Good morning!

It's worth noting that sterling is weakening again, which has a knock on impact on shares, as we've discussed here before. So those dollar earning companies, and UK exporters, are becoming increasingly attractive again.

As an example of that, Judges Scientific (LON:JDG) pointed out yesterday that as mainly a UK exporter, it is enjoying the most favourable exchange rates since 2009. This was one of the companies that I wrote about in a late update last night. The other one was Fastjet (LON:FJET) - a complete crock.

Here is the link to yesterday's complete report, to get you started whilst I crack on with writing up some new stuff about companies reporting today.

Profit warnings

As the day goes on, I will report below in more detail on 3 companies which have all put out profit warnings this morning, and are all hitting fresh 52-weeks lows, namely;

Majestic Wine (LON:WINE) - under-performance in commercial, and Naked Wines USA. Warning doesn't look too bad though. Am awaiting updated broker forecasts.

Bonmarche Holdings (LON:BON) - as I predicted here on 28 Jul 2016, another profit warning looked "a virtual certainty". I don't see any rush to buy the shares this morning, as profit expectations are way down, and the company is clearly under-performing. Guess what? It blames the weather!

Cenkos Securities (LON:CNKS) - not a sector I usually cover, but the deep plunge in H1 profit today illustrates the feast or famine cyclicality of this sector.

SWP (LON:SWP)

Recommended cash offer - the company's own Directors have made a cash bid for SWP, at 9p per share. This looks a fair price to me, being a 50% premium to yesterday's closing price of 6p.

Well done to all holders. The usual form now is for everyone to start bellyaching that the company is worth far more, etc. Then people quietly accept the deal, bank the profit & move on.

It's almost a done deal, with 57.2% already in the bag.

Majestic Wine (LON:WINE)

Share price: 325p (down 25.0% today)

No. shares: 70.8m

Market cap: £230.1m

Trading update (profit warning) - the key sentence is this;

EBIT for the current financial year ending 3 April 2017 is expected to fall below current market expectations1.

The "1" footnote is important, and very helpfully gives a figure for what market expectations currently are;

1 The board believe current consensus PBT for the year ending April 3 2017 to be £16.1m

All companies need to do this - i.e. if an RNS mentions market (or Directors') expectations, then it should always state in a footnote what that figure actually is. I think it should also state the forecast EPS figure too. This clarity greatly helps investors interpret statements correctly, and is to be applauded.

Good bits - 3 divisions within the group are trading well;

Majestic Retail trading on track and making good progress on the transformation plan

Naked Wines UK and Australia are performing well and on plan

A return to growth for Lay & Wheeler

Bad bits - 2 divisions are not trading well;

Commercial division

- Trading has deteriorated.

- H1 has seen no sales growth, and a 200bps drop in gross margin.

- If these trends persist in H2, then operating profit (EBIT) could be around £2m lower than expectations.

- Internal review underway to improve performance.

Naked Wines USA

- Increased marketing initiatives have impacted profitability.

- Direct mail campaign has not worked.

- Small loss for the full year (versus an "unscheduled" profit last year)

- Operating profit performance also c.£2m lower than expectations.

Put that together, and it's about a £4m shortfall in operating profit, versus a £16.1m market forecast, so about a 25% shortfall from expected profitability. Not great. The share price has exactly mirrored this, at the time of writing, with a 25% fall today.

My opinion - I'm not sure about this share. It had a honeymoon period after the new CEO joined, and bolted on an apparently exciting growth business - Naked Wines.

The glass may now be turning half empty, with the reality dawning that this is really a low margin retailer. £12m operating profit for this year, on turnover of c.£440m is not good. Sure, the hope is that Naked Wines could become a blockbuster business within the group. I think the jury is out on that, personally I'm not convinced. I signed up for its service online, only to find that the wines I liked were unavailable.

