Good morning! I hope you enjoyed the Bank Holiday as best the weather permitted.

It's interesting to note that the US market (the S&P 500) hit a new all-time high yesterday. People keep saying that the market is overvalued, but it still wants to go up whenever there's a correction. From my point of view, small & mid caps overheated in the spring, but have now corrected considerably, and I'm starting to see some pockets of reasonable value emerge again. We've also seen strong recoveries in some small caps shares in the last fortnight, so that usually pulls in buyers to the stocks that haven't yet recovered.

As ever, I remain focussed on the fundamental value of the companies I'm invested in, and to a large extent the short term price movements are just background noise. I think most transactions in small cap shares are done by people who don't have a clue about how the company is performing - they're just buying & selling on short term market sentiment. So if they sell below fundamental value, then that creates a buying opportunity for me!

So overall, I'm feeling considerably more bullish than I was a few weeks ago, because the market has done what it should do - i.e. scrubbed off many excessive valuations, which should clear the way for renewed upward moves in sensibly-priced companies which report good earnings & outlook statements.

Bioquell (LON:BQE)

Share price: 88.5p

No. shares: 42.43m

Market Cap: £37.6m

I've been watching this company for a couple of years now, but held back buying any shares because it never quite reached an attractively cheap valuation, and the newsflow has been rather negative - so it seemed to be a company that had a lot of potential, but wasn't executing well.

Interim results to 30 Jun 2014 are out this morning, and look weak to me, although the company had previously flagged that H1 would be weak, therefore the share price has only moved down 2p this morning, on what looks like just a single trade of 5,000 shares.

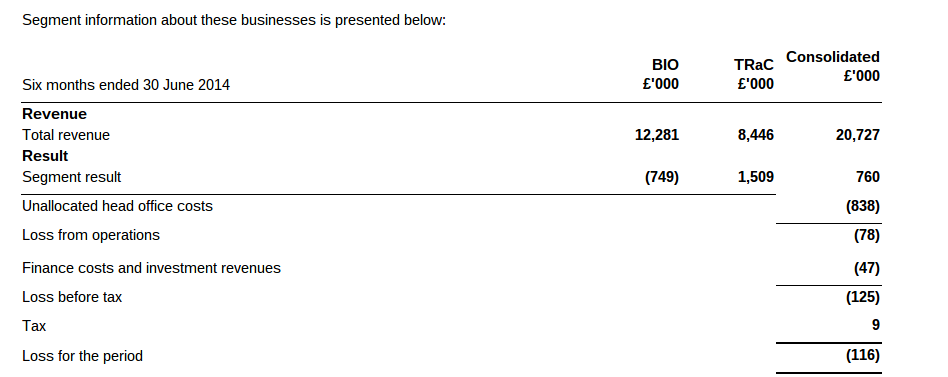

Profitability - at the operating profit level, has dropped to a loss of £78k in H1 this year, versus a £1.0m profit in last year's H1. The company has two divisions, and as you can see from the extract from today's accounts below, its TRaC division is trading quite well (flat against last year at £1.5m profit for H1), but its other diivision, Bio, is having real problems, moving from a £220k profit to a £749k loss for H1:

Remedial action - Management are on the case, and are sorting out the Bio division, commenting as follows;

The Bio division is undergoing significant changes designed to improve financial returns from its substantial and unique technology base, including modifications to its senior management, business models and a programme of cost reductions.

Outlook - despite the problems, today's results narrative sounds reasonably positive, saying;

TRaC is well positioned for further growth as it continues to expand its services and the territories it operates in, and we are anticipating a good second half performance...

Overall the Group is on track to meet the Board's expectations for the full year.

Stockopedia shows a broker consensus of £2.15m profit for this year, which is £0.9m lower than last year, which roughly ties in with the drop in H1 profitability. So the company needs to match last year's H2 this H2 in order to hit forecasts, which looks possible, although I don't like valuations that only stack up if a company recovers lost ground in H2, as often the problems continue into H2 and result in another profit warning.

Balance Sheet - this looks fine to me, and passes my simple but important tests. Writing off intangible assets results in net tangible assets of £18.0m, and the working capital position is strong, with current assets at 187% of current liabilities. I've checked the last Annual Report, and the company appears to not have any pension fund, so no issues there, which is good.

