Good morning. Sorry for running late today, I can't shake off this chest infection, so am still stranded on my friends' sofa in London. Not ideal. Phone & email messages are piling up, so I'll work my way through them once I'm a bit better, apologies for any inconvenience. Anyway, here's a quick skim of the morning's small cap trading updates & results.

4imprint (LON:FOUR)

There is a confident Q1 trading update from this group issued today. Group revenue for Q1 was an impressive 16% up on last year's Q1. That's all the more impressive since they are up against a headwind of a stronger sterling:US dollar exchange rate. A large part of 4Imprint's business is conducted in America, so that is translating into sterling at a less favourable rate of $1.66=£1 as opposed to $1.55=£1 in Q1 of last year.

I would have liked something a bit more specific about profitability, but the Chairman comments reassuringly;

The excellent performance in the first quarter again demonstrates the strength of the business. Notwithstanding the early point in the year and the short order to sales cycle, the indications are for a positive outcome for the year as a whole.

Checking back to my most recent comments here on FOUR, on 5 Mar 2014 I reviewed their 2013 results, and concluded that whilst it's a good business that is performing well, the price looked up with events on a PER of around 20 (at 691p per share). Although it's surprising how companies can grow into warm valuations when earnings are rising strongly.

Considering that they delivered 35.5p of underlying EPS in 2013, then broker consensus for this year looks too low to me. With such strong revenue growth, then surely 40-45p EPS should be do-able this year? Yet Stockopedia and another site have 2014 broker consensus of 33.4p EPS. At the current share price of 665p that is a PER of 19.9 times broker consensus, but more like 15-16 times if my guesstimates above on 2014 EPS (i.e. 40-45p) are correct. So it looks like a situation where there could be upside surprises on earnings possibly?

The dividend yield is reasonably good, at a forecast 2.9%, which has been growing at an average of about 5% p.a., and is twice covered. The Balance Sheet is sound, with net cash of £19.9m at 31 Mar 2014. Although the pension deficit remains a fly in the ointment, requiring substantial annual overpayments of £3.3m, rising at 3% p.a. That's money that could otherwise be spent on a more generous dividend, so it needs to be factored into the valuation. Note that today's statement says;

The Board is continuing to focus on reducing the risk and size of the Group's legacy defined benefit pension scheme, and accordingly is investigating the cost of insuring additional pensioner liabilities.

That won't come cheap, but sounds like a good idea in principle.

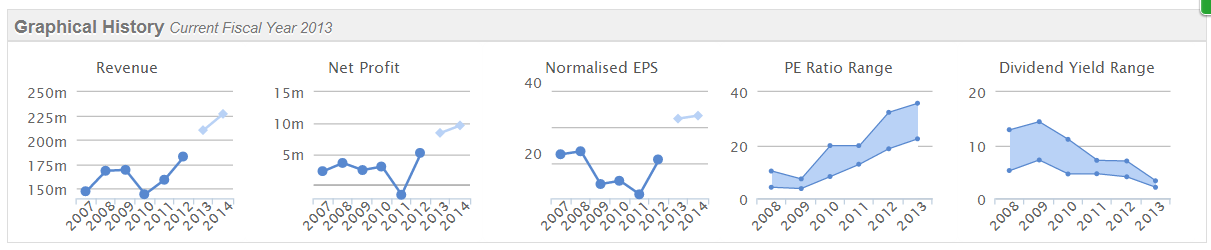

Overall then, this is a nice company, performing well, but I'm not seeing value in the shares at the current valuation, so it's not for me. Here are the Stockopedia historic data charts, which emphasise the point that it's gone from being a cheap stock to a rather expensive one, which may be justified given good performance:

Creston (LON:CRE)

This marketing & PR group has today issued a positive sounding trading update for the year ended 31 Mar 2014. The key paragraph says;

Following an improved second half performance the Group expects to be in line with consensus, both in terms of revenue and Group Headline PBT. Revenue will be £74.8 million (2013: £75.2 million), with cash (excluding deferred consideration) ahead of Board expectations at £7.5m.

I have some reservations about their accounting presentation, which is confusing, and over-complicated. However, the strong dividend yield goes a long way to soothing those worries - it currently has a forecast divi of 3.85%, which is pretty good at this stage of the economic cycle (assuming that earnings & hence divis should continue rising for say 5-7 years?).

At 109p these shares are approaching their 12-month high again. I'll wait to see the full figures which are due to be announced on 11 Jun 2014.

Sanderson (LON:SND)

This small, acquisitive software group has today put out a reassuring H1 trading update, covering the six months to 31 Mar 2014. Turnover grew 20% to £7.9m for the half year, although most of the growth is coming from acquisitions - organic growth was pedestrian at 4%.

Adjusted profit looks in line with expectations, at £1.2m for the half year. There is a strong order book, and they sound confident about the prospects for H2. Net cash is strong at £5m, although as with most software companies that has mostly come from clients paying up-front.

Personally I was a lot more comfortable when small software companies used to be priced on a PER of 8-10. My view is that most of them are too expensive now. This one is on a forward PER of 15, whilst showing little organic growth, which to me doesn't seem an attractive investment proposition. There seems to be quite a gap between the price of private deals, and the rating of public companies, with the latter being put on a perhaps unjustified premium. That does however create an opportunity for consolidators like Sanderson to buy up cheap companies, and then get rated by the Stock Market as a growth company on a premium PER. But is it really a growth company? Probably not, in my opinion. So I think there could at some point be a reset of the PER down to a more realistic level of around 10 perhaps?

Having said that, the dividends have been growing nicely, and a forecast yield of 2.4% lends support. If that keeps rising, then perhaps people won't worry too much about the PER? Also, software companies do embed themselves into clients in a way that makes them business critical. Which can be a licence to print money, as I recall from my days in clothing retail, where the EPoS system provider took full advantage of their power to fleece us for excessive charges in any way they could. Absolutely brazen, and if you refused to pay they threatened to just turn off the EPoS system remotely! There is also a clever wheeze where small software companies charge a client for a bespoke upgrade, but then go out and sell the same upgrade to other clients, charging them all for the entire cost of man hours involved, multiple times. Hence a good software company can make a very good investment!

NATURE (LON:NGR)

There always seems to be something going wrong at this company. Their oil facility in Gibraltar blew up some time ago, and a disputed insurance claim has now been settled at £1.35m, as announced today. I'm not sure how that relates to what was expected, as it is not stated in today's announcement. Looking at the last Balance Sheet, there was an amount of just over £4m in both debtors and creditors, relating to third party insurance claims, so it's not clear whether this issue has now been settled satisfactorily, or only in part.

Also a new problem has surfaced, so a provision of £819k has been made against a disputed contract for disposal of contaminated soil in Gibraltar, where the customer is seemingly refusing to pay those additional costs.

I've come to the conclusion that any small company dealing with hazardous materials of any type, is just best avoided altogether. There always seem to be disputes & potential catastrophes lurking around the corner, so this type of company is probably far better off in private ownership.

See you again tomorrow morning.

Regards, Paul.

(Paul has no long or short positions in any of the companies mentioned today)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.