Good morning!

Xaar (LON:XAR)

Share price: 440p

No. shares: 76.4m

Market Cap: £336m

I dropped SCVR coverage of this innovative industrial printhead manufacturer last year, as the shares shot up, taking its market value into mid cap territory. However, after a series of profit warnings (another one today) it's coming back into range, indeed it's a stock that I already hold, having seen value at around 500-550p, based on its strong Balance Sheet with plenty of cash, and a PER that was in the low teens at the time.

The catalyst for my initial buys was the R&D Director spending £200k buying stock - which clearly indicates that he must feel confident about the new products due for launch over the next year, which seem to have potential to be game-changing (allowing inkjet printing directly onto any shape, such as bottles, without the need for a label). I am guessing that more Directors buys could be likely now interim results have been published today.

Averaging down - In my view this morning's initial 25%+ drop in share price was a considerable over-reaction, so in my opinion was a buying opportunity on the opening bell. People say that averaging down is a losing strategy, but personally I've found it can be a highly successful strategy, but only if you are certain that the difficulties triggering the profit warning are of a temporary & recoverable nature, and only if you're prepared to hold for a while, riding out any further price weakness. Averaging down on a stock that is fundamentally going to pot, or is a stale story stock, is of course a disastrous strategy, so great care is needed!

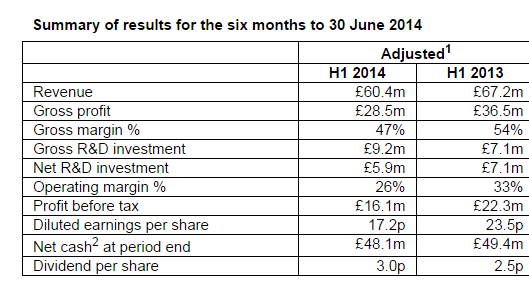

Interim results - As you can see from the headline "adjusted" figures below, taken from today's interims, both turnover & profits are down - the main reason for this is because of increased competition in their main market of printheads for ceramic tile manufacturers. Although this is a known factor, and a broker says this morning that the interim results were in line with expectations. 2013 should really be seen as a spectacular one-off year of growth, which is not sustainable;

Outlook - the long-term prospects sound good (and bear in mind that only something like 3% of potential industrial printing has made the move from analogue to digital, and that the technology is being adopted in waves by individual sub-sectors);

We continue to lead the market in ceramic tile decoration and remain excited by the future potential offered by tile decoration and a number of other ceramic tile processes. In addition, our partners continue to develop solutions with our technology across multiple applications in both the packaging and industrial markets. As highlighted in June, pre-production activities within the 'Direct-to-Shape' application continue, and our expectations of this opportunity for the longer term have strengthened. Despite being long lived, Grand and Wide Format Graphics remains an opportunity and we are targeting to regain share. Our Thin Film Programme, we believe, will open up multiple further markets to Xaar, significantly broadening the total opportunity over the long term.

This is the stuff that personally I find most interesting about Xaar shares - the company has already shown that it can achieve considerable sales/profit success from one area, printing on tiles, so there is every reason to believe that future success could be achieved in other, potentially much bigger, areas.

On the more immediate outlook, the company issues a mild profit warning for 2014, as follows;

During the third quarter, demand from the ceramic tile decoration sector has softened, which we believe relates to a slowdown in construction activity in China. In light of this, the Board's expectation for 2014 revenue has reduced to £115-125 million, with adjusted operating margin projected to be broadly in line with the 26% achieved in the first half of the year.

FinnCap say this morning that the impact on full year profitability is a reduction of about £4m. So it's unhelpful, but not a disaster. In my view this profit warning warrants a perhaps 10% reduction in share price, but no more than that, given the importance of new products for launch in the next year, in the valuation. If the new products don't sell, then the valuation should of course take another tumble, but if the new products do well, then this could transform back into a growth stock, with a potentially big re-rating. So it's a finely balanced thing in my view.

So, it could have another profit warning in it, who knows? Personally though I'm not interested in short term price movements - it's all about whether Xaar can hit another sweet spot of analogue to digital adoption with its new products in 2015. So personally I see a potential 20% downside risk (from another profit warning), but with 100%+ potential upside, with a 1-2 year view. Let's hope I'm right! As always, this is not a recommendation, it's just my personal opinion only. As we always stress, please Do Your Own Research! (DYOR).

