Good morning! I'm running a little late today, due to having a jolly old time last night at a wonderful event organised by ShareSoc, and kindly hosted by Killik & Co, in their beautiful and historic Mayfair offices (3 very large, old townhouses combined). I'm sure far more exciting events have been held there over the last few centuries in their stunning wood paneled ballroom, than me rambling on about balance sheets! I really enjoyed the wisdom & experience from Lord Lee, David Stredder, and my boss here, Ed from Stockopedia.

As I usually say when invited to talk at this type of event, I feel like a charlatan to some extent, in that I've made some horrific investing mistakes, especially in 2008 when I blew up my personal portfolio by going into the credit crunch highly geared, and holding big positions in very illiquid stocks. Hopefully though, having learned some vital lessons the hard way, my openness about the things I've got wrong in the past, will help other people avoid the same mistakes.

Indigovision (LON:IND)

Share price: 340p

No. shares: 7.6m

Market Cap: £25.8m

Final results - for the 17 months to 31 Dec 2014. This is a one-off extended period, due to the year end being more sensibly set at 31 December, rather than the illogical previous 31 July (which caused year end nightmares, as they tried to close deals in the middle of summer when prospective clients tended to be on holiday).

Rather than type up a long-winded commentary, I will copy here the comments I've just emailed to several large holders who like to hear my views on the company at results time;

My opinion - results today are OK - underlying performance is flat against last year. One

region went backwards (S.America), which offset strong performances elsewhere.

Positives

- Gross margins strong (so clearly a good product)

- Balance sheet strong

- Valuation is low

- Move into mid-market augurs well (much bigger market)

- Generous divis (2 interim divis already paid, totalling 12p, and 5p final divi declared - so 5% yield, but that's inflated due to one-off 17 month period).

Negatives

- Weak outlook statement (sales to date "subdued")

Conclusion - seems to forever have good potential, but never quite gets there in terms of overall progress. The company has performed better than other UK security companies, eg Synectics (LON:SNX) and 21st Century Technology (LON:C21) have been very disappointing. The market leader, Axis, was recently bid for by Canon at a 50% premium to the market price, in a $2.8bn deal. So maybe that will be the start of consolidation in the sector?

I'm not inclined to sell at this lowly valuation, and I think the company is doing a lot of things right, but overall progress is frustratingly limited.

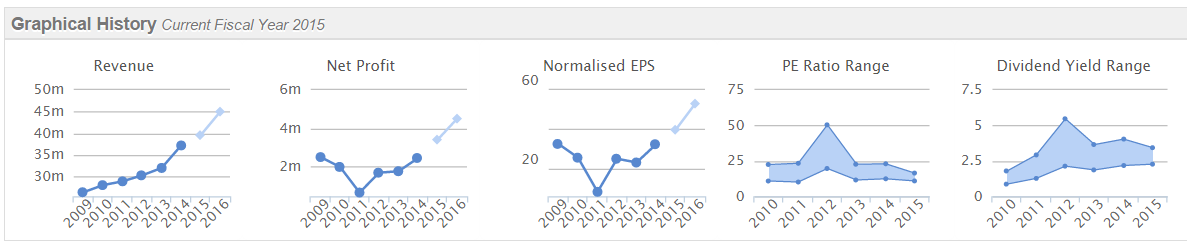

That said, the Stockopedia graphical history looks pretty good for a £25m market cap company:

Zytronic (LON:ZYT)

Share price: 292p

No. shares: 15.3m

Market Cap: £44.7m

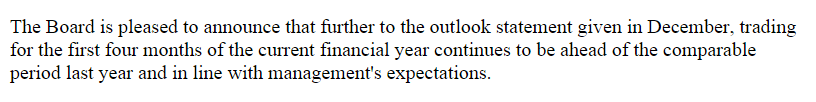

Trading update - this is short & sweet!

My opinion - this is one of my favourite companies, as it ticks so many of the boxes on my checklist - strong balance sheet with plenty of cash, consistently good payer of divis, honest & hard-working management, good quality scores (especially operating margin, the most important in my opinion), innovative products.

