Good morning!

Hydrogen (LON:HYDG)

Oh dear, it's another profit warning from this recruitment company. I last reviewed it here on 22 May 2014, when a rather hesitant trading update referred to lack of growth in fee income, and that they were cutting costs. As I concluded at the time, this is all wrong in a recovering economy. Competitors are reporting stronger sales, as they should be, given the reasonable pace of economic recovery in the UK now - so this should be positively impacting Hydrogen given that 56% of the group's gross profit comes from the UK (from last full year accounts, note 2(b) ).

I don't know if any readers actually use the hyperlinks I put into these reports, so if you don't note that I link to the RNS itself on investegate, and where relevant to my previous articles here. I did put in a deliberately incorrect link a few weeks ago to see if anyone would notice, but nobody commented on it.

Today's update follows the same format as before, saying that underlying business is good, but various delays & problems mean that they are performing badly. Net Fee Income (NFI) actually fell by 7% in the six months to 30 Jun 2014. That's bad.

So management are doing more restructuring, with exceptional costs of £1.8m likely for the full year. Interestingly that means the H1 profit warning does not follow through to the full year, as they say;

The strong client pipeline and reduced cost footprint give the Board confidence that future business profitability will improve, and the Board therefore believes that profit for the full year before exceptional items will be in line with expectations.

So it could have been a lot worse. Although there must be a high risk that something else will crop up in H2 to deliver another profit warning. It's just one after another with this company. The inescapable conclusion is that it's not a very good company. However, it has a reasonable Balance Sheet, with less debt than some other smaller recruiters, and it has consistently paid a generous dividend. the forward yield is just under 6% after this morning's 5p price fall to 77.5p per share.

For value investors, this might be worth a closer look. Although the key issue to my mind is whether management are any good. Current performance suggests they're possibly not. It would be good to get them along to an investor evening - Mello or EDIF perhaps? The shareholder register is dominated by individuals - the CEO & Chairman own 29% of the company. Five other individuals also have discloseable stakes, who I presume are probably other employees/founders. So the shares are illiquid, and as Dan from Shares Magazine has Tweeted this morning, it makes you wonder why they bother with a stock market listing at all? Especially now the mkt cap is so small, below £20m. Lovely divis though, and I very much enjoy a good dividend.

Ideagen (LON:IDEA)

Acquisitive small software group Ideagen has reported solid-looking results for the year ended 30 Apr 2014. I mention the word acquisitive, because it's important to distinguish between organic growth (which justifies a high PER), and growth by acquisition (which usually doesn't). At the risk of rubbing salt into recent wounds, a good example of investors mis-pricing growth by acquisition was Judges Scientific (LON:JDG), where people chased up the share price much too high, into the low 20s (PER), when actually the underlying businesses only deserved a PER in the low teens. The price has now corrected, with the trigger for the 50% share price fall being just a 10% reduction in current year forecast earnings.

This is a good example of why I hardly ever pay a racy PER (i.e. over 20) for anything, because risk/reward is usually wrong at that sort of rating. Although that safety-first approach also means that when the next ASOS comes along, I'll sell it way too early again because it's got too expensive during the early stage growth - so a bit of lateral thinking is needed with very convincing growth stocks sometimes. It's so difficult to sort the wheat from the chaff with growth companies though.

Ideagen put out a year end trading update just a few days after the 30 Apr 2014 year end, indicating good financial controls are in place (always a major positive in my view). I felt the company looked far too expensive at 44p then, but they have since come down usefully to 34p (mkt cap of c.£42m), so might be worth another look now.

As people seem to like bullet points, let's do them for Ideagen's full year results today;

.

Positive

- Revenue up 38% to £9.0m, of which 13% was organic

- Recurring revenues of £5.1m covers 86% of fixed costs - de-risks things nicely

- Niche business for customers in highly regulated markets - sticky

- Balance Sheet is sound, with net cash of £4m (but note £2.4m deferred income - i.e. cash paid up-front by customers)

- Outlook sounds encouraging, in particular potential for more NHS contract wins

.

