Good morning!

Due to computer problems, yesterday's report ended up taking me most of the day (I lost a large section and had to re-do it). So in case you missed it, here is the link, to where I looked at Regenersis (LON:RGS) and Pittards (LON:PTD), in addition to earlier comments about Boohoo.Com (LON:BOO)

The market so far today has that feeling of a crisp autumn morning, immediately after a big storm - a few bargain hunters are emerging from their battened down hatches, to be the first to collect up some of the debris from the storm!

Regenersis (LON:RGS)

Director buying - a couple of readers thought my comments on the Directors of Regenersis yesterday were a bit harsh, which on reflection they probably were. My main point is that they've been extremely shrewd in loading up with cheap shares at the right time, and dumping a large chunk of them a few months before things started to go wrong.

So, when you see Directors with a track record of timing entry/exits uncannily well, then it pays to take notice of what they are doing with their own money. Sure enough, and on cue, a decent-sized Director buy has been announced today.

Hanover Investors (the key shareholder in Regenersis, connected to Chairman, Matthew Peacock, and one of the NEDs) has increased its stake by 200k shares, to just over 5.4m shares (6.9% of the total).

As a general point, the only exception to when to follow Director trades (in my opinion), is immediately after bad news. Since, with many companies, such purchases are nearly always just done for PR reasons, to reassure shareholders. Often such purchases only stabilise the price for a day or two, before continued falls.

That's not the case here. As I explained in yesterday's report, Regenersis is starting to look interesting again, as the rather unimpressive, low margin electronics repair division looks set to be disposed of. That would then leave a higher margin, smaller business focussed on data erasure software, which Regenersis reckons is a good growth area.

I really hope management twig that "less is more" with the future accounts. The ridiculously over-complicated reporting, and incredible adjustments to the accounts, should be ditched. Instead I think investors would probably put the company on a more decent rating if they just present clean, simple accounts, without lots of overly-aggressive adjustments. Oh, and hopefully they will ditch the ridiculous "HOP" profit reporting, which raises more questions than it answers.

So overall, RGS is sitting in my "potentially interesting" tray, to do more research & think about more. I see that the shares have already bounced quite well, and are up 8p to 160p so far this morning. It's difficult to value right now, as it depends what the disposal will generate, and how much real profit the new Regenersis will make (which depends on how much of the central costs disappear with the planned disposal).

Globo (LON:GBO)

Share price: 34p (up 3% today)

No. shares: 373.7m

Market cap: £127.1m

(for the avoidance of doubt, I have no position in this company)

Proposed acquisition - this looks a potentially sensible move. Globo claims to have a large cash pile, yet simultaneously also has large bank borrowings (why???), and has been trying to raise a further substantial amount recently through a junk bond issue. This has understandably raised a lot of questions, as it's totally illogical behaviour, and looks more like a company in financial distress than a cash-rich company. Or possibly a company where cash might have been syphoned off, and/or moved in circles between connected parties possibly?

The obvious solution is for the company to abandon its junk bond issue, and instead use its cash pile to make some smallish acquisitions, and thereby prove to the market that it can do a good job buying other companies & integrating them.

The second thing they need to do, is turn some of the debtor mountain into cash, to demonstrate that it's a proper business.

Anyway, today's announcement says that the company has signed a letter of intent to buy an unnamed European software company. The name is to remain secret until a final agreement has been reached. Which begs the question, why pre-announce it now, if it's not been agreed? Why are things never simple with this company?

Globo gives the following financial details about the company it hopes to acquire;

- Revenue is based mainly on annual recurring license fees (sounds good, so how much is the turnover then?)

- Projected Dec 2015 y/end adjusted EBITDA of E900k (so no real profit then, presumably! Also, what are the historic figures like?)

- Considerable EBITDA growth predicted over the next 2 years (great, depending on how much is being capitalised into intangibles - presumably a lot, otherwise real profits would have been mentioned)

- Up-front consideration of c.E6.5m (relatively small beer, compared with the last reported net cash of E47.4m)

- Earn-outs of up to E7.5m payable over 2 years, based on profit targets (sounds sensible) - note that these are payable in a mixture (not specificed) of cash & new GBO shares - so potential for some dilution.

- Globo says it will be immediately earnings enhancing - which is a given, when paying cash that is otherwise earning next-to-nothing in interest

- Will be completed during Oct 2015.

My opinion - a strategy of using surplus cash to make bolt-on acquisitions looks sensible. Although given the numerous red flags with this company's accounts (and actions), it pays to be highly suspicious about everything they do, in my opinion.

