Good morning! There's an interesting-sounding statement from a recent addition to my portfolio, Ubisense (LON:UBI) - the company announces a strategic partnership in Asia, and the passing of regulatory hurdles such that their product can now be sold in Japan. No financial details are given, and no revenue impact is expected until 2014, but this sentence intrigues me (see bolding below), as it seems to be pointing towards potentially significant growth perhaps?

Cambridge, UK - Ubisense Group plc ("Ubisense" or the "Company") (AIM: UBI), a market leader in real time location intelligence solutions, is pleased to announce that it has entered into an exclusive strategic partnership with one of the world's leading automotive logistics companies in Asia.

Following an engagement and trials over the last 12 months, both companies have agreed to work together to deploy an integrated automotive logistics solution to new and existing customers, built on the Ubisense Real-time Intelligence Platform. The solution will be deployed on sites at large scale Asian ports and leading automotive OEMs.

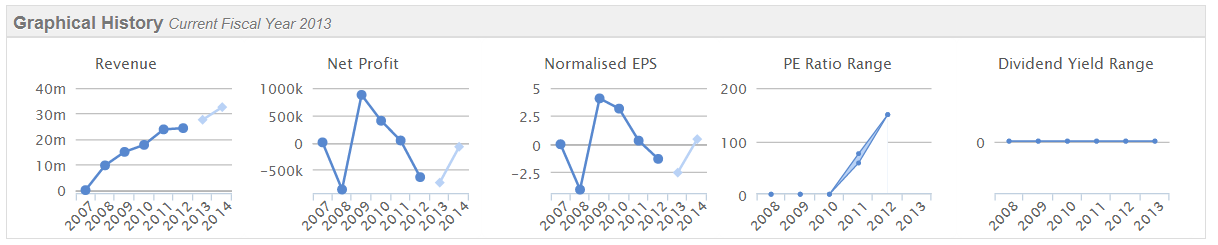

At almost £50m market cap at the current share price of 218p, Ubisense shares cannot really be valued on the historic figures. So this is very much a speculative, growth company. I would only buy into something like this in a bull market, when the market is highly receptive to growth situations, and is tending to put an optimistic valuation on growth potential. You certainly couldn't justify a £50m market cap on the historic numbers, as the Stockopedia graphical history below makes clear. However, I think it looks an interesting growth stock:

Broker forecasts show a loss of 2.53p per share in calendar 2013, and a tiny profit of 0.46p EPS in 2014. So the valuation hinges on the market believing that further growth will see a decent move into profit in 2015 and beyond. So today's announcement can only help in that regard. NB - this shares is considerably more risky than the usual things I cover. The problem with growth companies is that if they disappoint on the figures, then the share price can lurch downwards suddenly & violently. However, they also have exciting upside potentially.

I've had a quick skim of the interim results to 30 Sep 2013 from Chamberlin (LON:CMH). This is a small (£6.8m market cap at 86p per share) engineering company based in Walsall, making iron castings, etc. I've been watching this one for signs of a possible turnaround. New management were appointed in Sep 2013, so it's perhaps too early to expect much improvement as yet.

The figures don't look good - revenue down 14% to £19.5m for the six months, and an underlying loss of £639k (against a profit of £914k last year for H1). The interim dividend has been suspended, and net debt has risen sharply to £2.3m. The outlook statement provides some comfort, saying that H2 should show an improvement on H1, but will still be loss-making.

I've reviewed the Balance Sheet here, and think overall it's too high risk for me. I wish them well with the turnaround, but it's not something that I want to take a punt on, because risk/reward is hard to judge here, and a loss-making company with bank debt is wholly reliant on continued bank support - not a comfortable situation for investors.

Topps Tiles (LON:TPT) issues its results for the 52 weeks ended 28 Sep 2013. Revenue is flat at £177.8m, and adjusted profit before tax a whisker up at £13.0m (2012: £12.8m). Their adjustments flatter profit by £2.4m, so reported profit before tax is £10.6m, so it's up to each investor whether you value the company on the adjusted numbers, or whether you want to take a more conservative approach and use the warts & all profit figure. So depending on your view, EPS is either 5.44p (adjusted) or 4.76p (non-adjusted).

