Good morning! Not a huge amount of news today, which is handy, as I still haven't prepared my slides for the two presentations I'm giving at Mello Workshops tomorrow & Friday! So looks like I'll be having a busy afternoon & evening rushing to get those finished. Should be a fun event - David Stredder says there are still a few tickets left, so not too late for anyone who wishes to join us at the last minute.

McBride (LON:MCB)

Share price: 96.25p

No. shares: 182.2m

Market Cap: £175.4m

Trading update - this company describes itself as Europe's leading provider of private label household and personal care products. For anyone not aware, private label means supermarket's own label products, which are cheaper than the big name branded products.

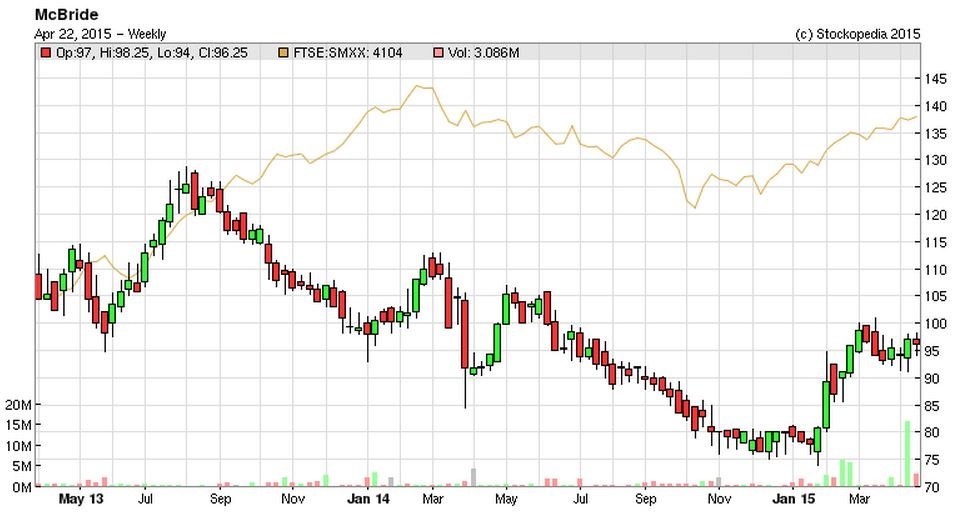

As you can see from the two year chart below, the shares have under-performed the FTSE Small Caps Index, although they put on a partial recovery spurt in Jan-Feb 2015, getting back to where they were about a year ago.

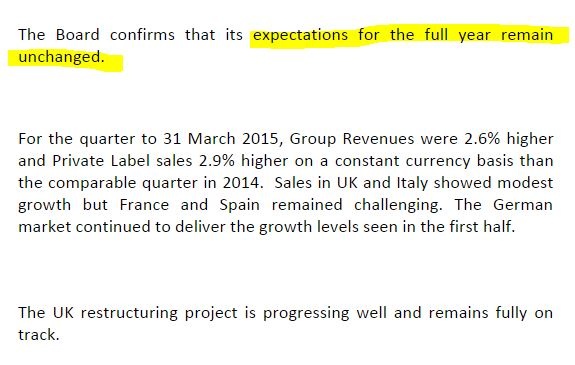

Today's update covers Q3, being the three months to 31 Mar 2015, so we're now getting close to their 30 Jun 2015 year end.

I note that they company only reports sales growth on a constant currency basis above, which is not very satisfactory - companies normally report both constant currency, and reported currency sales growth. Since currencies are volatile at the moment, with the Euro in particular having depreciated heavily, then I think the above reporting is a bit too selective. I imagine that sales in sterling might be down overall, which should have been stated.

Anyway, the key bit is that profit is in line with expectations, so that look alright overall.

Valuation - broker consensus is 7.89p EPS this year, so that puts the shares on a PER of 12.2, which sounds about right, if the company was debt free. Trouble is, it has a heavy debt burden on the balance sheet, last reported at £90m on 5 Jan 2015. That's just over half the market cap in net debt, so the valuation doesn't look appealing at all once you factor that in.

