Good morning. Firstly I've had a quick look at the interim results to 30 Sep 2013 from Newriver Retail (LON:NRR), which as regulars will know is a property company that I rate highly - with excellent, experienced management, and a good strategy to buy cheap shopping centres which they can improve through better management. It's a REIT therefore obliged to pay out 90% of its earnings as dividends. That has meant an attractive dividend yield for investors (forecast at 6.2% this year), however the downside of this approach is that the company has had to issue new equity to finance its expansion. So there is continuous dilution going on.

So despite profit growth of 60%, EPS has only marginally increased to 6.5p for the half year. The dilution has also had a negative impact on NAV. Despite increasing net assets substantially from acquisitions, the 115% increase in ordinary shares in issue means that NAV per share has actually fallen, to 222p. This compares with a share price of just under 260p, so that's a valuation of 17.1% premium to NAV, which strikes me as getting a bit warm. I would suggest that these shares probably need to take a breather, to allow time for NAV to catch up with the share price. As a long-term growth, and decent dividend paying share however, it remains attractive in my opinion. I would certainly buy back if the share price fell back to around NAV again.

The upside should come from the company gearing up a bit more, and deploying the rest of the cash raised in July 2013. More property acquisitions are announced today, including £34.3m being spent on acquiring two centres, in Llanelli and Oxford, at an initial rental yield of 7.8%. Also, an interesting deal to acquire 202 Pubs from Marstons for £90m (so an average of £445k each), and gradually convert them into convenience food stores or restaurants. This looks a clever deal, as Marstons are guaranteeing the rent for up to four years, at an initial yield of a whopping 12.8%. This deal is being funded through a JV with an investment partner.

It's a reminder of the fundamental problem that Government policy is having on Pubs in Britain - i.e. that it is so expensive to buy drinks in a Pub, increasingly people are instead opting to buy cheap supermarket drinks, and have friends round to their homes instead of going to the Pub. Who can blame them? So Pubs being converted into convenience supermarkets is the logical result of the Government over-taxing Pub drinks, and the highly leveraged large Pub chains squeezing their tenants until many of them only have a subsistence income.

Which brings me round to thinking about how all this will affect Vianet (LON:VNET) ? They seemed to think that Pub closures had largely finished, but this news from New River undermines that view, and suggests that Pub closures are likely to be ongoing. The Government proposed Statutory Code for the Pub sector should be due for publication soon, so I shall watch this area with interest. Certainly some sort of action is needed, if local Pubs are to survive - with the fundamental problem being that drinks in Pubs are too expensive.

Edit: the market has reacted positively to New River's announcements today, with the shares up 3% to 267p. I'm not interested in chasing them up, now that the price is well above NAV.

Israeli software company Pilat Media Global (LON:PGB) has issued a positive set of figures for Q3. They rather disingenuously describe themselves as London-based I notice. I spotted the value here in the Spring, and caught the big re-rating from April-June, so it was one of my best trades this year. However, I was happy to move on once they had got to 50-60p, as it's not the easiest company to value - because they trade not much above breakeven for most of the year, and are reliant on Q4 trading to make the full year numbers. As an investor that leaves you in a permanent state of nervousness about the potential for a profit warning.

Today's statement will leave shareholders not only breathing a sigh of relief, but anticipating a further rise in share price, as the company has said this today;

The contribution of the new contracts will increase in Q4 and even more so in 2014. Accordingly the Board expects that Q4 will be Pilat Media's strongest quarter ever, when most of the annual profits will be generated, as in previous years. This sets the Company on track to achieving significant year-on-year growth by the end of 2013 in all key parameters; annual revenues, operating profit, net profit and cash.

So all looks good. I'm not intending to revisit this one, having made my money on it.

The market has reacted positively, with shares in Pilat currently up 7% to 67p.

Shares in marketing group Creston (LON:CRE) are down 6% to 91.5p this morning, on publication of their interim figures to 30 Sep 2013. I've found their numbers pretty impenetrable in the past, as there are so many adjustments and different profit measures presented, that it's a struggle to work out how the business is actually performing.

The headline figures don't look good. Turnover is down 4% to £35.7m for the six months, and diluted EPS is down quite sharply, to 4.35p (H1 2012/13: 7.44p). Although the interim dividend has been raised 20% to 1.2p. They state that they are moving to a one third: two thirds dividend split between interim & final, so we should therefore expect 2.4p for the final dividend, giving 3.6p for the full year. That equates to a 3.9% dividend yield, which seems fairly attractive. Whilst higher yields can be found, especially in larger caps, the beauty of smaller cap dividends is that they should have scope for more growth, especially in a recovering economy. So if all goes well, then a 3.9% dividend yield now could be considerably higher in several years' time perhaps.

