Good morning! It's scheduled to be a very busy week for results and trading statements, so here we go.

Spaceandpeople (LON:SAL)

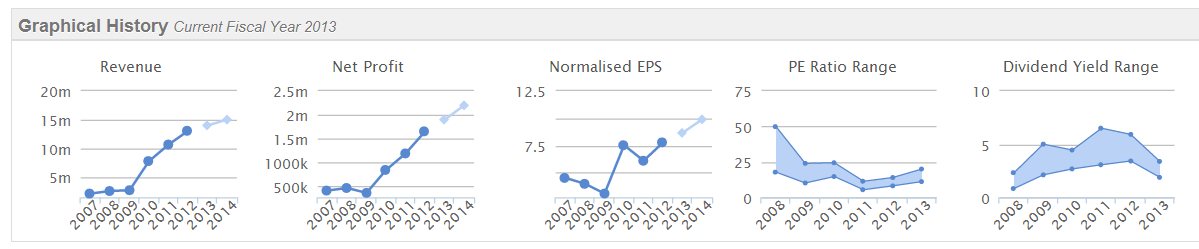

This is one of my favourite long term shareholdings, for a number of reasons - the ones that spring to mind are its excellent track record of growing EPS and dividends (see Stockopedia graphical history below), dominant in a small niche (managing promotions and kiosks in shopping centres, railway stations, etc), entrepreneurial management with plenty of skin in the game, barriers to entry for potential competitors, and a valuation that still looks reasonable.

As regards the last point, I think we've probably now had the re-rating from ridiculously cheap to sensibly priced, so I'm not expecting any further major re-rating of the shares in the short term. Longer term though, I think there is every reason to anticipate steady share price appreciation, and of course continued decent dividends. So with patience, the overall return should be good, in my opinion, but maybe not exciting enough for short term traders who are always looking for the next multibagger!

I have done well buying the dips with this share over the last year, as it's still fairly illiquid, so when someone with a lot of shares wants to sell, the opportunity sometimes arises to pick up some stock at a 10-20p discount. This should be a fairly safe strategy, as most of SAL's revenues (and costs) are recurring and hence predictable, so the chances of an unexpected profit warning are slim, and even if one does happen, it shouldn't be a big miss.

Turning to calendar 2013 results from Spaceandpeople, it all looks fine to me, as expected.

The key numbers are nearly all up between 10-20%. I tend to focus most on diluted EPS, which is up 15.4% to 8.98p, although some investors might be happy to base a valuation on the basic EPS of 10.11p. Note that there's quite a noticeable difference between the two EPS figures, which is due to an unusually large number of share options here for management and employees. So at 145p per share the PER is 14.3 times basic EPS, and 16.1 times diluted EPS. That's probably priced about right for the time being, in my view, although of course that valuation drops to 14.7 times 2014 fully diluted EPS forecast, which seems perfectly reasonable to me.

I'm very pleased with the increase in the final dividend to 4.1p (up 17%). Note there is no interim dividend, so 4.1p gives a reasonably good yield of 2.8% based on a share price of 145p. That may not be a spectacular yield, but when you factor in that it tends to grow a decent amount each year, and take a long term view, it's a lot better than money in the bank, or Gilts, in my opinion.

The Balance Sheet is fine. Although net tangible assets are only £1.8m, that's because this is a people business, and has inherently positive cashflows. The dividend reinforces that positive cash generation. It held £1.9m in net cash at the year end, so absolutely fine there.

Note that earnings has been boosted by £215k interest received, being a "refund of interest previously paid on interest hedging products...". So that looks like a one-off. Stripping that out, operating profit actually fell 3.9%, which isn't great - although this is down to factors that have been previous disclosed at the interim stage, and are mentioned again in today's report - namely that the UK retail side had a poor year, with revenue down 22%. The slack was taken up by their German operation, which had a remarkably good year.

The outlook sounds sufficiently buoyant that I think investors will probably forgive the slip-up on the UK side in 2013, which seems to be due to 3 major sites reconfiguing their kiosk space, resulting in some down time where SAL received no income. I also like the significant new contract wins, e.g. St. Pancras station, and a chain of garden centres.

