Good morning. Should be another interesting day today, with the FTSE 100 futures indicating a lower open, 30 points down. US markets bounced strongly on Friday, but have given up almost all of those gains overnight, so it's not really clear whether the significant market falls lately will continue or not. I remain of the view that this is a healthy & necessary correction to valuations, which had clearly become stretched.

Interim results from Porvair (LON:PRV) look pretty good, with turnover up 8% to £38.6m, profit before tax up 27% to £3.1m, and EPS up 23% to 4.9p. There seems to be an H2 weighting to their trading, based on last year's figures, so it looks to me as if they are heading towards perhaps 11-12p EPS for the full year this year? Broker consensus is 11.4p EPS.

Therefore at 296p the shares are on a very warm PER of 26 times! That looks far too high to me, and I cannot understand why the market took them up another 50% in the last three months, from a price of 200p where they already looked fully valued? It's a smashing company, but the shares are over-priced now in my opinion at 296p.

Next I am reading the results from Cohort (LON:CHRT) which look very good, considering its modest valuation of £56m market cap at 140p per share. I almost bought some of these a few months ago, but didn't quite have enough confidence to hit the buy button, at around the current price.

Turnover for the year-ended 30 Apr 2013 has come in well below expectations, at £70.9m (Stockopedia broker consensus shows £75.6m). Despite that, EPS forecasts of 14.4p have been beaten considerably, at 17.94p. So the shares look to be on a modest PER of just 7.8 times. That looks even more interesting when you consider that the company has £16.4m in net cash too. So at first glance these really do look cheap, I shall do some more digging.

Right, to update on Cohort, I've taken the plunge and bought a few at 150p, as based on these numbers out today, I cannot see how a valuation below 200p makes sense. Even if you only put it on 10 times EPS, that arrives at 179p, plus they have £16.4m in net cash, which works out at 40p per share. They should be able to make some nice acquisitions using that cash pile.

Going through Cohort's accounts in more detail, the only "funny" I can find is that their corporation tax charge is unusually low this year, for a variety of factors (e.g. R&D tax credits, deferred tax calculations, prior year adjustments, and utilisation of tax losses within one subsidiary). They state that in the current year (ending 30 April 2014) the tax rate should rise to 16%.

So by my calculations that means earnings have benefited by about £1.1m, or 2.7p per share from the unusually low tax charge in 2012/13, which adjusts EPS down from 17.9p to 15.2p. So not quite as much upside as I originally though, but it still means the shares are on a modest PER of 10, with the £16m cash pile thrown in for nothing. That's still a bargain in my opinion, especially as the outlook statement sounds pretty confident. Although it is perhaps a reminder that I'm sometimes too prone to rush into buying shares before having properly researched them!

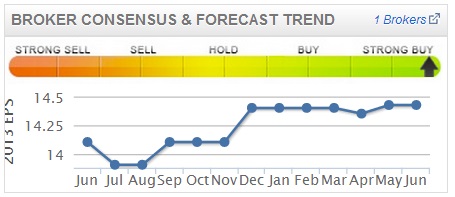

Interesting to note that once again, rising broker consensus estimates throughout the last year turned out to be a very good indicator of likely out-performance at Cohort.

Interesting to note that once again, rising broker consensus estimates throughout the last year turned out to be a very good indicator of likely out-performance at Cohort.

I shall start looking at this indicator much more closely from now on.

It stands to reason really. Brokers talk to companies throughout the year, hence are steered in the likely direction of profits by the company itself.

Some interesting Stats on AIM - May 2013 was a record month so far, with £351m raised (£160m in 6 new issues, and £191m in secondary issues). Six new companies joined AIM, and 7 left (2 went bust, 2 were taken over, 1 transferred to the Specialist Fund Market, and 2 de-Listed after no longer seeing the benefits of a Listing).

Next, I've been looking into Cambria Automobiles (LON:CAMB) which has issued a positive IMS today, which says that trading has continued to be strong, and that results for the year ending 31 Aug 2013 will "comfortably exceed market expectations". That's a strong message. Consensus forecasts are showing 2.6p EPS, so we must be talking 3p+ surely? At 35p the shares therefore seem reasonably priced. They are up over 50% since March, so I'm not interested in getting on board at this late stage, but well done to anyone holding.

I'm reading a lot of stuff in the financial press about concerns over the Chinese economy slowing down, and a possible financial crash there. My view, for what it's worth, is that the Chinese economy is completely uninvestable, because it's a giant game of pass the parcel, where bad debts are never recognised, both in Banks and company balance sheets. Hence one has to regard the accounts of Chinese companies listed in the UK as just works of fiction.

They supposedly hold all this cash, so why don't they pay dividends? Funny that! I don't think Western investors will ever see a penny of that cash, so it has to be valued at nil when considering the value of the company. If you're never going to get a dividend, then arguably the shares should also be valued at nil?

So if/when the Chinese economy does implode, when it's credit bubble blows up, why should this concern me as a British investor? Surely it will be good for Britain, since demand for commodities will drop, making oil & other resources cheaper, which is a good thing for us in the West surely? We don't export much to China, but mainly import from them, which won't change. So why all the concern? Other than that it might destabilise our banks again - but again, so what? The politicians know what to do now - if a bank goes wobbly, they have to refinance it somehow.

The big lesson learned from 2008 is surely that Governments cannot not act, and allow banking problems to fester. They must & will intervene in any future crises. So I doubt any future banking crises (in Britain anyway, where we wisely retained the key to our own printing presses) will be as bad as 2008. As for the Eurozone who knows? It such an obviously broken system, to my mind they are only delaying the inevitable break-up. The Euro solely exists to give Germany an artificially cheap currency to continue their export boom indefinitely. The price is paid by the Southern European states, which are now in permanent depression - until the people/army finally snap, and overthrow their Governments.

Who would have thought that the organisation which was supposed to create peace in Europe, is actually creating a re-run of the economic conditions which sparked WWII (i.e. economic depression, mass unemployment, etc).

The solution is that Germany must leave the Euro & go back to the Deutschmark.

A trading update from Allocate Software (LON:ALL) has been well received by the market, with the shares up 7% to 72p at the time of writing, taking the market cap up to £46m. They state that the company "delivered a very strong second half performance", but do to say that full year results will be in line with expectations, which strikes me as slightly odd. So a very strong performance was already expected then?

EPS broker consensus is for 5.29p, so that puts the shares on a PER of 13.6, which doesn't strike me as particularly exciting in value terms. The forecast dividend yield is just under 2%, so not madly exciting there either.

It does look like a fairly good turnaround though, so I would be interested to know whether these improved results are sustainable, or could be improved further? Might be one to look at in more detail one rainy Sunday afternoon?

There is an excellent results presentation video here from Cohort (LON:CHRT). Well done to them for taking the trouble to do this. All companies should publish results presentations on the web, for their private shareholders. This would level the playing field compared with Institutions & analysts, who have results presentations laid on for them.

It continues to amaze me how so much of the City just ignores private investors. Yet we are the people who create almost all the liquidity, and set the share price! So it's encouraging to see that some companies "get" that, and deliver good information online for private investors to view.

Well I appear to have run out of time, so will sign off for today.

See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a newly opened long position in CHRT, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.