So the obvious question is whether the company being acquired has any link to Globo, or its existing shareholders/management? Which country is it based in? (hopefully not Greece).

The company seems to be ploughing ahead with its junk bond issue - an update was given on 14 Sep 2015 saying that everything was on track. Hmmm, let's see what actually happens. This looks like long-term financial suicide for the company, as it has a chronic inability to turn profit into cash, therefore a 10% interest bill on borrowings that it doesn't actually need, is a totally bizarre thing to do, and just reinforces my suspicions that things possibly may not be what they seem at this company.

The company says it wants to use the junk bond issue to make cash generative acquisitions. So far they have failed to demonstrate that they can do this - so why would bond investors lend the company fresh money at a high coupon, for them to spend on acquisitions that (based on what's happened to date) only generate fantasy profits (EBITDA) and not real, positive cashflow?

I shall watch developments from the sidelines, but for me this remains completely uninvestable unless & until it can straighten out its wonky balance sheet (mainly turn debtors into cash), and can generate proper profits which do not rely on capitalising an enormous amount of costs into intangibles.

The problem with repeated acquisitions, is that it muddies the water further, making it harder to untangle what is really going on at the group. So I suspect Globo will remain a mystery for some time to come. As always though, this is just one person's opinion, so feel free to disagree, and do what you want with your own portfolio. Who knows, if I'm wrong, then this share could turn out to be a bargain? I can't see why it's worth taking the risk though. After all, you don't lose any money by avoiding a share, especially as there are plenty of other safer things to invest in.

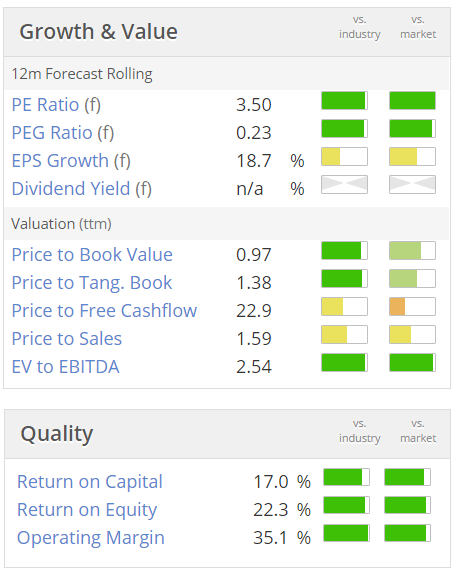

The market clearly shares my concerns about the company, as the unfeasibly low PER is itself a red flag - as the valuation stats below combine to demonstrate that the market simply doesn't believe the figures. A PER below about 5 is usually a sign that there's something badly wrong, in my experience, so 3.5 is screaming to us that the figures are probably not right;

Publishing Technology (LON:PTO)

Share price: 115p (down 22% today)

No. shares: 16.3m

Market cap: £18.7m

Profit warning - I'm not familiar with this company, but it appears to offer software relating to the publishing industry. Looking at the most recent accounts (interims to 30 Jun 2015), they look poor, which is probably why I didn't report on them here at the time.

The company did a £9m Placing at 120p (plus a small Open Offer) in May 2015, to repay bank debt, another £1.5m loan relating to an old acquisition, and a Director loan of £1.25m (put in to prop up the company and stop it going bust, by the looks of it). Although Directors put in £2.7m in the Placing, so a net £1.45m put in by Directors, a good sign of confidence. Martyn Rose (Chairman) seems to be the key player, with a 27.3% shareholding currently.

I like to see a strong Chairman, with a decent shareholding, as it means they can kick out under-performing management, which seems to be what happened at PTO last night - with the CEO departing, and the existing CTO stepping up as acting CEO.

Turning to the profit warning itself, the problems seem to be confined to one division, ironically called "advance". The sales pipeline has not converted into adequate sales, and as a result;

Although the Board believes that the advance division remains well placed for growth, the Company is now not expected to meet current market expectations and is expected to produce a loss for the year.

It made a loss of £1.1m after tax in H1, on turnover of £7.6m, so I suppose a full year loss is not altogether surprising.