My opinion - the points I made here on 5 Jan 2015 still stand, so for me this is not a share of any interest. It beats me why anyone would be interested in buying a share which is a low margin manufacturer, selling into the cut-throat supermarkets sector.

The divis look attractive, but reduced in 2012 from 6.8p to 5.0p, and has remained static at 5.0p since - which is usually a sign that the company is deferring a further cut in the dividend. I'd want to see net debt reduced as a bigger priority than paying out divis.

On the positive side, the company appears to be continuing to restructure, so that could unlock further upside on future profitability. Although I suspect the supermarkets won't waste any time squeezing those profits back out again!

Sanderson (LON:SND)

Share price: 62p (down 2.3% today)

No. shares: 54.6m

Market Cap: £33.9m

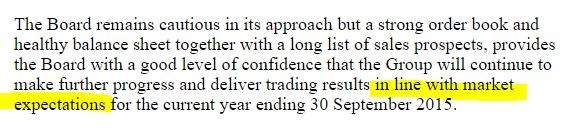

Trading update - this is group of small software companies, which reports today on trading in H1 to 31 Mar 2015. Revenue and profit are up by just over 10% compared with the prior year's H1. The order book was up a similar amount, and net cash is reported at £4m.

Outlook comments sound reasonably positive;

Valuation - the company reported adjusted EPS of 4.6p last year, so if they're 10% up this year, then that looks to be just over 5p EPS. Broker consensus is 4.86p, so in the right ballpark. Taking broker consensus, then that becomes a PER of 12.8, which on the face of it looks about right in my opinion, for the size & type of company.

Balance Sheet - looking back at the last reported balance sheet dated 30 Sep 2014, the problem is that it's dominated by intangible assets of £28.5m, so when you write off that lot, net assets of £25.8m becomes negative £2.7m, not an ideal position.

There's a £4.8m pension deficit, and £1.8m in deferred consideration & deferred tax in long term liabilities. Looking at working capital, the current ratio is 1.29, which is alright for a services company (i.e. which has no inventories), but not exceptional by any means.

Note that £680k of development spending was capitalised in 2014, which helps boost profits.

Dividends - the company has a good track record of paying increasing divis each year, and the yield is c.3%, so not bad for the type of company.

My opinion - overall this company looks reasonable, but growth seems fairly pedestrian, and looks to have come from acquisitions over the last few years. So overall it's probably priced about right at the moment - so where is the upside going to come from?

Punch Taverns (LON:PUB)

Share price: 105p

No. shares: 221.9m

Market Cap: £233.0m

Interim results - for the 28 weeks to 7 Mar 2015. This is an interesting special situation. The company did a large and complicated debt restructuring last year, involving some debt being swapped for equity. This has brought down net debt from £2.2bn to £1.6bn. Still a vast amount, but the interesting thing is that Punch owns fixed assets of £2.3bn, which is mostly freehold property (i.e. its pubs estate). The debt is secured on the freeholds.

Net assets are £868.0m, less £167.7m intangible assets (nearly all goodwill), and you get £700.m net tangible assets - or exactly three times the market cap. So if the assets are really worth what they're in the books at, then potentially these shares could be cheap.

Trouble is, it's difficult to know if the pubs really are worth book value. I've heard all sorts of anecdotal evidence that some pubs are on inflated rents, which the tenants can't afford to pay, and that sites could end up being written down to much lower book value in time.

The other key question is what terms the debt is on. If there are tight covenants, then the lenders could end up seizing control of the company and diluting away existing shareholders (as happened recently at Afren (LON:AFR) for example).

