Good morning!

Paul is off today. I'm planning to cover Rightmove (LON:RMV) and anything else that pops up or is requested in the comments. Let me know what looks interesting to you.

Best regards

Graham

Rightmove (LON:RMV)

Share price: 4065p (-4.2%)

No. shares: 93.1m

Market cap: £3,785m

The market was more than a little disappointed with this announcement at first.

It's obviously a highly rated stock, which makes for volatility even when results are quite positive:

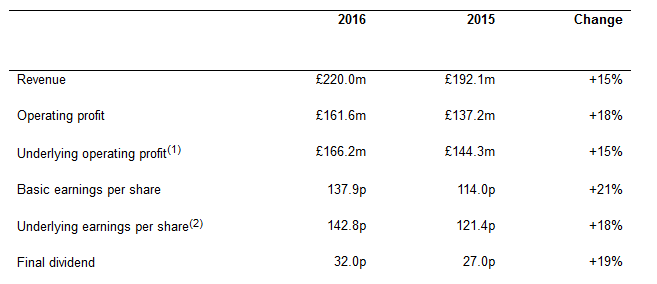

Annual percentage revenue growth over the past six years has been within an 11%-23% range, and the last three years have been 17%, 19% and 15%, so today's result is nothing special in that regard.

The operational highlights are fairly impressive, including the claim that Rightmove has a third more residential properties than any other portal. The CEO claims it is "the only place you can see almost the entire UK property market", and appears to have some justification in this claim, despite well-publicised moves by competitors in recent years.

I've tended to think that Rightmove deserved its premium rating in recent years, and that remains the case for me now.

It looks really shareholder-friendly too, with £131 million having been returned to them this year. I'd just have a slight concern about the mix of buybacks within that - I'll need to find out what the rationale wasfor including £88 million of buybacks. They must think the shares are good value at an average price of £40 each!

CEO retirement: This explains why the shares were so weak on the open. The co-founder CEO is retiring after 16 years. He'll be replaced by the COO, who is also highly experienced at Rightmove. See separate RNS.

Outlook: Nothing specific in the outlook statement, just that the BoD is "confident of continued success in 2017".

ARPA: This is a slightly unusual argument and I'm not sure how it works exactly. Rightmove says that the average revenue per advertiser per month for newspapers was £2,500 in 2007, while Rightmove's ARPA today is just £842 per month. While I'm sure that ARPA growth is possible, I don't see the relevance in terms of what newspapers were doing back then!

Commercial property: Rightmove claims to have 86% market share among the top 3 commercial property portals. A number as big as that is a natural monopoly and highly valuable in my book.

My opinion: I'm going to have to move on and look at some other companies instead of reading the entire statement right now, but I personally don't think that the company is overvalued here, and wouldn't be averse to having a small position in it.

The free cash generation is real, even if I'd prefer to see that cash being used slightly more toward dividends than buybacks. The trailing PE ratio is 29x, or perhaps less than 27x on a forward basis. Market leaders are expensive and in the current stock market environment, that doesn't look exorbitant to me!

Brainjuicer (LON:BJU)

Share price: 742.5p (unch.)

No. shares: 12.2m

Market cap: £90.7m

Just a quick note on Brainjuicer, the branding agency which I like to report on from time to time.

Unfortunately, it might not be called Brainjuicer for much longer, as there is a proposed name change to System1 Group.

I quite like its quirky name but I suppose good things just don't last!

System1 refers to the emotional, instinctive ways people are thought to make many decisions according to behavioural science, which Brainjuicer uses to help their clients succeed.

Separately, there is a new LTIP proposed which will reward gross profit growth at a rate of up to 30% p.a over four years. The minimum achievements required for vesting aren't mentioned in the RNS, so it's hard for me to judge at this point whether this is something I could vote for if I held shares.

The max award "will result in dilution of up to 8.5% of the company's issued share capital" - would that be fair compensation for gross profit growth of 30% p.a. for four years? I guess so, but it will be up to shareholders to decide.

