Good morning!

Mothercare (LON:MTC)

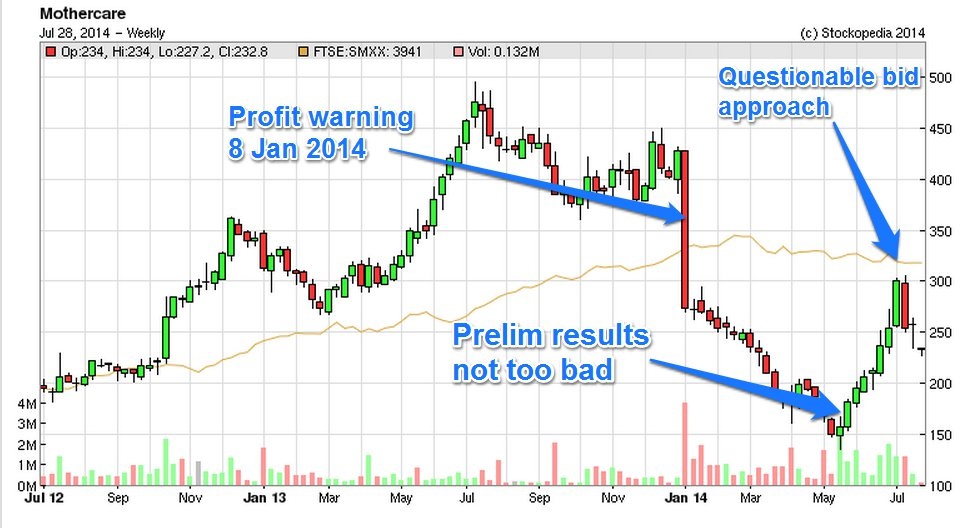

Mothercare has responded to the news that American company Destination Maternity does not intend to make an offer for it after all. Surprisingly, Mothercare also notes that it "has had no contact with Destination Maternity since 3 June 2014". That is strange because news of Destination's interest in potentially buying/merging with Mothercare broke on 2 July 2014, so a month after the last contact between the companies.

As I mentioned in my report here on 2 Jul 2014, the takeover potential of Destination looked highly questionable, as it was clear from their accounts that they did not have the financial firepower to bid for Mothercare. So without explaining who was going to finance the deal & on what terms, their approach had little credibility.

I've added Mothercare to my new "Bargepole List" - companies where I feel there is far too much risk to invest. In this case Mothercare has too much debt, a horrible Balance Sheet including a pension deficit, and problems with onerous leases in the UK. Their UK operation looks very weak, although there is a decently profitable overseas operation. So it's really a question of whether the UK losses will pull down the whole group?

On balance, I suspect it probably won't, but certainly a rights issue (possibly deeply discounted) is looking increasingly likely - if I were their bankers I would insist on it. Banks don't like providing risk capital, that's the job of equity investors. So when Banks find themselves in a position where their lending has become risk capital, they look for a way out. Or at least that's how it's meant to work, but things have gone topsy-turvy in the last few years.

On the positive side, the prelims for y/e 29 Mar 2014 were not as bad as I expected, where in my review here, I concluded that the company probably wouldn't go bust, and it looked like management have stabilised the position. But who knows what will happen? It's too risky for me to even consider a long position. I'm not negative enough to risk a short position either, so will watch from the sidelines.

Here's the two year chart, with the beige line being the FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX) comparison line;

EDIT: Note that Mothercare is losing its FD - as announced late last week, he has given 12 months notice to leave. So no doubt he will actually leave well before then, with the full 12 months' money, as usually happens (an ongoing scandal in my opinion - Director contracts should be 3 months notice maximum. Any longer is just throwing free money at departing Directors, all too often a reward for failure).

The CEO seems to be living in a parallel universe, or in denial, when he comments;

"Matt has strengthened Mothercare's financial position during his time with the company and is leaving the business in good shape (Ed - really???!!!). We would like to thank him for his contribution and wish him well in the future."

Tristel (LON:TSTL)

This is a very interesting small company that supplies disinfectant wipes & similar disposable devices. I hold a few shares in it, even though the valuation is perhaps a little on the warm side. Although the key to valuation is always to look into the future, not the past. So in this case, the company has some good niche products that they are rolling out into more international markets, having reached maturity in the UK.