Naked Wine's marketing is undoubtedly very clever, and draws you in, but in the end I'd rather just pop down to Waitrose and buy something nice from there, if I have guests coming round for dinner. Aldi plonk will do for the rest of the time. So maybe I'm not the target customer here?!

Looking at the chart, 300p has twice formed strong support, in early 2015, and 2016, so maybe it will do again? Therefore if you like the company, this could be a buying opportunity. Personally I don't particularly like the company, so will pass on this one, and don't have a strong view either way really.

Today's warning doesn't look too bad, with the core business doing alright. Also, the intention to resume divis is reiterated in the Directorspeak section.

I should also commend the company on a very well thought-out statement today. I found it comprehensive, easy to follow, and explained fully all the issues, and most importantly actually quantified their impact. If only all trading updates were this well constructed.

Bonmarche Holdings (LON:BON)

Share price: 90.5p (down 21.3% today)

No. shares: 50.0m

Market cap: £45.3m

Trading update (profit warning) - readers here were well prepared for this profit warning, as I predicted it very specifically in my report here on 28 Jul 2016. It seemed obvious to me that the company couldn't possibly hit its full year forecast whilst LFL sales were down 8.1% in Q1.

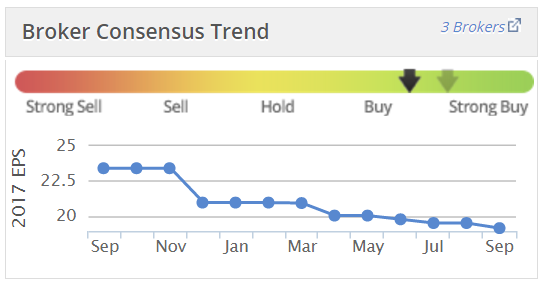

Another canary in the mine was Stockopedia's terrific little graph on the 12 month trend in broker consensus EPS forecast;

This graph is so useful, as repeated moves downwards is telling us that things probably are not going well. Research analysts at brokers don't operate in a vacuum - they talk to the FD at the company concerned, who will often give them a steer.

Mind you, broker forecasts are often still wildly wrong, which they're bound to be - nobody can predict the future with any great certainty.

This is an important general point to make actually. It's important to crunch some figures yourself, and check whether broker forecasts make sense. Surprisingly often with small caps, they don't. As in this case, back in July the company reported awful trading in Q1, but insisted it could still meet full year figures. That looked ridiculous to me. What the company said, and what brokers forecast, just didn't pass a simple common sense test. That's why I didn't buy any BON in the last few months, as another profit warning was very likely, hence today's price drop was a bullet that could & should have been dodged.

Profit warning - anyway, this is what the company says today;

Notwithstanding difficult trading conditions in July and August, overall performance was in line with management's expectations for the full year. However, trading in September has been extremely poor, largely as a consequence of the unseasonably hot weather which has not favoured sales of our new autumn ranges.

The hot weather conditions have resulted in the strong sales of residual summer stock however, and this will result in an end of season summer stock holding which is below last year's level, despite the generally poor summer season.

Nonetheless, we currently estimate that the store like-for-like ("LFL") sales result for Q2 will be approximately -8.0%, and the LFL for the first half-year will also be approximately -8.0%.

Now, let me compose myself before I explode. Deep breath. It is true that a warm September will indeed curtail sales of autumn ranges. That is, if you pack your stores with woollens, overcoats & hats/gloves, then of course they won't sell when people are on the beach in a heatwave. That's why sensible retailers bring in transitional ranges in July/August - i.e. new styles that will sell regardless of weather conditions, if the design/fabric/price, etc are all good.

Good retailers also find that unfavourable weather causes temporary downturn in sales, which they will usually recoup as the season goes on. In my experience, retailers that continuously blame the weather throughout the year are not seeing the wood for the trees. The underlying problem is that their product offering isn't good enough. The weather just makes that worse.

