Good morning!

Brady (LON:BRY)

I'm busy preparing for another interview with Gavin Lavelle, CEO of Brady (LON:BRY). He asked for an opportunity to respond to the points I raised in my report here on 21 Mar 2016, which was critical in parts.

If fundamentally sound companies want to engage, then great, I'm happy to do so. Indeed I enjoy helping sound companies and private investors communicate with each other, whether or not I hold the shares personally. I won't waste your time with dodgy resource stocks, or blue sky nonsense. Let's see if Gavin can be persuasive enough to tempt me (or you) back into Brady shares!

EDIT - all done - here's my new interview this morning with Brady's CEO (audio, 26 minutes)

IT improvements

Good news re the annoying HK tickers that sometimes pop up in these reports - Ed has tweaked the coding so that the £ symbol before a ticker will now only pull up UK companies. Hoorah!

Also, I was given some re-training yesterday on a better way to insert pictures into my reports. So hopefully we should not get a repeat of past technical problems where sections of the reports disappear. It's fair to say that my relationship with computers is, at best, an uneasy truce!

Timing

At 12pm I have a (non-recorded) call with another company CEO to learn about his recently floated company. So if it sounds any good, I'll let you know. Therefore, timing-wise, most of this report will get written this afternoon, and possibly this evening.

Incidentally, I added loads more sections to yesterday's report last night. So please do have a recap on that report here whilst you're waiting for today's report to gestate. It's so busy at the moment! I can't cover everything, but do my best to report on the most interesting announcements.

Tracsis (LON:TRCS)

I should also mention that the CFO of Tracsis emailed me yesterday to point out that the deferred consideration creditors on their balance sheet should be self-funding. So the deals have been structured as earn-outs. This means that challenging profit & cashflow targets have to be hit, in order to trigger the payments. To be prudent, the company has booked the maximum possible earn out onto its balance sheet.

This is a really important point, as it means that the company's cash pile should not be eaten into by those liabilities, as I incorrectly stated in my first draft of yesterday's report. Am happy to clarify this point, and yesterday's report has been amended to include the CFO's email. It's great when companies engage like this, to clarify or correct misunderstandings.

I suggested that they include a bullet point in the highlights section of future reports to flag up the self-funding nature of the earn-outs, which they took on board.

Ab Dynamics (LON:ABDP)

Share price: 382.5p (up 4.5% today)

No. shares: 17.3m

Market cap: £66.2m

(at the time of writing, I hold a long position in this share)

Trading update - there's an upbeat report from this company today;

Revenues and operating profits for the six months to 29 February 2016 are expected to be significantly ahead of the same period last year. Sales in USA, Europe and China performed exceptionally well. In addition, as the industry increases investment in new models with a focus on advanced safety systems, sales of both our track and lab testing products has remained strong throughout the period. It is expected that revenues for the full year will be considerably ahead whilst operating profit will meet or marginally exceed market expectations.

All good, but the upshot is in line, or "marginally ahead" of market expectations, so it's not something to get wildly excited about. Positive yes, but only modestly so. Therefore I think the market has got it right, with a 4.5% increase in share price.

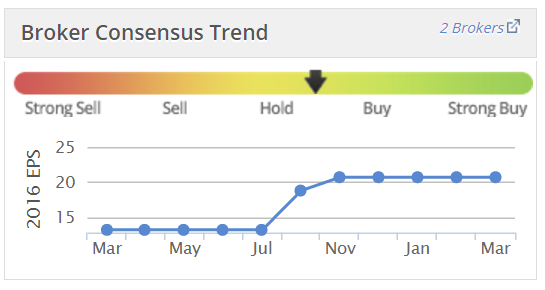

The company looks on track (geddit?!) to do about 21-22p EPS this year. That's a PER of nearly 18, so the price is looking quite full now. I've taken this opportunity to sell half my personal position this morning, to lock in some nice gains, and am happy to run the balance for the foreseeable future.

Nice company this one, and it seems on a roll. Broker forecasts have already been raised quite a lot earlier this year;

Intelligent Energy Holdings (LON:IEH)

Share price: 9.2p (down 80% today)

No. shares: 188.3m

Market cap: £17.3m

Update on funding position - I've not looked at this heavily cash-burning company before, and judging from today's announcement doesn't look like I'll need to. This is probably about to go into Administration I'd say;

The Company refers to its announcement on 26 February 2016 which included an update on the Company's proposed funding process.

The Company announces that, in light of recent and unexpected developments in the discussions with various parties, the Company will not be able to complete a funding process, in sufficient quanta, by the end of Q1 2016. Further, at this stage, there can be no certainty that an appropriate funding plan can be implemented at all.

The Company is reviewing all options and further announcements will be made in due course.

That sounds terminal, and imminently. Expect the shares to be suspended later today, or next week perhaps.

Over-ambitious, heavily cash-burning business models are very rapidly going out of fashion right now. Not before time either.

ADVFN (LON:AFN)

Share price: 27p

No. shares: 25.4m

Market cap: £6.9m

Interim results - 6m to 31 Dec 2015 - as this RNS was slipped out at 5:45pm the night before a Bank Holiday, I'm going make a special effort to shine a light on it.