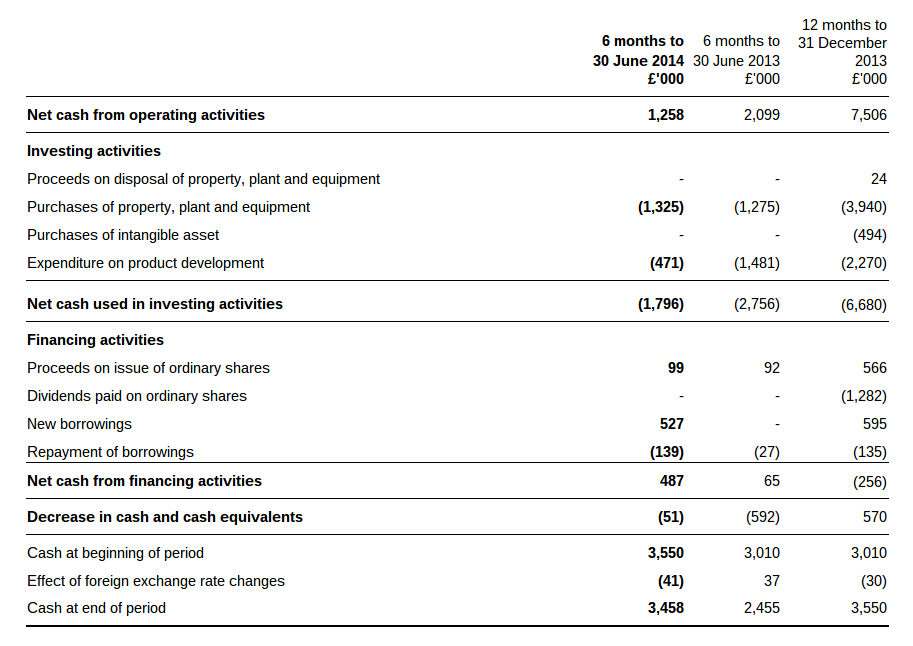

Capex - one thing that did strike me when reading the accounts, is how capex hungry this company seems to be. Fixtures & fittings seem high, and although it generated a very healthy operating cashflow in 2013, this was almost all spent on capex & development - see the top part of the cashflow statements below, both for last year, and H1 this year;

So I need to understand why the company is spending so much on capex, and if this level of capex is likely to be ongoing, or is more one-off in nature?

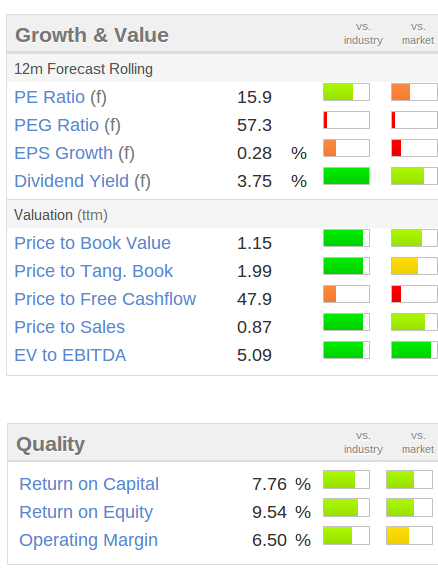

Valuation - If we assume that the company meets broker forecast for this year (which is quite a big "if" in my view), then the valuation looks about right - i.e. a medium quality company on a medium (in current markets anyway) valuation. Note also there's quite a good dividend yield, and solid tangible asset backing (including £4.5m in freehold property at end 2013);

My opinion - It strikes me that this company seems to be trying to do a lot of things considering its small size. Perhaps a more focussed approach is needed? Perhaps it's too small to be a standalone company, and might be better off merging with a similar company like PuriCore (LON:PURI) and combining sales teams & removing other duplicated overheads?

There could be interesting upside from products like their pod for patients in hospitals, to stop the spread of infections in a world where bugs are increasingly resistant to antibiotics, e.g.

...in our Healthcare business the recent order for 20 Bioquell Pods and associated HPV bio-decontamination equipment from a Middle Eastern hospital concerned by viruses is an encouraging first step in developing international markets for these products. The underlying drivers for the Bio division should be compelling due to the continuing problems posed by micro-organisms and the breadth of Bioquell's unique portfolio of solutions to combat such microbes.

So overall it looks potentially interesting, and certainly is a share that I shall keep on my watchlist, although it's difficult to see enough firm upside from the current share price to tempt me into buying any shares. I'd rather pay a bit more for a company that's growing like mad, rather than speculating that this one might be able to restructure successfully.

Audioboom (LON:BOOM)

Share price: 9.125p

No. shares: 466.5m

Market Cap: £42.6m

This share is an interesting speculation. It cannot be described as anything else, as on fundamentals you would probably value it at less than cash (i.e. below £3.1m in cash reported at end May 2014). So why is it valued so highly, considering that it has today reported dismal interim results? Well, part of the reason is that it was a shell company, and the company which reversed into it, called AudioBoo, is only reporting 11 days figures in the interims to 31 May 2014 reported today, the deal having been completed on 20 May 2014.

So the interim figures today don't really matter, which is a good job, as they show turnover of just £24k, and a pre-exceptional loss of £745k.

I should add at this point that I spotted the highly speculative potential here a couple of months ago, and bought some stock. It's not a value or GARP share, it's a pure speculation. Having said that, I think it's potentially very interesting for the following reasons. It is currently the UK market's only Listed social media share. The company is trying, through the AudioBoo platform, to become the world's YouTube, but for audio (instead of video).

