Good morning!

Ed is doing an interesting-sounding webinar today at 12:30 - signup link here. The topic today is different ways of using the StockRanks system to find good shares.

I see that Debenhams (LON:DEB) (in which I currently hold a long position) has appointed a new CEO. It's noteworthy because he's come from Amazon. So it shows how much emphasis retailers are now putting on online & mobile. Debenhams already has a very substantial online operation - it's actually one of the UK's largest internet retailers. It's funny the way the market ignores that, and puts it on a low earnings multiple, as if it were just a stores-only retailer.

Another stock I hold, Restaurant (LON:RTN) has still not said anything to the market about very specific potential takeover stories in the media. How can this be? Normally when a share price surges strongly, on rumours of takeover approaches, the company is obliged to make a statement to the market.

To date, RTN has said nothing. This seems most irregular. RTN shares are up 32% in the last 3 weeks, largely driven by takeover speculation. The company MUST make a statement, confirming or denying the situation. Also it needs to explain why there has been such a long delay in updating the market with price sensitive information that is currently being withheld - the rumours are either true or false. We need to know, now!

Hostelworld (LON:HSW)

Share price: 188p (down 27% today)

No. shares: 95.6m

Market cap: £179.7m

AGM statement (profit warning) - I haven't read it yet, but it must be a profit warning because the shares are down 27% - a typical drop for a standard-type profit warning.

A city friend asked me to look at this company, to give him a second opinion on it a few weeks ago. I've not written anything here about it before now. My view at the time was that the website looks good. The business is profitable & pays divis. However, growth seems to be stalling, and the group appears to be cannibalising sales from one of its own websites.

Anyway, on to today's statement. Q2 trading is not going well:

Reflecting recent geo-political events, particularly in Europe, trading over the second quarter has been at a level below our expectations...

...Overall, Group bookings are therefore marginally down compared to last year.

Doesn't sound too bad though.

Costs are being squeezed down:

...this will result in marketing investment as a percentage of net revenue coming in below the previous guidance of 45%-50% on a full year basis. We continue to see strong underlying cash conversion.

45-50% of revenue spent on marketing is gigantic! It reinforces my view that there are few barriers to entry for internet businesses of many kinds. However, the problem is that nobody will find the website unless you spend a huge amount on marketing, and keep spending.

So barriers to entry are low, but barriers to commercial success are very high. This is why I generally don't invest in early stage internet businesses. They nearly all flounder, because they haven't got the marketing budget necessary to drive traffic to their website. Look at Koovs (LON:KOOV) for example - burning large amounts of cash, with little to show for it so far.

Have you noticed how fashionable it has become to describe any type of spending as "investment"?! So yesterday we had Marks and Spencer (LON:MKS) calling price cuts, "price investment". Today we have marketing spend being called "marketing investment". It's a bit daft really. I think they're trying to emphasise that not a penny is being wasted! It's all investment!

Apparently it was a American department store entrepreneur called John Wanamaker who famously quipped:

Half the money I spend on advertising is wasted; the trouble is I don't know which half.

The interesting thing today, is that with clicks being trackable, increasingly companies can measure the effectiveness of their online marketing.

Today's statement is a bit vague, but I'm increasingly forming the impression that things are not great, but not disastrous either, reinforced by this section:

The trends in bookings and Average Booking Value that we have seen in the travel market, particularly into higher priced European destinations, while partially offset by improved marketing efficiency, means that the year's outturn will be dependent on a recovery in key European destinations over the important summer travel season, and we remain mindful of the exchange rate environment.

My opinion - this company joins the long list of companies to have warned on profits not too long after listing. This share has a full listing, and joined the main market in Oct 2015.

I quite like the company, and the shares look potentially good value.

Numis has reduced its 2016 forecast EPS by 8% today, to 19.6 Euro cents, so that's about 14.9p EPS this year (albeit down on last year). At 188p/share, the PER is 12.6, which looks good value to me.

