Good morning!

Netcall (LON:NET)

This is a good company, demonstrating growth, and with high quality, recurring revenues constituting 63% of total revenues - which is good because recurring revenues greatly reduce investing risk - after all, if your clients are on long-term contracts, then all being well most turnover is in the bag before a financial year has even started. Sales efforts are then mainly focussed on additional revenues, which will build the recurring revenues again for the following year, etc. So that's why investors like companies with strong recurring revenues, and are prepared to pay more.

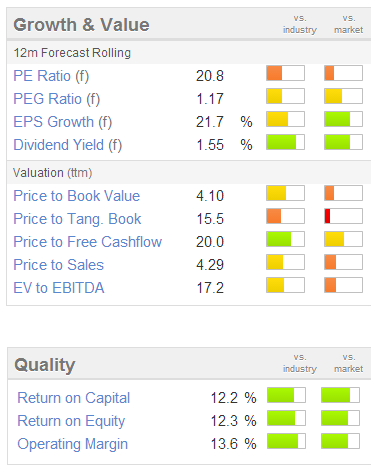

That said, on first glance at Netcall's interim results for the six months ended 31 Dec 2013, I'm wondering if the growth is strong enough to support the elevated share price? At 56p per share the market cap is about £69m.

The company achieved sales of £8.43m for the six month interim period, up only 3%. They quote the horrible "adjusted EBITDA" as their first performance measure, which is an inflated number as it ignores capitalised costs (mainly software development) of £390k, with adjusted EBITDA coming in at just under £2.5m.

The company achieved sales of £8.43m for the six month interim period, up only 3%. They quote the horrible "adjusted EBITDA" as their first performance measure, which is an inflated number as it ignores capitalised costs (mainly software development) of £390k, with adjusted EBITDA coming in at just under £2.5m.

I'm surprised at the size of share based payments, which are also identified as being an adjusting factor (i.e. they want us to ignore the cost) of £462k, which seems high for just six months (coming on top of £505k from the previous year). So some pretty generous share options being issued by the looks of it?

So basic EPS drops out at1.04p, with fairly heavy dilution that reduces to 0.94p. Annualise that, as there doesn't seem to be much seasonality to the business, and we're at just under 2p EPS for a full year. So at 56p you're looking at a very rich price of 28 times! That's too high a valuation in my view. That's based on my estimate of current year figures, calculated on a conservative basis.

That conservative diluted EPS figure is massaged from 0.94p up to 1.47p through the various adjustments, so I guess the company and its advisers are hoping that the market will value the company on nearer 3p adjusted EPS for a full year, which brings the valuation down to a PER of 18.7 times, still not cheap.

One needs to take into account net cash in the valuation too though. So they have net cash of £ 10m, although about half of that is up-front payments from customers (shown as deferred income in creditors) so should be disregarded when calculating Enterprise Value.

The Balance Sheet overall is strong in my view, with current assets being 157% of current liabilities, and negligible long term liabilities.

In conclusion then, in my view this is low risk in terms of the business, but the shares look too expensive to me, for what seems fairly pedestrian growth. The valaution might start to become more attractive if the company is able to put its cash to good use, by bolting on some more profits through an acquisition, which is their stated aim. Nice company, but the price is up with events.

The outlook statement concludes by saying;

With a robust financial position and strong market prospects, the Board remains confident in a successful outcome for the year.

General comments on risk/reward

This is a bull market, and hence riskier shares are generally rising the most at the moment. So it's easy to feel that you're missing the boat, or have a flawed strategy if you lean towards a Value approach, as I do. Although sprinkling a bit of GARP onto my portfolio has meant that returns have been good overall, and Value shares are going up at the moment too.

People keep telling me, "you were wrong about that share, it's gone up 100% since you said it was high risk". The point they're missing is that it was high risk! Just because the share price has gone up, doesn't mean that the risk disappeared. The market is currently sanguine about risk, which means there are opportunities for risk takers, and the short term rewards are good. However, there will also be some nasty mistakes too, when risk suddenly turns nasty, as it did say with Albemarle & Bond Holdings (LON:ABM).

