Good morning! A rather large backlog of emails has built up, so I apologise to anyone who is waiting for a response from me. Maybe people could hold fire on sending me any more emails for a few days, so I can catch up?!

KBC Advanced Technologies (LON:KBC)

Share price: 106p

No. shares: 81.8m

Market Cap: £86.7m

Interim results are out this morning covering the six months to 30 Jun 2014. The company is a consultancy and software supplier to the oil refinery sector, globally.

Balance Sheet - the strength of KBC's Bal Sheet is the first thing that jumps out at me from the figures. This has been helped by a relatively large Placing of £24m in May 2014, which was executed at 115p, just a 3p discount to the share price at the time - impressive. The share price is now 106p, so I like the fact that shares can now be bought at a lower price than the company was most recently financed at.

My only concern from the Bal Sheet is that Debtors looks too high at £30.1m. That's only a little less than the whole six month's turnover of £34.4m, and is £7m higher than the equivalent figures six and twelve months earlier. So the questions need to be asked - why is Debtors so high, and what it has been brought down to post year-end? Excessive debtors is my number one red flag for possible accounting problems, so this definitely needs looking into.

Acquisition - some of the Placing monies (£ 10m) was used to finance the acquisition of a UK competitor called FEESA in July 2014. So the 30 Jun 2014 Bal Sheet is flattered somewhat, but even when you strip out £ 10m in cash, it would still be very healthy, so a strong tick in the box for financial strength, which is always a great place to start.

Profitability - not particularly impressive, this has edged up a tiny bit from last year's H1, at £3.2m, on higher turnover. Note also the very high tax charge of £1.1m on £2.8m profit before tax - I recall there being a problem with this company whereby is generates profit in high tax countries, and losses in low tax countries, giving an unusually high blended tax rate. The FD was meant to be fixing this, but it doesn't seem to have been fixed as yet, so that's another question to ask management about.

Put these factors together, and H1 EPS has dropped from 4.8p to 2.9p, which is unimpressive. In common with many companies, KBC say that exchange rates had a big impact on profits this year.

Outlook - the forward-looking comments sounds positive, including these key points;

- Continuing good level of contract awards since period end

- Board remains confident of meeting its full year expectations

Valuation - Some adjustment is needed for the strong Bal Sheet, although I'm a bit wary that growth seems to be piling into Debtors, rather than cash. With just over 7p EPS forecast for this year and next, the PER is around 14-15, which looks a fair price to me.

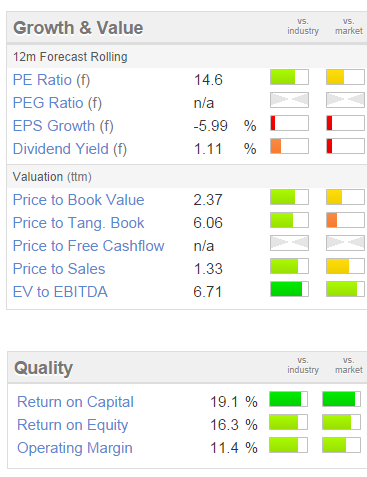

My opinion - as you can see from the usual Stockopedia graphic below, KBC scores reasonably good quality scores, although post-Placing I imagine that ROE and ROCE will fall, as the business has more working capital tied up. The dividend yield is stingy (this company used to pay out handsome divis, but no more it seems), and the PER looks fairly priced.

The company has been quite accident prone in the past, so it's one that I would consider buying in future after a profits warning, at a lower price. Based on my superficial glance at the figures this morning, It's not of any interest to me at the current valuation, although the order book sounds strong, so it might do better than expected in the future perhaps, who knows?

Panmure Gordon & Co (LON:PMR)

Share price: 148.5p

No. shares: 15.5m

Market Cap: £23.0m

I cannot understand what has been going on with the share price here. Panmures is quite a big name broker, but the market cap is peanuts! Restructuring had clearly fixed their main problems, which was obvious about six months ago, with decent figures for 2013 (once you stripped out non-recurring restructuring costs), but despite this the share price has just ground downwards.

There was a bizarre sell note in the Times about a week ago, which basically said that despite Panmures being about to report excellent profits, you should sell the shares. Just complete nonsense! I don't think journalists should be allowed to give buy/sell recommendations at all, as they don't seem to have the time (or the skill in some cases!) to properly research things that they write about.

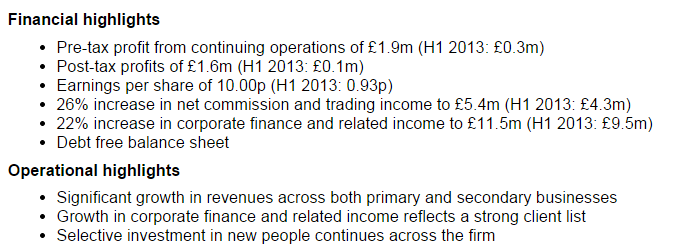

Interim results - to 30 Jun 2014 look jolly good to me. Although care is needed, as of course H1 of this year was a buoyant time for IPOs and Placings. So there's no guarantee Panmures will be able to repeat these figures. Here are the headline comments, which all sound good to me;

Outlook - this sounds pretty solid to me;

We have recorded an impressive start to the year in the first half as all of our teams contribute to providing an excellent service to our clients. We will look to further invest on a selective basis in good people and business opportunities whilst remaining focussed on controlling the cost base.

