Good morning! The FTSE 100 futures are indicating a buoyant start, with an open up 29 points to 6,702 currently being forecast. However, one share which is likely to be maked down is NATURE (LON:NGR) which has issued a profit warning. The £28m market cap (at 36p per share) group indicates that trading at its maritime division (which provides services such as recycling polluted oil) is under-performing due to a variety of factors, such as delayed planning permission for its Gibraltar facility (which was damaged by fire in May 2011), and higher costs of complying with legislation in Rotterdam.

Their other divisions (Oil & gas, and engineering) are performing better than expected, but the overall group performance for H2 is slower than H1, therefore results for 31 Dec 2013 will be below market expectations.

Broker consensus is for 2.3p EPS this year, and 2.8p in 2014. The company reported just under 2.5p EPS for H1, although that seems to have been boosted by a one-off gain from the disposal of an interest in a former associate (which booked a £912k profit). That created 40% of the H1 profit, so if we adjust down H1 EPS by 40%, then it comes out at 1.5p. So if H2 is expected to be lower, then (guesstimate) we might be looking at say 1p for H2, which means the full year EPS might drop out at around 2.5p perhaps?

Although there is some guesswork in my figures here, this doesn't sound like a disaster, and it's down to clearly identifiable factors, which should be resolved in time. Therefore I would imagine, given that we're in a bull market, the share price here is not likely to be too badly hit today - I'm thinking perhaps a 10% drop in price?

No, hang on that doesn't make sense. If the company is saying it's going to miss FY 2013 market forecast of 2.3p, then that must mean that H2 will be less than 0.8p EPS. Hmmm, tricky one this, as the usual problem is that it's not clear which figures broker consensus refers to (i.e. normalised or not, diluted or not?).

Thinking about it again, this must mean that normalised EPS is more likely to be around 2p perhaps? That would put them on a PER of 17.8, but given that this has been affected by fixable problems, then the market probably won't react too badly. I need to see updated broker forecasts after they have adjusted for this morning's profit warning.

This situation demonstrates the general problem we have with the current system of reporting. Companies know what the figures are, but instead of giving the market a clear estimate, they issue a statement which then has to be interpreted by investors, and we have to make estimates from the coded messages in a statement.

What a ridiculous situation! Why can't the company just say, e.g. - "normalised EPS is now expected to be between 1.8p to 2.0p for 2013"? Wouldn't that just make life simpler for everyone? And before someone says that companies cannot issue forecasts, that's nonsense, because some larger caps do exactly that - e.g. Next keeps the market well informed, by publishing an estimated profit range for the current year.

It really is high time that companies and brokers moved to a reporting mechanism which gives investors a range of likely profit/EPS numbers for the current year, and then just update (and narrow) that range as the year progresses. That would be a simpler & more transparent method, likely to lead to fewer misunderstandings & would hence reduce market volatility.

We saw Nature Group present at an ED Investor Forum earlier this year, and I quite liked them, although felt at the time that the valuation wasn't compelling enough to make me want to buy, but that's true of practically everything at the moment in small caps - bargains are very hard to find, given the substantial re-rating that has occurred for small caps in the last 18 months.

I see that the price of Gold is continuing to fall, it's now down to $1,234. I did have a dabble in some gold mining shares earlier this year, and got the concept right, but fluffed the timing unfortunately (I was a bit early for the bounce, then got cold feet right at the bottom, selling at the wrong time).

That made me think that it really was pointless trying to buy gold mining shares, as their viability is so leveraged to the price of gold, which is something I cannot possibly forecast. I've never bought into the the gold bull case in the last 10 years or so. It had always struck me as just another huge speculative bubble. Sure there was demand from the Far East, but the price rising to $1,900 was probably just as much driven by momentum buying & the creation of numerous new Gold ETFs, Funds, etc, all of which were long. So as that all unwinds, it's not really surprising that it's taking the price of Gold back down again.

Anyway, I've decided that this makes shares in gold mining companies pretty much impossible to value, so have decided not to return to that investing theme for the time being.