Furthermore, market sentiment can turn on a dime, so it would only take a crisis (e.g. Russian tanks rolling into the Ukraine, or China attacking Japan) to send risky shares plummeting. Value shares will fall too, but nowhere near as much, since the holders are generally long term and are not likely to be using any gearing (hence won't be forced sellers).

It's been so long since we've had a really big market sell-off, that many people have forgotten what it feels like, and the devastation it can bring to a geared portfolio in speculative stocks. Hold on to those memories, as one day they will save your bacon when you see the same thing starting to happen again.

So hopefully my comments won't put you off investing in something you like, but my job is just to flag up the risks, and investors can then decide for themselves whether or not they are happy to take that risk. So again, nothing is a recommendation either way, it's just one person's opinion.

Wilmington (LON:WIL)

This is an educational & training group, with a market cap of about £214m at 250p per share.

My last report on it was here on 5 Nov 2013, after an IMS, where I detailed how the shares looked fully priced at 219p, and the high level of net debt was my main concern.

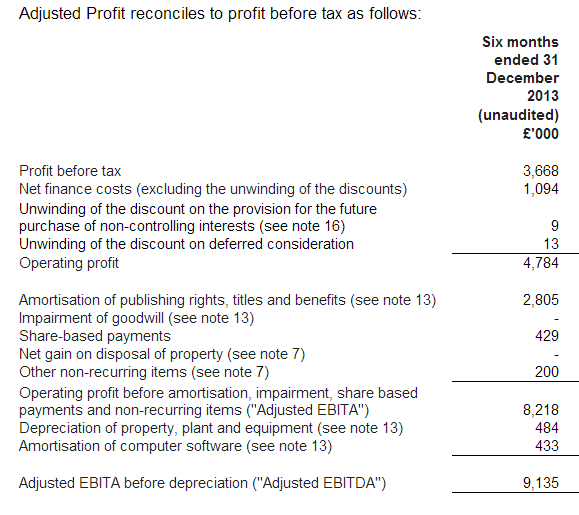

Interim results to 31 Dec 2013 are issued today. This is yet another company which selects & defines its own measure of profitability, EBITA in this case (note the lack of a D). So that's effectively profit before tax, but adding back amortisation of intangibles.

There was no amortisation charge on goodwill in this period (see note 13 to today's results), but there was a £2.8m P&L charge for amortisation of publishing rights, titles and benefits. Also I see that £4.0m of those costs were newly capitalised to the Bal Sheet in this six month period.

Therefore in my view, EBITA is a misleading performance measure, as it is completely ignoring a whole bunch of costs - by a material amount too. This is best explained by the company's own reconciliation in note 5 to the accounts today;

You can see from this table how the company's own adjustments to profit increase statutory profit before tax from £3.7m by a factor of 2.5 times to reach £9.1m EBITDA! They then give prominence to figures near the bottom end of this table, in the headlines to the statement today.

For people who don't have time to dig into the numbers, I think this can very easily lead people into materially overvaluing companies. It feels as if the presentation of results is getting more & more flexible, we must surely be getting to the point where some standardisation is required from the accounting standards people, as numbers are now not comparable between different companies. Reported performance is now an identikit, where companies just mix & match whatever costs they feel like defining as underlying or not.

The more adjustments that happen, the more confusing the figures, and personally the less likely I am to invest in the company. In this case it's too complicated to work out what EPS figure is reliable, and a true reflection of the company's performance, hence I don't feel able to value the company at all really.

The Balance Sheet looks pretty horrible - writing off intangibles takes net assets down to negative £57.3m, so it's not a soundly financed business in my view.

On a more positive note, their activities should benefit from the improving economy, especially as financial services is booming again, and they have indicated that dividends will begin increasing, after about six years of being static, at 7p per share (a yield of 2.8%).

Overall, in my view there are better value opportunities elsewhere, and at lower risk than this share, although it's had a great run up in price, so what do I know?!

