Good morning! In case you missed it, I published another audiocast interview this weekend with renowned investor @WShak1 - click here to listen, sorry for the sound quality not being great, I have a cunning plan to fix that issue next time.

I am flying to Las Vegas in the morning, for a short holiday, so I apologise that there will inevitably be some disruption to these reports this week, mainly due to the time difference, as I will be 8 hours behind. Therefore my plan is to write tomorrow's report as usual from the departure lounge at Gatwick, then Wed-Fri reports this week will be published in the evening UK time.

Naibu Global International Co (LON:NBU)

Profit warning - this Chinese maker of sports shoes warns on profit today, blaming a sales slowdown leading to overstocking by distributors. So margins will be hit in Q4 of 2014, and Q1 of 2015 as stock is cleared by discounting.

Dividends - this company has paid dividends before, but from memory I think they had stopped. However, it says today;

Naibu has substantial cash balances (RMB 315 million as at 31 October 2014) and the Directors are confident that the Company has sufficient resources to implement the programme referred to above.

There seems to be a technical glitch stopping me from copying any more of this accouncement, but there is another section saying that Naibu, "intend to resume the payment of dividends in 2015, once the overstocking issues referred to have been resolved".

My opinion - personally I wouldn't put any reliance at all on any stated intentions, nor the accounts, from Chinese companies on AIM. I remain of the view that the inevitable end game here is likely to be a de-listing, probably in 2015.

Of course, if the numbers were real, then insiders would be massive buyers of these shares, given that the forecast dividend yield is about 50%, and the PER is 0.35! Funnily enough though, they are not buying. What does that tell you?!

Avingtrans (LON:AVG)

Share price: 104p (down 24% today)

No. shares: 27.6m

Market Cap: £28.7m

Profit warning - there seem to be so many profit warnings happening at the moment - which is the main reason that I don't like over-paying for any small cap, as you can end up horribly off-side if you pay top dollar for a company, only for it to disappoint on trading.

The profit warning doesn't look too bad to me;

However, as a consequence of these short term issues, the Board now expects Group revenue and profitability in respect of the current financial year to be similar to that reported for FY14, excluding the revenue and initial losses from the RMDG acquisition. The steps set out above will improve operational efficiency and we expect the full year impact of these actions to be approximately £0.6m, the full benefit of which will be reflected in FY16.

Bear in mind that the company has a 31 May 2015 year end.

The progressive dividend policy is re-stated.

Valuation - actually, looking at the figures, broker consensus was for a big increase in profits this year, so if that's not now going to happen, then it's quite a big profit miss after all.

As my article of 1 Oct 2014 detailed, the accounts at Avingtrans are complicated by lots of adjustments. Hence it's not really clear to me what the true level of profitability is.

The Balance Sheet here is sound, and the dividend last year was 2.7p, so that probably means this year's dividend is likely to produce a yield of c.3%, or just below - not too bad.

My opinion - today's profit warning gives more detail about reduced demand meaning they will have to make more site closures. So that will no doubt mean another load of restructuring costs, so the accounts are likely to remain messy for some time to come.

I'm going to wait for the dust to settle here. It doesn't look a particularly good quality business, on the Stockopedia metrics, and there are too many adjustments to the reported figures. Although with the share price now back down to a level not seen since the spring of 2013, this could be a reasonable entry point for anyone who likes the company & is prepared to take a long term view, if you think it can recover from the setbacks announced today.

I don't have a strong view either way.

MoPowered (LON:MPOW)

Profit warning - yes, another one!

The company today says that revenue for the year is likely to fall short of market expectations of £1.6m. Honestly, how ridiculous having a stock market listing for a company that can't even manage to do £1.6m turnover in a year.

The company is therefore doing more cost-cutting.

On a more positive note, it has recruited a new FD, and says that it's in the final stages of a "major new product release".

This company did a rescue fundraising only about a month ago. So it's really a question of how quickly they are burning through the cash, and whether the company can turn itself around before running out of money.

It looks a basket case to me. However, micro caps that do manage to turn the corner can become multi-baggers, so who knows? It's too risky for me.

GB (LON:GBG)

Share price: 144p

No. shares: 120.6m

Market Cap: £173.7m

Interim results - for the six months to 30 Sep 2014 are published today.

The headline figures look good, but I'm uneasy about several things. Firstly, and most importantly, the high valuation - it's rated at about 24 times forecast EPS for this year.

Secondly, the profit growth seems to have mainly come from an acquisition. Adjusted operating profit for the six months is up from £2.6m to £3.8m, but note 17 says that a newly acquired company, DecTech, contributed £833k to adjusted operating profit. Strip that out, and the original business only increased profit from £2.6m to £3.0m, not very impressive for such a highly rated share.

Thirdly, there are too many adjustments to the profit figure, and non-recurring items which seem to happen in every half year. Share based payments are stripped out, but this is staff remuneration, and it's running at about 10% of profit. So a material cost, that should not be ignored, in my view.