To deliver LFL sales of -8.0% for the whole of H1, then Bonmarche clearly has problems. What is frustrating is that management don't seem to be recognising that, and have instead looked for excuses, such as weather. Weather happens every year, it's always unpredictable, this is Britain. Good retailers navigate through that.

Revised forecast - well done to the company for giving us a revised profit forecast today. Companies can, and should publish guidance to the market. Brokers/NOMADs who say it's not allowed are just lying, and should be sacked, in my view. Lots of companies both on the main market, and on AIM, do publish current year forecasts. Everyone should do it - because managing investor expectations is a key part of being a listed company.

Here we go;

Combining the effect of September's trading with a more cautious forecast for the second half of the year, the Board's view is that the Company's full year profit before tax is likely to fall within a range between £5.0m and £7.0m.

Balance sheet - there's no problem with solvency, as the company remains profitable, and has a decent balance sheet with cash on it;

The Company's financial position remains strong and the Company is expected to end the half year with a net cash balance of approximately £9m. In addition, the Company is supported by a £10.0m revolving credit facility, which is currently undrawn.

Dividends - look enticing in the short term, but remember that this level of payout may not be sustainable, if trading deteriorates further;

Notwithstanding the difficult trading conditions set out above, the board proposes to announce an interim dividend of 2.5 pence per share, a similar level to that paid in respect of the first half of FY16, and currently expects to announce a final dividend of 4.6 pence per share.

Directorspeak - the new CEO does seem to acknowledge that action is needed to improve execution. Retail is detail;

"I was attracted to Bonmarché by its potential to grow as a business serving the 50 plus women's value clothing market. My early impressions of the business have underpinned this, and I am currently formulating my plans for the future.

The direction of travel is right, but the effectiveness of execution needs to improve. My plans are therefore likely to focus on improving the clarity of the customer proposition and operational improvements in all channels rather than a major strategic repositioning.

That's good. She's on the case by the sound of it.

My opinion - I'm very wary of getting involved with any struggling conventional retailers. They're up against big headwinds right now, and the one who are struggling now could end up in dire straits once these headwinds have taken their toll, specifically;

- Continued increases in Living Wage

- Pension contributions

- Apprenticeship levy

- Weaker sterling - large cost price rises in the pipeline for next year

- Upward-only rent review system, and increasing business rates

- Highly competitive sector, with new online competitors emerging & growing fast

A business experiencing all these headwinds, and seeing sales decline by 8%, could get into real trouble.

Therefore, I see this share as a potential value trap. Sure it looks cheap now, but it won't look cheap if current trends continue. Another drop in sales could easily see this move into losses next year.

The new CEO may be able to turn it around, but I reckon it's safest to steer clear of this, and other struggling retailers. I reckon it's better to spot overlooked growth stocks, and pay a bit more for them, rather than trying to find low PER bargains - which are often struggling companies that are being overtaken by online competitors.

A few quickies to finish off with;

eg Solutions (LON:EGS)

Interim results for the 6 months to 31 Jul 2016 are out today, and they're pretty awful;

- Turnover fell 31% to just £2.5m.

- Pre-tax losses ballooned from -£0.26m in H1 2015, to -£1.33m in H1 2016.

- Net cash almost halved from a year earlier, to £1.66m

The company, and FinnCap trumpet good contract wins in H1, which FinnCap reckons will lead to an "exceptional" H2. Sounds interesting, but it's more jam tomorrow from a company that has been a serial disappointer in the past.

Given its track record, I'm certainly not minded to give this company the benefit of the doubt. It very much appears to be a lifestyle company for the CEO, in my view. I'm basing that view on fact - i.e. comparing the cumulative amount raised from investors, compared with the cumulative amount withdrawn in remuneration by management.

DX (Group) (LON:DX.)

