Good morning!

Earthport (LON:EPO)

Share price: 44.5p

No. shares: 475.7m

Market Cap: £211.7m

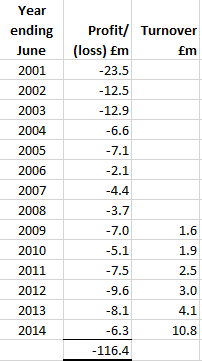

This company has a staggeringly bad track record. It has raised money from shareholders more times than anyone can remember, and has been loss-making every year since it was created. Not just a little bit loss-making either. I thought it would be fun to look back and collate the losses since 2001, and they look like this (see spreadsheet on the right).

Turnover has been rising in recent years, but it really doesn't matter because losses have stayed the same. So they could just be recirculating payments through the system to generate more revenue, it's meaningless unless they actually make a profit.

More recently, turnover has been bought in through acquisitions, to (in my view) mask the fact that the legacy business is going nowhere.

Over the years there have been numerous big fanfare deals announced with major banks, etc, and none of it has ever created anything of commercial value.

Yet the market keeps coming up with new enthusiasts to pour money into the company, and on it goes. All this company actually is, is a collection of bank accounts in multiple countries, and small payments are made for clients across borders by grouping them together, and making a single bulk payment. The payments are then broken down at the other end and paid out to the people they are intended for.

The only usefulness of this, is that it saves clients the bother of opening up numerous foreign country bank accounts. Since Earthport kindly operate this service running at a permanent loss, then it's no wonder that some clients take advantage of that by using Earthport instead of managing their own cross-border payments in-house.

None of which has ever sounded even remotely like a viable business to me. The market cap of £211.7m is beyond insanity in my opinion.

Final results - for the year ended 30 Jun 2014 are published today. The company trumpets 161% growth in turnover, to £10.8m, although note that most of the growth has come from an acquisition.

The underlying loss before tax didn't fall, it actually rose slightly to £8.6m (2013: £8.1m). This is masked somewhat by a £2,274k foreign exchange gain, bringing the reported loss before tax down to £6.3m.

Balance Sheet - it is rapidly burning through the cash, with £9.1m remaining at 30 Jun 2014, enough for about another year of operations. Although I note that amazingly, another Placing was done in Sep 2014, raising £26.6m (gross) at 40.85p, to accelerate growth. So it's fine for cash now, for probably another 2-3 years.

My opinion - as you might have gathered from the tone above, I think this is a terrible company, which has dismally failed to produce anything close to commercial success over the last 15 years. It should have been put down years ago, but astonishingly has managed to keep raising fresh funding to essentially pay salaries to staff & Directors to do something completely uneconomic.

The whole area of international online payments is a difficult area to invest in, as there are lots of this type of company, and I wonder how many will still exist in 10 years' time, given that the big players such as Apple, Google, etc, are starting to get their teeth stuck into this area?

I'd be amazed if Earthport is still around in 10 years' time, but there again I said that 10 years ago!

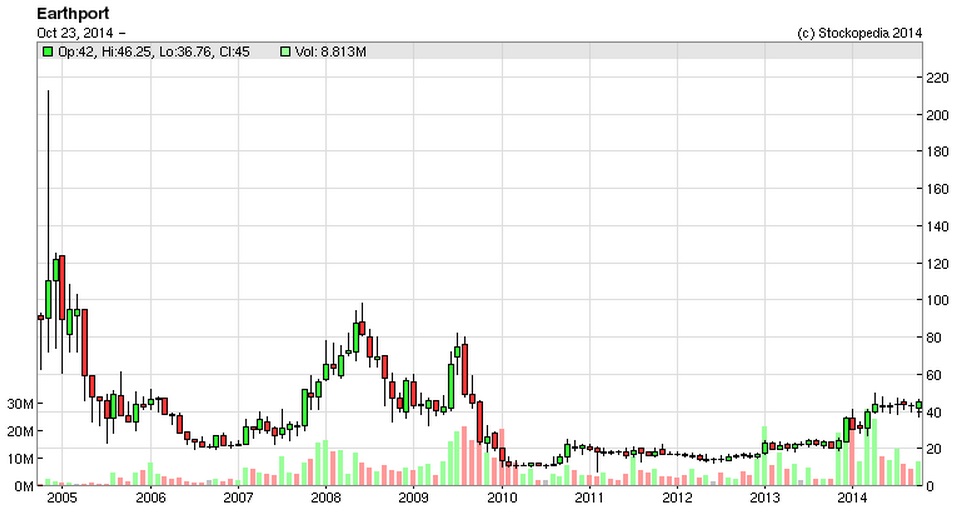

As you can see from the long-term chart, every now and then the market gets excited about Earthport, but after a while reality comes home to roost when people realise all the hype was just more hot air.

Broker forecasts indicate the company should reach breakeven next year, but they've been saying that for more than 10 years, and it never happens.

Sepura (LON:SEPU)

Share price: 133.5p

No. shares: 138.2m

Market Cap: £184.5m

Trading update - today's update covers the six months to 26 Sep 2014, and all looks in order;

...Trading in line with market expectations for the full year...