Markets are healthier than in recent years though remain challenging. However, our strong pipeline of corporate transaction activity supported by our re-invigorated team of excellent people means we look forward with confidence to the remainder of the year.

There don't seem to be any broker forecasts out there, which is a rather bizarre omission given that Panmures is a broker! However, if we assume that they repeat H1 and deliver 10p EPS for H2, then that means 20p EPS for the full year possibly?

Valuation - it looks very good value to me, assuming that performance can be maintained. With the shares currently at 148.5p, and assuming 20p EPS for 2014, then that would mean a PER of only 7.4!

So is the Balance Sheet shot to bits then? Quite the opposite, it looks good. Net current assets (i.e. net working capital) is £17.6m, which is 77% of the market cap! So strongly asset backed, and there is no debt in long term creditors, just about a million of deferred tax.

My opinion - I really like this share, and think if offers strikingly good value. It's ideal in my view - on a low multiple of earnings, AND strongly asset-backed. However, before I get too carried away, the sustainability of earnings is the big question mark. The risk is that big fee earners think more about lining their own pockets, and hence leave to join other firms on higher pay. Panmures did lose one such member of staff to Zeus Capital not that long ago.

That said, Panmures has won plenty of new corporate clients, and it has a good name in the City. The market cap looks very cheap to me, especially considering that other similar-sized brokers are on much higher multiples of this year's earnings - for some reason, Panmures shares just seem completely overlooked by the market, perhaps because of the firm's poor performance in the past. Maybe the market hasn't yet spotted that a significant turnaround in performance has happened?

Reinstating dividends could be the catalyst to trigger a proper re-rating perhaps? The company today indicates that it is looking at resuming divis next year.

I have to leave it there for today, as off to an investor lunch.

See you tomorrow!

POST SCRIPT: to keep the records up-to-date, I have added new comments below on Mothercare

Mothercare (LON:MTC)

Share price: 244p

No. shares: 88.8m

Market Cap: £216.7m

Mothercare is currently on my bargepole list of high risk shares, because as I've commented several times before here, the company clearly had a very weak Balance Sheet, including bank debt & a pension deficit, plus onerous shop leases in the UK that it was struggling to exit (if a landlord doesn't want a shop unit back, then he will exact punative terms from the existing tenant in return for allowing them to surrender the lease).

As I mentioned on 28 Jul 2014 here, "certainly a rights issue (possibly deeply discounted) is looking increasingly likely - if I were their bankers I would insist on it". Sure enough, that's what happened. Well, I don't know if their bank insisted on it or not, but Mothercare has today announced a £100m fully underwritten Rights Issue.

The terms are that existing shareholders are entitled to subscribe for 9 new shares for each 10 existing shares they hold, with the price of the new shares being at a substantial discount, at 125 pence per new share.

So why haven't the existing shares collapsed in price today? Because unlike open offers that we are used to with small caps, Rights Issues are tradeable, so anyone who doesn't want to take up their Rights can sell them on in the market. On the day that the shares go ex-Rights, then the share price will adjust to a new level, which will work out something like this:

Existing shares 10 at 244p (the current market price) = 2440

Rights shares 9 at 125p (the Rights price, set by the company) = 1125

New total number of shares = 19 shares at ((2440+1125)/19= 187.6p.

So in theory, the share price should jump down on the ex-Rights day, before the market opens, to c.187.6p.

It doesn't always work out like that though. So the underwriters (who are obliged to buy any Rights Issue shares that shareholders don't want) need the share price to hold up during the period of the Rights Issue - as that will pacify shareholders, and make them logically want to take up their Rights.

I don't know what the detailed rules are for share price support whilst deals like this are underway, whether it is legal or not? Perhaps any readers with more knowledge of this area could comment below? Perhaps it has to be done on the quiet, I don't know? Although with three heavyweight brokers underwriting the issue (Numis, JP Morgan Cazenove, and HSBC), then it's a done deal.

Note that of the £100m being raised, £5m is going in fees to advisers, a large chunk of which will be the fee to the underwriters.

My opinion - on the upside, this means that Mothercare is now not likely to go bust any time soon, so that adds value to the shares. On the downside, I suspect that most of this money is essentially going to be wasted dealing with legacy issues, so over time the share price will probably continue to fall - i.e. the £100m fresh equity invested by shareholders is likely to dissipate over time.

The £95m net proceeds are ear-marked for £40m to get the Bank off the hook with their term loan. £ 10m for IT, £20m for store refurbs, and £25m for store closures.

Personally I think anyone holding these shares, let alone taking up their Rights, needs their head examining. If I stump up fresh money for a company, I want it to be for exciting growth, not fixing legacy issues. That said, Mothercare does have decently profitable overseas operations, so perhaps once they've worked through the legacy UK issues, then there might be a decent business after all?

Personally I think there are much better companies in the market to choose from, so won't be investing here. I did short it briefly a while back, and did OK on that, and I'd be more inclined to short it now, than go long, but it doesn't look a compelling short to me, unlike quite a few other companies that I am not allowed to mention here! Mothercare seems a dreary old brand that is well past its sell-by date.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PMR.

A fund management company to which Paul provides research ideas has a long position in KBC)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.