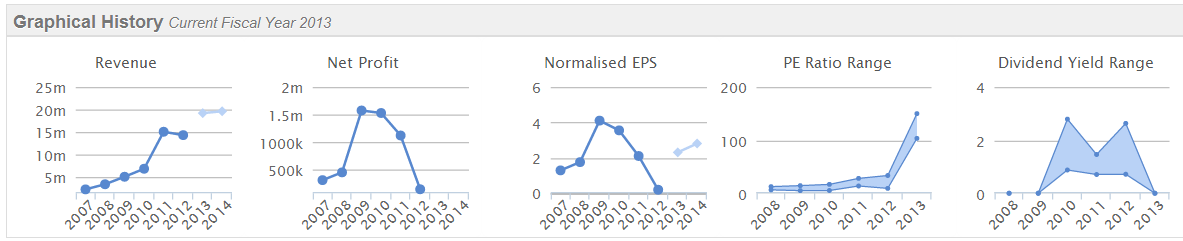

Returning to NATURE (LON:NGR), the market has been less forgiving than I expected, with the share price currently down 20% to 28p mid-price (27p Bid. 29p Offer). So if you like the company, this could be a good entry point? I'm not that keen, so will pass on it. As you can see from the Stockopedia graphics below, the company's track record is not great, and they only paid a small dividend for 3 years before passing it again.

I've got a bit more info on Nature Group now. WH Ireland has revised down its forecasts to 1.9p EPS this year, and 2.2p next year, and have reduced their stance from Buy to Neutral. Interestingly, they say that the Gibraltar facility would not be operational until Q4 2014 at the earliest. This makes me think that it might possibly be a bit early to jump in here. With this degree of uncertainty, I wouldn't want to be buying on a PER of more than 10, so 20p is probably around the level where these shares would begin to interest me.

Shares in TV set-top box maker Amino Technologies (LON:AMO) have also dropped sharply this morning, on publication of a trading update for the year ending 30 Nov 2013. They are currently down 8% to 89p, having bounced a bit from an earlier low of about 86p.

Having read the statement, it's initially somewhat perplexing that the shares have fallen, because this statement reiterates profits, the key bits being these;

The Company expects to deliver profit and period end net cash in line with market expectations and, as such, demonstrate solid like-for-like growth in these metrics. The period end net cash balance is expected to be approximately £19.0m.

Particularly noteworth is the very strong Balance Sheet here, with pots of net cash. Bear in mind that at 89p the market cap is just under £50m, so having a £19m cash balance is highly material - that's almost 40% of the market cap held in cash!

EPS is forecast to be 6.2p for the year that is about to end, so at 89p that makes the PER 14.4, but if you adjust out the net cash then the underlying PER drops to only 8.6. Now you could argue that cash on a company's Balance Sheet should not be valued at par, because what use is it just sitting there gathering dust? So I'm coming round to the idea that one should apply a discount to net cash held, when valuing companies, at what level is up to you. It really depends on what management intend doing with it. In this case they are committed to progressive dividends, 3.45p for this year in question, and they reiterate that this will also grow 15% next year, giving a payout of about 4p, for an attractive yield of 4.5%.

So why have the shares gone down today? It seems to be because the outlook is a tad uncertain, indeed there now seems a question mark over whether this is a growth company at all? Consider this part of today's trading statement:

During the second half of the financial year, the Company has experienced a change in mix to its revenue with a combination of strong demand for its lower priced, lower specification products mentioned above, coupled with reduced levels of demand from a specific customer. Taken together, this will result in revenue for the full year ending 30 November 2013 being in the range of £35.0m to £36.0m.

The Board expects that these trends will continue in to 2014, leading to a revenue performance for the full year ending 30 November 2014 that is similar to 2013. Despite this, profit and cash expectations for the year ending 30 November 2014 are unchanged.

So is this now a mature, or even declining business?

I've not looked at their products, which seem to be some sort of hybrid internet TV set-top boxes. From what I'm observing amongst friends & family, and just in day-to-day life, more & more people seem to be watching TV personally, on their tablets or mobile phones. So I wonder how long the big TV in the sitting room, with a set-top box, will continue to be relevant? Particularly when Google Glass, and other next generation devices come along. The trend seems to be towards things fragmenting down to personal level. So will services like Sky or Virgin Media even be needed in 10-20 years' time? Probably not. So I'm not sure this is a sector that I'd be rushing to invest in, even though the valuation figures do look quite attractive for Amino.

I recall from looking at it in the past, that the customer base is quite concentrated into certain countries (e.g. Holland, and Russia, from memory). So there could be risk here from key customers pulling out, and leaving a big hole in the order book perhaps?