The company still has a weak Balance Sheet, with net liabilities of £10.2m, although debt has reduced usefully to £36.6m, although that's still quite hefty relative to profit. Quite a big chunk of profit is consumed by interest payments - finance costs of £3.7m used up 27% of the £13.8m operating profit.

Most striking is current trading, which has jumped up 7.4% on a like-for-like basis in the first 8 weeks of the new financial year. That's very impressive, and if continued should drive good profit growth this year.

The dividend has been increased to 1.5p for the full year, giving a dividend yield of just over 1.5% on this morning's price of 98p.

In my view Topps Tiles seems to be performing quite well (especially current trading), but the valuation is not attractive at all to me. The market seems to be pricing in continuing profits recovery, whilst ignoring the weak Balance Sheet. We saw this pattern with Thorntons (LON:THT) - where in this bull market people just ignore issues like debt & pension deficits. I think that's a mistake, but it doesn't stop the shares going up in price, and this one looks like it's on a roll, for the time being anyway. However, don't forget that highly indebted companies are high risk - if something goes wrong, then the share price can be vulnerable to a big fall.

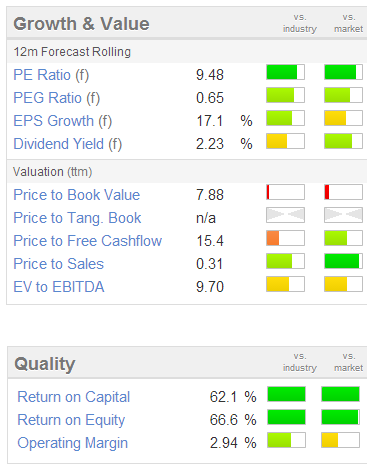

Results from Renew Holdings (LON:RNWH) announced this morning look good. They report for the year ended 30 Sep 2013. Turnover is down 1%, but more importantly profit is up - adjusted profit before tax came in at £10.7m (2012: £10.0m). That's a low, but improved operating margin of 3.4% (2012: 3.0%). The commentary indicates they are hoping to gradually raise their margin to 5% over time.

Adjusted EPS is 14.8p, so even though the shares have had a good run, to stand currently at 165p, that is a far from expensive historic PER of 11.1. Having said that, a low margin infrastructure support group is never going to command a premium rating, so there's probably little upside on the share price from here.

Adjusted EPS is 14.8p, so even though the shares have had a good run, to stand currently at 165p, that is a far from expensive historic PER of 11.1. Having said that, a low margin infrastructure support group is never going to command a premium rating, so there's probably little upside on the share price from here.

As you can see from the Stockopedia growth & value graphics here, the forward PER is only 9.48, although that will be based on last night's close (as they update overnight). So quite good value still.

Although it's another success for Paul's Picks, where it was flagged up as good value at 92p on 30 Jan 2013. So a very pleasing 79% gain to date. I could see it going a little higher, maybe at a stretch to 200p in due course, but most of the upside gain has probably been had by now. Hence I'm not planning on buying back into this one.

What intrigues me about this bull market, is that whilst racy valuations are being put on high-tech, and fashionable growth stocks, we're also seeing quite boring companies rise in price too. That is in stark contrast to the bull market of the late 1990s, when hot money flowed into rapidly rising tech stocks to such an extent, that it sucked the money out of other sectors - and boring "old economy" stocks fell to amazingly low valuations.

Of course when the bubble burst in Mar 2000, then the tech stocks mostly crashed 90%+ (plenty even went down 99%!), whilst the boring old Value shares subsequently did very well - a very good example of mean reversion, something that I'm a strong believer in, because it ties in so well with a value investing strategy.

So it's interesting to see different dynamics play out in this bull market - and rises seem much more broadly based. The only sector that is in the doldrums right now is the natural resources sector. I still feel that money will probably flow back into that sector at some point, offering up potentially very good gains, but who knows when?

