Good afternoon. Lots of results today, so I'll get through as many as I can.

M&C Saatchi (LON:SAA)

Share price: 349p (down 3.8% today)

No. shares: 70.7m

Market Cap: £246.7m

Final results - for calendar 2014 are out today, for this well known PR group.

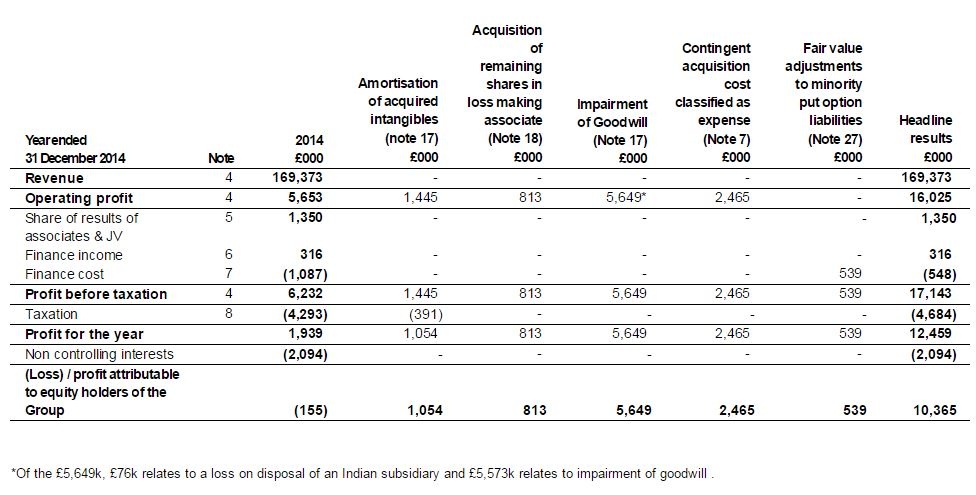

Profit & loss account - doesn't look too good at first glance, but I see from the cashflow statement that there were about £7m in non-cash charges for impairment of goodwill, and amortisation of intangible assets. So there's a big difference between statutory profit before tax of £6.2m, and headline profit before tax of £17.1m.

Note 3 to today's accounts gives the reconcilation from statutory profit on the left, working through the various adjustments to adjusted or "headline" profit on the right. These seem reasonable adjustments to me, to arrive at the underlying performance of the business in the far right hand column below.

Growth - having established that I am happy with the company's definition of headline profits, there is impressive growth in headline profitability - EPS rose 28% to 15.88p (slightly ahead of broker consensus of 15.5p)

Valuation - at 349p per share the PER is too high for me, at 22 times. Although it depends what future growth is going to be like. If the company can carry on growing EPS at 28% p.a., then a PER of 22 would be justified.

The narrative today talks about a lot of impressive, big name client wins, such as Land Rover, John Lewis, Foot Locker, BMW, and Douwe Egberts. From what I can gather, the growth in profits seems to be mainly organic, rather than by acquisition - one acquisition is mentioned, Lean Mean Fighting Machine Ltd (good name!)

Balance sheet - here's another one where the company says it has a strong balance sheet, but actually doesn't. Its net assets of £35.9m reduces to only £6.8m once intangibles are removed. The current ratio is 1.01 - only a whisker above my cut-off of 1.0 for companies which don't carry inventories (I use 1.2 for companies that do use inventories).

Year end net cash was £5m, but I reckon that's probably window-dressed for the year end, as the balance sheet shows cash of £23.4m, and financial liabilities of £18.2m, so if you had that as a permanent position, you would pay off the financial liabilities using the cash. The fact that they haven't, indicates to me that the year end cash balance is probably not typical of cash levels throughout the year. This points is relevant to many companies, not a specific criticism of this one - all companies window-dress the balance sheet for year end - the FD wouldn't be doing his job properly if he didn't!

Minority put options - there is an unusual structure, in that not all group companies are 100% owned - indeed some are associates (under 50% owned). The potential liabilities to the group for these put options is shown clearly on the balance sheet. I'm just flagging it up so you are aware.

My opinion - nice company, but it's too pricey for me. I'd take another look if the PER came down to about 15, which is as much as I would ever pay for a PR/marketing company. A lot of them are on PERs of around 10. Although Saatchi does seem to be on a roll with quality client wins.

Safestyle UK (LON:SFE)

Share price: 181p (up 4.0% today)

No. shares: 77.8m

Market Cap: £140.8m

Final results - for calendar 2014. This is a replacement windows & doors company, obviously a cyclical sector, but one which is probably in a good place right now - spending on home improvements seems to be increasing, indeed Topps Tiles (LON:TPT) commented on that earlier this week, especially now disposable incomes are rising again.