Coats (LON:COA)

Share price: 55.5p (-4.7%)

No. shares: 1407.6m

Market cap: £780m

I'm afraid this isn't one I've looked at before, but thanks for the comments suggesting that I mention it.

From a quantitative point of view, it has a mighty StockRank of 97, and passes 5 investments screens! (for its momentum, value and growth characteristics.)

Anyway, the results today are sturdy: revenue up 2% on a constant exchange rate basis, but adjusted operating profit increases 16% thanks to "market share gains, cost productivity, controlled overheads and raw material price benefits". Sounds good.

What's even better is the company's pride in its excellent return on capital employed, which improves to 39% from 33%.

Another highly relevant KPI which the company uses is free cash flow (it's own, non-statutory measure), which improves 10% to USD $78 million. That's worth about £62 million, or 8% of the current market cap (i.e. the trailing free cash flow yield is currently 8%).

It describes itself as "the world's leading industrial thread and consumer textile crafts business" - and has been around for over 250 years.

Debt and pensions: Coats is carrying an accounting pension deficit of $627 million, though at least it has net cash at the Group level of $78 million.

Checking footnote 14. (c), I see that the company added back its pension scheme payments of $99 million, as well as several other important costs, to get the adjusted free cash flow mentioned above - which sorts of takes the shine off the adjusted free cash flow measure.

Outlook

The outlook seems a bit nervous in relation to H1 comparatives, which might go a large way toward explaining the share price softness today:

We enter 2017 on a solid footing however remain cautious about market conditions. We expect to continue to deliver growth in line with management's expectations through our initiatives to deliver market share gains, productivity improvements and tight cost control. This growth is likely to be weighted to the second half of the year due to strong profit growth in H1 2016, and may also be subject to further foreign exchange headwinds on translation that have been seen in recent periods.

My opinion

Coats claims that one in five garments made in the world today are sewn using their threads - and that's only the apparel division.

So it sounds like a fantastic business. The market cap is worth about USD $1 billion and if we naively add the pension deficit to that we get an enterprise value of $1.6 billion for a business which just produced (after-tax) profit from continuing operations of $76 million.

I could get behind investing at that sort of multiple for a business with this sort of competitive position.

You do need to have some view on pensions, though. There were actuarial losses this year of $325 million. If you hold this for the long-term, you'll be sharing the company's real free cash flow with the pension fund, and interest rates and investment returns will have an enormous impact.

While not claiming to know the future path of interest rates and investment returns, I'd tend to give the company the benefit of the doubt and have a positive view on the shares, based on what I know so far.

Purplebricks (LON:PURP)

Share price: 260p (-1%)

No. shares: 270.5m (including 22.7m placing shares)

Market cap: £703m

By multiple reader request, let's see what I can make out of this Purplebricks situation.

It's relevant to my Rightmove coverage, as Paul wrote in December:

Also, if PURP became really dominant in online estate agency, then why would it need Rightmove? It could cut out Rightmove altogether (or offer it as an optional extra), and create its own property portal.

And yesterday, Paul wrote:

I think estate agency is clearly a sector ripe for internet disruption. I did some googling the other day, and found about a dozen or so online estate agencies. Then I checked all of them on Alexa.com . Sure enough, Purplebricks is the clear market leader, by miles - it was claiming about 62% of the market, but in last night's RNS that has gone up to 67% (based on listings on Rightmove).

I think this illustrates why it's much too soon for Purplebricks bulls to announce the impending death of Rightmove - the overall property market is still measured in reference to Rightmove!

(In a similar way, stale gold bulls like myself have had the occasional temptation to announce the death of the dollar - by referring to the price of gold measured in dollars.)

Conquering the Web

Since we still compare agents according to their Rightmove listings, Rightmove remains the barometer. And while purplebricks.com is undoubtedly a valuable domain, with a UK Alexa rank of c. #2,500, it is simply nowhere near the rightmove.co.uk rank of #37!