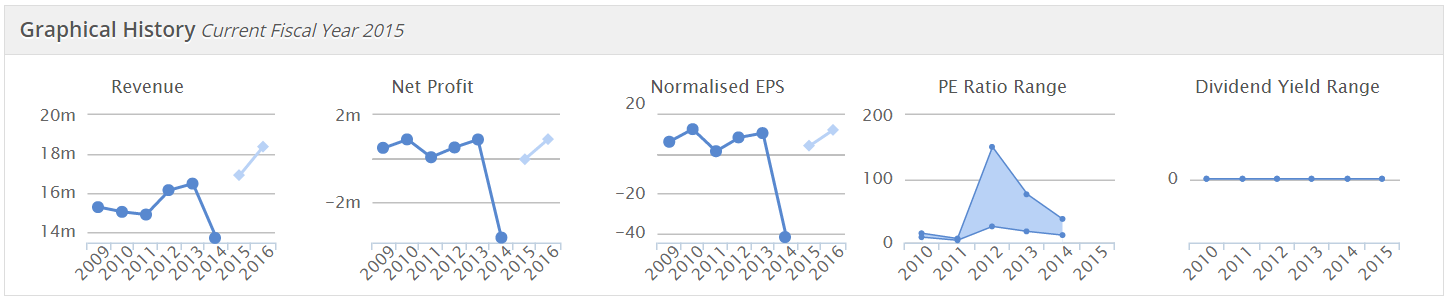

Historic performance - looking at the Stockopedia graphical history, the company does seem to have been profitable in the past, which ties in with comments in today's announcement about the core business being profitable;

With the exception of the advance division, the Group is trading profitably and has a highly cash generative core business. Its fundamentals remain strong, with anestablished franchise providing software systems to blue chip global publishing companies.

So this might provide the basis for a recovery, if they turn around the advance division.

Balance sheet - it's not very good actually, so the Placing earlier this year really just sorted out existing stretched creditors, rather than providing real strength.

NTAV is only £193k for example. The current ratio is not great, at 0.93. So it seems clear to me that, without its deep pocketed Chairman, this company could easily have gone bust this year. It won't now, as the finances look stable, and debt has been eliminated.

As with many software companies, the cash of £2.6m is really customer cash, since deferred income within creditors, is £2.9m. Don't jump down my throat, I'm just pointing out the facts & figures! Interpret them how you like.

Dividends - there aren't any! A 1.0p maiden divi was forecast for 2015, but I imagine that will be abandoned now - the company is loss-making, and has a weakish balance sheet, so it's not the right time to start paying divis.

People don't buy small growth companies for the divis, they buy for capital appreciation, and then long term divi potential once profits are booming. Although there's not much sign of profitable growth here, looking at the graphs above, especially as the light blue dots (which are forecasts) will now be coming down after yesterday's profit warning.

My opinion - I wouldn't dismiss this company out of hand. It might be a turnaround situation, and there does appear to be a profitable core business. The profit warning doesn't look catastophic;

The Board continues to believe that group turnover will improve compared to 2014 and that performance at EBITDA level, although reduced from earlier expectations, will show a significant improvement on the prior year.

To my mind, the £18.7 market cap after today's fall doesn't look at all attractive on a risk:reward basis. The sort of valuation that might start to interest me, is £5-10m (c.30-60p per share). So at 115p it's still way above that range, hence not of any further interest to me.

Although the bull case depends more on looking into the products, and assessing what you think their potential is. I've not done that, as my job is just to do a desktop review of the figures, and then throw ideas over to readers to do more detailed research on the company itself & its products.

I like that management have lots of skin in the game here, as I've noticed that such companies are usually successful in achieving a turnaround. Therefore buying after disappointments can (if you time it well) be quite lucrative. It's usually best to wait a couple of months, to see at what level the share bottoms out. V-shaped recoveries are unusual, so there's usually no rush to buy in after a profit warning - I'm forever jumping the gun on this, so am primarily lecturing myself on this point by typing this!

The two year chart basically shouts - lots of hype, then serial disappointments:

Begbies Traynor (LON:BEG)

Share price: 42p (up 1% today)

No. shares: 109.6m

Market cap: £46.0m

AGM trading update - steady as she goes for the UK market's only listed pure play insolvency practitioner:

Trading in the first quarter of the current financial year was ahead of the same period last year and in line with our expectations; performance benefited from the Eddisons' acquisition and a reduced cost base in the insolvency division.

The ahead of last year bit is as expected, due to the acquisition noted.