The only negative that bothers me, is that the nature of the business means there is limited sales visibility, so every now and then a gap opens up in the order book, with the potential for a profit warning. Although those corresponding share price plunges have been good buying opportunities in the past.

Director shareholdings - this was a topic we discussed at last night's investor evening. Lord Lee was saying that it's a vital requirement for him that management have a very significant shareholding themselves. This got me thinking. Sometimes management just don't have the personal wealth to buy a significant number of shares. Yet that doesn't necessarily mean they are not committed, or will be inferior in performance.

Many businesses are staffed by people at all ranks, who give their heart and soul to their employer, even though they don't hold a single share. People with the right ethics commit wholeheartedly to their employer, and actually I think it's all about the attitude of the people, and not necessarily about whether they hold shares or not.

I mention this because in my view management at Zytronic seem passionate & highly committed, even though they don't hold a lot of shares in the company. So I'm increasingly questioning the conventional wisdom on this issue. If management have too large shareholdings, then they tend to run companies like their own personal empire, and you wonder if they really have external shareholders' interests at heart? Who knows what horrors might go through the expense accounts of Directors who have large shareholdings in the companies they run, for example? Do overly dominant controlling Directors have a sense of entitlement, or blur the lines between their personal money, and the company's money? I think these are considerable risks with companies where Directors have dominant shareholdings, so it's not necessarily always a good thing.

So overall, I'm going to de-emphasise Director shareholdings, and instead try to assess how committed Directors are to the company.

Energy Technique (LON:ETQ)

Share price: 295p

No. shares; 2.4m

Market Cap: £7.1m

Formal sale process - this is an unusual one. The company has put itself up for sale. It's not terribly clear why the Directors have decided to do this, but reading between the lines it sounds like they have possibly been pressurised by major shareholders into doing so?

My opinion - I've done a quick review of the numbers & recent trading statements, and the company seems to be trading well, and has a sound balance sheet. Hence it makes quite an interesting each-way bet - on the one hand there's the chance of a profit if a takeover bid is forthcoming. If there is no bid at a premium, then the company looks perfectly viable to continue on a standalone basis.

Redde (LON:REDD)

Share price: 103.5p

No. shares: 292.2m

Market Cap: £302.4m

Interim results - these are remarkably strong results, covering the six months to 31 Dec 2014. Turnover is up 32% (of which half is organic, the balance from acquisitions). Adjusted profit before tax is up an astonishing 172% to £11.5m for the half year. So whatever they are doing, is working very well indeed.

Companies in this sector, e.g. Quindell (LON:QPP), and Accident Exchange, have been blighted by balance sheet issues - indeed Quindell's chronic inability to generate cash has brought the company to its knees - it ran out of cash in Q4 of 2014 and currently has investigating accountants poring over the books. Companies always claim to have instructed reporting accountants themselves (which is technically correct), but the truth is that they go in on the insistence of the banks.