There could be speculative upside from a takeover bid possibly - there don't seem to be any significant founder shareholders, instead 7 Instis are the biggest shareholders, with combined about 62% of the stock. Therefore if a competitor came along and made an offer at a decent premium, they would probably succeed.

Valuation - I'll watch out for detailed revised broker figures, but my back of the envelope sums suggest that about 30p EPS might be the right ballpark for 2014. Therefore at 440p per share at the time of writing, the valuation on a PER basis is 14.7. This could turn out to be very cheap if new products take off. Or it could come under further pressure if existing business (to the tile manufacturers) continues to fall, and new products flop.

Balance Sheet - is bulletproof, with net cash of £48.1m at 30 Jun 2014, although that might reduce somewhat due to capex & the new policy of capitalising some development spend. Net cash is 14.3% of the market cap, so it's providing an increasing support to the valuation with each successive profit warning. Moreover, a healthy bank balance means that R&D spending can be high, and is not disrupted by short term trading, which I like.

Dividends - The interim divi has been hiked by 20% to 3.0p, and policy is a 1:2 policy for interim:final divis, suggesting 9p full year divi. That's a yield of 2.0% - which is OK for a technology company - it's always nice to be paid whilst you wait for a re-rating.

It's certainly been quite a rollercoaster for Xaar shareholders in the last two years, so it will be interesting to see how this one pans out over the next few years.

Molins (LON:MLIN)

Share price: 134p

No. shares: 20.17m

Market Cap: £27.0m

Interim results - for the six months ended 30 Jun 2014 have been published today. The company describes them as;

H1 performance broadly in line with management expectations although market conditions in the Middle East and eastern Europe adversely impacted the Tobacco Machinery division

The 18% drop in share price today suggests to me that management had not correctly communicated their expectations to the market. If they had, then the share price wouldn't have moved.

The market cap here is very low now, so I'm wondering whether there is value here?

Profitability - I thought this company was mainly a tobacco machinery company, but looking at the turnover mix from its three divisions, tobacco machinery turnover has fallen dramatically, and it was actually the smallest divison, reporting £ 10m turnover in H1 of 2014 (down 44% on H1 in 2013). That was 25% of total group turnover. This division moved from a profit of £1.3m to a loss of £0.2m (pre-exceptional) in these interim results.

Packaging machinery was the largest division, at 45.8% of turnover, but only delivered a whisker above breakeven, at £0.1m (same as last year).

The only division that really made any money is the scientific services division, although this looks like a bit of crafty wording, as this division makes analytical machines for the tobacco industry! Hmmm. I wonder how much of the packaging division supplies the tobacco industry too?! So-called "Scientific services" had a good half year with profit up from £0.1m to £0.7m.

So overall, H1 saw an "underlying" operating profit of £0.6m (down from £1.5m), which scrubbed off to zero once non-underlying items are taken into account.

Capitalised development spending - If you check the cashflow statement, the company is capitalising quite a bit of development spending - £1.3m in H1, and £2.2m last full year. That exceeds the H1 amortisation charge of £0.6m, so in cash terms it didn't actually make any profit at all in H1.

Seasonality - The company is keen to point out that it tends to have an H2 seasonality to its profits. The trouble is, with H1 near breakeven, the year's profits are now totally dependent on H2, which makes the shares higher risk. I prefer companies that can at least get a decent slug of profits in the bank by the end of H1. It's easier to sleep at night then.

Outlook - the company today says;

As in previous years, the Group's full year trading performance will be significantly weighted towards the second half. The Board is mindful of the strength of sterling and current market conditions for the Tobacco Machinery division. The prospects for the Scientific Services and Packaging Machinery divisions continue to be encouraging.

The Group continues to focus on its growth initiatives, including further development, both organically and acquisitively, within our core sectors.

So that's very mixed, with enough wiggle room included for another profit warning in H2 potentially, so I don't think much reliance can now be placed on estimates for this year's earnings, which of course makes it difficult to value.