Such a high ranking means that we can consider rightmove.co.uk to be an essential part of the internet experience for vast swathes of the UK public, and that doesn't simply vanish overnight.

Yahoo! has been considered uncool and out-of-date for many years, and yet it still has a global Alexa rank of #5!

So while Purplebricks might be making great headway in the estate agency business, achieving the online feats of Rightmove is a different task.

The way I could see it playing out is in some kind of consolidation or collaboration between Rightmove (or Zoopla) and Purplebricks (or another new-wave estate agent). But that would only happen if the thesis turns out to be true that one of these new-wave estate agents is going to achieve an unassailable competitive position.

Conquering the US

This is the key paragraph in the rationale for me, since it explains why Purplebricks might be able to disrupt a new territory:

The Directors believe that real estate agents in the US will want to become LPEs, given the compelling customer proposition and the benefits of the Purplebricks model. The Purplebricks model should allow agents to spend more time focusing on looking after customers and selling homes, rather than a significant proportion of their time being taken up prospecting for the next listing. This is possible because a sustained marketing and advertising campaign is intended to drive listing appointments to the LPEs (see below). The Purplebricks platform and business model is designed to result in improved LPE productivity which provides LPEs the opportunity to earn more revenue than they would as a traditional real estate agent.

So the idea is that centralised marketing campaigns in the chosen states will enable US real estate agents to spent more time with customers and prospects and less time marketing - makes sense.

It's hard for me to imagine that £50 million would be enough to bring the businesses to a self-sustaining level of activity, but I guess the devil will be in the detail in terms of which states they are targeting and how much advertising will cost there.

My opinion: It's not really my style to buy into something like this, I'm a bit too boring and tend to go for companies which are at a more mature stage of development, so I miss out on these types of opportunities. But I can see there is a rationale for continuing to hold Purplebricks for the long-term possibilities - I'd try not to watch the share price too closely though, to avoid getting too stressed or excited!

TBC Bank (LON:TBCG)

Share price: 1424.5p (unch.)

No. shares: 52.5m

Market cap: £748m

I'm taking liberties now by covering a mid-cap financial based abroad, but there was a reader request from Ric so hopefully I'm justified! And it had final results out today.

This is the largest bank in Georgia, market share c. 37-39% after a recent acquisition, depending on how you measure it.

Some financial highlights, key metrics in bold:

- Net Profit for 2016 up by 36.4% YoY to GEL 298.3 million

- Return on equity (ROE) amounted to 22.4% (20.6% without one-off effects) and Return on assets (ROA) to 3.9% (3.6% without one-off effects)

- Cost to income ratio stood at 45.8% (42.9% without one-off effects), compared to 43.9% in 2015

- Net interest margin (NIM) stood at 7.8% in 2016, unchanged from 2015

For a quick comparison with a British bank: Barclays had a Return on Tangible Equity of 9.4% in 2016, a cost to income ratio of 61%, and a net interest margin of 3.6%.

So by all of these primary financial metrics, the lowly TBC had a much better year than Barclays.

It may have done this in a somewhat riskier way than Barclays, however, holding tier 1 capital (equity plus reserves) of 10.4%, compared to Barclays which reached 12.6% by Dec 2016 (it started the year at 11.4%).

Acquisition

TBC bought rival Bank Republic in Q4 2016, which had a market share of about 7% in Georgia. This is now consolidated within TBC.

My opinion

Thisis a new listing since August 2016, and has been a success for investors so far. The market cap in Georgian currency is worth GEL 2.4 billion, whereas the balance sheet equity is just shy of GEL 1.6 billion.

I haven't got any insights into the outlook for the Georgian economy but in principle I don't see anything wrong with paying 1.5x book value for a bank with metrics such as TBC has achieved.

I'm going to have to go now, thanks for the suggestions and apologies for not getting around to all of them.

Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.