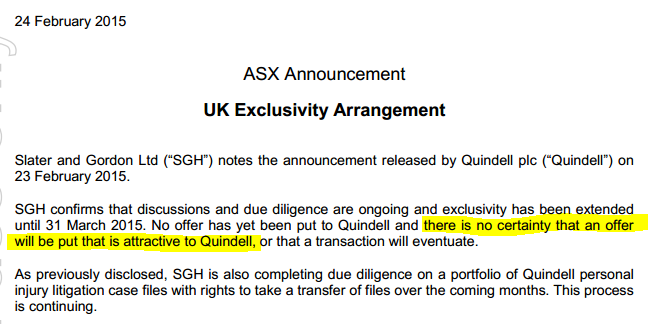

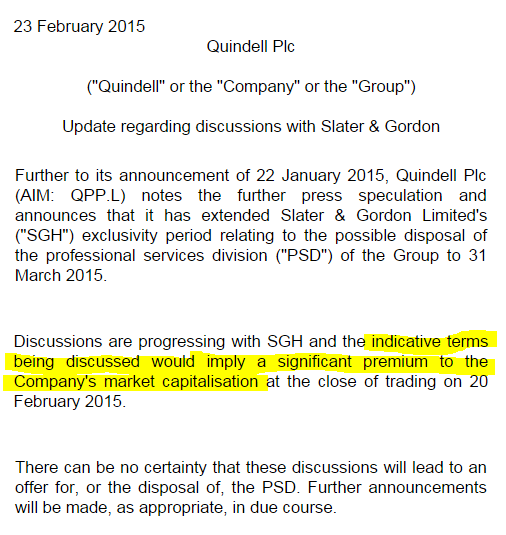

Some people blame short sellers for the company's woes, but as is always the case, short sellers only get involved when they spot serious underlying problems - in Quindell's case there were numerous question marks over deals, finances, and former management's integrity. However the crux of Quindell's problem is that it ran out of cash, and hence is now in a fire sale of assets to Australian law firm Slater & Gordon (SGH).

SGH's latest update to its shareholders seems to hint that they are not planning on being generous in any deal that may be proposed to Quindell, which is contrary to what Quindell has itself said to the UK market - note below the very different perspectives from the two companies on their current discussions!

Contrast that with Quindell's upbeat assessment of the same talks:

Make of it what you will. I've previously been short (and long) of this share, but have decided for the time being that the situation is too fluid and confused, so currently hold no position.

My opinion - based on its superb interim results this morning, I think REDD looks a much safer bet if you feel compelled to invest in this rather grubby sector. REDD has proven it can generate copious cashflow, control its balance sheet very well, and pay generous dividends. Maybe it is benefiting from Quindell's weakness?

Redde's figures look very attractive to me, at what is probably still quite a reasonable valuation (broker forecasts are likely to be raised following these results, and we could be looking at 8p EPS, so at just over a quid the shares seem good value). Worth a look anyway.

Digital Barriers (LON:DGB)

Share price: 41p

No. shares: 84.5m

Market Cap: £34.6m

Profit warning - as I predicted in my report of 27 Nov 2014, a profit warning was on the cards here, and it's been issued today. Companies that say it will be an H2-weighted year, after a poor H1, are nearly always just deferring a profit warning, as has proved the case here.

Things sound pretty grim;

The market forecast shown on Stockopedia is for a £5.9m loss in the current year (ending 31 Mar 2015), so the out-turn sounds like it will be worse than that, but not as bad as last year, a £12.0m loss. Perhaps the result might end up around £9m loss then?

Cash - I thought the company was going to run out of money this spring, but they are saying there will be £8m in the kitty at end Mar 2015, so it sounds like things aren't desperate yet.

Sales pipeline - the rest of today's statement is starting to show a glimmer of hope, in that the sales pipeline sounds like it is strengthening. The company reiterates its target of breakeven for y/e 31 Mar 2016.

Directorspeak also offers a glimmer of hope;

Contract wins - these are in a separate announcement today, totalling £1.5m they're not exactly massive.

My opinion - my scepticism about this company since 2012 (I've reported on it here 12 times, always bearish) has proved correct so far, as the shares have plummeted from a peak of 197p in Mar 2013, to just 41p today.

However, sometimes you can do very well buying fallen stars when the first signs of sales growth are developing, as that can be a turning point. I've therefore done something potentially rather stupid - I've taken a punt on this share today, buying a few at 40p, in the hope that they might be near a turning point, possibly. The company's terrible track record cannot be over-emphasised though, so I'm already starting to worry that I might have made a mistake buying some. However I think it was Anthony Bolton who said that his best investments were always uncomfortable purchases at the time.

I wonder if it might form a double bottom on the chart (which could pull in technical buyers), if it finds support just below 40p again?

ATTRAQT (LON:ATQT)

Share price: 59.5p

No. shares: 20.6m

Market Cap: £12.3m

Full year results for the year ended 31 Dec 2014. This SaaS company listed in Aug 2014. It's a new one to me, that I've not heard of before. It looks potentially interesting - I like the SaaS (software as a service) business model, as it ensures a reliable income stream, of monthly recurring revenues. This company is still very small though, with turnover of only £2.1m (up 32%) and a loss before exceptionals (probably listing costs) of £1,049k.

