Good morning. People seem to like the new format, with clickable (through to that company's StockReport) headers, so I shall do that every day from now on.

Also please note that I'm spending all morning writing these reports now, updating them about every hour from 8 a.m., so if you keep this page live in a tab on your browser, refreshing it from time to time will ensure you don't miss anything! The email goes out at noon (see sign up box below this article), but I might still be updating it until about 2 pm, depending on how much news there is each day.

Networkers International (LON:NWKI)

Recruitment group Networkers International (LON:NWKI) issues a trading update for the year ended 31 Dec 2013. It says that pre-exceptional profit before tax, and EPS should be in line with the Board's expectations (urgh, hate that phrase, why can't they say market expectations, like most other companies? We know what market expectations are, but the Board's expectations could be different, so it's a bit of a cop-out referring to the Board's expectations!).

Although they also note that Net Fee Income fell by 5% in 2013 (i.e. NFI = gross profit, which for recruiters is their fees excluding the wages paid to temporary workers, so it's the most meaningful measure of revenue the company has earned, as opposed to total revenue which includes the wages of the temps that they supply & hence recharge on to clients).

The reasons given for the fall in NFI are twofold - firstly that 2012 (surprisingly) was a record year, and secondly that there has been a (positive in my view) shift in NFI more towards permanent placements, as opposed to temps. I think that is positive because the profit margin is higher on permanent placements, whereas supplying temps is very competitive, with clients squeezing out profit margin by playing recruitment companies off against each other.

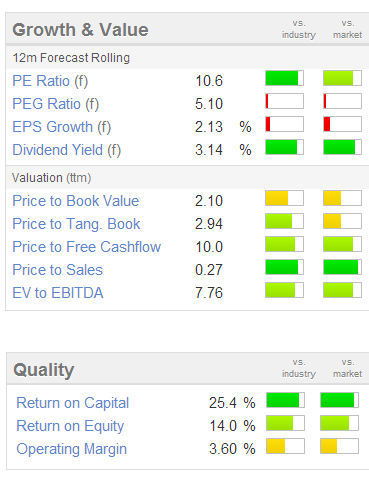

It's valued at a market cap of £41.2m, at 50.5p per share, which has enjoyed a re-rating of about 46% from the 34.5p low six months ago. Is there more in the tank? Quite possibly, as the forward PER is only 10.6, with a 3.14% dividend yield, and they carry little debt - today's statement says that the only debt is invoicing discounting (normal for recruitment companies) and reduced over 55% to £3m at the year end.

It's valued at a market cap of £41.2m, at 50.5p per share, which has enjoyed a re-rating of about 46% from the 34.5p low six months ago. Is there more in the tank? Quite possibly, as the forward PER is only 10.6, with a 3.14% dividend yield, and they carry little debt - today's statement says that the only debt is invoicing discounting (normal for recruitment companies) and reduced over 55% to £3m at the year end.

The fly in the ointment here is some litigation in the USA. This is the first I've heard about that, so it just shows how important it is to read the Annual Report & results statements very carefully. They have made an existing provision of £1.6m, and are making another £0.25m provision. This is a worry, and personally I wouldn't want to invest until this matter has been closed off.

Also, it's a worry that the company has allegedly violated laws governing employee conditions & payments. There could be a perfectly reasonable explanation, but I would want to ask some difficult questions before investing here, to ascertain whether the company just messed up, or deliberately violated laws in the hope of getting away with it? Also, what procedures have been put in place to ensure that this cannot happen again, and that the company complies with all relevant legislation in future?

There is more information in the 2012 Annual Report apparently, so I'll have a look at that when time permits. The outlook sounds positive, with the company saying today;

Whilst we are only in the early stages of the year, the Group has made a very encouraging start to 2014.

So if I can get comfort on the litigation issue, then these shares look potentially good value & worthy of further research in my opinion. As always I am NOT recommending any shares, just flagging up ideas for research that look interesting on an initial, cursory glance, which is all I have time to do here - hence further, deeper research is essential.

Edit: On reflection, maybe I'm worrying too much about the litigation issue here? It's been known about for a long time, and hence is probably discounted into the share price already. So I might dip my toe in here with a small purchase, given that the outlook statement uses the words "very encouraging" start to the new year, and the valuation looks good value to me. With the economy apparently improving quite strongly now too, recruiters should have a good year in 2014.

Cello (LON:CLL)

This marketing group issues a trading update for the year ended 31 Dec 2013. It looks good - the key point saying;

Strong trading for the year, revenues and headline profit before tax ahead of consensus market expectations

Various other positive points are listed, in particular I like that net debt has reduced below expected levels. Although as I reported on 18 Sep 2013, the Balance Sheet at Cello is weak, with net tangible assets being negative by £6.9m at the last reported date. Furthermore, they make lots of adjustments to profits, some of which are questionable. So overall, it's not for me, although I can see the attraction, especially after this positive update statement today. So it's a question of weighing up good trading, against a weak Balance Sheet.

Their shares are up 9.5% this morning, so good news for shareholders. Marketing is an excellent sector to be investing in right now in my opinion, as flagged here several times before - as the valuations are still reasonable, yet clients are starting to crank up their spending, given that the economy is now appears to be recovering on a sustainable basis.

Tristel (LON:TSTL)

Tristel seems to be making progress, with an H1 update for the six months to 31 Dec 2013 (their next year end is 30 Jun 2014). What an excellent trading update too, it's crystal clear, giving the figures, I wish all companies would report like this (I have added bolding to most important points below);

Tristel has had a strong first half and expects to report encouraging performances from all business segments. Furthermore, following a better than expected December, revenue will be in excess of £6.4m (2012 £4.4m) and pre-tax profit in excess of £0.7m (2012 adjusted pre-tax loss of £0.6m) exceeding levels indicated in the AGM trading update issued in December.