The forecast divi for this year is 14.9 Euro cents, or 11.3p, giving a divi yield of 6.0%. Wow, that's excellent.

The difficulty is, we don't know where the shares will find a bottom. It's usually a mistake to buy after a profit warning, as it's a mistake that I frequently make unfortunately. However, decent companies recover from profit warnings.

Going back to my 5-point checklist on profit warnings, this is how I score Hostelworld:

1. Is this a story stock? No, it's a profitable, cash generative, dividend paying company. PASS.

2. Are the problems fixable in a reasonable timescale? Yes - it just looks like a period of soft demand. Discretionary spending (marketing) is huge, so profit can be protected by cuts there. PASS.

3. Is the company financially sound & stable? Yes. It's cash generative, and has net cash on the balance sheet. PASS.

4. Will there be another profit warning? Possibly - the company says it needs a good summer season. So if current trends continue into the summer, then we might see another profit warning in say Aug/Sept perhaps? So probably a FAIL.

5. Are management doing the right things? Probably YES - trimming costs, to preserve the profit margin seems sensible when demand is soft.

Overall then, I'm getting a fairly favourable result from my tests above, apart from point 4, which is always the big uncertainty. Therefore, combined with an attractively low PER and high divi yield, I'm going to stick my neck out here, and suggest that this share might possibly be worth a small purchase for my portfolio.

I'm worried there may be more serious problems underlying. With 40% market share in the hostels niche, this company is a mature business now. So its PER should be fairly modest. I don't think it warrants a racy internet rating.

Overall though, I like it at this valuation. It might be sensible to wait, and see where the share price bottoms out. That said, today's fall in price does seem rather extreme, for what seems quite a mild profit warning.

Lombard Risk Management (LON:LRM)

Share price: 9.9p (up 2.9% today)

No. shares: 305.5m

Market cap: £30.2m

Results, y/e 31 Mar 2016 - another year, another lousy set of results under the belt of this banking software business.

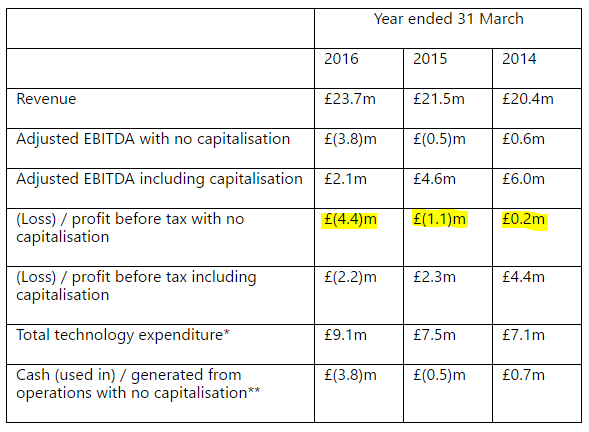

The narrative is always similar - promising great things in the future, but it never seems to translate into real profits. Fantasy profits are reported - EBITDA, but that's reliant on a huge chunk of costs being capitalised into intangible assets.

The company is transparent though, and provides a table to enable readers to select which profit measure we prefer. I've highlighted the one that's most meaningful to me:

So using the most conservative figures, the company is now heavily loss-making. The trend for all the profit figures is downwards.

It's burning cash now at quite an alarming rate. The company raised fresh equity this year, so this looks like a planned increase in spend, in the hope that higher revenues will follow later, from new products.

Balance sheet - looks weak to me. The current ratio is poor, at 0.82. For me, the 1.2-1.5 range is a comfortable lower level for the current ratio. LRM is well below that.

Another fundraising looks inevitable at some point. Will there be investor appetite to keep throwing money into this company, for little tangible result? I wouldn't.

Dividends - confirming that cash is tight, the final divi has been passed.

My opinion - I don't like it. The business consumes cash, and is always promising jam tomorrow. Who knows, it might succeed in the end, by why speculate on that? I'd only be prepared to take a punt at a much, much lower share price, if at all. I can't see much evidence that the equity is worth anything, based on historic performance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.