Good morning.

Afren (LON:AFR)

Share price: 8.0p (down 55% today)

No. shares: 1,108m

Market Cap: £88.6m

I don't normally report on the resources sector, but there are lots of interesting things going on at the moment - as the plunging oil price is throwing up risks, but also opportunities. So I will mention the odd one. The opportunities are going to be the companies that survive this period of low oil prices, where share prices could rebound strongly once the oil price is moving back up again. So cashflows, hedging, balance sheets, terms of bank debt & bonds, etc, are the crucial elements to consider right now.

Review of capital structure - the title of the RNS alone should be enough to frighten shareholders. Key points seem to be;

- cash is now tight

- negotiations are underway with providers of a $300m debt facility

- $15m of debt interest payments due on 1 Feb 2015 may be deferred

- bond holders are mobilising - have formed an ad hoc committee (to represent their interests)

However, the killer one is this;

"...there is an equity fundraising requirement which is likely to be significant and in excess of the Company's current market capitalisation".

So who knows what is going to happen next? It hinges on whether existing & new investors are prepared to stump up fresh cash for equity.

There is also ongoing discussions about a "possible combination", i.e. takeover, by Seplat Petroleum Development (LON:SEPL) , a Nigerian oil company which listed on the London market in Apr 2014, and has a market cap of £675m at 122p per share.

My opinion - when companies get into financial distress, effective control passes from the equity holders to the debt holders. If debt holders play hardball, then equity can end up being worthless (if they seize control by forcing it into Administration). At the very least, equity holders here are likely to be heavily diluted. Or it could go bust.

I'll be giving this one a miss. Although it might be worth another look once they have raised some fresh cash, but who knows what price that might be at? 5p? 3p? 1p? Massive dilution appears inevitable.

I think you would need to be a sector expert to even consider getting involved here, or just a gambler. It's a good reminder that, if the capital structure is wrong, a share that drops a lot can keep dropping. Cash is king at the moment for oilcos. I hope readers are incredibly careful if you do decide to catch any falling knives in this sector, and doing really thorough research is more important than ever. There will be fortunes made and lost this year on oil shares, that's for sure.

Benchmark Holdings (LON:BMK)

Share price: 95p (down 14% today)

No. shares: 219.3m

Market Cap: £208.3m

I've looked at this company a couple of times, and saw a presentation from management last year, but must confess that I don't really understand the company, nor have any idea how to value it. It's difficult to value, as it has limited track record as a Listed company, and has made acquisitions, so you're really having to rely on broker forecasts to value it, which are notoriously unreliable.

Final results - for the year ended 30 Sep 2014 are out today.

The company grew turnover from £27.5m to £35.4m, but recorded a loss before tax of £1.4m (vs. profit of £4.9m in 2013). They say this is in line with market expectations.

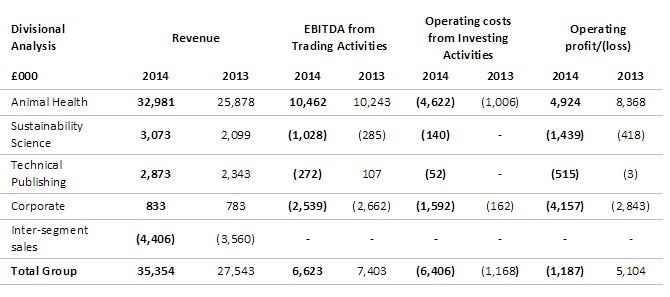

The issue seems to be that the company has profitable trading activities, but then spends that profit on product development, as set out in the following table from their results today;

The animal health division is the profitable bit, making £10.462m positive EBITDA, but it has ramped up "investing activities" that seem to be expensed through the P&L, over four-fold to £4.6m, giving a reduced operating profit of £4.9m for that division.

The other two divisions are small, and loss-making.

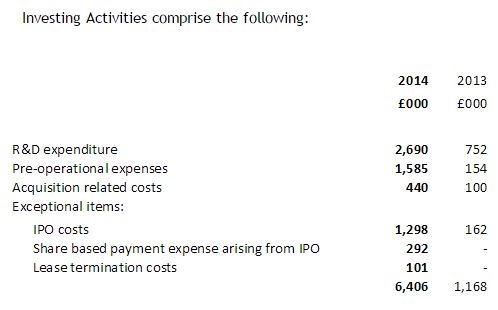

A further breakdown is then given of the £6.4m "investing activities";

I'm a little confused as to why they didn't capitalise the first two items in this table?

Balance Sheet - looks fine, with net tangible assets of £29.4m, and the current ratio is very strong at 3.42, including a healthy net cash balance of £16.3m.

Subsequent acquisitions - note that a substantial, £70m fundraising occurred after the year end, to finance two acquisitions. That is almost a third of the current market cap, and explains why broker forecasts show a large jump in turnover and profit in the current year.

My opinion - unfortunately, there are too many moving parts here for me to form any meaningful view. Valuation all hinges on how well the various constituent parts of the group perform, and how much they then decide to reinvest in R&D. So the profit figures are moveable, and hence it's very tricky to decide how to value it.

This is a share where there's no alternative to doing the detailed research on its products & markets. So a cursory look from me won't really add any value at all, I'm afraid - I've no idea what it's worth, because I don't know what sustainable profits could be generated.

Looking at the chart, it found very strong support at 80p last year, so if it drops to that level again, and holds it for a few weeks, then it might be worth a dabble, as a trade, perhaps?

Carpetright (LON:CPR)

Mkt Cap: £304.6m at 449.5p per share

More evidence of good consumer spending in the UK, with an impressive performance from Carpetright, delivering 7.5% LFL sales in the 13 weeks to 24 Jan 2015.

Even Europe managed a positive LFL sales performance, in local currency, of +1.7%, but the depreciation of the Euro turned total sales negative (in sterling terms) at -6.0%.

I'm surprised that the company only confirms full year expectations, as I would have expected a strong sales increase to feed through into profit out-performance.

These shares have looked irrationally expensive for the last ten years - nobody has ever managed to explain to me why this low margin retailer of carpets should be rated on a PER typically of 30+. It remains a mystery.

Sinclair IS Pharma (LON:SPH)

Mkt Cap = £179.1m at 36.75p per share

A very detailed trading update today says that the company is trading well, and in line with the Board's expectations.

This company seems to have transformed itself from loss-making to decently profitable. It makes skincare pharmaceutical products. The Directorspeak today sounds good, with them saying that it has, "multiple avenues for continued high growth across several products and territories, while prospects for the US provide an opportunity to take the company to a new level".

Sounds quite interesting, so this one might be worth doing some more research on, possibly.

There's a fair bit of debt, and no divis though, which puts me off a bit.

I'll sign off for today. See you tomorrow!

I see Afren is down to 6p now. This is why I'm obsessed with balance sheets - if your balance sheet unravels for any reason, then the shares are toast.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.