Various other details are given, but the only thing that really matters is how the company is trading compared with market expectations.

The Company is expected to report net debt of €13.8 million which includes a working capital outflow of €10.6 million for the period. This is expected to largely unwind during the coming quarter, with cash generation for the year on track to meet market expectations.

Trading in the first half and further contract wins, resulting in a strong closing order book, gives the Board confidence in the Company's ability to meet its existing guidance of 10% revenue growth and 15% adjusted EPS growth for the full year ended 27 March 2015.

Sounds like everything is fine there.

Valuation - Stockopedia shows broker consensus of E0.096 for this year (ending 29 Mar 2015), which converting from Euros into Sterling (at £1 = 1.265 Euros), gives forecast EPS of 7.6p. Therefore at 133.5p per share I make that a PER of 17.6. That's a fairly warm rating, and is too high for me.

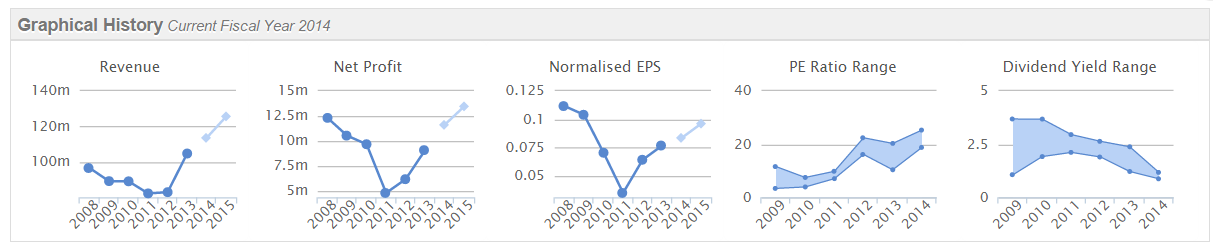

My opinion - I like this company, as they seem to have a strong market position, supplying technically advanced radios to the emergency services in many countries. However, as you can see from the historical graphs below, whilst the company has performed well in recent years, it had a period where there were lumps in the order book, and profit declined. The shares went as low as 50p, I remember that because I bought some at that level. For that reason I would only pay a more modest rating for these shares, of maybe 10-12 times earnings, to take into account the risk of a future profit warning. Also the dividend yield is paltry, at 1.4% - personally I like to be paid more than that to wait for the shares to go up.

On the other hand, the company's prospects may have improved in a way which I've not identified, in which case that would explain why the company is on a warm rating. As always, this is just a quick review of the numbers here, and digging deeper by readers is the idea.

Bloomsbury Publishing (LON:BMY)

Share price: 153p

No. shares: 73.8m

Market Cap: £112.9m

Interim results - for the six months ended 31 Aug 2014 are out today. Adjusted profit before tax is down from £2.3m to £1.7m, but the problem with this company is that it is so heavily reliant on H2 for profitability, that the interim results don't really matter very much.

This is emphasised in the CEO's comments today;

We have a strong publishing list for the second half including Paul Hollywood's British Baking, Tom Kerridge's Best Ever Dishes and River Cottage Light & Easy by Hugh Fearnley-Whittingstall. We expect results to continue to be significantly second-half weighted, as in the past. October is the peak for academic book sales and Christmas is the peak season for the sale of general books.

Outlook - I can't see any reference to expectations for the full year, apart from the company saying it has a strong H2 pipeline of books, but it always says that.

Also noteworthy are the company's comments about having another puff on the Harry Potter cigar;

Not since the launch of the final Harry Potter book in 2007 has there been such a range of activities in support of the Harry Potter phenomenon. The year ahead will see a huge surge in public interest in Harry Potter with our launch of new children's editions in this period, Warner Bros announcement of a trilogy of films based on Fantastic Beasts & Where to Find Them, which is published by Bloomsbury, the creation of a stage play of Harry Potter for London's West End, significant new material on J.K. Rowling's highly successful Pottermore website and Bloomsbury's Harry Potter Book Night in February 2015. In addition, Bloomsbury has commissioned artist Jim Kay to work on the new edition of Harry Potter with magnificent illustrations on every page which will be launched in Autumn 2015 and has the potential to create as much interest in the Harry Potter books as Tenniel's illustrations of Alice's Adventures In Wonderland did.

My opinion - I'm very wary of the publishing sector, after seeing a documentary about Amazon's plans to totally dominate not just the sale of books, but also the actual publishing of them. This will probably cut out existing publishers from the process altogether in many areas, with authors simply self-publishing.

It may take years for that process to happen, but it seems to me that it is likely to be a permanent drag on publishers such as Bloomsbury, notwithstanding their own efforts in the digital area. So this is really the key area to concentrate on when doing research, in my opinion - how will publishing work in future, and will companies like Bloomsbury be needed at all?

Against that, the reasonable dividend and strong Balance Sheet pale into something close to insignificance in my opinion. The danger here is that the market sees this company as in terminal decline (long-term), and de-rates it to a PER in single digits. Look how cheap newspaper groups became in 2012, when they were on low single digit PERs.

