Good afternoon!

Since there were quite a few announcements over the past few days, I'm going to add a few on those which haven't been covered yet.

Paul produced a huge numbers of comments in a Part 1 report this morning at this link:

- Fevertree Drinks (LON:FEVR)

- Revolution Bars (LON:RBG)

- Elegant Hotels (LON:EHG)

- Belvoir Lettings (LON:BLV)

- Minds + Machines (LON:MMX)

- Henry Boot (LON:BOOT)

- Flowtech Fluidpower (LON:FLO)

- Redx Pharma (LON:REDX)

Please let me know anything we've missed, and I'll include a comment (preferably small-caps).

Cheers

Graham

Dods (LON:DODS)

- Share price: 12.125p (-8%)

- No. shares: 341 million

- Market Cap: £41 million

This is a media business providing data, events, research and training, focusing on political and public policy matters.

It's a big turnaround story - after many years of losses or marginal profitability, it swung back to a decent profit result last year.

The momentum has continued this year (ending March 2017), with a further improvement in PBT to £1.6 million (from £1.1 million).

Looking at the Director backgrounds: the current CEO is said to have gained considerable internal influence in 2013, and was subsequently promoted to his current position in August 2016. He has been at Dods since 2001, but appears to deserve particular credit for the turnaround.

But for what it's worth, the Dods share price does remain considerably below it's pre-Great Recession levels.

But things are looking up now:

The Group's operations generated £3.4 million of cash during the fiscal year. Continuous improvement in back office procedures, a decrease in days sales outstanding from 37 days to 32 days and diligent management focus all contributed to cash generation. The Group used £3.1 million in investing activities during the year of which £2.5 million was used for the build-out, furnishings and equipment related to the relocation of Dods' registered office and headquarters into new premises at The Shard in London Bridge Quarter.

It's a shame that free cash flow could not have been greater. Though perhaps these one-off costs will bear fruit, now that the company has a new office in The Shard.

Outlook is solid:

Given the Company's robust client retention programmes, its forward bookings and current sales activity levels, the Board is confident the Company is, year over year, in a position to achieve consistent organic growth. The Board is optimistic about Dods' prospects for continued success in fiscal year 2018.

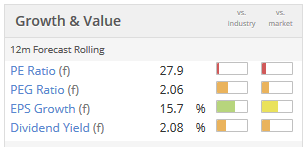

You can take these adjusted numbers with a pinch of salt, but they do help to smooth out the results a bit for the past few years:

Dividend: unfortunately, still no dividend.

My opinion: I tend to be a big fan of investing in companies which have been around for a while, and Dods has been around, unbelievably, since 1832.

The cash flows are real, but there is a bit more work to do in terms of carrying the turnaround to the point where the company feels confident enough to make dividend payments.

At the moment, it is still thinking in terms of acquisitions as part of its strategy, along with organic growth, so I'd be a bit cautious that exceptional costs are going to be around for a while, and we'll have to continue making a big distinction between the adjusted and the reported numbers.

Overall, I wouldn't mind holding a few shares in Dods as part of a super long-term portfolio (out to 2132!)

Van Elle Holdings (LON:VANL)

- Share price: 101.5p (+4%)

- No. shares: 80 million

- Market Cap: £81 million

Everything in line for this piling and ground engineering business:

Further to the announcement of 22 March 2017, conditions in Van Elle's key markets were unchanged to the end of the fourth quarter and, consequently, the Board expects to report results for the year ended 30 April 2017 in line with its revised expectations.

Further to that, there is a mini-boardroom shuffle, some executive appointments, and news that the current financial year has started positively across all divisions.

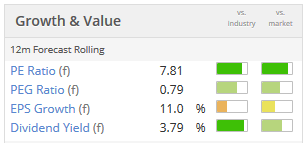

I haven't studied this in any detail before - it's a new listing, since October. It looks really good value, about 8x earnings, and only carrying a small amount of net debt after raising £7 million at IPO.

It's not a sector I can claim any expertise in, but if you're interested, you can find comprehensive information about the group's activities at this link.

Ruffer is the largest shareholder, with 9%, followed by the CEO with 7%. Miton are also there with 3%.

Looks promising.

Gateley Holdings (LON:GTLY)

- Share price: 171p (+2%)

- No. shares: 107 million

- Market cap: 183 million

Another fairly recent flotation (2015), and this one has been storming higher.