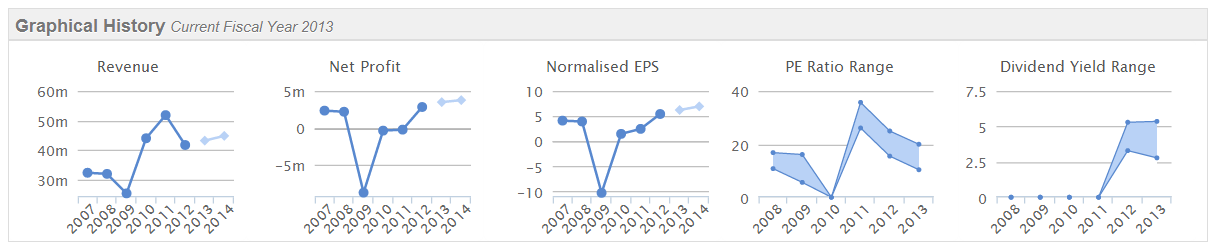

As the Stockopedia graphs below indicate, this doesn't look like a growth business any more. Although they have done well in restoring profitability by rebuilding gross margins. If I were running this company, I'd be hunting around for some suitable acquisition targets, to get that cash pile working, and to encourage the market into thinking the company is a growth company still. They seem to be letting the grass grow under their feet.

One of the meetings I had last week was a visit to the office of a leading Market Maker, who kindly gave me a tour of their offices, and the opportunity to sit with several of their traders and discuss how things work & talk about the markets generally.

It was fascinating, seeing things from the other side, if you like. You sometimes read on Bulletin Boards from (novice?) investors talking about "market makers shaking the tree", or playing games, etc. Whereas in reality they are just intermediaries, who try to skim off a bit of profit on every trade, and are simply adjusting prices in response to supply & demand from investors such as us.

Also, they're looking for patterns in investor behaviour, which will indicate when a stock is in demand (or not), and hence try to ensure they are correctly positioned, i.e. not caught short (haha!) on a stock which is seeing strong investor demand. It was amazing to see the speed that some of their most experienced traders are adjusting prices on multiple stocks in real time, in response to individual trades - still very much an activity where the wits and market experience of individuals takes precedence over computers.

It was good to see a strongly competitive market, where the various MMs are battling each other all the time, to attract the most business by offering the most competitive prices. The quoted market prices, with very wide spreads, are not the actual prices on offer, since MMs use a system called RSP (retail service provider) to offer improved price quotes, but you & I don't get to see the RSP prices, only our brokers do.

You can of course find out the RSP quotes by requesting a price through an online dealing account, something that many traders on bulletin boards have known about for years. Yet it's still surprising how many investors moan about the wide spreads on small caps, without having first checked to see what the real prices are via an online dealing account. Often the real spread can be far narrower than the published spread. Perhaps this is an opportunity for the LSE to improve trading volumes & narrow spreads in small caps, by publishing the RSP prices, rather than just the indicative quotes?

I was pleased to hear that this MM does not insist on running a neutral book, but that in fact traders have discretion to build up a long or short position in individual stocks, subject to overall risk limits. Anyway, a very interesting visit, so thanks again to the people involved who were generous with their time.

Another company whose shares have fallen today is Hardide (LON:HDD), an advanced surface coating technology company. Preliminary results for the year ended 30 Sep 2013 look poor to me - turnover fell 17% to just £2.4m, due to "a sudden and significant inventory adjustment by one major customer". They moved from a small profit to a £0.9m loss, although £0.5m costs were one-offs, so £0.4m underlying loss.

All in all, and taking into account the outlook statement, it seems to me that they are finding it much more difficult to generate sales than planned, which is often the case for new technologies. The shares are down 18% to 0.9p this morning, which values the company at about £9m, which looks pretty generous to me. The question is whether you think this is a setback year in a growth curve, or whether the company is going to struggle to progress much further. I'm leaning towards the latter, based on these figures.

I'm wondering if a bit of the more speculative froth is starting to come off this market? I think there are many small to mid caps that have risen, and risen, well past levels where the valuation still looked reasonable. Yet momentum seems to have an energy of its own. This is a very dangerous way to invest, just assuming that things will keep going up forever, and something I very much eschew - once the valuation is no longer attractive, then it's time to sell as far as I'm concerned. Running stocks to an over-valuation is no longer investing, it's become speculation.

