Good morning. Lots of results today, which I will have to really belt through, as I have to be on a train for London by 10:30 this morning, for a company meeting. My diary is packed for the next 3 weeks, with in total meetings or presentations from 18 companies scheduled (some in groups, such as the ED and ShareSoc investor evenings), so it's going to be pretty manic trying to take in all of that! But it's what I enjoy doing, so bring it on! I find the more companies' management you meet, the better you get at sorting the wheat from the chaff. Or at least spotting the better risk/reward opportunities, might be a kinder way of putting it.

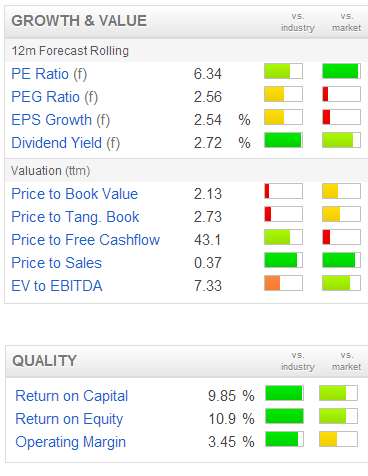

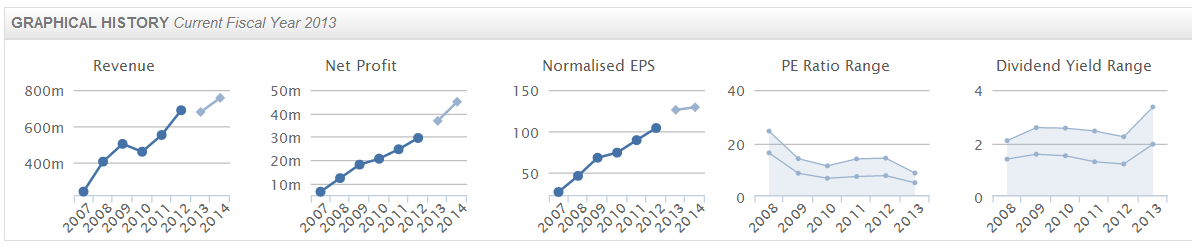

The company I am seeing for an analysts lunch today is £270m market cap Hargreaves Services (LON:HSP) - they operate some UK coal mines, and are a distributor of coal & coke, haulage, etc. The reason I'm interested in seeing this company is because they seem so cheap on a PER basis. At 806p the shares are indicated by Stockopedia to be on a forward PER of just 6.3, and with a 2.7% dividend yield. The Balance Sheet has some long-term debt, but it's not excessive at all, with net debt reported at £77.9m as at 31 May 2013.

Figures issued this morning are for the year ended 31 May 2013, and show turnover up a whopping 36% to £843m, and continuing underlying profit before tax up 5.9% to £52.2m. Looks like there are some one-offs due to problems at one of their colieries, but this has been known about for some time.

From a Google search, I can see that the price of coal seems to have shot up in recent years, so presumably that is driving things. Continuing underlying EPS is reported at 134.6p, with a 20.5p dividend, which both look a little ahead of expectations. I don't know anything about the coal sector, and obviously given its history of decline, have always assumed that it's moribund in the UK, but maybe not? In any case, I think most of HSP's profits come from parts of the business other than production.

If any readers have looked at this company, and understand them, then do please jot down your comments in the comments below, and I will read them on the train up to London. Would be good for me to have some intelligent questions to ask! But for the time being, a PER just over 6, combined with a reasonable dividend yield, and moderate net debt, have certainly sparked my interest. As regular readers here will know, I like sniffing out value, and GARP (growth at reasonable price), so will report back with my thoughts after meeting the company.

Check out the Stockopedia historic graphs here - everything going nicely in the right direction - smooth profits growth, and the valuation coming steadily down, and the yield (recently) going up.

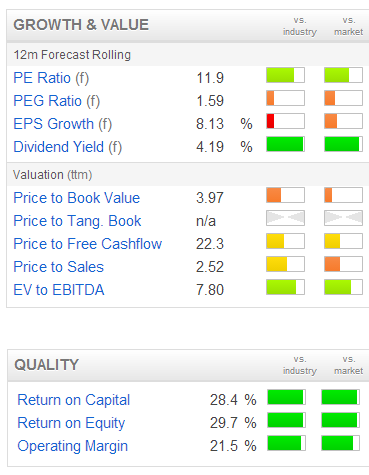

Small recruitment software company, Dillistone (LON:DSG) has issued its interim results to 30 Jun 2013 today. It's like a smaller version of Bond International really, and I'm booked in to meet management at an investor lunch in November, so that should be interesting.