Negative

- Diluted EPS was up, but only by 12% to 1.67p - not great compared with a PER of 20

- Development costs of £525k capitalised, so EBITDA falls from £2.8m to £2.3m after those costs added back

- Tiny dividend of 0.15p for full year is a yield of only 0.4%

- Share based charges of £285k (£178k LY) are remuneration, so should be deducted from adjusted profit in my view.

.

Overall then it looks a much more sensible investment proposition at 34p per share now than when I last looked at it in May at 44p. To my mind though, it's still a rather toppy rating for a very small company. It is a good quality business though, with decent recurring revenues, a strong operating margin (which for some reason doesn't show up on Stockopedia, which shows a negative operating margin - could be because of adjustments to profit reported by the company). The forward PER is about 17 times, based on 2p EPS forecast. I think that's high enough, so don't see any valuation upside on that price for the time being. To my mind the rating should be about 13-14 times for a company this small. Although the clever thing here is that by having highly rated paper, the company can keep bolting on cheap private companies, which become earnings enhancing, creating a virtuous circle - higher earnings, higher share price, etc. Like Judges did...

Renold (LON:RNO)

Shares in this industrial chains maker are up 6% today to 64p, on a positive IMS covering the period from 1 Apr 2014 to date. The key sentence says;

The combination of the early delivery of savings from the Bredbury factory closure, and other ongoing incremental actions to reduce the Group's breakeven point, have resulted in the Board's current expectations for the full year adjusted operating profit being above the current range of market forecasts, despite the adverse impact of foreign exchange movements.

That's good, but my only reservation is that improved profitability is coming from cost-cutting. Top line growth is minimal at 0.9% y-on-y. In terms of valuation, the forward PER is shown by Stockopedia as 13, which seems reasonably until you look at the net debt & pension deficit. There's no dividend either (although a tiny divi is forecast to start this year), so I can't see anything to get excited about here at the current valuation, which looks aggressive to me, when you properly allow for debt & pensions (key factors which many commentators overlook completely).

Yes the company has improved its trading performance considerably, but that has been reflected in the share price already. There must be a huge amount of global competition too, so not likely to ever become a high margin business. If it was my money, after such a good run, I'd bank the profit at 64p per share & move on. But as always, DYOR.

Hogg Robinson (LON:HRG)

I've not looked at this share for years, but as it's made a new 12m low this morning at 65p per share, the market cap of about £210m has come in towards the top end of what I look at.

It's a corporate travel management company, which seems to add value by providing expenses reporting, and other services. Their website is here for more info.

Today's news is an IMS covering 1 Apr 2014 to date. It's a profit warning. Various factors are mentioned which will result in a poor outcome for H1 (6m to 30 Sep 2014);

As a result of the lower than expected revenues during the first three months, together with the higher costs we maintained as the Government of Canada contract ramped up, our profitability for the first half of this year is likely to be significantly lower than in the six months to 30 September 2013.

Action is being taken to reduce costs, but they caution;

At this early stage in the year, the actions we are taking to balance costs should materially improve the Group's overall performance in the second half, but it is unlikely the anticipated shortfall in trading in this first half can be recovered in full. We therefore now believe that trading for the full year is likely to deliver an outcome slightly below current market expectations.

That doesn't sound too bad to me. Although it's the type of H2 weighted hope for the best profit warning where you often later find that they don't recoup anything much in H2 after all. Therefore another profit warning is probably quite a high probability for later this year.

Mention is made of clients self-booking travel arrangements, and that is my main worry about this company - why use it at all? Surely local management are best placed to manage the travel expenses of their staff, and you have PAs to book things for you online. Perhaps very large organisations prefer to have things centralised?

On the positive side, it's made very good profit margins in the past - last full year it made a 14.5% operating profit margin, indicating pricing power - so they must be doing something that clients value. There's no growth though, turnover has been flat for a few years, and this might be a business that sees itself being slowly ground down by competition?

