Hi there! It's Graham reporting for Friday.

£G4M (StockReport)

- Share price: 714p (-13%)

- No. of Shares: 20.9 million

- Market cap: £149 million

AGM Statement and Trading Update

This has been heavily covered by Paul over the past year or so, but I will pitch in here with a few comments on today's trading update.

Performance for the year to date is in line with expectations.

But the shares are off for a reason, or perhaps multiple reasons.

Given the track record of exceeding expectations, perhaps merely being "in line" isn't good enough anymore?

There is no getting away from the fact that the share became very highly rated by any standard valuation measure, in comparison with short term profits.

And now those short-term profits are going to impacted by upfront costs associated with the growth plans.

These comments might have been received in a calmer way by investors in a share at a normal valuation:

As previously outlined, the current financial year is expected to follow a more typical seasonal trading pattern, with a higher proportion of sales and profits being generated during the second half of the year than was the case in the previous year.

Also, as previously notified, the first half of the current financial year will include the costs of embedding our new European distribution centres and setting up our recently acquired Head Office in York. Based on the overall performance of the business during the financial year to date, the Board is confident of another year of good progress."

Without applying any great leaps in logic, they are telling us not to expect very much in H1.

Edit: Last year's H1 was profitable to the tune of around £1 million in PBT, but now we know that this year's H1 is going to be affected negatively by more seasonality and by one-off costs.

I am not as familiar with G4M as my co-writer but I'd be very cautious about considering this for a long-term investment at the current share price.

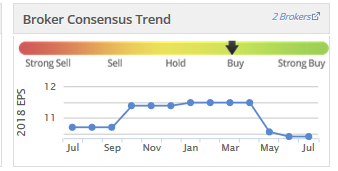

EPS forecasts have been adjusted lower as follows:

Rightmove (LON:RMV)

- Share price: 4293p (+0.3%)

- No. of shares: 92.3 million

- Market cap: £3,960 million

This property portal is well above our market cap remit here, but many of us are interested in the property market and this is a share I quite like, so I'm breaking the rules for a minute! I last covered it in Febraury.

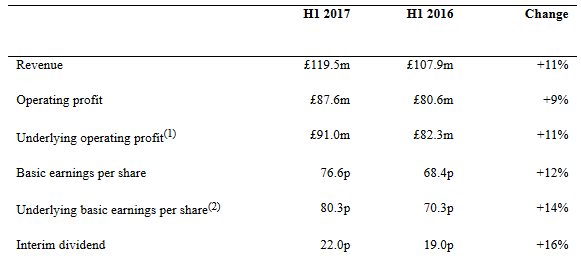

The interim results are fine:

The revenue growth rate has slackened; it never had the explosive rates of G4M but it was previously as high as 23%.

It is still a good cash generator. And the next interim dividend will be 22p, up from 19p.

Visitor numbers have stalled at a 3% growth rate for total visits during the period. It's still the biggest property portal by some distance, but the segment now appears to have matured. Market share of total traffic is 75%.

Expectations are unchanged for the current year.

My opinion

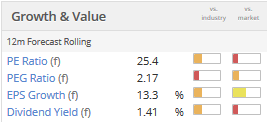

The economic fundamentals are fantastic here, in my view: huge operating margins of some 73% are achieved thanks to the non-physical nature of the product! (Better not to bother with the "underlying" margin, in my view, and there's not much difference anyway.)

Cash conversion is excellent (over 100%) and total cash returned to shareholders over the 11 years since flotation is now apparently over £750 million!

While the rating here is undoubtedly on the higher end of the scale (ValueRank is just 12), I don't think it's hard to argue that this is justified. It's got a compelling competitive position as the stand-out market leader.

As a directory, the position of market leader is self-reinforcing. So knocking it off that spot looks extremely difficult for the foreseeable future.

Given the cash generation (a consequence of extremely high returns on capital), I'll have to consider picking this up for my personal portfolio. Share price gains have been limited for the past 18 months, and I think it's growing into its valuation very well.

£QUIZ

- Share price: 196p (+22% versus placing price)

- No. of shares: 124.2 million

- Market cap: £243 million

Admission to AIM and first day of dealings

It's a strong start to life on AIM for this Glasgow-based womenswear fashion retailer, with c. 1,400 employees.

You can read Paul's previous coverage of it here.

The placing raised £103 million (gross), of which £92 million is for the selling shareholders and £11 million is for the company itself.

The admission document can be found at this link, if you're interested.

Skimming through it, I see the expansion since 2015 has been sufficiently strong (compound sales growth of 21%) for investors to give it a strong market cap and thus for the selling shareholders to capitalise by making a partial exit.

Online is 13% of revenue while international sales to 19 countries is 18%, and with each of them growing at much faster rates from their low bases than total sales, long-term forecasts can potentially be made even juicier.

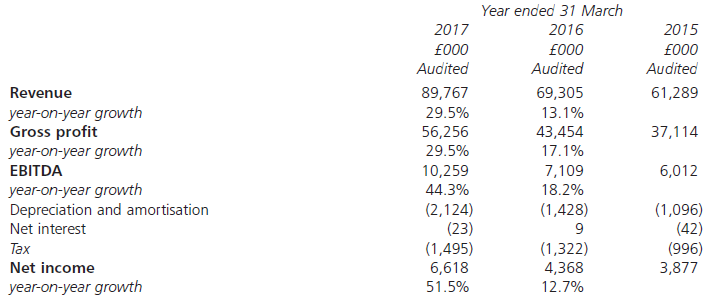

The summary income statement is as follows:

The gross profit margin looks good at 62.7% (versus 54.5% at Boohoo.Com (LON:BOO) for example).

The proposed non-exec Chair is also the exec chair of JD Sports Fashion (LON:JD.) and is also chair at United Carpets (LON:UCG), a company in which I hold shares. Perhaps that information is not particularly useful, but I like to have some kind of mental image of the boardroom!

If you get deep into the second half of the admissions document, you'll see there are related party transactions to do with rental of business premises. It's just worth noting, and perhaps reading into a bit more - hopefully not a problem.

Tarak Clothing, "a company holding the business and assets of QUIZ standalone stores", went into administration in March 2009. We need to look forward not back, but these are the sort of interesting historical tidbits you get in an admissions document!

My opinion: The valuation is full but that's what you're going to get with a profitable, growing company electing to IPO when the stock market is at an all-time high.

This should be an interesting one to include within our coverage from now on and see how it develops.

That's it for today, thanks for reading and have a good weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.