Good morning! It was quite a wobbly week last week, and with the main US Indices continuing to fall after London closed on Friday night, more jitters should be expected today. Although I note that the FTSE 100 Future has recovered fron an overnight low of down another 120 points, to currently (07:16) being down 38 points, indicating a start at about 6,618.

I see a pullback as being both necessary and healthy - there has been an element of euphoria in the market of late, which needs dampening down, otherwise a bubble builds up with speculative valuations, and we all know how those end.

I am hoping that there will be some good buying opportunities this week, as hopefully some weak holders in good quality small caps will panic and sell at a daft price, so I can deploy my reserve cash and grab some bargains. I don't believe there will be a crash, but a correction is certainly needed. It's true that many shares are currently expensive, and valuations need to come back down to reality in some cases. However, with the macroeconomic picture now looking brighter than at any time since 2007, warm valuations on a PER basis are in many cases justified, since earnings could & should rise rapidly for cyclical companies.

Note that previous market crashes (e.g. 2000, 2008) have occurred at the end of a sustained (5+ years) period of economic buoyancy, and in anticipation of sharply falling corporate earnings. We're currently in a situation that's the opposite of that, with a recovering economy, and probably being at the start of a good period of economic growth. That doesn't strike me as a likely time to have a bear market.

Albemarle & Bond Holdings (LON:ABM)

I've repeatedly warned readers here that the situation at Albemarle & Bond was looking extremely dicey - with a mass resignation of Non-Execs in early Dec 2013, and current trading being at an EBITDA loss, it seems clear that the most likely outcome is probably a pre-pack Administration, which would probably leave nothing for shareholders (since in a pre-pack the profitable bits of a business are usually sold for peanuts, and the proceeds used to repay the Bank.

The company seems to be be moving closer to that today, with an announcement that the formal sale process of the company has ended;

...despite a number of proposals being received from interested parties through the course of the formal sale process under the City Code on Takeovers and Mergers (the "City Code") as announced on 2 December 2013, none of the proposals were deemed to represent a fair value for the Company.

The Bank have given them more breathing space until 31 Mar 2014, and they talk about maximising value for "all stakeholders" (note, not just shareholders). In particular, this sentence leads me to believe things might well be terminal here for shareholders;

Whilst alternative options continue to be explored, the Board of Albemarle now believes that, depending on the final outcome, there may be limited value attributable to the ordinary shares.

So I hope that none of my readers here are holding these shares, you've had enough warnings, as you could be in for a 100% loss I'm afraid. Although I don't suppose many people will be commiserating over a pawnbroker (possibly) going bust. It's not over yet, but seems to be going that way, in my opinion.

Software Radio Technology (LON:SRT)

I've received some flak in the past for being sceptical about this small company which makes radio-based "marine domain awareness technologies", but today's trading update justifies that scepticism. To be blunt, they don't seem to have any visibility over the business - today's statement gives a bizarrely wide range of turnover & profit guidance for the year ending in only 2 months, on 31 Mar 2014.

Turnover could now be between £6-13m, with profitability ranging from a loss of £1.5m to a profit of £2.5m! How can you possibly value the shares in a business that has such erratic trading? What it really means is that performance is at the lower end, unless they get lucky and finalise some big contracts before the year end.

Broker WH Ireland has this morning reduced their forecast to the bottom end, to be on the safe side, and I'm afraid these shares are likely to crater this morning. I don't know what the solution is? Maybe the company should just try to run at breakeven, and regard any large orders as good fortune, rather than anticipate large orders, and then fail to deliver?

It's not the first time this has happened with SRT, so to my mind the company doesn't really have a lot of credibility left, and certainly doesn't warrant a premium rating any more. The trouble is, even if they do land some big contracts before 31 Mar, the same problem will be ongoing - over-reliance on large, unpredictable orders. It's not really a suitable business model for a Listed company, as investors need some degree of predictability in order to value a company.

The statement today does however end with a bullish tone, so perhaps some investors will see the glass half full? In which case the most bullish might see the likely sharp fall today as a buying opportunity?

However, it is important to note that none of the project and mandate opportunities have gone away. Indeed, the opposite is the case, with SRT supporting its customers on an increasing portfolio of projects and mandates. The fact remains that SRT sits at the centre of a developing global market to monitor vessels using AIS and I therefore look forward to announcing the pending orders in due course.