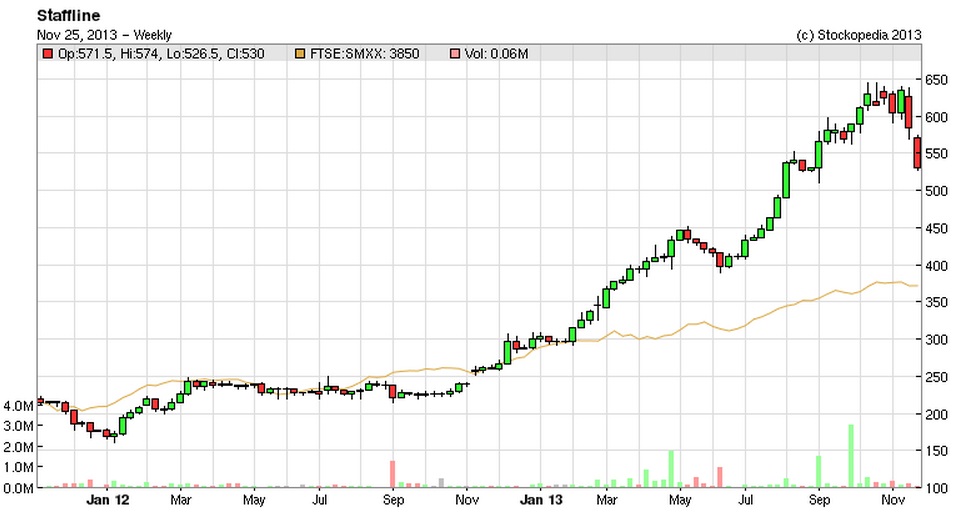

Looking at the top daily % movers each day, I'm starting to notice some buoyant stocks coming off sharply, often on no news. I notice that Staffline (LON:STAF), a company I previouslyed liked (and bought) at 226p last year, but sold far too early at 300-330p, ran all the way up to a peak of almost 650p recently. Good company though it is, that was just too high in the short term, on over 20 times historic earnings.

Anyway, the shares have come down sharply in recent days to 536p, and I think you'll see more of this happening with share prices that had detached from valuation coming back down to earth with a bump. That said, if you believe the forecasts, then STAF is not looking expensive on forward earnings estimates - 45.4p EPS forecast for 2014 means the forward PER has now fallen to 11.8, which is starting to look interesting again. The trouble with forecasts is that companies don't always meet them. So one has to be a little careful valuing companies too fully on forward estimates.

Another issue to consider is Director selling. There's been some hefty Director selling at STAF last & this year, although at much lower prices than now, so they've not timed their sales well, and you do wonder if the current price is reasonable, given that Directors were quite recently selling at about half that level?

Heavy Director selling generally on a weekly email I receive on this matter, is another sign of a market that's got a bit toppy in parts.

Regulars here will know that my bargepole is most often deployed for Chinese & Indian stocks listed on AIM. In fact I rarely touch any overseas company listed on AIM, for the reasons previously given.

Occasionally it's entertaining to delve into the bizarre world of Chinese/Indian accounting, and have a look at some figures. Today I've had a quick look at micro cap Chinese software company, GEONG International (LON:GNG). The shares recently spiked up from 2.8p to 10p, but are now coming back down again. The company issued a no reason for share price movement type of statement on 14 Oct 2013, and has today issued a trading update that has hit the share price by about 30% to stand at 6.4p currently.

Revenue for the six months to 30 Sep 2013 is £4.1m, generating an unspecified loss. Most notably though is that trade receivables are a scarcely imaginable £21.0m. So this means that a company generating just under £10 m p.a. in turnover, has about two years worth of trade debtors sitting on its balance sheet!

That is insanity. At what point does a sale become a gift? After 3 or 4 years, pehaps 5? This is not Capitalism, it's the bizarre Chinese way of doing things, when nobody seems to bother about collecting in payments from customers. When spread throughout their entire economy, this must mean that vast bad debts are really being hidden within every company's Balance Sheet, as well as within the banking system.

It would be interesting to calculate what the level of bad debts really are within the Chinese economy, if all companies moved to 45 day payment terms. I suspect it would require a write-off in the $trillions. So it will be very interesting to see how that situation pans out. In a one-party State, it can theoretically carry on forever, but the inevitable result is debasement of the currency, so inflation is likely to continue there, which will continue undermining China's low production cost advantage, which several companies have told me is already slipping away.

Personally I think one has to value Chinese companies listed on AIM at nil, unless they pay a regular dividend. My view remains that most of these stocks are likely to de-List from the UK, which will mean huge losses for UK holders of the shares, as a de-listing announcement typically takes 50% off the share price for starters. I have no idea why anybody in their right mind would invest in this type of share, when the figures are so ridiculous.

That's me finished for today. See you in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.