The Company has benefited from strong operational cashflow in the first half of the year and net cash at 31 December was £1.4m (2012 net debt of £0.4m).

My only criticism of this trading update is that it is vague about full year expectations, saying only;

We continue to build upon these successes with confidence that they will continue into the second half and beyond.

So looking at the broker consensus forecasts, 1.8p is forecast for this year, and 2.7p for next year, which at 51.8p makes the shares look a tad pricey perhaps - that's 19.2 times next year's earnings. So bulls on this stock must believe they will beat broker consensus, and today's positive statement might mean they're on the right lines? It's not for me at this valuation though, and the shares have had a great run of about 150% in the last six months.

General market comments

This is very much a sentiment-driven stock market at the moment, which is increasing risk - because as we are increasingly seeing, it only needs a slight disappointment to knock prices back 20-30% (or even more). That's the big problem when you start chasing up stocks to more & more stretched valuations.

Also, I think the risk of a general meltdown in frothy stocks is increasing by the day. So I'll stick to my Value & GARP stocks, comfortable that they are good businesses at reasonable valuations - so if they drop, I'll use my spare cash to buy more. Whereas momentum traders are all assuming that they will be the first out of the exit - well they won't all be first out, will they?!

I think that, at some point, we could see a real meltdown in some of the more wackily valued stocks. I've no idea when though! (probably triggered by the next big correction in the USA). Sentiment can turn so rapidly, especially when all those stop losses start being hit, so it pays to be prepared.

Overall though, I think this bull market will continue, after the next correction. So my feeling is that there's no reason to be bearish overall, just cautious about valuation. After all, the two big bear markets in my investing career (2000-early2003, and 2007-early 2009) happened at the end of a long (7+ years) period of strong economic growth, and increasingly stretched share valuations.

Comparing that with now, whilst there are pockets of over-valuation at the moment, many of the larger companies making up FTSE 100 actually look quite good value. So it's mainly small to mid caps where some valuations have become stretched. In my opinion, stocks will correct individually, as investors take profits, and it dawns on them that they are over-valuing a lot of companies.

Consider also the macro picture - we're coming to the end of a long period (5 years) of depressed economic conditions, falling real household incomes, etc. So now recovery is taking hold, the stock market is just factoring that in - and valuations often look quite high on a PER basis at the start of an economic recovery. Once companies earnings rise, on an operationally geared basis sometimes very considerably, then the valuations become much more reasonable.

Overall then, I think caution is needed on valuation, and I'm banking profits by top-slicing things that have gone up a lot (as I always do). So that gives a pot of cash to keep on the side, and invest when prices correct, or when particular bargains pop up, as they do all the time, especially at the overlooked micro cap end of the market.

Please add your comments about your general market view in the comments below, this is not intended as a monologue, but a conversation starter!

Carclo (LON:CAR)

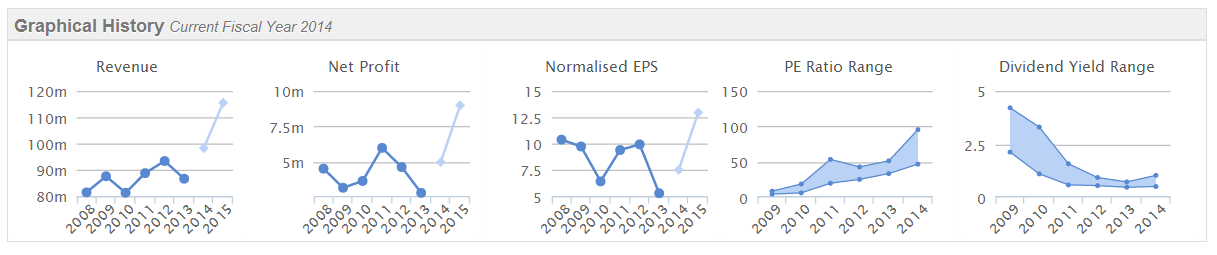

Checking the archive here, I haven't reported on this company before. It's cropped up as the largest significant sized company % faller of the day today, down 33% to 178p per share, so the market cap has plunged from £175m to about £117m. Not good. It's some sort of UK-based specialist plastics company, and performance in recent years looks to have been fairly lacklustre, so the valuation appears to rest on broker expectations of much higher profits in 2014 and 2015, as indicated in the Stockopedia graphical history below;

As I don't know anything about this company, it's not really possible for me to interpret this trading update very much at all. It says that H2 trading was stronger, but lower than expected. As regards outlook, the company says;

The group's balance sheet is strong and its funding remains secure. The board looks forward to sales and profits progression across the group in the coming financial year.

There are no figures in this trading update, so it's not possible for me to comment any further. Look at the forecast PER range above - between 50 and 100 earnings, and it doesn't appear to be trading as well as expected, so that's a perfect example of the dangers of highly rated stocks disappointing on growth that I mentioned earlier on in today's report.

Why take things on faith, pay up for a racy valuation, and then wake up one morning to find your shares 33% lower, because growth hasn't turned out to be quite as good as hoped? That seems like lousy risk:reward to me, and is exactly why I don't pay high prices for growth stocks. It has to be GARP, or I'm not interested.

That's it for today, see you tomorrow morning as usual!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in NWKI, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.