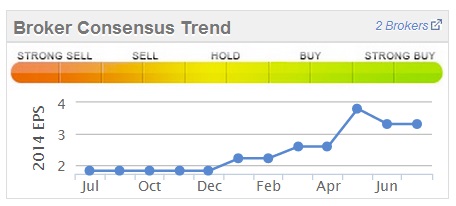

There have been a series of positive trading updates & broker upgrades this year;

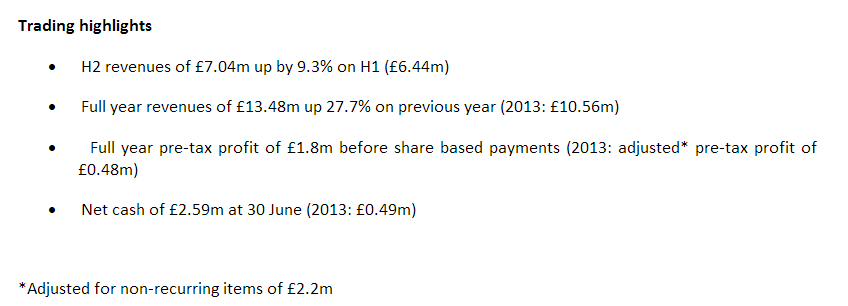

The bullet points in today's trading update certainly look strong;

Although as with all companies, the bullet points are the things they want you to look at, so it's always worth digging more deeply to find where the bodies are buried! In this case I can't find anything untoward in the accounts, although it's worth noting that £300-400k of development spend is capitalised each year.

Arguably their RNS writer needs a good dousing with cold water, as today's announcement gushingly says;

The Company enjoyed a strong second half performance which has led to a fifth profit upgrade this financial year. The preliminary results for the year ended 30 June 2014 will be released on 13 October 2014 and will show revenues and pre-tax profit ahead of expectations that were last updated in June.

However, I've had two broker emails through this morning, both saying that the £1.8m full year pre-tax profit figure quoted in today's statement is actually in line with expectations. So not ahead of it to any material extent.

The share price has reflected that, spiking up earlier this morning 3p, but having come back down, and now slightly down on the day, as it clearly sunk in that the company had not beaten expectations really. So they need a bit of a slap for this over-excitably-worded RNS in my view. Keep the excitement for when you thrash forecasts, not when you marginally exceed them.

There seems to be a selling overhang in the market for these shares at the moment too, so the shares look as if they've probably gone as high as they want to for the time being, until the overhang clears.

ECO Animal Health (LON:EAH)

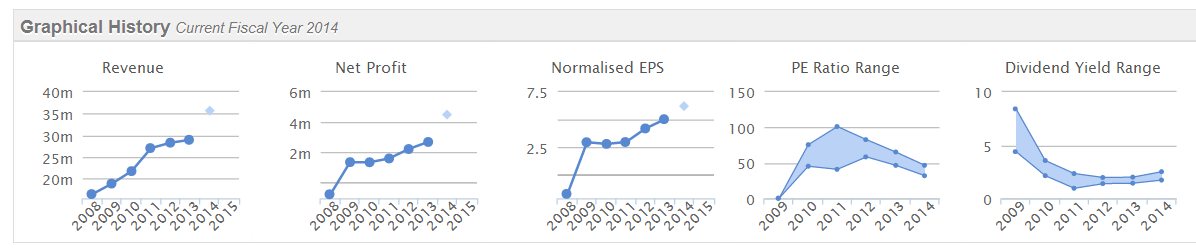

This is a new one for me, despite it being a £108m market cap at 173p per share, I don't recall having looked at it before. As you can see from the Stockopedia graphical history below, it's a profitable growth company, although that big market cap seems to rely heavily on the forecast improvement in profits this year (and beyond)

Note how the PER has been coming down, but is still very high, on historic figures.

The company sells animal healthy products, like antibiotics & such for animals). It looks to have raised a fair bit in new equity funding during the year ended 31 Mar 2014, reported today, so the Balance Sheet is very strong at 31 Mar 2014 - with a working capital position of current assets being a whopping 524% of current liabilities, and negligible long-term creditors reported. This includes £18.2m of net cash, so material to the valuation - that's nearly 17% of the market cap in cash, impressive. Although it depends what they intend doing with the cash?