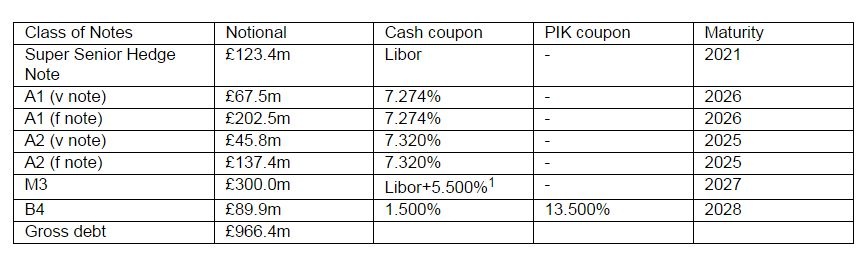

The following table is provided today to summarise the different tranches of debt, and two things jump out at me - firstly that the maturities are now quite long term, so the company should not be under any danger of going bust for the time being (providing it meets debt covenants). Secondly, the interest rates on the debt are high (c. 5-8% p.a.), and looking at the P&L it is clear that debt interest will continue to swallow up the lion's share of operating profit. So you could argue that the company exists to provide cashflow for the holders of debt, rather than for holders of the equity stub. The prospect of any dividends in the foreseeable future looks close to nil.

Punch A debt structure:

Punch B debt structure:

I would also be interested to find out what the early repayment terms are on the existing debt? So possible upside for equity holders could come if another debt restructuring became possible, which allowed Punch to borrow from a new lender at a lower interest rate. That might then free up more cashflow to further repay debt, and hence provide more long-term upside for shareholders.

My opinion - Stockopedia shows it being on a forward PER of only about 4, but that is dependent on finely balanced forecasts, whereby earnings are likely to be volatile, as it's what's left after paying debt interest.

This is clearly a high risk share, but for special situations investors, who are capable of doing the detailed research to understand the various points raised above, then it's possibly worth looking into.

There is the further complication of recent Government legislation to offer tenants a free of tie rental option, which could be very damaging to traditional pubcos.

I'm wondering whether this might be a potential trading idea too, given that the chart seems to be finding support at about 100p. I'd be inclined to use a guaranteed stop loss though, just in case something awful happened. So I might take a small long position with a stop loss, as more of a punt than an investment. Am still pondering that idea. Have any readers researched this recently? If so, I'd be interested to hear your views in the comments section below.

Vianet (LON:VNET)

Share price: 89.8p

No. shares: 27.9m

Market Cap: £25.1m

Trading update - covering the year ended 31 Mar 2015.

The key part says;

That looks alright to me, given that we already knew the company is up against headwinds of pub closures & Govt regulatory issues surrounding the brewery tie, which adversely affect Vianet's core product line, the Brulines beer flow monitoring equipment.

More colour is given, with vending telemetrics doing alright, and "prospects for this business remain excellent", particularly for the coffee vending machine market.

The less important fuel division made a small profit for the year, which is good to hear, as losses had been incurred here previously.

Dividends - the 4.0p final divi is being maintained, so the Exec Chairman has been good to his word, when he assured me a couple of years ago that the divis would be held. So even though the share price has meandered up & down, but broadly sideways for a couple of years, when you add on the 5.7p total divis each year, the overall return for shareholders has been positive.

My opinion - I got bored a while back and moved on, roughly at breakeven overall, including divis. So not a disaster by any means - I wish all stock ideas that don't pan out as hoped for, ended up at breakeven!

It's got a very high StockRank of 98. Personally, I won't be revisiting this share, as I think the growth prospects are somewhat limited, and the Brulines business will inevitably see more headwinds from continued pub closures - the big pubcos are looking to offload quite a lot of non core pubs still, which is likely to mean lost custom for Brulines.

Nothing is said in today's statement about how sales in the USA are going, although increased investment is noted. So presumably that is still work in progress. If big strides had been achieved, then the company would have said so today, but it didn't. So I expect that might be a long haul.

Overall, good luck to them. I like management here, but for me the growth potential looks too modest to persuade me back in as an investor.

All done for today, see you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.