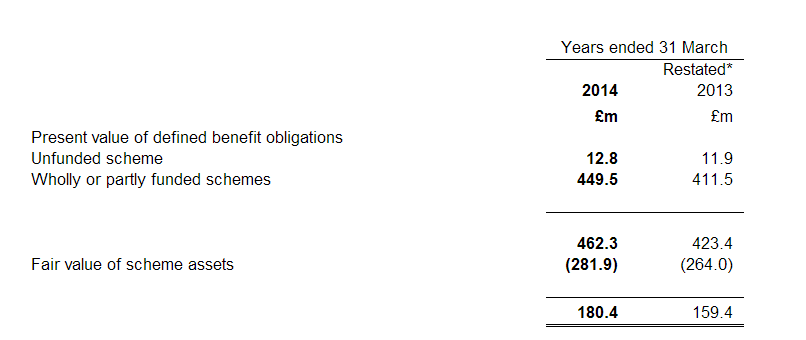

Skimming the last full year results, I see a pension deficit of £180m, and overall an absolutely dreadful Balance Sheet - it has negative net tangible assets of a scarcely believable £258.9m! The pension deficit seems to be seriously under-funded, so this doesn't look like a deficit which is going to melt away when interest rates rise - the scheme assets would have to rise by 64% (which isn't going to happen) to eliminate this deficit;

A deficit recovery payment of £8.2 was agreed with the pension fund trustees for the year ended 31 Mar 2015, with revised payments to be negotiated in 2014. So that's about a quarter of operating profit being consumed by deficit recovery payment at the moment, with potential for that to get worse.

This is just a mess, and the apparently low PER of about 9 is not cheap enough in my opinion, to offset the negatives of - mature business, poor current trading, too much debt, terrible Balance Sheet, huge pension deficit. So it gets a bargepole rating from me I'm afraid.

Scapa (LON:SCPA)

The issue of currency (strong sterling) is being mentioned in many, or even most trading updates at the moment - it seems to be a significant headwind for many UK companies with overseas operations or which export/import a lot. Scapa today says;

The Group's trading performance for the first quarter is in line with the Board's expectations, despite currency headwinds

The valuation looks full to me, on a forward PER of 17.5, and a divi yield of only 0.9%, so I'm not going to look any deeper than this. Please refer back to my previous comments for more details - note there is a pension deficit here too.

McColl's Retail (LON:MCLS)

A recent float, the convenience stores operator. It looks superficially cheap, on the Stockopedia rankings, but I wouldn't touch it. It's a low quality business, up against increasing competition from supermarkets. The Balance Sheet is weak, with negative net tangible assets of £31m, and it's got too much debt for my liking.

Interestingly, the shops seem to be slightly loss-making overall, with all the profit coming from "other income". This appears to be related to the Post Office? It could also be National Lottery income perhaps? With a supermarket price war on the cards, I think this chain's days are numbered - if it didn't exist, would you invent it? Probably not. I'm surprised it survived the last recession actually. In my opinion these shares could become a value trap - things that look cheap, but turn out to cheap for a reason.

On the other hand, there is quite a hefty depreciation & amortisation charge, of about £12m p.a., so if you strip that out, then it's generating reasonable cashflow. I suspect that a lot of the cashflow will need to be used for capex though - the recent IPO to provide an exit for the company's Private Equity backers, probably means it may have been starved of capex as the assets were sweat for cashflow, possibly? That would be something to check anyway. Plus the usual tax avoidance excessive debt structure seems to have been used. I find that PE tend to leave too much debt behind when they do IPOs.

I was head-hunted to possibly become their FD about 15 years ago, but the headhunter & I didn't click, and I was lukewarm about joining them anyway, so it was probably a good thing nothing came of that.

That said, the forecast divi yield of 6%-ish looks enticing. Is that sustainable though? It's not for me. I suppose it could be potential takeover target for one of the bigger supermarkets? Although they probably wouldn't want to take on a rag-bag of leases, many of which might be too small.

It's too hot to carry on working now, so I'm off to the beach to drink Pimms with my friend & her daughter!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.