The figures are poor. Turnover is down 11.1% to £4.3m for the 6 months. The operating loss was £538k, slightly less bad than £647k in the prior year H1.

Balance sheet - looks stretched;

NTAV is negative at -£604k

Current ratio is weak, at 0.69

Cash is only £784k (down from £1,510k a year earlier)

Outlook - costs have been cut, and the current trading comments sound a bit more positive;

More cost cutting benefits have been felt in the new calendar year as contract and headcount reduction periods have passed with January and February showing good levels of operational performance. This has been helped by a pickup in advertising sales.

At an operational level we have seen improvement in the first few months of the calendar year of 2016. Our aim is to capitalise on last year's hard work to build upon the good start seen during January and February and continue to improve performance on a running basis in the final half of this financial year.

My opinion - this is clearly a lifestyle business for the Directors. It doesn't pay divis, and has never managed to extract any value from its large database of investors, nor gain traction from overseas expansion.

Talking of that user database, it's probably not worth very much, because it clearly contains many fake, multiple accounts set up by rampers to abuse its bulletin boards. Also the drivel posted by many of its genuine members suggests that they're (a) not very bright, and (b) haven't got much money.

It would certainly need new management to stand any hope of creating any shareholder value, in my opinion. What's the point in it being listed?

Time is short now, so I'll go into snippets mode;

Northamber (LON:NAR) - another company where the burning questions are what's the point in it being listed, and why does it actually still exist at all? Its interim results today show a worsening trading picture - an H1 loss of £547k (prior year H1: £292k).

The only saving grace is a solid balance sheet, with NTAV of £19.9m (versus a market cap of £8.9m at 32.5p per share currently). However, you might ask, so what? What is the value of assets which are just being tied up in a completely unproductive activity?

So it's another lifestyle business I'm afraid. The only value for shareholders would be if they decide to do something radically different with the company. In the meantime it's just dead money tied up. There's been a small dividend in the past, reduced to only 0.6p per share in each of the last 3 years.

Management need to bite the bullet, and come up with a new strategy for the company, as currently they're just treading water, and shareholder value is slowly leaking away with losses each year.

The Chairman holds 61%, so there's no chance of any activists being able to get involved here. The company is his plaything, and I don't think he has any idea what to do with it. My suggestion would be to wind down the existing, loss-making activities, and instead use the company's facilities & expertise to reverse in an e-commerce business of some kind.

Churchill China (LON:CHH) - good figures from this UK manufacturer of crockery, mainly for the hospitality sector. I often see their products when eating out. Basic EPS rose 20% to 37.3p, which is a little ahead of expectations (of 36.6p).

The company also has a super balance sheet, with plenty of cash - this rose to £11.8m, with no debt. That's material to a market cap of about £84m (at 767p per share currently). It owns the freehold to its main site too.

The shares look fully priced to me, on a PER of about 19.

It says that "the current year has started well".

Fastjet (LON:FJET) - I see that the CEO, Ed Winter, stepped down on 18 Mar 2016. Good job too, as he's been a complete disaster. Another Director stepped down at the same time. The Chairman has taken over until a CEO can be found.

Therefore EasyGroup Holdings requisition for an EGM to oust the CEO has lapsed, as its objective has been achieved.

The latest twist in the saga, is that EasyGroup (which owns the Fastjet brand), and is a 12.6% shareholder in Fastjet, has published a letter (publicly) accusing Fastjet of being in breach of the brand agreement. So it sounds to me as if EasyGroup has given up on Fastjet, probably doesn't want to put in any more funding, and maybe wants to kill it off (why else would they take such a provocative public stance towards it?)

Fastjet has put out several responses, saying it is considering the matter with its advisers.

In my view, if one of your major shareholders appears to be actively trying to destroy the business, then private investors should probably dash for the exit and salvage what's left of your failed investment. This is not a viable business, although it could perhaps stay in business for a little while longer by doing a sale & leaseback on the aircraft it owns.

It seems to me virtually certain that this company will go bust within a year, so the shares are probably worth nothing.

Lakehouse (LON:LAKE) (at the time of writing, I hold a long position in this share) - another company where board room battles are underway, with the founder (Steve Rawlings) having joined forces with Slater Investments to requisition an EGM to replace the Non-Execs (strangely). Lakehouse has published its response today, here.

My view is that this is a mess, and that it's a great pity all this dirty laundry is being aired in public. However, as an investor, I'm far more interested in how the company is trading, and the most important line in today's RNS is confirmation that trading is alright;

"The Board confirms that the Company remains on track to deliver its revised expectations for the current financial year."

The forecast is for adj. EPS of nearly 10p this year, so the PER is staggeringly low, at only 4.5. I think this could turn out to be a terrific bargain at the current level, indeed I tried to buy more today, but didn't get a fill unfortunately, as I tried to be too clever on price.

The board room issues will get resolved, one way or another, and for me are presenting an opportunity to pick up a fundamentally sound company at a price which looks dirt cheap.

I'm not sure it was wise of LAKE to put out this document today, which rubbishes the skills & experience of the founder, and the other 2 suggested new NEDs. However, I don't think the requisitionists have behaved sensibly either. They should have thrashed out any disagreements in private, not embarked on this daft public spat.

Anyway, let's see how it plays out, but for me, the shares are a bargain & I'll be buying more next week.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.