Good morning! I've been reading for the last couple of hours, but haven't got round to writing anything as yet, so more caffeine is needed I think. Anyway, let's crack on.

Superglass Holdings (LON:SPGH)

Profit warning of the day comes from this maker of loft insulation material. It's been a tale of woe from this company for some time now. I reviewed this company three times in 2013, most recently on publication of their interim results on 19 Nov 2013, coming to the conclusion that it was too difficult to work out whether there was a viable business there or not.

This morning's trading update covers the half year to 28 Feb 2014. It refers to continuing "very challenging market conditions", with retrofit sales being soft (due partly to weak Government incentive schemes for people to insulate their homes). That is offsetting "encouraging signs" in the new build market.

Although they do hold out some hope of a turnaround in this bit;

On a more positive note, the Government's announcement contained a commitment to include low cost loft and cavity insulation measures under ECO and this is expected to be of material benefit to the Company in the next financial year.

The company has also increased exports, and reduced costs, to combat weak trading in the UK.

Overall, the key part on profitability says;

... the overall trading performance of the business for the period, and for the full year to 31 August 2014, will be significantly below management expectations. There are no changes to management expectations for 2015. The Board still expects to return to positive EBITDA by the end of the second half of the year.

It was forecast to make a loss of about £3.5m this year (ending 31 Aug 2014), so being significantly below that means I am guessing it must be a loss of nearer £5m perhaps? (similar to last year, before one-offs). They have made cost cuts of about £5m annualised, although it's not clear how much of that has already happened, and how much is in progress.

If the best that can be hoped for is to reach breakeven in the foreseeable future, with hope that legislation might drive more demand, doesn't sound at all attractive as an investing proposition. If the market cap was buttons maybe I would consider it, but it's not really cheap at the market cap of about £11m (28m shares in issue, times 40p current share price, down 24% on the day).

Cash is probably getting a bit tight now too, and on this they say;

The Company continues to trade with adequate cash headroom going forward and is expected to be generating cash on a monthly basis by the year end, although the cash balance at 31 August 2014 will be below original expectations.

Overall then, risk:reward doesn't look attractive to me at this valuation. I'd want to see 10-20p before getting interested here, but the trouble is if it reaches that level then it will be because they've run out of cash & need to raise some more. I hope the company is successful in its turnaround plans, but it doesn't look a good investment to me at the current price.

Sanderson (LON:SND)

This is a small software company, addressing the retail & manufacturing sectors. In the past I've questioned the valuation, and pointed out the pension deficit, and negative net tangible assets. My most recent review was on 25 Oct 2013 after a trading statement, where I thought it looked unappealing on a valuation basis at around 65p per share.

The shares continued rising, peaked at about 74p, and have since come back a bit to 60p. Other people might like buying momentum, but I don't. So for me, a falling chart is a good thing, as it means I'm getting the shares more cheaply. Just like if apples are half price, I buy more of them.

There's a lot of detail in today's statement, which as I hardly know the business, I'm finding difficult to interpret. This bit impressed me though, as it lowers risk as a business model;

Sanderson continues to develop a robust business model with over half of Group sales being derived from pre-contracted recurring revenues, the margin from which covers over two-thirds of business overheads.

With software companies you have to be very careful about product development costs. In my view these are an intrinsic part of running a software business - i.e. constantly improving the product & introducing new ones, so all development spend should be directly expensed to the P&L in my view, and I'm leaning towards adjusting the figures to reflect that, when valuing this type of company.

It can make a huge difference - e.g. Lombard Risk Management (LON:LRM) is apparently very profitable at the EBITDA level (a totally misleading measure for software companies that capitalise a lot of development spend), but hardly makes anything once you conservatively account for development spending. The telltale signs are always in Cashflow & Balance Sheet anyway - if it doesn't generate any proper cash, year in, year out, then the P&L figures are probably being massaged to present an overly optimistic view.

Going back to Sanderson, on development spend they say (this is music to my ears!);

Product development, especially in the area of mobile solutions across the Group's businesses is at a very high level but, in line with the Board's cautious and conservative approach, it is planned that most of these development costs will continue to be expensed as they are incurred.

On strategy, Sanderson say;

The Board's strategy is to achieve organic growth, supplemented by selective acquisitions which are expected to become earnings and value enhancing.

In conclusion today's update says;

A strong balance sheet, a robust business model and an improved market position provide the Board with a good level of confidence that the Group will make further significant progress in the current year.

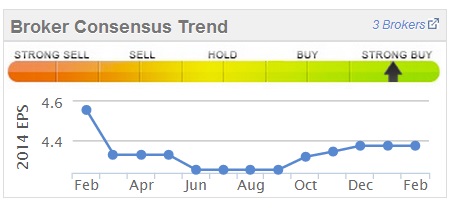

So let's look at valuation for Sanderson. Broker consensus EPS forecast has fluctuated but more recently was revised up to around 4.4p, as you can see from the handy Stockopedia graphic on the right. That is set to rise to about 4.7p next year. These are only a guide of course, as actual results can differ hugely from broker forecasts.

Therefore at 60p these shares are starting to look sensibly priced on a PER basis. I haven't worked it out exactly, but it looks to be in the low to middle teens, which is the right sort of ballpark for a company of this size and type, in my opinion.

The Stockopedia valuation & growth graphics are starting to show a bit more green than last time I looked last year, when they were mainly amber. So that shows valuation has become more attractive.

Note the dividend yield is starting to become useful - it's better than a deposit account anyway.

A couple of things put me off with this company though. On looking at their last set of full year accounts again, I note that the Cashflow statement shows £677k cash outflow to the pension fund, which has not gone through the P&L as a cost I believe - since it's reducing a liability on the Balance Sheet. Although a net cost of £103k did go through the P&L (finance income & expenses, relating to the pension fund, being £415k in, and £518k out - see notes 9 & 10 to the 2013 Annual Report).

That £677k cash outflow to the pension fund was actually more than the company paid in dividends last year, of £590k, which highlights that the pension deficit is a material factor in valuing the company.

Note 28 to the 2013 Annual Report says that the company is committed to making payments of £360k into the pension fund in 2014.

Also, looking foward (which is really how we value companies), today's trading update somehow lacks any excitement. The market is looking for growth, but it comes across as a bit subdued. With the shares apparently in a downtrend now, and many investors acting like traders, where two weeks seems long term, I wonder if the price may just continue drifting down as people get bored and sell up to chase opportunities elsewhere?

Overall then, Sanderson is starting to be noticed on my radar, but is not yet cheap enough to look exciting on valuation grounds. One for the watch list methinks.

Waterman (LON:WTM)

I flagged up a positive trading statement from this small engineering consultancy on 6 Dec 2013, but didn't have time to look into it in detail. Pity, as the shares have since risen nicely, from 58p to 74p in just under the last three months.

Their interims this morning look worthy of a look, showing good progression in profit and the dividend.

It has a target of tripling profit over the next three years. So might be worth a look. It doesn't look cheap against the existing broker EPS forecasts, so the growth would need to happen.

Their Balance Sheet looks decent, with net cash, and a healthy working capital position. I don't like the low margins though, nor the sector. Might be worth investigating further though.

Five hours has just gone by in the blink of an eye, it's incredible! Time for lunch & then meetings in London this afternoon, so I shall sign off. Wishing you a pleasant weekend.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.