Good morning!

Spaceandpeople (LON:SAL)

Regulars might recall that this was one of my favourite shares of 2013, and is a core holding in my long-term portfolio. I see this as a hold forever type of share, as it pays a decent dividend, is priced reasonably, and delivers reliable growth every year. It's a niche marketing company, which manages kiosks and advertising campaigns in open spaces, mainly the central parts of shopping malls, but also railway stations, garden centres, festivals, indeed anywhere there is a concentration of people and open space.

It's the market leader in this niche in both the UK and Germany, and also has smaller operations in India, Russia, and is likely to continue further overseas expansion. The company is based in Scotland, and has entrepreneurial management who are properly incentivised with relatively modest remuneration packages, but decent-sized shareholdings and share options - exactly the way it should be done - none of the disgustingly bloated pay packages that many London-based small cap Directors take.

So it ticks a lot of boxes for me as an attractive small cap niche growth company. The company has issued a positive trading update today, for calendar 2013, with the key part being this;

Gross revenue for the year increased to £36.8 million (2012: £30.1 million) and net revenue increased to £13.8 million (2012: £13.1 million) as the Company continued to expand its client base whilst delivering increased sales to its existing clients both in the UK and Germany.

Pre-tax profit for the year is anticipated to be in line with current market expectations.

Cash flow was again positive during 2013 with net cash being £1.9 million at the end of the year compared with £834k at the end of 2012.

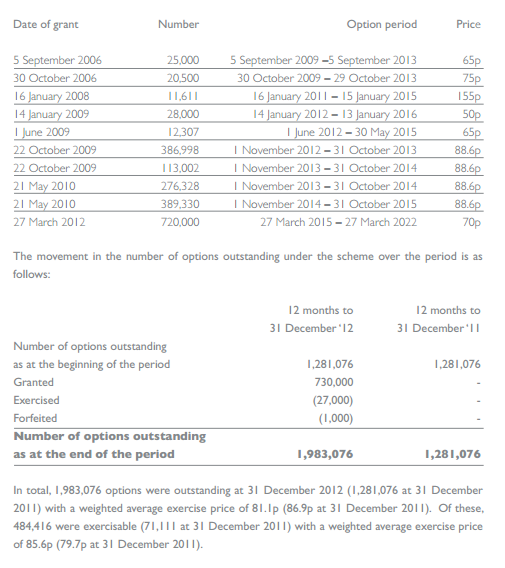

So all looking good. What are profit expectations then? Stockopedia shows consensus forecast of 8.66p EPS - this is a fully diluted figure, as there are a lot of share options here. The basic EPS is around 10p I am told. Checking the most recent Annual Report (for 2012), note 27 (see excerpt below) states that there were 1,983,076 share options outstanding, with a weighted average exercise price of 81.1p.

There are currently 19.5m shares in issue, so Options are slightly above what many investors consider the maximum acceptable dilution of 10%, so I wouldn't want to see any more share options issued for the time being. I'm all for Directors and staff being paid modest salaries, but being incentivised with generous share options packages, so that their interests are aligned with shareholders, and they are focussed on the long term, rather than chasing short-term targets for an annual bonus (although that has its place for sales staff only, and provided that they are not allowed to discount prices to win more sales volume). However 10% dilution is the limit, and SAL has gone slightly above that, so should rein in the share options from this point in my view.

Incidentally, it's always worth checking the Annual Report for total share options in issue to Directors and staff, as it's all too easy to just focus on Directors options in the remuneration report, and overlook the fact that (as in this case) there can be a significant number also granted to other staff. The share options note is usually right at the back of the Annual Report - and these are always available online in pdf format, so it's very quick to check key points in the AR, you don't have to read the whole thing. Just Google the company name + "annual report", or "investors", and that takes you straight to it.

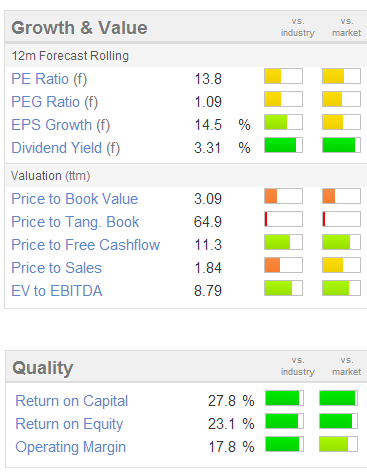

Looking at valuation, I would say that for the time being, SAL is probably priced about right (as can be seen from the amber traffic light for PER).