Quite a lot of readers like to attend investor presentation evenings in London, so I usually give a reminder to the ones that I attend, or any other ones that look interesting in terms of the companies presenting. The latest Equity Development Investor Forum is being held tomorrow in London.

Companies presenting are: Kromek (LON:KMK), Fairpoint (LON:FRP), and Molins (LON:MLIN). I'll be attending, so look forward to seeing some of you there. NB. please note that it is being held at a new venue - 60 Great Portland Street, London. W1W 7RT. It's very near to Oxford Circus tube, so easy to get to. To book yourself in, please see details here.

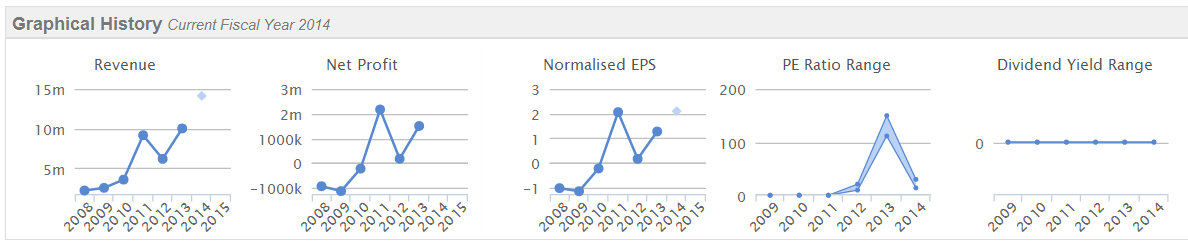

Interim results from Software Radio Technology (LON:SRT) are in line with their most recent trading statement from 14 Oct 2013, with turnover of just £3.2m, generating a £0.4m loss. Therefore a very strong H2 is needed in order to hit full year (ending 31 Mar 2014) broker consensus of £14.1m turnover, and 2.1p EPS.

I cannot see the attraction of paying up-front for a share on the basis that you hope it will achieve massively improved performance in the second half of the year, particularly because past performance has been unpredictable and volatile, see the graphs below. To my mind the market cap of £36m (at 30.5p per share) looks very stretched, for a business with such lumpy & unpredictable performance.

I note that they capitalised £706k of product development costs in H1, although the amortisation charge was not too far behind, at £564k, so the net benefit to the P&L (compared with cash costs) was fairly small, at £142k.

The Balance Sheet is strong, with current assets of £7.2m being almost 9 times all liabilities.

I'm sorry this is all sounding so negative, but being a Value/GARP investor mainly, it strikes me that there just isn't much value out there at the moment in smaller caps. Whereas 18 months ago, when I first started writing these columns (on my Blog initially, before moving to Stockopedia) there were numerous good companies on cheap valuations.

Sure the UK economy is apparently recovering, but only on the back of the Government reflating the housing boom, Banks which are under political instructions not to shut down zombie companies, and consumers who are spending PPI compensation or blowing their savings since they've given up on trying to buy a house. Meanwhile younger people are subsisting on Min Wage jobs, if they can find one at all. So where is the sustainable growth going to come from, when household incomes are still falling in real terms? That looks a very shaky basis for this degree of stock market optimism, whilst acknowledging that these days much of the Listed sector's earnings comes from overseas.

So, I'll just increasingly move into cash if this mood of excessive optimism continues. There will be better opportunities available in future, I'm sure. That said, I have still got about 25 shares in my personal portfolio, so can still find enough value to keep me occupied, although it's a shrinking pool at the moment.

So looking at some positive movers next, gun maker Manroy (LON:MAN) is up 31% on news of it entering into "very preliminary talks" with three potential bidders (Herstal, Beretta, and USO). The shares look cheap on a forward PER basis, but that's probably because a lot of people (myself included) don't want to own shares in a company that makes guns, whatever the price.

