Good morning!

ShareSoc Masterclass

These events are great fun, with lively discussion, followed by drinks, excellent buffet, and friendly chats with pleasant people, so come highly recommended.

The next one is being held at the offices of IG, very near Cannon Street station, in London. The date is 4 Nov 2015, so next week. There is an entry charge for these events, to help raise funds for ShareSoc, and to cover the catering costs.

I've been asked to sit on the panel, and give my views on the topics - finding multibaggers, and lessons to be learned from Quindell. I've also managed to get Globo added to the agenda, to make it more topical. Roger Lawson is also appearing on the panel, and so there should be some lively discussion, as neither of us tend to pull our punches!

Last few tickets are available - details here. In particular also note the high security issue - so bring photo ID to gain access to the building.

Amino Technologies (LON:AMO)

Share price: 115p (down 26.5% today)

No. shares: 70.3m

Market cap: £80.8m

Trading update - this must be a profit warning, as the price is down heavily this morning - bad luck to holders. It doesn't look that bad to me actually, so if you like the share, then this could be a good time to buy more, perhaps? I always try to decide whether a profit warning is something that is fixable relatively quickly (which means it could be a buying opportunity), or whether there is something more sinister underlying the warning (in which case it's a bargepole job).

The Company now expects to report a second half shortfall in revenue versus expectations within its core Amino business. As a result, the Company expects profit before tax, before exceptional items, to be below expectations, but in line with that achieved in the previous financial year. The Company also confirms that revenue and cost synergies arising from its recent acquisitions of Entone Inc. and Booxmedia Oy are tracking ahead of plan and both the teams and product lines of each acquired company are integrating well.

The acquisitions are significant, because Entone Inc in particular was a very large deal - the total purchase price being £46.7m, of which £21.0m was raised in a Placing at 130p.

Dividends - the company today reiterates its progressive dividend policy, so the yield should now be rather attractive, and is probably back up to about 5%, but not very well covered now.

In spite of this expected trading outcome, the Board reconfirms its commitment to the Company's progressive dividend policy and expects net cash balances at the period end to remain in line with current expectations.

Forecasts - FinnCap have reduced their top line for this year (ending 30 Nov 2015) heavily, from £49.5m to £41.0m. Although their revised adjusted profit figure is down from £5.7m to £4.3m.

Forecast EPS is down from 8.5p to 7.0p, so the share price having fallen to 115p puts this share on a current year PER of 16.4, which looks about right to me.

Net debt/cash - is forecast to be about neutral.

My opinion - if you like the company, and think the problems are fixable, then this could be a good time to buy. I'm tempted actually, but need to do more research first. Bear in mind also that the large recent acquisition will kick in for next year's figures, so EPS should rise next year.

The downside risk, is whether this company's set-top box technology is being surpassed by people watching TV individually on their tablets, rather than around a large TV in the corner of the sitting room? Will these products be seen as antiquated in 10 years' time? Answers on a postcard, sent from the future, please!

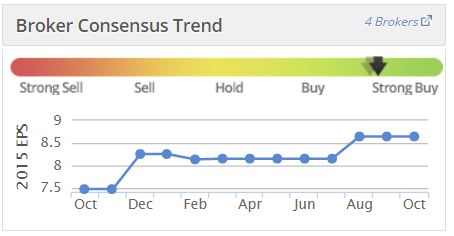

The StockRank is 93, so Stockopedia's algorithms didn't see this one coming either! It's unusual to see broker forecasts being upgraded over the previous year, and then a profit warning be issued, so more investigation is needed into what went wrong. The company says it's all down to poor sales execution - trouble is, that is just fancy words for customers not buying their products. So could there be something more worrisome underlying this profit warning? I don't know, so on balance have decided to hold back on buying any today. More work is needed to understand the company & its prospects rather better.

Shoe Zone (LON:SHOE)

Share price: 192p (up 4.3% today)

No. shares: 50.0m

Market cap: £96.0m

Trading update - this retailer of cheap shoes blotted its copy book with a profit warning in Apr 2015, within its first year of listing too, a serious black mark. However, I reckon it's a decent business, so should recover in time.

Today it says;

The Group has traded well in the second half of the year and expects to report revenues for the 52 week period to be in the region of £166.8 million (2014: £172.9 million), reflecting the continued planned closure of loss making stores. The Board expects pre-tax profit for the period to be in line with expectations.

The Group ended the year with 535 stores, having opened 18 and closed 28 during the period. The business continues to have strong cash conversion and closed the year with an approximate net cash balance of £14.2m (2014: £9.1m).

That sounds fine to me! In line with expectations are the key words.

Valuation - broker consensus is 18.1p EPS this year, so at 192p the shares are rated at a fairly modest 10.6 times.

Given that the company has a sound balance sheet, with net cash of £14.2m, then the rating is really somewhat lower.

My opinion - it takes time for confidence to rebuild, but this share now looks a lot more appealing. I'm tempted to pick up a few, but don't have any spare dosh at the moment, and am already very heavily exposed to UK retailers. I could see say 20% upside from the current price, providing they don't slip up again.

There's also a 5%+ divi yield, and a Stock Rank of 93, so I imagine this stock will gradually come back into favour with investors.

Dialight (LON:DIA)

Share price: 571p (down 14.6% today)

No. shares: 32.5m

Market cap: £185.6m

Trading update - this is not the easiest of statements to interpret. The new (since Jun 2015) CEO sounds keen to set out his revised strategy & targets.

Comments on current trading sound to me like a veiled profit warning;

Trading in the three month period to 30 September 2015 was characterised by continued weakness in the oil and gas sector and reduced levels of industrial capital expenditure, particularly in North America. As a result, reported lighting revenue growth for this period was 5%. The cost reduction actions announced on 7 August are on track to deliver their targeted reduction in operating costs and we are encouraged by the strength of our order book.

However, with market conditions having become more challenging during the third quarter, and Dialight's financial performance weighted as usual to the seasonally-strong fourth quarter, the Group faces an increased level of uncertainty in the remainder of the current financial year.

A lot of mixed messages in that update, which leaves me rather confused, in all honesty!

Dividends - the company has cancelled this year's divi, and says they're unlikely to be resumed before 2017. That clearly sends a negative signal, although the divi yield here was only small anyway.

My opinion - it sounds as if the company is limbering up for a a profit warning in Nov or Dec 2015, if Q4 under-performs. On that basis it's not a share I would want to touch at the moment.

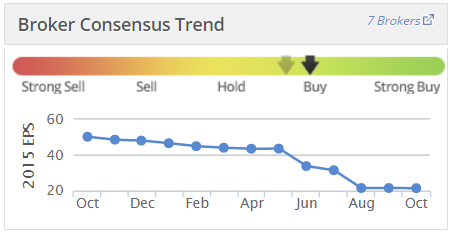

Broker forecasts have already come down a huge amount this year, and with an uncertain outlook, and divis cut, there looks to be something fairly seriously wrong here. I reckon there'll probably be more bad news, before any turnaround gets underway. The valuation still looks too high to me, so I'd be more inclined to short this, than go long. Although it doesn't look compelling either way.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.