Pension deficits - I've reported about this before, so please look back in the archive for more detail. Suffice it to say the company has a gigantic pension fund with total liabilities (on an accounting basis) of about £356m at 30 Jun 2014. Yes, you read that right, three hundred and fifty six million pounds, over 13 times the company's market cap! There are assets covering nearly all of that, on an accounting basis, so the deficit shown on the Balance Sheet is £9.9m. However, on the last actuarial valuation;

The UK scheme was subject to a formal actuarial valuation as at 30 June 2012, which showed a funding deficit as at that date of £53.0m. The agreed level of deficit funding is £1.7m per annum (increasing by 2.1% per annum, except in respect of the payments for the year to 30 June 2016 which will increase by the percentage increase in ordinary dividends in respect of the Company's 2014 financial year if higher than 2.1%). The deficit recovery plan will be formally reassessed following the next scheme specific funding valuation, which will be carried out as at 30 June 2015.

So it's one of these iceberg pension deficits. The crux for me is that cash overpayments of £1.7m are being made, and that seems to me very material to the company's profits & cashflow. It does manage to pay divis, but there's not really much scope to increase the divis, as you can see from the except above that increases in the divi trigger increases in payments into the pension fund.

It also means that nobody in their right mind is likely to attempt a takeover of this company - why would you want to take on the pension liabilities? (and the pension trustees could block a takeover anyway). Thus reducing the potential upside, and eliminating one potential exit route for shareholders.

Balance Sheet - overall it looks reasonable, putting aside the pension deficit for one moment. Although I'm not clear why the company has £9.4m in loans, largely offset by £8.5m of cash. Seems an odd way of doing things.

Dividends - The company has consistently paid slightly increasing dividends over the last six years, so there's no reason to suppose that will stop. Although as mentioned above, the pension scheme heavily restricts the company's ability to increase the divis by much. Although I note that at 134p per share today, the forecast 5.5p total divis for this year give a yield of 4.1%. That's reasonable, but given it's very unlikely to increase by much, dividend seekers would probably be better served going for a more liquid large cap paying 5%.

My opinion - I just don't like it. The pension fund is far too big to make this investable in my view. Even ignoring the pension fund, it doesn't particularly excite me. In my view the rise in share price over the last two years looks pretty spurious - a rising tide lifting all boats & all that. Now reality is coming home to roost in my view.

EDIT: For a more positive take on the results, and interesting background info, there is an excellent update note out today from Paul Hill at Equity Development - who is a brilliant analyst, and also a very successful investor. So whilst he'll naturally paint a positive picture in a commissioned note, it's very much worth reading, and might perhaps offset some of my gloom!

A couple of quickies now before I knock off for lunch;

Kromek (LON:KMK) - This is a loss-making growth company which looks potentially interesting to me, so it's on my watch list. However, I don't like paying up-front for potential, unless there's a very clear & credible path to substantial profits. Looking at the results for the year ended 30 Apr 2014, published today from Kromek, I can't get enough comfort to come anywhere close to the £54m market cap.

It's still much too commercially speculative for me, but looks interesting technology. Having said that, the vast majority of such companies turn out to be terrible investments, so it's very much like looking for a needle in a haystack. Also there is a risk here that if little commercial progress is made in the next year, it could well need to come back to the market for more cash - so potential dilution, especially if the market is not receptive to growth stories when they need the money.

So I'll continue to watch from the sidelines.

Macfarlane (LON:MACF) - I've had a quick skim of the interim figures, but don't like the low operating profit margin, the pension deficit, and too much bank debt. Also H1 operating profit was down on last year.

Office2office (LON:OFF) - looking at today's interims very much reinforces my view that shareholders here got extraordinarily lucky with the recent takeover approach for equity that in my view is worth nothing - I would have bitten off their hand, indeed, sold in the market as soon as the deal was announced, happily giving up a couple of pence in case the deal falls through.

The company's Balance Sheet is in a terrible mess, with negative net tangible assets of £42.4m. Furthermore, whilst they have managed down bank debt to £20.4m, it is clear that this has only been possible by stretching supplier payments, and/or getting up-front payments from customers. Consider this - trade & other creditors (excluding bank debt) is £64.3m, versus £85.4m in six months Cost of Sales (from the P&L a/c). Assuming it's all UK turnover, then trade creditors will include VAT, so strip out 20% VAT in trade creditors, reduces ex-VAT trade creditors to £53.6m. So I make that 114 days credit they're taking from suppliers!

That's probably why they don't really make much profit, as suppliers will be loading up the prices to tolerate such late payment.

Awful figures, so a very lucky escape for anyone daft enough to buy these shares!

On that bombshell, it's time for me to sign & off and grab some lunch.

Back tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in XAR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.