UK Investor Show

I'm always happy to flag up interesting investor events, and note that ADVFN (LON:AFN) has today issued details through an RNS of an event they are organising, which is being held on 5 April 2014.

The headline speaker has been announced as Ben Edelman, as associate professor at Harvard, who shot to recent notoriety over his Blog posting which triggered a dramatic sell-off in Blinkx (LON:BLNX) shares.

The headline speaker has been announced as Ben Edelman, as associate professor at Harvard, who shot to recent notoriety over his Blog posting which triggered a dramatic sell-off in Blinkx (LON:BLNX) shares.

This was controversial, as he disclosed in his report that it was partly funded by two US investment funds, who one assumes took short positions in Blinkx. As you can see from the chart, this had a rather dramatic effect, and wiped about £400m off the market cap of Blinkx. It remains to be seen how this will play out, but I shall watch with interest.

I have been invited to appear on a discussion panel talking about shareholder activism at this event, since I ran five shareholder action group websites in 2001-2. Most of the infomation on that has disappeared into the annals of history, but I did a search and found an old article from the Guardian from 2002, for anyone interested. So it should be an interesting day.

Synety (LON:SNTY)

I've mentioned this one before, as one of my favourite early stage growth companies. It's stretching it a bit to call if GARP (growth at reasonable price), since the historic performance figures are miniscule. However, recent trading statements and contract wins have dangled potentially exciting growth in front of investors - who as you know, are currently paying high prices for growth, especially if it's cloud-related, as Synety is.

Yesterday I questioned the extremely high valuation on Coms (LON:COMS) another cloud telephony group, and as someone rightly commented in the comments, it's all about looking forwards, not backwards at the historic figures. Coms is valued at about £80m, and I don't really know what their activities actually involve, so am not qualified to comment on it really.

However, I have done some research on Synety, and am excited by its potential. The market cap is just over £18m at today's 280p per share, which is supported by growth rather than historic results.

The risk is mainly that they fail to deliver more growth, and if that happens, then the shares would probably collapse in price, so it has to be seen as high risk. However, the last trading statement said that growth was going very well, from a low base. Revenue is small, but is recurring, and growing fast.

Today they announced a new contract win with Peninsula, a telephone-based HR support function for SMEs. I used to be a client of Peninsula years ago, and their service is very good. So to my mind the fact that they have signed up to use Synety's cloud-based telephony which integrates with multiple CRM systems (that's the key point of difference) on a contract that is expected to worth around £100k per annum (subject to actual telephony usage) is a bullish sign.

In the past I've found that spotting high growth early stage companies is often about them winning credible clients as reference sites. When I originally bought heavily into IndigoVision, it was based on them having won the CCTV contract for the Athens Olympics. After that, the shares 30-bagged for me over the next 3 or 4 years.

Make of it what you will, and this one comes with a huge flashing neon high risk warning sign, but in this bull market I've seen plenty of less attractive growth companies achieve much higher market caps. So who knows? Anyway, the market agrees with me that today's contract win is positive, and has marked the shares up 11% now to 292p. They're not very liquid, and have a nasty bid/offer spread unfortunately, and the shares are tightly held.

Top Level Domain Hldg (LON:TLDH)

Announces today that it has won the auction for the domain names ending .WEDDING. It now has a portfolio of 26 such new domain name endings, including .london, .art, .app, .book, .cloud, .hotel, etc.

It will be interesting to see whether this takes off commerically. It didn't work last time it was tried, years ago, as there isn't really any need for domain names to be memorable. You just search Google for a business you want to look at, and Google finds it. The domain name is irrelevant.

They might make some money from people pre-emptively registering domains, to protect their brand name, but I remain to be convinced that this is the next big thing. Anyway, time will tell. The market cap of £138m looks optimistic to me, but they've got Hargreave Hale and Henderson on the >3% shareholder list, both of whom are highly respected, so who knows?

All done for today, comments in the comments below please! Especially if you wish to add colour to companies that I've only touched on, and it's absolutely fine to disagree with me - indeed that is welcomed here, as it adds value to have both the bull and the bear case discussed amicably.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SNTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.