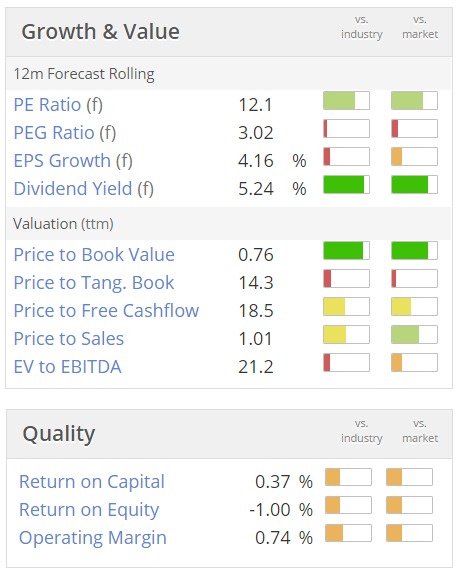

Valuation - looks about right to me, at a fwd PER of 12. Also note the lovely dividend yield:

The quality scores look anomalously low, and having a quick look at the 2014/15 summary on the StockReport, it's probably due to restructuring costs, amortisation, etc. If you look back at previous years, the quality scores look more attractive. I don't believe there was any permanent deterioration in the business in 2014/15, therefore I think the negative scores above are best just ignored, as they should reset in the current year when those results feed through next year.

It's worth noting, that with small caps you really do need to dig into the detail, and look at the trend over time, as individual years can often throw out odd results.

My opinion - I am impressed with the way Ric Traynor (CEO, and major shareholder) has steered this insolvency practitioner through a unique period of artificially low interest rates, and hence artificially low insolvency rates. He's managed to strip out costs to keep the profit margin healthy, although that has come with sometimes hefty exceptional restructuring charges, and the divi has been maintained at 2.2p every year since being lowered in 2011.

So it's another example of the way owner/managers usually tend to do a better job than hired hands with minimal shareholdings.

As I always say, at some point these guys will see an upturn in business, but I've no idea when (does anybody?). There is something to be said for buying this share at a reasonable price now, when earnings are relatively subdued, as you're then getting the eventual upside thrown in for free. Plus you get a nice divi while you wait. So I can see a good case for tucking away a few of these as a long-term hold, but it's not one I currently hold. They can be difficult to deal in at times, as quite illiquid. I imagine it's tightly held.

WANdisco (LON:WAND)

Share price: 138p (down 15% today)

No. shares: 29.5m

Market cap: £40.7m

Interims to 30 Jun 2015 - another set of diabolical figures from this jam tomorrow software company. I will donate £5 to a local charity for the first person who can tell me how many times WAND uses the capitalised term "Big Data" in this announcement! More than enough to make me suspicious anyway.

Key points;

- Pedestrian top line growth - only up 13% to $5.7m

- Huge losses again, at -$17m before tax! So the loss is 3x turnover! Just horrendous

- Large deferred income on the balance sheet, so cash position is really a lot worse than it at first appears, as the company has to continue operating (at massive cost) to release that deferred income into the P&L

- Net cash only $15.2m, so yet another fundraising will be imminent - will anyone have the appetite for it, given such weak performance to date?

- HSBC - probably the biggest mystery - why on earth has HSBC continued to offer this company a $10 borrowing facility? Banks normally steer well clear of such high risk companies

Outlook - there are 5 paragraphs of Directorspeak, all of which sounds pretty flat to me. The concluding section says;

At this stage in the company's growth we are experiencing variability in quarterly sales bookings, and expect that to continue as we progress through a period of rapid change in our operations and in the Big Data market. Nevertheless, with a compelling new Big Data product, increasing engagement of high-quality partners, and a well-established ALM product, we expect to build momentum through the rest of this year.

That doesn't sound like an exciting growth company to me. It sounds more like management who are beginning to think that this isn't going to work.

My opinion - this stock has been on my bargepole list since Jul 2014, and is down 72% in that time. It's staying on that list.

I don't understand what the product does, but if you're providing a service at a huge loss, then you're just subsidising your customers' businesses. How on earth does that make sense?!

If the P&L and cash burn are as bad as this, there needs to be spectacular growth & an exciting outlook. This has neither, by the looks of it.

Based on these numbers, I'll be amazed if this company is still in existence in 2-3 years' time in its current form, but you never know. Why take the risk?