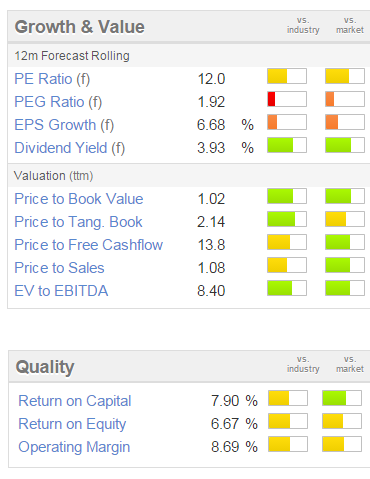

So caution is needed here in my view. The valuation metrics below don't look anywhere near cheap enough for a company that could be struggling to survive in a few years' time;

On the other hand, if you think companies like this will retain a profitable niche, then it might be worth looking at.

Foxtons (LON:FOXT)

Share price: 169p

No. shares: 282.2m

Market Cap: £476.9m

Why on earth am I mentioning London's dominant estate agency? It's above my usual market cap limit of c.£300m, but Foxtons shares are falling fast, and I suspect it won't be long before they are below my limit, hence wanting to start coverage today to get some notes into the system for future reference.

It has already been reported in the press how London's bonkers property bubble is finally bursting. Bubbles don't deflate, they burst, so I think there will be a big drop in prices. As usual, dipstick politicians have been the trigger, with talk of the Mansion Tax meaning that wealthy people are now less likely to want to own expensive property in London, some might pre-emptively put their properties on the market, and so a downward price spiral begins.

The Daily Telegraph (or Evening Standard, I forget which) recently reported that prices at the top end in London are already down 20%, and there is surely more to come? This has wider economic impact, as all the people who rely on the wealthy spending on renovations, furnishings, etc, will also now see a slowdown in business. I wonder how many more residents of central London will be excavating out grotesque, windowless basements with swimming pools & cinemas in them now that they know adding value to the property is likely to trigger a bigger tax bill? So just talking about a Mansion Tax will have already triggered reducing tax receipts from VAT, PAYE/NICs, Stamp Duty, etc. I really do despair at the ineptitude of the people running this country.

So all this is going to hit Foxtons hard, and the stock market has been anticipating this for a while;

Why am I interested in all of this, apart from it giving me a good excuse to have a rant? It's because Foxtons income is split between sales-related commissions & brokerage, and lettings. The former may be set to decline, but the lettings side of the business should be unaffected. Rents won't be going down, because they are not linked to capital values. The rental yields on top end London property have been been unrelated to capital values for years now, with the rental yields very low.

Q3 Interim Management Statement - issued today by Foxtons, talks of a "sharp and recent slowing of volumes in London property sales markets..."

Q3 lettings income was flat, at £21.9m, and 9m YTD lettings income was also flat at £53.7m.

Q3 sales commissions at £16.4m were down 7.8% against Q3 last year.

Outlook - the key part says;

Market volumes in Q3 have been more in line with the first half of 2013 and we now believe that market volumes in H2 2014 overall will be significantly below levels during the same period last year. Consequently, we expect full year 2014 adjusted EBITDA to be below the prior year figure of £49.6m.

My opinion - it's not cheap yet, not by a long shot, and I think we're only starting to see the slowdown in London property. The outcome of the General Election in May 2015 will be key, and the London sales market is bound to be weak until then, so I would be amazed if this company does not issue several more profit warnings.

So it could make a good short, although looking at the chart you think that the clever money has already been made on the short side here.

However, there is value here due to the lettings business being unaffected by any downturn in capital values. So at sub-100p per share, I think this company would begin to look interesting. With staff paid on commission, the overheads should be reasonably flexible in a downturn, although they might end up lumbered with some shop leases that they would rather not have.

One to watch anyway, I think.

Note also that Foxtons is debt-free, and pays a nice divi, although given its property markets are now tumbling, I wouldn't set much store on a dividend that may be unsustainable.

Porta Communications (LON:PTCM)

Share price: 8.4p

No. shares: 229.7m

Market Cap: £19.3m

I last reported on this fast-growing PR group on 16 Sep 2014 when it published interim results which I thought showed good progress. However, the share price resumed its downward trend after an initial blip up on those results, which seemed odd to me.

Trading update - issued today sounds good. This is for Q3, and says;

...trading has remained buoyant with all parts of the Group meeting their new business targets.

Various additional details are given on contract wins, etc. It sounds good, but I note the company doesn't say anything about trading vs market expectations, so I assume that it must be in line.

News of two more acquisitions in the pipeline sounds encouraging;

Furthermore, the Group is at an advanced stage of discussions regarding two acquisitions which, if completed, will be relocated to the London office. This is expected to have a marked impact on both trading and levels of profitability. These acquisitions will be funded from the Group's existing resources.

So it sounds positive, and will be interesting to see the next set of results in due course.

It's not the easiest company to value, as it's work in progress, in terms of building up the group, both from acquisitions and organically. Sounds as if they're making good progress though.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PTCM.

A fund management company with which Paul is associated may have positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.