That may sound ambitious, but they've already made a lot of progress - AudioBoo has 2.8m registered users at 25 Aug 2014 - growth of 100% in 12 months, and importantly this is happening with no marketing spend, growth is viral. What I've noticed is that when I find audio links on Twitter, they are very often hosted by AudioBoo. The company is collecting & managing audio content from many top media companies, e.g. the BBC, Sky, radio companies, etc. Users can then create their own radio station of audio content that appeals to them. This can then be monetised in various ways, e.g. advertising. However, as with most social media companies, it's likely to be cash burning for some time).

It might all sound bonkers to value investors, who look for assets, cashflows & divis, but this isn't a value investment, it's a fashionable growth company, where in my view I saw that it was going up, bought some as a complete punt, and will probably sell half at some point, and run the rest for free. So I am putting a massive, flashing neon wealth warning sign in front of this share, it's a total punt - but that's what people probably thought about Facebook, Twitter, etc, when they were small & growing rapidly.

The user interface with AudioBoo is rubbish in my view, at the moment. I tried it on my iPad and iPhone, and was very disappointed. However, the company is set to launch a new, all singing, all dancing user interface in Sept this year, which could provide some excitement if it's good.

A content deal in India is announced today, which sounds interesting.

So in summary, the figures are terrible, and the valuation is nuts. However, at the moment that doesn't really matter, because investors are prepared to take it to a higher & higher valuation. Bear in mind that in the USA social media companies are often valued on $x per user, and growth rates are taken into account too. So if AudioBoo manage to continue growing their user base rapidly, and get a decent App out there, then who knows maybe one of the heavyweights (e.g. Google, Facebook, Twitter, etc) might bid for it at a stratospheric valuation? Sounds crazy, but it's happening quite often at the moment - with paper on a wacky valuation, those giants can afford to shell out mad prices for bolt on acquisitions.

Anyway, it's easy to scoff, but just look at the chart below - nobody who owns shares in this will be complaining!

I should also note that this company's ticker, BOOM, is my second favourite ticker. This is great fun when telephoning an order through to your broker, as you can invoke various comedy voices, and make them jump by saying the ticker very loudly! (my favourite ticker is ZZZ for Snoozebox)

EDIT: Another point worth mentioning, is that in an announcement on 23 Jul 2014, about new content, BOOM said;

The Company has recently been approached by certain investors who have expressed interest in investing capital into the business. The Board considered these approaches, as the Company is growing very rapidly and additional personnel are required in new offices and in content management to direct this expansion. The Board has, however, decided that the number of initiatives in progress mean that this is not an appropriate time to raise further capital.

Now we don't know the amount, or price, of new funds being offered to BOOM by investors, but this does reinforce the point that social media is a very hot space at the moment. I increased my shareholding after reading that announcement, as it seems to augur well for the future.

Concurrent Technologies (LON:CNC)

Share price: 44.5p

No. shares: 72.6m

Market Cap: £32.3m

On re-reading my notes from here on 27 Dec 2013, not a lot seems to have changed. Interim results for the six months to 30 Jun 2014, published today, seem lacklustre, caused by issues with exporting licences being withheld by the Govt.

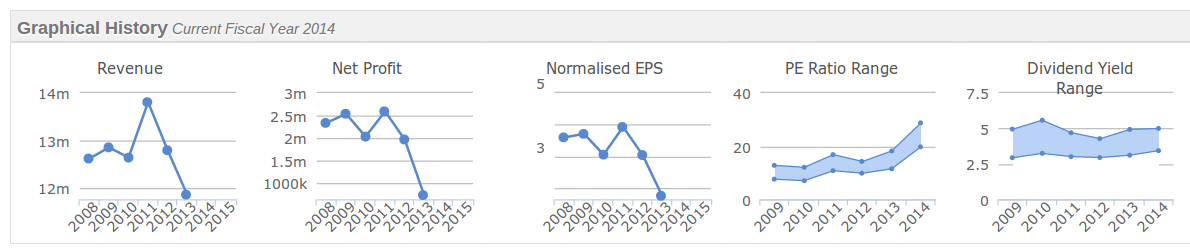

The company has a very good Bal Sheet, with net cash, pays decent divis, but it has been unable to generate turnover growth, and the previously high profit margins seem to have ebbed away in the last couple of years. So I'm not really clear why the market cap is as high as £32.3m - that seems to contain expectations that profit will recover to previous levels or more.

So looking at the usual Stockopedia graphs above, it doesn't appeal too me at all. Although I've not looked into the company's products or commercial position at all. Looking at the numbers, it seems to be a company whose performance is deteriorating, and whose valuation is becoming more expensiive - very much the opposite of what I look for.

Today's outlook statement doesn't exactly sound super confiident either, and I've bolded the bit that concerns me somewhat;

Our order book is good and our cash position remains strong. With the introduction by the UK Government of the more flexible licensing system, we can now focus on restoring customer confidence in those areas affected. How long it will take to recover from the effects of UK export licensing regulations, and what their full impact might be, remains difficult to assess at this time, but the Board is confident that the resolution of the major export licensing issues, together with the diversity of the Company's product range and customer base, will generate sound results.

My opinion - Based on current performance, the valuation looks much too high to me.

Right, that will do for today. See you in the morning tomorrow, as usual!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BOOM, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.