Porvair (LON:PRV)

Specialist filtration group Porvair has released its results for the year ended 30 Nov 2013. They're fairly good - revenues up 10% to £84.3m, and pre-tax profit up 25%, so a bit of operational gearing in play there by the looks of it (i.e. profits up considerably more than revenue, as fixed costs are spread more thinly).

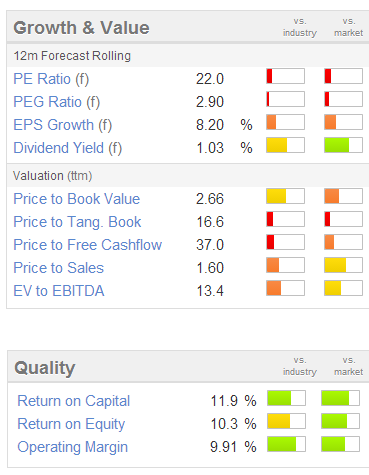

Basic EPS is up 26% to 12.7p, although at 293p the shares are on a lofty multiple of 23 times 2013 earnings. So that's clearly factoring in considerable further growth in profitability. So to be comfortable with that sort of rating, you would have to be happy to pay up-front for long-term growth, and be very confident that growth will continue.

Basic EPS is up 26% to 12.7p, although at 293p the shares are on a lofty multiple of 23 times 2013 earnings. So that's clearly factoring in considerable further growth in profitability. So to be comfortable with that sort of rating, you would have to be happy to pay up-front for long-term growth, and be very confident that growth will continue.

Net debt has been eliminated, with small net cash of £0.6m at the year end, and two small acquisitions have been bolted on. The company also mentions "high capital investment in 2014 to support long term organic growth plans", together with "steady underlying progress", and some large one-off contracts in the pipeline.

Nice company, but the price is too high for me.

Amino Technologies (LON:AMO)

This is an interesting, very cash rich company that makes set-top boxes for TVs, which work through the internet (if I've got that right?). Their shares have risen slightly to 92p this morning, which values the company at about £50m.

Results for the year ended 30 Nov 2013 have been issued this morning. Most striking first is how large the cash pile is - at £19.5m, that's 39% of the market cap, or 37p per share. It looks as if the company has been buying back its own shares, as well as paying out big dividends, as the number in issue appears to be falling, obviously a good thing as that means reverse dilution happening.

There's nothing funny about that net cash figure either, it's genuine surplus cash, as current assets are 369% of current liabilities, which is off the scale good - anything over about 150% is very good.

Looking at the P&L, it seems pretty good. Whilst turnover has fallen as expected, operating profit before exceptionals rose from £2.8m to £3.3m. A duties refund of £1.65m was partially offset by £0.84m restructuring costs, giving net exceptionals of positive £0.8m.

I note there is a negligible Corporation Tax charge this year and last year, which is unusual, not sure why. But I would want to normalise tax for any EPS calculations, to avoid over-paying for the shares. Ah, I've just found an explanation of the low tax charge - they have £37m of unrecognised tax losses to carry forward, so assuming it can utilise those losses then that's a very nice extra bit of upside on the valuation. Or you can just use reported EPS, and hence by implication factor in the nil tax charge into your valuation of the shares.

Dividends are rising 15%, in accordance with their previously stated policy, so the yield is fairly attractive here at about 3.75%, and a further 15% rise in dividend is pencilled in for 2014, taking the yield up to 4.3%.

My main problem with Amino, is that I don't really know how to assess the company's future prospects. Should it be treated as a growth company or not? I really have no idea, so can't form a conclusion on it, as I don't understand their sector. The outlook statement sounds reasonably positive, although seems more upbeat about prospects for 2015 than 2014, which introduces a note of caution;

The Board expects to see solid progress in 2014. For the full year, the Board expects to deliver a financial performance in line with market expectations for both profitability and cash generation. It is anticipated that revenue will show a second half seasonal weighting in line with that seen in prior years. The investment in developing a broader-based solutions offering underpins the continued innovation and momentum within the business and is an important step in increasing Amino's addressable market. The Board is confident that these measures will have a positive effect on revenues from 2015.

Broker consensus is for 6.93 EPS in 2014, so once you strip out the 37p net cash, the ex-cash share price of 55p puts it on a low multiple, of 7.9. That said, valuing the cash at par is probably far too aggressive, as in reality shareholders are not likely to see much of that cash, so it might be better to discount it by say 50%, which would take the cash adjusted PER up to 10.6 - still pretty cheap.

So it looks certainly worthy of further research in my opinion, but I would need to understand their products & market much better before buying any shares in it myself.

I'll leave it at that for today.

Same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.