At 136p per share that represents 15.7 times 2013 diluted EPS, based on consensus forecast of 8.66p.

The valuation now will be looking at 2014 EPS forecasts, which are 9.92p in this case, so 10p as near as dammit. So a PER of 13.7 for this year, which looks reasonable to me.

Perhaps the market might decide to push the valuation a little higher, based on the decent historic growth, and an outlook statement today which sounds optimistic (see below)?

My view is that this company should deliver steady long term growth, hence the share price is likely to continue its gradual upward trend, with regular pullbacks when some holders decide to bank profits & move on. A lot of market participants seem very short term focussed at the moment, whereas this share is more for the patient investor, in my opinion.

...the Company (is) in an excellent position to continue its growth going forwards

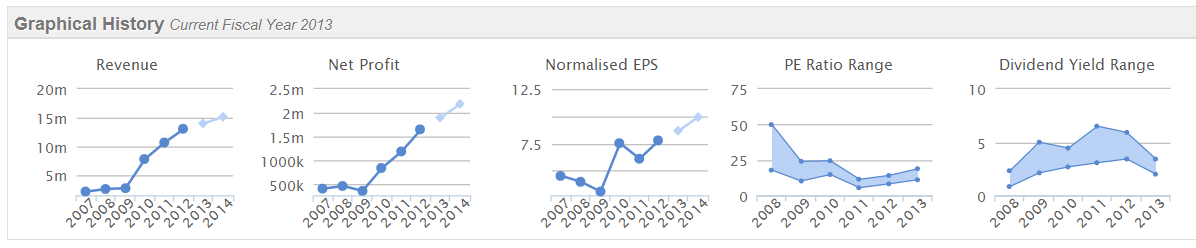

Overall then, I'm hoping to see something like 20% p.a. share price appreciation from SAL, plus a 3.3% growing dividend on top, that's a very appealing long term investment idea in my view. Probably not exciting enough for most people, but it works for me. Check out their long term performance track record, and bearing in mind this has been achieved in a lacklustre economy;

Stadium (LON:SDM)

The market likes today's trading update from Stadium, a niche electronics group. It's low volume, bespoke products, so they don't face too much competition from low cost, mass market producers overseas.

This looks like a good statement. The key bit being;

...trading for the year ended 31 December 2013 is in line with the Board's expectations. As anticipated, the second half of the year delivered significantly improved profits as the benefits of the recent restructuring programme have started to come through.

As I mentioned when reviewing their interim results on 10 Sep 2013, companies which report weak H1 figures and then promise an improvement in H2 often fail to deliver, so this type of statement can often be in effect a deferred full year profit warning.

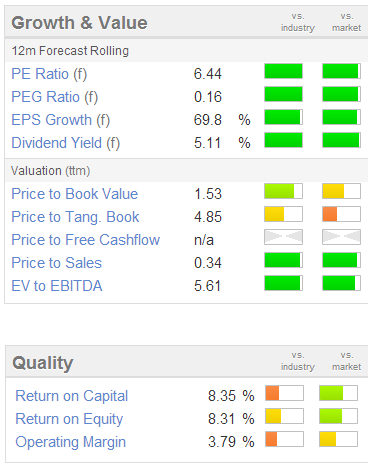

In this case however, Stadium deserves praise for having done what they said they would do, and H2 has delivered a better performance, in line with expectations. Broker consensus is for 4.3p EPS for 2013, despite the weak H1. That puts them on a PER of 12.1 times 2013 EPS. Probably about the right price.

However, the upside comes from expectations of an improved performance in 2014. There seems good reason to expect this, as the lower costs from their restructuring programme will benefit the whole of 2014, not just the tail end, as happened in 2013. So broker consensus for 2014 jumps up a lot, to 7.3p EPS forecast. That makes it look a lot more interesting, as the PER drops to just 7.1 times, based on the current share price of 52p. That looks good value to me.