Taking the clean figures, i.e. ignoring all the adjustments, earnings (i.e. post all costs, and post tax) here are quite modest. Only £3.5m last year, and £1.7m in H1 of this year. That's not a lot for a company valued at £174m.

So overall, I reckon the valuation here has probably got well ahead of reality.

Eckoh (LON:ECK)

Share price: 42.3p

No. shares: 223.1m

Market Cap: £94.4m

It's much the same story at Eckoh - another growth company which looks considerably over-valued to me.

Interim results - for the six months to 30 Sep 2014 are out.

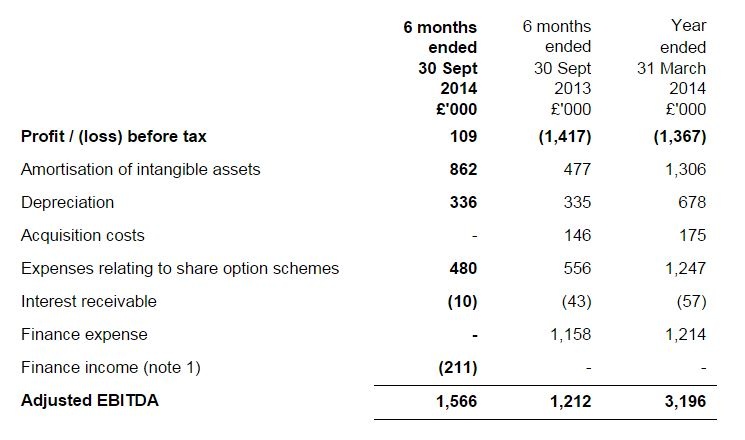

Revenue is up 24% to £7.8m for the six months. Profits? Take your pick, do you want adjusted EBITDA, adjusted operating profit, or conventional profit? Call me old fashioned, but I lean towards conventional profit, and on that basis Eckoh doesn't make any profit at all! Consider this table from today's results;

Again, the same issue with share-based remuneration - the company is trying to adjust it out, but it's a material cost here. The way I look at it, the company was loss-making by £1.4m last year, and that was mainly due to the £1.2m cost of giving cheap shares to staff & Directors!

Outlook - the company today says that the seasonality is for stronger trading in H2, and that is expected to be the same this year, and hence the company is confident of meeting market expectations for this year (ending 31 Mar 2015).

My opinion - I think the current market cap is crackers. It isn't supported by what I would consider to be real profits, and so the shares are effectively already pricing in considerable growth in profits in future. Why pay up-front? A bit of bad news could easily derail this valuation by a large amount. So it's too risky in my opinion.

Solid State (LON:SOLI)

Share price: 720p

No. shares: 8.3m

Market Cap: £60.0m

Interim results - for the six months to 30 Sep 2014 are issued today, and look excellent. The big win has come from a £34m Govt contract to provide electronic tagging equipment for hoodlums.

What a refreshing change to read a set of figures with no adjustments, no exceptionals, or highlighted items. Just a single, clean profit figure. This is how it should be done - straightforward presentation, and real profits, not adjusted profit conjured out of thin air!

So profit before tax jumped 175% to £1.55m, and basic EPS came in at 16.7p. Double that to annualise it, and 33.4p is the result. The 720p share price is therefore 21.6 times - yikes, that's a very rich rating for a small company like this.

I note that a big jump in EPS to 53.8p is forecast for next year, so the PER drops to 13.4 times, therefore all that profit growth is already priced-in, hence no scope for any disappointment.

More acquisitions are mooted, and a quick review of the Balance Sheet passes my simple tests. A small point to note is that the cashflow statement shows £244k of development costs were capitalised in H1 this year, whereas nothing was capitalised at all last year. So that has helped boost this year's numbers somewhat.

My opinion - I like the business, and the shares have done remarkably well, but the price looks fully up with events now, and there's no room for disappointment. So personally I would be thinking about top-slicing after such a great run, if I held these shares. That's just an opinion, obviously it's up to each individual to decide for themselves.

Flowgroup (LON:FLOW)

Share price: 47p

No. shares: 239.5m

Market Cap: £112.6m

Normally I would rip apart a heavily loss-making company with a blue sky product, at this kind of valuation (over £100m). However, there might be something interesting, albeit highly speculative here.

Flow has developed a new type of gas-fired domestic boiler, which generates electricity as a by-product. Manufacturing is starting around now, using a large outsourced manufacturer called Jabil Circuit Inc - who are US stock market listed (NYSE:JBL) and have a market cap of $4bn, so a sizeable business.

The contract terms have been amended to increase production from a total of 390,000 boilers to 500,000 boilers. So these two companies are not mucking about here.

I will be watching this company closely, to see whether commercial success is likely, as the numbers could be large if this product takes off.

Very high risk, disclaimer, disclaimer, etc.!

That's it for today.

Tomorrow's report will be shorter, and earlier, as I'll be luxuriating in the Club World lounge at Gatwick, but the flight is boarding around 10:30am, so hopefully I can get some meaningful thoughts published by then!

Best wishes, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.