The figures look quite good. Turnover is up 9% to £136.0m, and underlying profit before tax is up 10% to 16.8m. That's a healthy profit margin, of 12.4%.

Valuation - adjusted EPS rose 11% to 16.5p, so that puts these shares on a PER of 11.0, which looks about right to me.

Outlook - this sounds positive;

Dividends - are fairly generous. A final divi of 6.2p has been declared, which combined with the 3.1p interim divi already paid, gives a total for the year of 9.3p, yielding a healthy 5.1%.

Balance Sheet - net tangible assets look a tad thin at £6.0m, but judging by the relatively small inventories and debtors, I suspect the business model here might be to out-source production. That's certainly what competitor Entu (UK) (LON:ENTU) does, and it makes for a smashing business model - the company should be easy to scale down in a recession, without any worries of it going bust.

The current ratio isn't great, at 1.04, but given the small size of the balance sheet, and the highly cash generative nature of the business, this probably doesn't actually matter.

Overall, with profits & cashflow so good, I'm relaxed about the balance sheet here. It has net cash of about £8.2m too, so it all looks fine.

Obviously it's in a cyclical sector, so it would be one to drop like a hot potato once the next recession or financial crisis starts to happen.

I did a detailed write-up on Entu (UK) (LON:ENTU) in my report of 10 Feb 2015, so for anyone interested in Safestyle, it's worth you having a look at that, and comparing the two companies, which are very similar in valuation terms. On balance, I think Entu is probably slightly better value, and is paying a higher divi yield of about 6.0%.

(I hold shares personally in Entu, but not in Safestyle)

Plexus Holdings (LON:POS)

Share price: 239p (up 18.8% today)

No. shares: 84.9m

Market Cap: £202.9m

(at the time of writing, I hold a long position in this share)

Framework agreement - signed with Jereh - a Chinese oil services company listed on the Shenzhen stock exchange, with a market cap of $5.8bn. An agreement is being finalised, but is envisaged to have these terms;

- Jereh to make & sell Plexus products under exclusive licence in China & others.

- Jereh will buy 5% of Plexus, through a new share issue at 180p, with an option to buy another 5% at a maximum of 200p

- Jereh will appoint a Non Exec onto Plexus board

So it looks like a serious partnership arrangement, although no financial details have been given.

Plexus has talked before about a global roll-out of its technology, which does sound promising. So even though this is not my area of expertise, there does seem to be something very interesting going on at this company - i.e. technology that seems genuinely unique, and desirable to oil companies.

Mission Marketing (LON:TMMG)

Share price: 43p

No. shares: 83.6m

Market Cap: £35.9m

Audited results - for the year ended 31 Dec 2014 are out today, for this group of PR/marketing companies. The point of difference here is that they are regional companies, not London-centric, as much of this sector tends to be.

Things I like;

- New bank facilities secured (after the year end), on improved terms

- Positive outlook statement

- Cost reductions in Q1 2015 should improve profit further

- Modest PER 8.4 times 2014 headline diluted EPS (of 5.13p)

- Resumed divis in 2013

Things I don't like;

- Balance sheet weakness - NTAV is negative at -£6.8m

- Bank debt is still too high, in my opinion

- Current ratio very weak at 0.79, but this adjusts to 1.15 when £11m bank loans moved down to long term creditors (following bank refinancing in Q1 2015)

- £5.1m consideration still owing on previous acquisitions

My opinion - overall, I could see this having maybe 20% upside, especially if Simon Thompston tips it again, which he does from time to time. Overall though, taking into account the weak balance sheet & bank debt still being a little too high, I think the price is probably about right - i.e. the apparently cheap PER of 8.4 isn't really that cheap when you factor in those other issues.

I would prefer to see management allow cashflows to flow through to strengthening the balance sheet, rather than doing more acquisitions & paying divis.

Having said that, with an upbeat outlook for 2015, and forecasts of 5.7p EPS for this year, it should have scope to move up to 50p or slightly above in the not-too-distant future. That's probably not enough upside for me, so I'll just sit & watch, and I might buy a few if there's any unexpected sell-off, which you often get with micro caps, due to the illiquidity.

Stockopedia likes it, with a StockRank of 91.

It really surprises me that so few management of British companies seem to be able to anticipate the business cycle. Companies so often seem to get gung-ho and crank up the bank debt in the good times, and then struggle to stay afloat when recession hits, and banks are calling in debt. Just for once, wouldn't it be nice to see companies repaying debt, and going into net cash during the good times, so that they are well prepared for a downturn?

TMMG got into trouble with a weak balance sheet & too much debt in the last recession, so overall I'm a bit surprised that they are not being a bit more prudent this time, having sailed so close to the wind before. Some work has been done to repair the balance sheet, but not enough in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.