Cash - this is the problem. The company reports net cash of only £307k, which is clearly not enough. On going concern, the company suggests that its cash position is alright, but I disagree - it obviously needs to raise cash, and should just get on with it and strengthen its balance sheet asap, whilst the share price is still buoyant - if the roof needs fixing, then do it when the sun is shining, as the saying goes.

I'm surprised that the auditors have signed off on these accounts actually, as it's not at all clear that the company has adequate cash resources. The notes say that Barlcays extended an overdraft of £50k to the company in Jan 2015. So total cash + overdraft facility comes to £357k. Yet the company seems to be running a considerably larger annual cash burn. So it is probably now very close to running out of cash.

When is the Placing coming Singers? Why didn't you raise enough money at the original float?

My opinion - there are some interesting elements here - it has an impressive client list, and I like that the revenues are recurring in nature, with a low churn rate. However, I can't invest until the balance sheet is repaired with a sensible sized fundraising (I think they need to raise at least £2m in fresh cash).

Once the company has raised some dosh, I might take another look at this one.

The growth rate is not particularly exciting though. I'd want to see an acceleration in growth, as well as a fundraising.

Reach4entertainment Enterprises (LON:R4E)

Trading update - things seem to be falling apart here. This share is a very good example of where even the most cursory balance sheet analysis would stop you buying its shares. It fails all three of my simple balance sheet tests, as follows;

1. Are net tangible assets positive? No. The last balance sheet shows that net tangibles assets are negative by £16.7m. FAIL.

2. Is the current ratio at least 1.2 (and preferably over 1.5)? No. It is 0.91. FAIL.

3. Is long term bank debt modest in relation to profitability? No. Long term debt is high, at £15.4m, and the company has a track record of very modest profits, or even losses some years. FAIL.

Overall then, I just cannot see why any rational person would want to hold these shares, when the risk of insolvency so high. The bank renewed facilities in Apr 2014 on more favourable terms, but things seem to be going wrong now that the outlook for 2015 is looking poor;

My opinion - this looks a dire situation, but it has done for ages, so nothing new there. As I explained at last night's ShareSoc evening, the banks have allowed zombie companies to continue trading, because at ultra-low base rates, the banks make a fat lending margin. So each year they continue to just collect in interest charges, they are seeing a c.4-5% recovery against their (effectively) bad debt. So why not let that continue rolling? It will all get nasty when base rates eventually rise. You could then see a marked increase in the number of corporate insolvencies. Hence why I am constantly warning investors to tread very carefully with highly indebted companies, and it's safest to avoid them altogether.

The damage is probably done here, but I shall put it on my bargepole list anyway.

Lavendon (LON:LVD)

Share price: 174p

No. shares: 168.9m

Market Cap: £293.9m

This got a "might be worth a look" rating from me when I last reported on 15 Jan 2015.

Preliminary results for calendar 2014 published today look solid. EPS is up 9% to 15.65p (slightly ahead of broker forecast of 15.4p). At 174p per share that puts it on a PER of 11.1, which looks reasonable. Although it's got a fair bit of debt, as you would expect for an equipment hire business.

Balance sheet - overall this is strong, with the NBV of physical fixed assets being £237.0m, being well over double the long term debt of £106.4m, which looks a conservative position in my view.

The current ratio is healthy, at 1.43, so a tick in the box there.

EBITDA is enormous, so the beauty of rental businesses is that if they ever do get into financial trouble, they can just switch off capex, and let the cashflow pour in.

Dividends - not particularly generous at 2.7% forecast yield, but that's well covered (about 3.6 times), so combined with a strong balance sheet, there is plenty of scope to raise divis in future.

Outlook - despite a wobble in the UK, this sounds solid overall;

My opinion - I quite like this. It has a high StockRank of 90 too. The chart suggests to me that this might be an attractive buying opportunity too, so overall this gets a thumbs up from me. What do readers think, has anyone else looked at this one?

All done, see you tomorrow!

Regards, Paul.

(Paul has long positions in IND, ZYT, ETQ, REDD, DGB, and has no short positions in the companies mentioned. A fund management company with which Paul is associated may also hold positions in companies)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.