However, the upside comes from expectations of an improved performance in 2014. There seems good reason to expect this, as the lower costs from their restructuring programme will benefit the whole of 2014, not just the tail end, as happened in 2013. So broker consensus for 2014 jumps up a lot, to 7.3p EPS forecast. That makes it look a lot more interesting, as the PER drops to just 7.1 times, based on the current share price of 52p. That looks good value to me.

There is a pension deficit here, so that would need investigating before going further with this idea, but if I could obtain comfort on that, after reviewing the figures in the last Annual Report, then I would consider adding some of these to my portfolio. The bid/offer spread is a bit horrible though - at 49p Bid, 52p Offer, there is a 6.1% headwind to overcome, plus fees.

NB. Please bear in mind that the Stockopedia graphic above left is based on last night's closing share price, so given that the shares are now up about 10% on the day, those figures also need adjusting manually, or wait until tomorrow when they are updated overnight.

I'm not recommending any share, am just giving my personal opinion on it, based on a brief look at the figures. So as always, it's essential to Do Your Own Research! (DYOR). I keep repeating this ad nauseam, because it STILL hasn't sunk in with one or two readers!!

Avesco (LON:AVS)

This is the largest % faller of the day, down 45% to 128p, but that is due to the shares going ex-entitlement to the 110p special payout, so it's nothing to do with trading.

I might revisit this share when time permits.

Akers Biosciences Inc (LON:AKR)

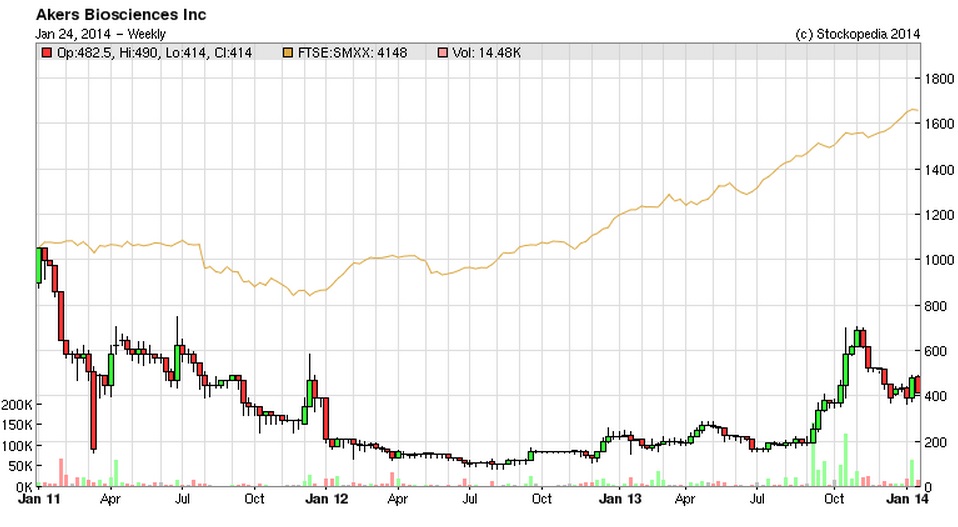

Shares in this micro cap medical diagnostics company have dropped 14% to 407p today, because they have taken the unusual step of taking a dual listing on NASDAQ. I'm wondering if the UK market is tired of this stock, which has been around for many years, and has been a huge disappointment from its glory days when investors were convinced that it had great potential.

That said, the more recent newsflow has been a lot more interesting, and it seems to me there could be a viable business here, perhaps? Anyway, American investors have stumped up $15m (£9m) in fresh cash, before costs, which I imagine would be fairly hefty. The shares will be quoted on NASDAQ under a different ticker of AKER, so it will be interesting to see what the liquidity is like. Pretty thin I would imagine. Although Americans are notorious for only ever wanting things to go up (hence the joke is that you should never get into a lift with Americans, as you'll never leave the building!), so as a fresh story to them, perhaps they will get excited about Akers and drive the price up? That is presumably the plan, one assumes?