Shares in Cambria Automobiles (LON:CAMB) have risen 13% to 50.5p today, in a positive market reaction to their audited results for the year ended 31 Aug 2013. It's a car dealership, which acquires under-performing sites, then turns them around. It currently has 27 dealerships.

EPS rose an impressive 49% to 3.49p, which is well ahead of broker consensus of 3.0p, and gives a PER of 14.5. Car dealers tend to make a very slim profit margin on huge sales, and this is no exception. The business seems to be mainly funded by the trade creditors, so bank debt is low, at £11.9m. Although at the year end date that was more than offset by £14.8m in cash, to give an overall net cash position. I suspect that's probably a favourable year-end situation, rather than typical of the situation throughout the year!

The company has begun paying a small dividend, totalling 0.5p for the year, a yield of 1%. On dividend policy they state the following;

The Board aims to maintain a dividend policy that grows with the Group's earnings but intends to ensure that the payment of dividend does not detract from its primary strategy to continue to buy and build and grow the Group.

This strikes me as a good time to be acquiring cheap assets, e.g. buying dealerships that have gone bust from the Administrator, etc., so there will probably be decent upside on the values being paid for dealerships now, in subsequent years.

The outlook statement sounds encouraging:

As our Chairman has already stated, the Group's performance in the first two months of the new financial year was both ahead of our business plan and the year under review. I am confident that Cambria will maintain this momentum and continue to deliver improved performances across all it departments in the current financial year.

As you can see from the chart, the time to have bought these shares was this time last year, so I feel that I've missed the boat on this one, and it's probably not worth buying now.

Cambridge Cognition Holdings (LON:COG) looks an odd situation. They floated on AIM in Apr 2013, but then changed the CEO and FD in Aug 2013. The cost base has been realigned (i.e. reduced), all of which are things you don't expect to see so soon after a company lists. So it looks as if the company has rather bungled its first six months as a listed company, which calls into question their business model.

The company is currently loss-making, so is really a punt on their product taking off. It's a computerised testing system for early detection of dementia, so sounds an interesting product. The outlook doesn't sound immediately exciting;

I believe that following our review of the business, and a refocused commercialisation strategy, we are far better positioned to deliver significant revenue growth and to move the Company towards a breakeven position in the next financial year, with significant future successes thereafter.

I shall keep this one on my watch list, as the product sounds interesting. However, I'd need more evidence of a move into profit before taking the plunge here. The market cap is currently just under £11m at 61p per share.

Interim results from VP (LON:VP.) look good. Revenue for the six months to 30 Sep 2013 rose by 9% to £91.3m, and profit before tax & amortisation rose 17% to £12.8m. Diluted EPS was 23.55p. There seems to be an H1 seasonal bias to trading, so allowing for that the company looks on track to meet or beat broker consensus of 34.4p EPS for this year (ending 31 Mar 2014). That puts them on a PER of 15.4 times, which looks about right to me, based on the current share price of 529p.

The outlook statement sounds reasonably positive too.

Interim results to 30 Sep 2013 from Scapa (LON:SCPA) look good - turnover up 8.1% to £111.6m, and profit before tax up 20.8% to £5.8m. Adjusted EPS for the six months was up 20% to 3.0p, and management say they are trading in line with full year expectations, which is for 5.0p, putting them on a PER of 18.4, which looks fully priced to me for the time being.

There's a pension deficit here of £38.0m, which is fairly material to the market cap of £131m (at 92p per share). It's difficult to see any upside on the current share price.

Finally, results from Sanderson (LON:SND) for the year ended 30 Sep 2013 also look good, with adjusted EPS up to 4.2p (2012: 3.6p). So at 69p the shares are not cheap, that's a PER of 16.4. The outlook statement sounds fairly positive though:

"The general economic environment, though showing some signs of improvement, is still challenging and accordingly the Board continues to adopt a cautious approach. However, the strong order book, improved market position and the two recent acquisitions provide the Board with an expectation that Sanderson will achieve significant progress during the current financial year."

Phew, bit of a marathon today, wading through all that!

See you tomorrow, I'm off for a sandwich & a nap on the sofa!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.