Good morning,

Quite a few announcements today.

I provisionally intend to cover:

- Haynes Publishing (LON:HYNS)

- CMC Markets (LON:CMCX)

- Rank (LON:RNK)

- Arden Partners (LON:ARDN)

I'll update this with a link to Part 2, if there is a Part 2 today.

Regards

Graham

Haynes Publishing (LON:HYNS)

Share price: 138p (+13%)

No. shares: 15.1m

Market cap: £21m

A really mixed bag of results here but the overall tone is encouraging (and hence today's share price increase).

I'm going to focus on the constant currency results, since they are more reflective of the company's competitive positioning and those elements which are under its control.

North America & Australia: sales down 20% to $7.5 million. Small operating loss (from small operating profit last year). Has been restructured. New sales initiatives being implemented.

UK: Sales up 17%. Excellent result.

Europe: Sales up 25%. Excellent result.

UK & Europe operating profit: £1.1 million.

Big picture: excluding FX movements, revenue was 1% higher in this period.

Other bullet points:

- Huge investment in the product range (vs. the market cap) of £3.3 million.

- Pension deficit up to £21 million after lower interest rate assumptions.

- Interim dividend maintained at 3.5p (same level since 2013).

My opinion: I am really warming to new management here (though still part of the Haynes family).

Even though the FX-neutral revenue gain was very modest, I like the online direction the business is headed in. Digital products were 36% of revenue in this period.

A lot will come down now to the returns made on £3 million + of product investment, and synergies on acquisitions.

The pension issue shouldn't be ignored either.

Overall, an interesting and potentially lucrative value stock. If you can satisfy yourself that demand will be resilient for these products (on balance, I tend to think it will be), and if you could have faith in the management and in the balance sheet, it could be worth a closer look.

CMC Markets (LON:CMCX)

Share price: 111p (-2.4%)

No. shares: 288m

Market cap: £320m

Q3 Interim Management Statement

[Update: After writing this report, I took a long position in IGG.]

This spread betting / FX / CFDs company has announced an update for the period from October through December.

I'm glad CMC is listed now, because it gives me more general knowledge for studying the big-cap IG Group (LON:IGG).

Anyway, CMC reports as follow:

The third quarter saw some improvement in client trading activity from the previous quarter, with net operating income for the period in-line with the same period last year. Active clients continued to grow, increasing by 13% from the same period last year to 41,234, although this was offset by lower revenue per client, which was 13% below the same period last year.

A winning strategy in this industry is to focus energies on high-net-worth and very active clients, as the revenues they generate are many multiples of the rest. So total numbers of active clients matters much less than the quality of those clients.

On the thorny issue of regulation:

The FCA announcement of 6 December 2016 and subsequent announcements from the German regulator, BaFin (8 December 2016) and the French regulator, AMF (10 January 2017) regarding the marketing and distribution of leveraged products are expected to impact the business when they are implemented.

At this stage, it is difficult to quantify accurately the scale of impact that the proposed regulatory changes will have on client behaviour, and therefore performance of the business, particularly as the final terms and timings of any changes are not yet finalised.

Checking back to recent announcements, I see that the BaFin proposal was that clients could not lose more money than is in their account - while that is a material change, I wonder how material it is. I'd guess that only a small percentage of clients have ever found their account in negative equity (it is not in the interests of the spread betting companies to have accounts in negative equity, either - they aren't supposed to be debt collectors).

The AMF requirements in France are a bit more serious: bans on advertisements for forex and binary options, along with the requirement of a guaranteed stop loss, and negative balance protection.

The more I look into this, the more I think that IGG might survive very well from this international regulatory crusade.

It has created a terrible amount of uncertainty, so I can understand why investors might stay away.

But the PE ratio on CMC has dropped to just 8x, and I can think of worse ways to gamble money away than this.

Rank (LON:RNK)

Share price: 193p (unch.)

No. shares: 391m

Market cap: £755m

A strange swing in the share price here today. Perhaps someone initially missed the sentence which said that trading was in line?!

Rank is an unusual and overlooked player in the gambling industry. Bingo halls and slot machines are not exactly flavour of the month these days.

To be fair, the news here tends to be unexciting - but on a financial level, the profits are real and there have been some serious buying opportunities in the shares.

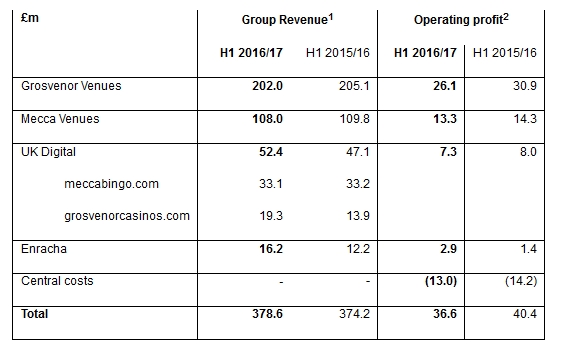

Here's the key table from today's announcement:

- LfL revenue + 2%

- Digital revenue + 11%

- Venues LfL revenue +0%

- Adjusted PBT -8%

Outlook: is in line with market forecasts for the full year. I believe that this is for EBIT of c. £81 million.

My opinion: A nice business, well run, showing steady but conservative gains in digital and impressive debt reduction over the past few years. Not expensive either. Worth a look.

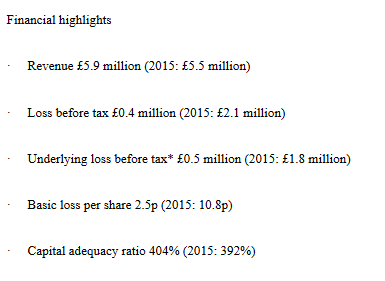

Arden Partners (LON:ARDN)

Share price: 35p (unch.)

No. shares: 20.3m

Market cap: £7m

Preliminary Results for the Year ended 31 October

Trading conditions are said to have been difficult for the industry in 2016. This is already known (e.g. see larger rival £CNKS).

H2 was profitable for Arden.

Checking the income statement, I can see that there has been tight cost control here - admin expenses are down by 17% compared to 2015, and that accounts for most of the improved performance in 2016 vs. 2015.

Net assets are £7.1 million (down from £7.9 million). Non-current assets are negligible, so this is a liquid balance sheet with value (as of October 2016) about equal to the current market cap.

Outlook:

While the sector background and competitive forces remain ferocious, I

am cautiously optimistic that in the medium term Arden can achieve a

satisfactory level of profitability.

So it's an explicitly cautious statement, and it must be difficult for external shareholders to have any sort of conviction in the earning outlook, after two unprofitable years.

The best hope seem to be a merger or acquisition, with increased scale helping to reduce the regulatory/administrative cost burden on a smaller company.

Downside is hopefully limited by the balance sheet. So maybe the shares are a reasonable call option on a possible deal or an improvement in the industry cycle.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.