There's a fair bit of development spending being capitalised - £4.3m in 2013/14, so that needs to be deducted from the reported £7.1m EBITDA to arrive at a more prudent level of cash profitability which I like to use. EBITDA is just horrendous, a horrible concept, as it leads to you being drawn into over-valuing companies that capitalise lots of development spend. We should resist EBITDA at every opportunity! EBITDA only makes sense where there is a load of historic depreciation/amortisation, but no current such capex.

All in all, it looks a potentially interesting company. I haven't got time to look into it in any more detail right now, but I like the profitability on decent margins, I like the Balance Sheet, and the growth.

Although note from the two year chart how these shares have been a relatively poor perfomer, going down during a period when small caps have generally risen a lot. So that makes me wonder if it was over-hyped before? I like situations like that, where everyone feels gloomy and the valuation is coming back down to earth. So when time permits I'll do some more research on it, it's going on the watch list anyway.

Filtronic (LON:FTC)

I've never been keen on this company, as it's not really clear that they have a viable business - it seems to bump along near breakeven, with the occasional awful year. Results for the year ended 31 May 2014 are published today, and as expected are poor - turnover fell nearly 18% to £32.9m, and last year's £3.1m adjusted operating profit fell to a £0.4m equivalent loss this year.

It's probably not going bust though, as it has net cash of £2.5m, and a reasonable Balance Sheet, although if losses were to worsen then things could unravel.

However, the outlook sounds potentially good;

Investment in the 4G equipment infrastructure market continues to grow and offer significant opportunities for both Wireless and Broadband. The number, scale and quality of new opportunities continues to be strong and whilst the timing and volume of contracts from design wins remains uncertain, we expect Wireless to return to growth and with the upturn we have seen in Broadband the board is confident about the prospects for the business.

So at 24.5p per share, and a £23.6m market cap, investors really need to assess what potential the company has to make profits in the future?

There have been no divis since 2010, and for me it would be pure guesswork trying to decide if they can become profitable again or not, and I don't invest on that basis. However for readers who understand their telecoms products & markets, then it might be worth a look? It's not for me - I've been burned too many times in the past trying to bottom fish for things that look cheap, but are declining businesses. This one doesn't actually look particularly cheap - on 22 times forecast EPS of 1.1p for the current year. If there was significant upside on that forecast though, then it might start to look potentially interesting perhaps?

A couple of quickies;

Globo (LON:GBO) - another upbeat trading statement has been released today, as usual. On the face of it, there are lots of positive noises. However, the key question here is whether the company can actually generate any material cashflow? They have not done so far, so I remain deeply sceptical - the Balance Sheet has an alarming build-up of stray debits, which either have to turn into cash, or be written off. So, time will tell.

Snoozebox Holdings (LON:ZZZ) - Some positive noises in this trading update too, although it's important to remember that the company is still loss-making this year, and the business model is in the process of being changed - the version 2 units are currently under construction and should enter service in late 2014. They should produce dramatically improved results in future, as they are far simpler & cheaper to set up & dismantle. The shares are still very speculative though, and although losses are being stemmed, 2014 figures will look pretty bad, as expected. In my view they will have a viable business with the v2 units, but it's a long & painful road for shareholders to get there.

Waterlogic (LON:WTL) - in a trading update the company says that it has traded well for the 6m to 30 Jun 2014. However it only then reports turnover, with nothing about profitability. It sounds as if the company is up for sale, as it says today, " the strategic review and formal sale process is continuing and the Company will provide a further update when it announces its interim results on 22 September 2013."

I don't like the net debt here, of $30.1m at 30 Jun 2014, combined with a track record which shows growing sales, but lack of traction on profitability. It doesn't interest me.

I'll leave it there for today.

An old friend is visiting this afternoon & evening, and wants to be shown round some of the local hostelries, so I think it might turn into a bit of a session. Therefore there's a moderate to high probability that tomorrow's report might be a little later than usual. Well it is the summer, and I don't take holidays, so why not?!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in TSTL, ZZZ, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.