Interestingly too, the narrative explains how they are working on wider European expansion, but without the cost of opening offices in new territories - which sounds quite exciting, as it could mean faster growth, and higher profit margins perhaps? I'm seeing management later this week, so will ask them about these various points.

Albemarle & Bond Holdings (LON:ABM)

Unsurprisingly, it's game over for this over-indebted pawnbroker. I don't suppose many people will be sad about that, indeed if there is ever an appropriate time for Schadenfreude, then this is probably it.

I very much doubt that any readers here would have been caught out on this one, as I've repeatedly warned that the situation was looking hopeless, and that a 100% loss for shareholders was the most likely outcome, which I warned readers about here on 27 Jan 2014, here on 24 Dec 2013, here on 9 Dec 2013, here on 2 Dec 2013, here on 27 Nov 2013 (where I gave it the "maximum possible risk warning from me", so people had plenty of time to get out.

Anyway, as announced this morning the Bank have pulled the plug effectively, forcing a sale of the business below the current level of debt, hence the shares are now worth nothing, as expected. The shares have been suspended. So that's the end of that one.

DX (LON:DX.)

The deluge of IPOs in progress this year mean that I'll have lots of new companies to review, so am trying to acquaint myself with them as they launch on the markets. My general rule of thumb with IPOs, especially in a bull market, is that the vendor has chosen a time & price to maximise their profits, hence it's usually going to be a mistake to take the other side of the deal! Although there are some nice initial premiums on listing at the moment, how long they will last though, is another matter?

Anyway, DX Group announces its Interim results to 31 Dec 2013. It's important to note that the results relate to the period when it was privately owned (by Private Equity it seems, Arle Capital Partners are noted at the controlling party pre-IPO). I'm not a fan of PE. It seems to me that they load up businesses with far too much debt, and look for quick ways to financially engineer a fast buck for themselves. That doesn't really help anyone, so it's a bad thing overall for society in my view.

DX joined AIM on 27 Feb 2014. It's a post & parcels delivery business. This is a highly competitive sector, so I was surprised to see that they make such a big profit margin - an operating profit of £24m on turnover of £297m for the year ended 30 Jun 2013. Then the penny dropped - I've heard the name DX before, it's a system that solicitors use for secure delivery of legal documents, which originated in the 1970s when the GPO was always on strike.

The 31 Dec 2013 Balance Sheet is best ignored, as it was before the Placing which eradicated most of the PE debt. There is a pro forma Balance Sheet given at the end of today's results, which shows net tengible assets of minus £25.4m. The working capital position is also poor, with current assets only 60% of current liabilities. This reinforces my view that even when they IPO a company, PE will still leave it with too much debt and a weak Balance Sheet.

Scott's Law* is once again confirmed, with the company today saying;

DX has delivered a good trading performance in the first half and has a strong balance sheet with comfortable headroom.

* = Scott's Law - a company with a weak Balance Sheet will always claim to have a strong Balance Sheet in its results narrative.

What they should have said is that they have a weak Balance Sheet, but it doesn't really matter because the business is generating plenty of cashflow. That is more accurate.

Their interim results today show operating profit flat against last year at £8.6m for the six months, which seems to point towards a stronger H2, based on the prior year comparatives (as they did £24m for the full year last year).

Their interim results today show operating profit flat against last year at £8.6m for the six months, which seems to point towards a stronger H2, based on the prior year comparatives (as they did £24m for the full year last year).

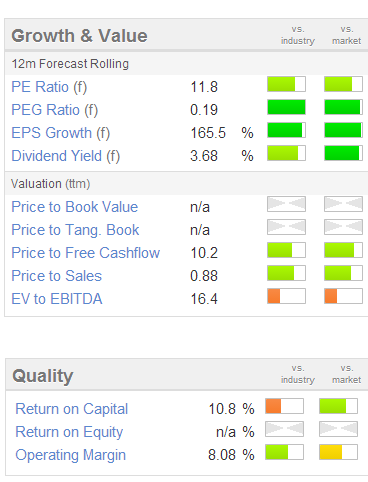

The key Stockopedia valuation graphics on the right look fairly attractive, in terms of a lowish PER, and an attractive dividend yield. Although note that these are based on broker forecasts for a company that is new to the market, so are probably more likely to be wrong than usual.