So the American fundraising being priced at $5.50 equates to 331p per share in the UK, so at 407p mid-price today, they are effectively at a 23% premium to the US issue price. It will be interesting to see what happens next. If it works well, then perhaps more small, speculative UK stocks will go for a NASDAQ Listing?

Here's a three year chart which shows recent volatililty;

Hornby (LON:HRN)

Another profit warning from Hornby, and reading the statement I'm surprised their shares have not fallen more than their current 8% fall to 74p. This company has had major supply chain problems, which have continued to impact the business. Although they have negotiated an exit from the problem supplier contracts, effective by July 2014.

To be blunt it all sounds down to bad management, so I would want to know what changes in management have been made, and why things will be better in future, before investing here.

Looking at it in a glass half full way (we are in a bull market after all), you could say that the problems have now been ring-fenced & closed off. It still managed sales on a like-for-like basis (i.e. excluding specials for the Olympics) level with the prior year, and expects breakeven for year-ended 31 Mar 2014 at the underlying trading level. After that, there will also be a £1m currency translation hit to the P&L.

Net debt at end Dec 2013 of £6.5m doesn't sound too bad, and they report having traded within the bank covenants in the last quarter, although any company at breakeven must be sailing close to the wind, depending what those covenants are? It's too risky for me. One more major mishap, and they could be in real trouble with the Bank, so that's not the type of risk I want to take. This type of messy, problematic situation can often drag on for longer than expected, and when there's bank debt involved too, it's risky - so why take that risk, when the valuation is not compellingly cheap? Long term will there really be much of a market for these products? I don't see many people playing with model trains any more, everyone is glued to tablets or smartphones.

Judges Scientific (LON:JDG)

There is a positive trading update for the year ended 31 Dec 2013 from Judges. the key paragraph saying;

Judges had a successful year including the completion of its largest acquisition to date, Scientifica Limited ("Scientifica"), and an £8.1m placing. The Group achieved good organic sales growth and, in addition, Global Digital Systems Limited ("GDS") and Scientifica performed well. Margins and cash generation were satisfactory and the Board believes that adjusted earnings per share for 2013 will be at the higher end of market expectations.

The year-end order book is similar to last year, at ten and a half weeks, but the company mentions that recent strength in sterling has been unhelpful for their exports. Something to bear in mind for other shares in our portfolios - a strong pound means imports get cheaper, and exports get dearer, so that helps the margins of importers (such as non-food retailers) and hurts the margins of exporters - not just of physical goods, but companies that provide services to people based overseas, e.g. tourism into the UK.

Broker WH Ireland say that the shares look fully valued on 22x FY2014 estimates, and they have moved their rating from outperform to market perform, purely on valuation grounds. I agree - it's been an amazing ride for shareholders, but with growth now much harder to bolt on, due to the enlarged size of the group, and a very rich valuation, if it was me, I would say thank you very much indeed, bank my profits, and move on. Each to their own of course!

SCISYS (LON:SSY)

Scisys is a software company, focussed mainly on long-term, public sector work. It's a steady, mature, niche company, on a reasonable valuation. The company reports underlying results for 2013 in line with guidance given in Sep 2013. The order book is described as "solid", with an encouraging new business pipeline.

There was restructuring done last year, but I was a bit concerned at the high cost of that restructuring, which seemed to be related to long-serving employees being paid quite a lot to leave. So if more restructuring is required, it could be costly, which increases risk somewhat.

Overall it's not exciting enough to spark my interest particularly, although I do hold a few in my long-term portfolio, and will remain a holder. The key to unlocking shareholder value is a more generous dividend, in my opinion. I don't see why they are only planning on paying 1.4p divis in 2014, over 5 times covered by earnings. Surely that could be safely doubled (or more?).

The other problem here is a very wide bid/offer spread, and lack of liquidity in the shares - a vicious circle unfortunately. The current 5p bid/offer spread would consume nearly 4 years' worth of dividends! So I think a strategy to improve market liquidity is needed, along with a more generous dividend. Then it would start to make sense to think about buying these shares, which do look reasonably attractive on a PER basis.

That's it from me for today, and the week.

Thank you for reading, and wishing you a pleasant weekend break.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SAL, AKR, and SSY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.