PuriCore (LON:PURI)

Share price: 20.7p

No. shares: 50.1m

Market cap: £10.4m

Interims to 30 Jun 2015 - I've had a quick look at these figures, and it's absolutely hopeless I'm afraid. The P&L is worse than last year;

Revenue is up 5.9% at $9.1m, but

Margins are lower, so gross profit is down 7.9% at only $2.2m

Operating expenses are $6.9m, so this company needs to more than triple its sales, just to reach breakeven at the existing gross margin of only 24.5%

So is a dramatic improvement in trading on the cards? The outlook comments sound good, but possibly not good enough:

...the Company expects significant top-line growth in H2 compared to H1, and for the full year compared to the prior year. Near term gross margin will continue to reflect investments to improve reliability of the Company's equipment.

That's promising news on sales, but no improvement in the margin sounds to be forthcoming.

How long can it last then? Cash is king, so let's have a look at that next.

Balance sheet - net cash was $16.3m, but it's depleting quickly (down from $20.6m in six months, so $4.3m cash burned in H1 of 2015).

At that burn rate, then the cash pile will last about another two years.

My opinion - I threw in the towel as a former investor in this company when it became clear that the large cash pile (from a disposal) was not going to be returned to shareholders, even partially, but instead was going to be squandered by management who appear more interested in preserving their own well paid jobs, rather than creating shareholder value.

So I think it's likely to just solider on for a couple more years, with the cash gradually dwindling away. For such a tiny company, a strategic review should be carried out over a cup of coffee, not take many months. So it just looks like stalling tactics when the company says it will announce the results of its strategic review in Q1 of 2016! How ridiculous.

There's also some commentary today about what sounds like regulatory fines, or investigations. I don't like the sound of that one bit. I used to think that PURI's technology sounded interesting, but it's taking too long to commercialise, and it now looks like a niche product that's not likely to take off on a large scale. With the cash pile dwindling, it's difficult to see what point there is to investing, unless you think the company is close to a commercial breakthrough. It might be, I don't know, but that doesn't really come through from today's results or narrative.

Eckoh (LON:ECK)

Share price: 41.5p (up 2.5% today)

No. shares: 223.3m

Market cap: £92.7m

AGM trading update - this all reads well. Here is the main bit;

Sales pipeline activity remains high with a particular acceleration in enquiries from the US subsidiary since the end of the summer period.

We have today separately announced a three year contract to provide CallGuard for the Co-operative Group following a competitive tender, further demonstrating that high quality organisations are prioritising the protection of their customers' credit card data.

Eckoh typically sees a strong second half trading performance following the delivery of contracts won in the first half along with seasonal volume increases for many long standing Eckoh clients. This trend is expected to be repeated in the 2015/6 financial year. We remain confident that the high levels of growth seen in previous years will continue through the new financial year and beyond with current trading remaining in line with market expectations

Sounds excellent, but important to remember that they are saying its in line with expectations, so good performance is already priced-in.

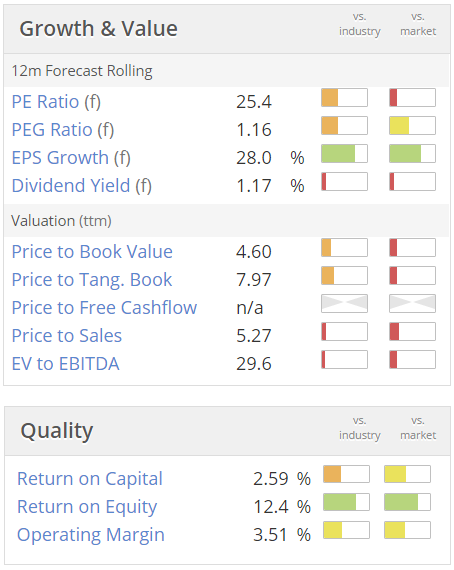

Valuation - the company is on a nice growth trajectory, good but not amazing.

So in that context, the valuation looks very full to me. Not wildly expensive, but I'd want more growth than this to pay a PER of 25, personally.

My opinion - nice company, but it's difficult to see much upside potential from this valuation, unless the company really thrashes forecasts. You would have to be super-confident about the company's ability to continue growing, to pay this kind of valuation. It might be worth it, I don't know.

Real Good Food (LON:RGD)

In-line trading update today. This company is investable now, after it disposed of a large subsidiary, and it now has a good balance sheet. So might be worth a look.

I also looked at Finsbury Food (LON:FIF) results in this space (cakes, etc) recently, so might be worth comparing the two. It's not a space that interests me, due to margin pressure from end customers, but on balance I think FIF is the more interesting of the two - bigger, and well managed, and expanding successfully.

Blimey, what a mammoth report, I need a lie-down lol!

See you tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions in the companies mentioned today.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, nothing more. So please always DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.