Preliminary results for the y/e 30 Jun 2016 are out today. They're not as bad as feared;

- Revenue down 3.2% to £287.9m

- Adjusted profit before tax of £11.5m (down 57% on prior year)

- Adjusted EPS of 4.9p

- Net debt of £9.8m

Given the share price is only 20p (down 9.1% today), surely this is a bargain at a market cap of only £40m? That's a PER of just over 4 - screaming bargain? I'm afraid not.

The problem is that the big profit generator is the DX Exchange business. This is in terminal decline, as solicitors & others substitute emails for documents. As the company explains today;

As we previously reported, the Group's profitability has been substantially impacted by three major factors. The most significant of these was an increase, above that expected, in volume erosion at the DX Exchange operation, our bespoke secure document handling service. As we have highlighted previously, this business is subject to e-substitution and has a largely fixed cost base...

... Renewals in the second half, which includes April, an important renewal month in the governmental sector, were in line with management expectations.

Revenue for the year from DX Exchange showed a decline of 10.1% compared to 5.4% in 2015. This decline significantly impacted profitability since the service has a mainly fixed cost base; deliveries and collections are made to all 4,500 document exchanges around the UK and Ireland every morning and every evening, largely irrespective of the volume of mail or the number of customers.

Volume erosion is expected to continue, with digitisation and electronic communications driving this trend, but DX Exchange remains a valuable service to its customers and we will seek to support renewal levels with high levels of customer service.

These comments should send a shiver down the spine of all shareholders. It's the worst possible scenario to be in - a fixed cost business with thousands of locations, combined with revenues which are declining at an accelerating rate.

My opinion - I think this company is the living dead. The dynamics described above seem to be pointing towards inevitable decline and eventual insolvency. It's likely to take several years, but I think this group is probably heading for extinction. Unless management can come up with a clever way of restructuring the core business to make it viable on dwindling revenues?

The rest of the business is operating in a cut-throat sector, where there's really not much profit to be made, as customers constantly shop around for the lowest prices.

So this one's a bargepole job for me. Although note that management did make substantial buys at 17p in Mar 2016, totalling £0.75m.

A divi of 1.5p per share is being paid, but it wouldn't surprise me if this is the last significant divi the company ever pays.

Dillistone (LON:DSG)

A couple of readers were discussing today's interim results from this software company, in the comments section below. I've had a quick look at the numbers, and the figures look alright. H1 2016 turnover & profit are little changed from last year.

There's an attractive divi yield here, but looking at the balance sheet, I'm concerned that the current high divi payouts might be unsustainable.

NAV of £7.1m becomes negative NTAV of -£2.4m. Generally I like to see generous divis only coming from companies with strong balance sheets. This one isn't strong.

Also, note that the current ratio of 0.57 is very poor - indicating a stretched working capital position. This could be because customers are paying up-front, so if that is spread evenly across the year, then it may not be such a problem.

The cashflow statement shows that the company uses up nearly all of its cashflow in paying the divis, and funding development spending.

Outlook comments are reassuring, and remind us that the business is mainly generating SaaS (i.e. recurring) revenues. This is an important point, as it means that revenues (and hence profits) should be much smoother & more predictable than other software companies which rely more heavily on licence sales.

Note 4 indicates that about two thirds of revenues are recurring. The Directorspeak section points out that recurring revenues cover admin costs. So the business should remain profitable, even in a bad year.

My opinion - given its strong recurring revenues, maybe my balance sheet concerns are unfounded. This strikes me as quite a nice, steady little business. It's probably priced about right for now. What is lacking, is convincing upside potential. If the company can start demonstrating some really strong growth, then I would jump in and buy some, for a re-rating. Trouble is, based on today's results & outlook, that prospect seems remote.

So the danger is that a purchase here would just be dead money, which comes at an opportunity cost of course. Sure the divis are nice, but you need the first year's just to cover the bid/offer spread. It's tricky to buy & sell in any volume too.

Overall then, it's not for me, but is on my watch list, as company I like, which I would consider buying in future if some exciting growth started to emerge.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.