If they do pay a 6p dividend for 2014/15 as indicated by brokers, then it could be attractive to consider on a yield basis.

My only reservation is whether the lucrative legal business might be on the decline as electronic methods could replace some of the movement in paper documents perhaps?

Note that the company has some very smart Institutions on its >3% list, including Henderson, Hargreave Hale, Miton, and others, which gives considerable comfort - those guys are smart, and will have checked it out thoroughly. So I'm starting to think this might be worth a deeper look, I'd need to see broker notes first, but it's on the watch list.

Inspired Energy (LON:INSE)

A new member of Stockopedia has asked me (in the comments below) to run my slide rule over Inspired Energy. Normally I ignore all companies with "energy" in the name, as I don't cover resource sector stocks, which is usually what they are. However, in this case it seems to be a me-too version of Utilitywise (LON:UTW), the cost consultant that helps corporate customers reduce their energy bills.

We've discussed Utilitywise at length. I liked it when it was around a quid a share, but think that the price now has run ahead of itself, at 316p Utilitywise is capitalised at about £230m, and has a forward PER of 20. That's fine if you think growth and high margins can carry on forever, but bear in mind that the profits all come from kickbacks from the energy companies themselves. At some point they're possibly going to twig that they are giving away too much, and cut the commissions.

The same thought occurred to me when I briefly looked at the accounts today from Inspired Energy. It reports revenue of £7.6m (up 45%) for calendar 2013, and EBITDA of £3.55m, which is a very high margin indeed. That comes down to £2m at the operating profit level, still a very high margin of over 26%. To me that suggests unsustainably high profits are being made, and at some point the party will probably come to an end - either by a deluge of new entrants, or by the energy companies scaling back the commission they pay.

I could be wrong, but it's a big risk factor. The market cap of about £68m at 17p per share looks too high to me. That's almost ten times revenues!

It looks likely that growth could continue for some time, but I think these utility consultants are an accident waiting to happen, so personally will be steering clear. The golden rule for valuing any company, is to consider whether profits are sustainable. I suspect they might not be, long term, in this sector.

DP Poland (LON:DPP)

I'm very sceptical about this company. It's trying to replicate the success that Dominos Pizza has had elsewhere, but in Poland. It has heavyweight management. However, the figures are really grim. For the year ended 31 Dec 2013, it reports turnover of only £3.2m, and an EBITDA loss of £2.8m. That's appalling. The bottom line after deprectiation, etc, is a loss of £3.3m.

This very poor financial result has been achieved after three years building the business, and despite LFL sales growth of an impressive 43% last year. So they still have a mountain to climb just to get anywhere near breakeven.

In my view a retail roll-out should only be done when you have proven the concept works. Indeed I've looked at a couple of private investments in the fast food space recently, and a good format should hit the ground running, and be making big profits pretty much from Day 1. Then you roll it out.

In this case though, DPP are soldiering on, seemingly pushing a boulder uphill, just to prove that they can get to individual store breakeven in some cases. Then all the central costs are over & above that.

If they don't make dramatic progress in 2014, I think it will be time for them to admit the probable truth, that this format just isn't going to work in Poland, for whatever reason. There's probably enough cash left to last them another two years, but I doubt whether anyone will refinance it again at that stage, unless performance has dramatically improved.

So I think DPP is a bit of a dud. Which is very surprising, as Dominos is a brilliant business in the UK. In fact, I did a one hour work experience shift there last Christmas, to see how the business worked, thanks to a kind franchisee. I was amazed at how efficient they are, and how the pizza is made & in the oven within 90 seconds of customers placing the order. It's in the oven for less than 5 minutes, so that's why they are delivered so quickly.

Anyway, on that bombshell I shall sign off for today!

Regards, Paul.

(cue the advfn loonies making jokes about me & Tom Winnifrith cooking pizzas together!! Don't worry I thought of it first. Of the companies mentioned today, Paul has a long position in SAL and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.