Good morning!

US markets

Fears about China seem to be abating, and the US markets put in an absolutely spectacular recovery last night - the Dow was up about 600 points, one of the biggest ever points rises (although of course that accolade gets easier over time, as the base is larger, so a big points rise is now not so big in percentage terms. Still, it sounds good!).

What I found particularly interesting, is that the big US end of day slump on 25 Aug appears to have been triggered by a technical factor - apparently traders spotted that the sell orders for the close were astronomically high, so they front-ran that selling, causing a late day plunge. That factor then reversed overnight and fed into the huge rises reported yesterday, once it became clear this was a one-off factor (possibly driven by forced selling by margin traders, and/or ETFs).

Furthermore, with the S&P500 futures now at 1962, we have not only broken the highs from Mon & Tue, but also put in what appears to be a short term bottom. I have marked on the S&P500 chart below the points where buyers overtook sellers (the blue arrows), and where sellers overtook buyers (the red arrows):

My occasional audiocasts with successful investors/traders are popular, and the most recent one with Richard Crow is now also available in typed form - for deaf people, but also for anyone who prefers to read the discussion, rather than listen to it. Here is the link for that.

Richard always comes up with interesting points, and his hunch that the market would rally, looks to have been spot on, so far anyway.

One final introductory point - I updated yesterday's report with further comments on James Latham (LON:LTHM) and SkyePharma (LON:SKP) so please click here to revisit that full report.

Churchill China (LON:CHH)

Share price: 535p (up 15p today)

No. shares: 11.0m

Market cap: £58.9m

Interims 30 Jun 2015 - these are such easy accounts to interpret - the numbers are simple, the narrative is concise, so a pleasure to read. I'm running out of time today, so will just do quick bullet points:

Revenue only up 3% to £21.4m (hospitality up 6%, and 83% of total)

Margins improved a bit, since operating profit up more, at 12%, to £1.6m, a 7.2% profit margin (up from 6.6%)

Note that CHH has H2-weighted seasonality to profits.

Strong balance sheet.

Net cash of £8.7m (material, at 14.8% of market cap, or 79p per share)

Note the pension deficit, unchanged in last 6 months at £4.7m.

Interim divi raised 10% to 5.6p.

Outlook - good;

We are confident that the continued growth of our markets and the strength of our position within them will enable us to meet our expectations for the full year.

Strength of sterling offset by efficiency gains.

Cashflow reduced, due to increasing inventories to improve service. I can live with this.

StockRank - very high, at 96.

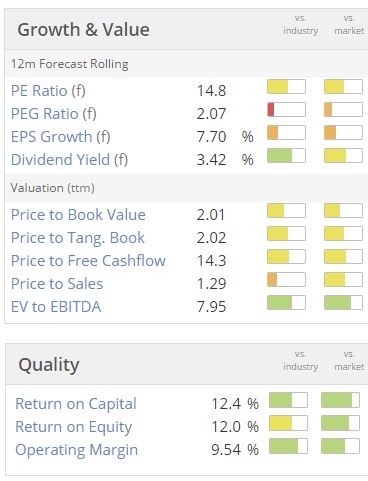

Valuation - seems reasonable, once you take into account the net cash:

My opinion - it's a good solid company, but the growth rate is very modest now, so I don't think it justifies a premium valuation. Which is good, as once you strip out the surplus cash, the valuation drops down to the low teens, which seems about right to me.

Strength of sterling is a headwind, but I would imagine they are benefiting from cheaper energy costs. I'd like to see a more dynamic strategy to grow the business - it's starting to feel a little stale, and ex-growth.

