Good morning!

Vislink (LON:VLK)

As it's a core holding of mine, I'll spend a bit of time on calendar 2013 results from this technology group, announced this morning. They make high end video equipment, serving the broadcast and security markets. The shares shot up last week on a positive market reaction to the news of a decent size and quality acquisition, funded from cash and a new debt facility, plus a relatively small number of new shares issued, which I reported on here.

Stockopedia shows normalised EPS broker forecast consensus of 2.85p for calendar 2013. The company has today reported adjusted EPS of 4.2p. However before getting too excited, that figure is flattered by a favourable tax treatment this year. So the company also helpfully highlights adjusted EPS on a normalised tax charge, which is 3.2p.

So in my opinion the 3.2p adjusted EPS figure (normalised for 20% tax) is the most appropriate figure to value the company on. That puts the shares, at the current share price of 49p on a (now historic) PER of 15.3.

The historic PER is a good starting point, but investing is all about looking into the future, and valuing companies on how they are likely to perform in the future. Or rather I should say, it's all about buying/holding shares that are currently cheap against what you think future profits are likely to be. It's also all about being right on what future profits are likely to be!

In this case broker consensus is currently 4.05p normalised EPS for 2014, so at 49p the company is on a 2014 forecast PER of 12.1, which looks good value to me. There might be upside on that earnings figure too?

In terms of outlook, the narrative today reiterates the £80m turnover and £8m adjusted operating profit target, saying the group is "wholly in line with executing our strategy". Comments on markets & current trading say;

Our markets continue to be challenging. However, the Group enters 2014 with renewed confidence buoyed by the introduction of new products and the added momentum which has come from the synergistic 'bolt on' acquisitions.

So it sounds like growth is being generated by new products & the acquisition of Amplifier Technology, and more recently Pebble Beach, whilst still up against unfavourable market conditions. However, Western economies are improving, and I've heard from several company CEOs that the brakes are coming off their customers capex budgets, so hopefully market conditions for Vislink might also improve as 2014 progresses.

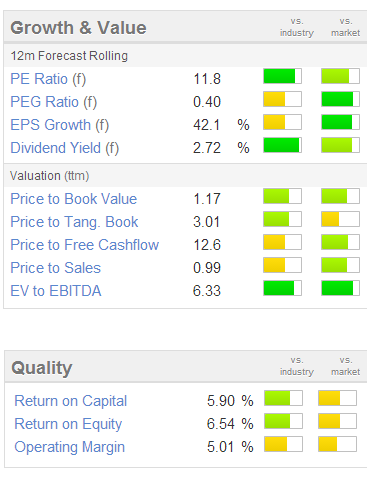

The dividend has been maintained at 1.25p, for a yield of 2.6%, which is a reasonably good payout for a smaller, growth company. As you can see from the usual Stockopedia graphics on the right, Vislink scores well on the main valuation measures.

The dividend has been maintained at 1.25p, for a yield of 2.6%, which is a reasonably good payout for a smaller, growth company. As you can see from the usual Stockopedia graphics on the right, Vislink scores well on the main valuation measures.

The Balance Sheet is strong in my opinion, and passes my simple but effective testing. Although I note that cashflow has not been good in 2013, with both Debtors and Stock rising significantly, although both look to be reasonable given the size of the business. I am a bit disappointed to see cash drop back sharply from £8.1m to £3.7m, so with the recent acquisition post year-end the business now has net debt. That's fine with me, since I'd rather they put the surplus cash to use in growing the business, rather than pointlessly sitting on a large cash pile earning nothing in interest.

There is no pension fund, which is good.

To find out more, there is a results Webinar (i.e. an interactive, live results presentation online) today at 1pm, click here to sign up for that. I'm a big fan of Webinars, as it saves traipsing into London for meetings, and allows ordinary investors to get mostly the same information that Institutions and analysts receive on results day. So well done to Vislink for being private investor friendly in this way.

There is also a new commissioned research note on the company, published today, here. People are cynical about commissioned research, which is understandable to a certain extent. However all research has to be paid for somehow, and if someone is being paid to write a report, at least they have time to do it properly. I cannot see any difference at all between a commissioned research note, and a house broker note. Both are putting the bull case, and being paid to do so by the company. Also, I tend to ignore the target price & valuation, and instead just use these notes to gain a better understanding of a business, so they are very useful in my view.

Investor Evenings - reminder

There are two investor evenings today in London which unfortunately clash - organisers, please liaise with each other to ensure this doesn't happen, I would have loved to attend both, but can't be in two places at once.

ShareSoc (the UK individual shareholders association) is holding a seminar at FinnCap's offices, London from 4pm today, with the following companies presenting: Pressure Technologies, Cambria Automobiles, MoPowered, and ServicePower Technologies.

More details are here, there might still be some places available, I don't know.

Equity Development are running their quarterly seminar from 5pm today, near Oxford Circus, London, from 5pm, with the following companies presenting: W H Ireland, Deltex Medical Group, Ilika.

More details are here.

Organisers in both cases urge that anyone who has booked in should please let them know asap if you are not able to attend, as they often have a waiting list of people who would like to attend.

SCISYS (LON:SSY)

This is a niche electronics & software company, which operates primarily in supplying long term software & support to the public sector. I met management last year, and was quite impressed with the company, taking a view that the shares were unlikely to do anything spectacular, but might be a good slow burner in my long term portfolio, so I've held a few shares since then.

I haven't read all the blurb yet, but the headline results published today look quite good. Adjusted operating profit is up 19% to £3.2m, and adjusted EPS up 31% to 9.3p. Bear in mind the shares are only 83p to buy at the moment (up 4p on the day) that's a PER of only 9 - cheap in a bull market.

So it must be stuffed with debt & have a weak Balance Sheet then? Actually no. Net debt was £2.7m at 31 Dec 2013, which looks reasonable compared with profits.

The outlook sounds encouraging;

With encouragingly high levels of sales and operations activity seen in the final quarter of 2013 being maintained to date in 2014, and the benefits of a realigned cost base following last year's restructuring measures, the Group looks well positioned to deliver an improved financial performance in 2014.

The only slight fly in the ointment that I can see is that the restructuring charges of £1.2m were rather large. Although these were flagged last year, so it's not news. It just seems a lot to me, as from memory I think it was mainly redundancy costs.

The shares are very illiquid, and have a wide bid/offer spread, so it's not something I would invest heavily into, but I have bought a few more this morning. The company has been perceived by the market as being rather boring, so has not commanded a decent PER for some time, but with value now so hard to find in this market, perhaps investors will look at this again and think that it might deserve a rating of say 12 or 13, which I think is reasonable, given that the earnings are mostly quite good quality, some being of a recurring nature.

There have also been investor concerns over the impact of public spending cuts, given that Scisys supplies the public sector. I seem to recall management being quite bullish about the outlook for 2015 onwards when I met them last year, so must dig out my notes & refresh my memory in more detail.

As usual please be sure to do your own research, I haven't covered all the angles on this share by any means, the above is just my general impression, so I might well have missed something.

I'll try to update on a few more companies later this afternoon, but have to sign off now for lunch & the Vislink webinar.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in both VLK and SSY)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.