Good afternoon!

I'm running a bit late today, as after the market going haywire yesterday, I decided just to ignore the market altogether this morning, and let it do whatever it wanted to do. I'd already decided that I wasn't going to make any changes at all to my long-term portfolio (as I ignore market volatility in that portfolio). Also I had taken my large cap long positions, in my separate short to medium-term trading portfolio, so didn't want to panic sell on any further downturn, so spending the morning in bed seemed a good way to achieve that aim!

China

What a lovely surprise to wake up to, seeing that there's been a really big recovery in the main markets, including (most importantly) the USA, and also a bounce in China. The catalyst seems to have been the Chinese Govt reducing interest rates, and relaxing deposit reserve ratios for its banks. The market had been looking for a reason to rally, and this was it.

"Buy the dip" seems to have worked, yet again! (for now anyway)

At the time of writing the FTSE 100 has recovered by 194 points on the day, to 6,098. Even oil is up 3%, amazingly, which of course is a major factor in driving the FTSE100, due to BP (LON:BP.) and Royal Dutch Shell (LON:RDSA) being the 6th, and the 1st largest constituents by market cap, and of course with other large cap resources stocks also being important parts, such as £BLT and Rio Tinto (LON:RIO) for example. Add in banks and pharmas, and that's a large chunk of the FTSE 100 already accounted for. So it's not a great index for we small cap investors to pay much attention to really.

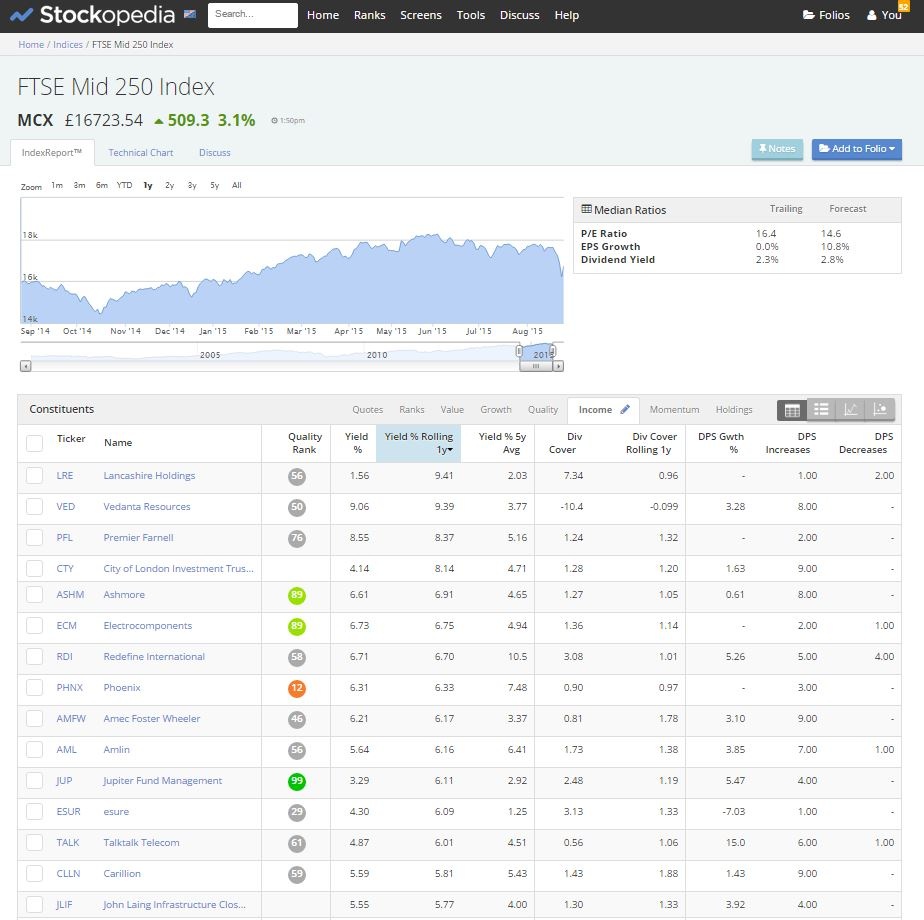

I recommend rummaging through the constituent companies in the various Indices, which is really easy to do on Stockopedia - just hover over the "Home" option on the black menu at the top, then select "Browse Directory", then select whichever Index you want to look at. The companies in that Index are then listed alphabetically, and you can sort them any way you want - e.g. by PER ratio, by dividend yield, relative strength, etc. This is a good way to scan for new investment ideas, I find.

For example, the screenshot below shows the FTSE 250 sorted by dividend yield, as I'm currently looking for some high yielding mid caps to add to my portfolio:

So this sharp market correction has certainly reminded us all that markets can go down, as well as up! Note how quickly this downturn happened too. Is this the way things are now, with so much more computerised trading, stop losses, HFT, etc.? Maybe we just have to get used to the market occasionally delivering a short, sharp shock?

Limit orders

The big opportunity that I missed yesterday unfortunately, was the chance to put in some opportunistic limit orders, well below the market price. If you had done that on some big US stocks, you could have absolutely cleaned up yesterday. I bought Apple Inc (NSQ:AAPL) shares at about $100 as they look terrific value at that price, on fundamentals.

However, imagine if, instead of buying just before the flash crash at 14:30 as I did, I had put in a limit order to buy at say $95. This is an automatic buy order, which will only be executed if the market price drops to that level.

So next time the market wobbles, I shall be putting in opportunistic limit buy orders on liquid large caps, to catch any opening spike down in price, when computers apparently were ramming through trades indiscriminately at any price, e.g. due to leveraged punters being closed out of positions.

Strong performers

Another area I've looked at, is to see which small cap stocks held up the best in this correction. Two in my portfolio really stood out, where all the selling was just hoovered up by buyers in the background, with the share prices hardly moving. These were accesso Technology (LON:ACSO) and Boohoo.Com (LON:BOO) and Norcros (LON:NXR) .

In my view the refusal of these shares to fall much is very encouraging, as if all the sellers are being soaked up during a chaotic down market, then that suggests to me these shares are likely to go up significantly in the future. It shows that existing holders are committed to their shares (thus limiting supply), and that buyers are seeking out the shares, even in a collapsing market (i.e. strong demand). We all know what happens when there is strong demand, but little supply - the price goes up!

So this is a good area to think about, in my view - which of your shares held up the best in the downturn, and maybe should you be buying more of them?

Or alternatively, if you were scared witless over the last week, then now that prices have recovered, today is a better time to sell things you're not comfortable with. Indiscriminate, panic selling in a downturn is nearly always the wrong thing to do.

Right, on to some companies - not that there's much news today.

(I am updating this article in sections, throughout the afternoon)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.