It's a commercial law firm, the first one to join the LSE. It's big, around 700 employees the last time I checked - but today's update says it has been a "significant year of staff recruitment across the group".

Shares climbed today with the news that revenue would exceed expectations, despite that adjusted EBITDA would only be in line with expectations.

Trading in the second half of the financial year hasexceeded expectations in revenue enabling the Group to further invest in the business. The Group is pleased to report that, subject to audit, revenue for the financial year ended 30 April 2017 will be not less than £77 million (2016: £67 million). Adjusted EBITDA* is expected to be in line with market expectations at not less than £14.7 million (2016: £12.9 million).

The adjusted EBITDA figure is very far removed from net profit, for the same reasons which seem to crop up all the time:

* Adjusted EBITDA represents earnings before interest, taxation, income or expenses that relate to non-underlying items, depreciation, amortisation, impairment and non-cash charges relating to share based payments.

Noting that the adjusted EBITDA/Revenue margin has not improved according to the figures above, reinforces my increasing wariness around investing in these types of businesses, which traditionally followed the partnership model. It's very hard to achieve operational leverage when the work done is proportional to the number of skilled employees you have!

What Gateley has in its favour is very heavy insider ownership, and a commitment to pay out 70% of net income to shareholders.

So it's not something that I would buy for my personal portfolio, looking for things I'd like to hold and to see grow over the long-term, but there should still be value here for the next few years at least, in the form of decent dividends and well-incentivised staff.

Clipper Logistics (LON:CLG)

- Share price: 412.5p (+3%)

- No. of shares: 100 million

- Market Cap: 413 million

Acquisition of Tesam Distribution Limited

This is a Leeds-based logistics company on the market since 2014, and another new one for me.

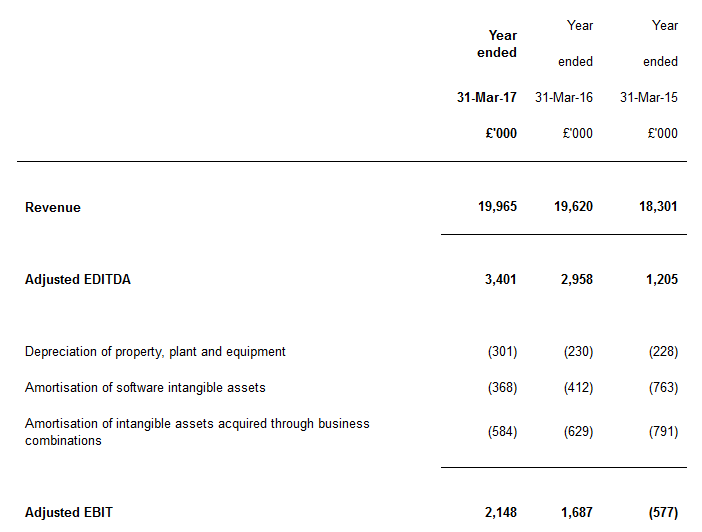

It's been a very successful IPO, though value is arguably stretched now according to the Stocko metrics:

The target company today, Tesam, has been around since 1984, is based in Peterborough, and employs 250 people (in contrast, Clipper has over 3,000 employees).

The consideration is being funded in cash from Clipper's existing cash and bank facilities. The gross consideration paid is £11.75m, however the assets being acquired include cash of approximately £3.4m and a freehold property which will be sold post-acquisition and is expected to realise £2.7m net.

Tesam was principally owned by managing director Stephen Smith who will become a consultant to the Group following completion. The other members of the management team will remain as full time employees of the business.

Good to see continuity in management.

Checking back to the half-year report from December, I see that the growth rates were excellent (EBIT +23%, PBT +25.5). Cash generation was strong too, and the company seems committed to increasing dividends.

So it looks like a tidy outfit, and it's not the company's fault that good-quality small-caps have become so expensive lately. I'm buying very few stocks at the moment, because of valuations, but this one looks worthy of research, if only for future reference.

Ramridge reckons that this acquisition is at a cheap price based on looking up Tesam's company accounts, and that Tesam can help to provide a material boost to Clipper's total profitability (see his calculations in the comment thread below). So it makes sense that the Clipper share price was nudging higher today.

That's all for today, thanks for the suggestions.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.