I note also that they are doing a results Webinar today at 3pm. What an excellent initiative! This is an ideal way of getting information out there to private investors & City people alike. It's great to see companies & their advsiers starting to do things like this, and I really hope that we quickly move to a situation where all Listed companies do results presentations or webinars twice a year. It's important that a recording of the webinar is also put on the web, as personally I probably won't be able to look in at 3pm today, but would like to see it later tonight.

Turnover is up slightly, at £3.8m, but Dillistone make decent margins, so £856k operating profit (before goodwill amortisation) is a strong result at 22.5% operating profit margin. They do capitalise development spending, £339k in H1, but my my calculations operating profit is stated after a £210k amortisation charge - i.e. profit is only boosted by £129k through capitalising development spend as opposed to expensing it fully as incurred (which is my preferred, more conservative accounting treatment).

So Dillistone look on track to meet broker consensus of 7.6p EPS this year, which puts the shares at 96p on a PER of 12.6, which looks about right to me. Larger competitor Bond Intl recently said that their markets are picking up, as recovering economies mean that companies are more prepared to spend on upgrading their software, after 5 lean years. Therefore I am receptive to the idea of investing in good quality, reasonably priced software companies at the moment.

Dillistone are also a small consolidator in a fragmented sector, and that's a nice place to be - because the valuations on small private companies are usually much lower than the valuation of a Listed company. Therefore you can create shareholder value by acquiring lots of small companies at low valuations, bolting them on, thereby growing earnings, and hence pushing up your own share price as investors react to increased earnings, and even afford you a higher PER because you are delivering growth. This is exactly the business model that Judges Scientific (LON:JDG) have deployed, with astonishing success. So again, I'm receptive to the concept of investing in small consolidators in fragmented markets, who make good quality but cheap acquisitions. You have to be careful of course to avoid small consolidators that overpay for rubbish acquisitions, and then fail to manage them properly! There are plenty of examples of that on AIM, where you see enormous Goodwill written off after a couple of years, when everyone realises they've cocked up.

One final point on Dillistone - I found some interesting "scuttlebutt" on the company on the web - a user group of recruitment agencies, discussing the software they use. Dillistone's product generally got very positive remarks from its users. On the back of that, and the reasonable valuation, I picked up a few shares a while back for my long-term portfolio. There's a good dividend too - the forecast yield is 4.2%, twice covered.

Being a former retail man myself, retail roll outs always interest me (i.e. where a retail format has been proven as profitable in a few locations, and is then rolled out to many more locations, thus generating rapid & profitable growth). Tasty (LON:TAST) is one which I've looked at before, but never been convinced by. They operate 27 restaurants, branded as "Wildwood" and "Dimts".

The roll out looks to be going reasonably well. Turnover is up 24% to £11.0m, and operating profit (before pre-opening costs for new units) was up 39% to £1,045k. Not bad going. They look to be at the stage where they can finance capex from a combination of existing cashflow, and bank debt, which is the point where retail roll outs really get exciting - as the rapid growth from that point doesn't need any further shareholder dilution.

However, the valuation is also pretty racy, as again is usually the case with a good roll-out. The market cap is £48m at 98.5p per share, which is a PER of about 30 times current year forecast EPS, dropping to about 20 times next year. They always look pricey at this stage, but it will probably look cheap in a few years time at this price.

I wonder, have any readers tried their Wildwood or Dimts restaurants? If so, I'd be interested to hear your views as a customer.

The Dominos pizza operator in Poland, DP Poland (LON:DPP) has always looked promising, but their figures are always dismal. Today is no exception, with really poor interims - only £1.5m revenue, and an EBITDA loss of £1.4m from 15 units - that doesn't look like a format that is going to work in Poland. The basic premise of any retail roll out is that you get the format to work highly profitably from the first handful of units, THEN you roll it out. That doesn't seem to be happening with DPP. They are assuming it will work, and rolling it out anyway. They now have an uphill struggle to make it work, but with £9.2m cash in the bank, it looks like they are likely to plough on regardless.

Maybe it will work, but based on the current figures, it isn't so far, so personally I shall be steering clear of these shares. The market cap of £16.9m is too high, in my opinion.

Results from Regenersis (LON:RGS) look good - worth a look.

Similarly results from Netcall (LON:NET) have good headline numbers, not got time to review at the moment, but might be worth a look. Decent cash pile too.

Sorry, got to dash, see you same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in HSG and DSP)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.