 19.5p, and our shareholdings will be adjusted so that we'll have one tenth of the number of shares that we currently hold. Therefore no overall impact short term.

Looking at their website, the company is hoping this will make the shares more attractive to investors, as they will look less like a tinpot penny share. That's purely cosmetic of course, but it might have some impact, and could result in a slightly narrower quoted spread perhaps (since the existing price has to move in 0.25p or 1.3% increments), although the real price is not always the same as the quoted price - we have a two tier pricing market with small caps - the quoted spread is often wider than the real prices that brokers see on their screens.

The record date is 29 Sep 2015, and CREST accounts are adjusted the next day. So don't wake up and get excited that you have a 10-bagger on your hands! Because you'll only have one tenth of the original number of re-priced shares.

Finsbury Food (LON:FIF)

Share price: 99p (down 2.5% today)

No. shares: 126.8m

Market cap: £125.5m

Results year ended 27 Jun 2015 - the headline bullet points look very good. Revenue up 45.8% to £256.2m, mainly driven by an acquisition, but there has been organic growth of 6.1% too. These figures are in line with the trading update which I reported on here on 16 Jul 2015.

I hope some readers bought this share, as I flagged up what good value it was at 63p in my report of 19 Jan 2015, but for some bizarre reason, I didn't actually buy any myself, which was a bit daft! The trouble is, when you're trying to report on lots of companies, you can sometimes overlook the obvious bargains, or just forget to buy any because you're rushing to meet a deadline, etc.

Adjusted EPS of 7.7p looks slightly below recently revised upwards consensus of 7.95p, but is nonetheless a good increase on 6.3p in 2014.

Dividends - have shot up from 1.0p in 2014 to 2.5p in 2015, which is terrific, and it's well covered too, so that gives a current yield of 2.5%, and usually when a divi rises that much, it carries on rising for a few more years.

Balance sheet - overall this looks alright, but not amazing.

NTAV is £22.5m

Current ratio - is only 0.83, a bit too low for comfort, with one figure jumping out at me as looking rather high - namely the £62.3m of "trade and other payables". This is considerably larger than the £48.4m trade receivables, which is unusual - normally it's the other way around. So it looks as if Finsbury is quite effective at collecting in cash from its customers, but possibly strings out payments to its suppliers? That's not necessarily a problem, if you can keep such a position rolling indefinitely, but if it's a temporary thing, then bank debt is likely to go up considerably once timing effects wash out. So I'd like a bit more clarity on that.

Net debt of £21.3m looks under control, and the company points out is only 1.0 times annualised EBITDA - well within what most banks and investors consider reasonable. Note that it also owns freehold property, which makes things much more secure.

Narrative - there is a lot of commentary with today's figures, which impresses on me that this is an ambitious, expanding group, which has delivered good results and a successful large acquisition in the year being reported on.

I can't find any specific outlook comments, other than general points about ambition for further expansion, etc.

My opinion - this looks an impressive, well-run company, which has transformed itself into a major player in the bakery market. The shares have had a nice re-rating in the last year, and look priced about right for now. However, I wouldn't be surprised to see the company grow further, and the shares go up further, once they've paused for breath, and if more good acquisitions are made.

So a thumbs up from me, and am kicking myself for not having bought any last autumn, when my friend Edward Roskill explained in detail why he liked the shares in our audiocast here. I'll see if Edward wants to do an update audiocast, as he's always full of good stock ideas.

The StockRank is high, at 91 - which gives additional comfort.

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SAL & FCCN.

A fund management company with which Paul is associated may also hold positions in companies referred to.

NB. These reports are just Paul's personal opinions only, and never recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.