Xaar (LON:XAR)

Share price: 489p (up 8.2% today)

No. shares: 77.0m

Market cap: £376.5m

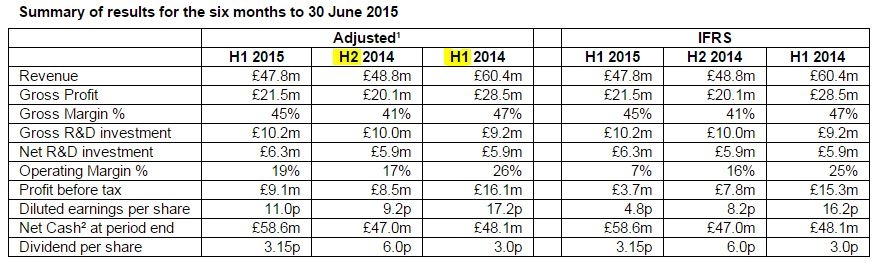

Interims to 30 Jun 2015 - these results have been cleverly presented to emphasise that adjusted H1 2015 performance shows a modest improvement against H2 2014, whilst side-lining the usual comparison with H1 2014. Some good creative minds at work at this company's PR adviser, that's for sure! (we will find a way to show a positive trend, if it kills us!);

If the results had been presented in the conventional way, with H1 2015 compared with H1 2014, and the percentage changes given, then I doubt the shares would have gone up as much today, as it would have reinforced that the business has gone backwards year-on-year.

However, that was already expected, as there have been profit warnings flagging up the issue of declining/uncertain demand from the main customers, ceramic tile manufacturers in China.

Balance sheet - still very strong, with net cash of £58.6m (76.1p per share).

Outlook comments - these seem lacklustre to me;

"After a challenging 2014 our business achieved stability in the first half of 2015, with sales into all segments performing in line with expectations. For the remainder of 2015 we anticipate continued stability with the intention to return to growth in 2016. Our longer term ambitions remain much more significant, reflecting the digital inkjet market opportunity and our technology leadership position."

Stability, and an intention to return to growth (as opposed to being confident about growth) is far from inspiring. Further comments are in the same vein;

In the shorter term our ambitions are more modest. For 2015 we anticipate a period of stabilisation with an intention to return to growth in 2016. Although visibility of demand remains limited, particularly in China, based on the sales performance in the first half of the year the Board expects 2015 full year revenue to be in the range of £92-95 million.

New products - the key thing I'm looking for at this print head manufacturer, is signs that the next generation products (printing directly onto shapes such as bottles) are taking off. The comments today on this seem somewhat contradictory, saying;

Direct-to-shape printing in packaging continues to gain traction; branded commercial products are retailing in Europe and the US

The contribution from direct-to-shape printing in packaging, which is currently mainly printing directly onto plastic and glass bottles, was broadly consistent with the modest levels achieved in 2014. We remain excited about the size of the opportunity in the direct-to-shape application and we are encouraged by both the progress being made by our OEMs and by the level of engagement from some very large brands. Commercial products are retailing in both Europe and the US.

So no signs of any significant commercial progress here really, but hopes for jam tomorrow.

My opinion - I think the market has been very gentle with Xaar of late, considering it has such heavy exposure to China. Furthermore, the new products don't seem to be gaining any traction yet.

Therefore, I think this share is looking too expensive given where things stand at the moment. There can't be much certainty that existing levels of profitability will be maintained, and it's had to cut costs heavily to stay profitable.

I can't see why the shares have recovered as well as they have from the series of profit warnings last year. To my mind a price of say 200-300p would probably be more appropriate for where we are currently.

Fyffes (LON:FFY)

(at the time of writing, I hold a long position in this share)

A couple of readers have asked me to comment on interim results today from this fruit importer. It looks good - solid growth, with more indicated from potential acquisitions.

Balance sheet - strong, but note the pension deficit.

Valuation - reasonable, on a PER of about 10.

High StockRank of 91 is another positive.

Divis - yield is 1.9%, not madly exciting.

Heavy H1 weighting to results.

Current trading - helpful that they give full year forecasts in today's update (I wish all companies would do this!)

Listed in UK & Ireland I think.

Overall - I like it, this ticks a lot of my boxes, so I've just bought a few. NB I haven't done proper, in depth research into it, hence my only picking up a very small opening position in it. I'll do more detailed work on it at some point in future & report back.

I have to stop there I'm afraid, as got some year end figures to prepare for my local share club this afternoon!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FFY, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's fallible personal opinions, never advice nor recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.