The headline figures don't look good. Turnover is down 4% to £35.7m for the six months, and diluted EPS is down quite sharply, to 4.35p (H1 2012/13: 7.44p). Although the interim dividend has been raised 20% to 1.2p. They state that they are moving to a one third: two thirds dividend split between interim & final, so we should therefore expect 2.4p for the final dividend, giving 3.6p for the full year. That equates to a 3.9% dividend yield, which seems fairly attractive. Whilst higher yields can be found, especially in larger caps, the beauty of smaller cap dividends is that they should have scope for more growth, especially in a recovering economy. So if all goes well, then a 3.9% dividend yield now could be considerably higher in several years' time perhaps.

The outlook sounds reasonable, as they say that new business wins have been strong, so the full year is expected to recoup the H1 shortfall in turnover. I am intrigued by their comment that the latest IPA Bellweather survey (whatever that is?!) shows the fastest recorded growth rates in advertising spending - which sounds encouraging for this sector, but also for the economy as a whole.

Overall I think this might, possibly be a reasonably good entry point for Creston at 91.5p. As always that's just an opinion, we never give recommendations on this site, and the whole ethos here is to encourage members to DYOR (do your own research). I haven't bought any myself yet, as I need more time to think about it, but can see the attraction for a patient investor of buying cheaply after mildly disappointing figures today, but a reasonably alright outlook. Nice divis too. The Balance Sheet is reasonable, even after writing off all intangibles. So I suppose on balance it gets a cautious thumbs up from me, at this price.

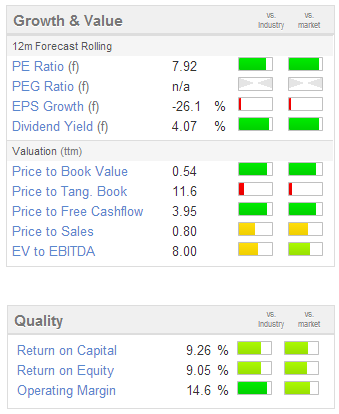

The Stockopedia value & growth graphics above show plenty of green (green is good, red is bad, as the colourings are based on traffic lights), most notably for the low forecast PER and good dividend yield. Although bear in mind that broker forecasts for the current year might be reduced following rather disappointing H1 figures today (so that PER could go up, if EPS estimates come down).

Shares in NATURE (LON:NGR) seem to have stopped falling, and have edged up slightly this morning, so I have decided to pick up a few at 26p. Originally I was hoping it would drop to about 20p, but that seems unlikely now, and I've noticed that buying on profit warnings seems to be working well as a trading strategy at the moment. Indeed, most small caps are now so expensive that buying after a profit warning can often be your only chance to get something at a sensible valuation.

Also, smaller companies do tend to have more bumps in the road on their journey than larger companies. As anyone who has run a SME will know, the smooth progression of profits that investors expect just isn't the way it works in reality. Normally profits move in a zig-zag way, dependent on all sorts of factors which are sometimes outside of your control - e.g. what competitors are doing, decisions by customers, etc.

The key thing is to try to sort the wheat from the chaff, in terms of only buying good companies which have had a temporary setback, whilst avoiding bad companies that are in long term decline. Easier said than done!

Whilst momentum investing might be an empirically proven successful investing strategy, it will never appeal to me. I am too wedded to the fundamental, golden rule of investing - the principle of BLASH (Buy Low And Sell High). So buying something because its gone up in price just seems wrong to me, even though I understand why people like the concept. At a push I can run to buying something that has gone up a bit, providing the fundamentals have improved a lot.

WH Ireland forecasts are for 1.9p EPS this year, and 2.2p next year. Although that factors in a fair bit of bad news already announced. So if we see those figures are the floor, then a recovery (and anticipation of Gibraltar coming back into operation in late 2014) could drive a share price recovery perhaps in 2014? I might have to be a bit patient on this one, so will just tuck my shares away and forget about them for a year, and see what happens. I've not bought a lot, as it's not really a conviction buy. Personally I like to start off small, then gradually improve my understanding of the company over several months, and add to the position as I grow more comfortable with the company & the valuation.

Interim results to 30 Sep 2013 from Digital Barriers (LON:DGB) look very poor to me. It's an innovative security equipment company, which at 169p per share, with 64.3m shares in issue has a market cap of £108.7m.

That looks absolutely bonkers to me, given that they have just reported terrible figures - turnover of £9m, and a loss before tax of £7.2m for the six months. For a supposedly high growth company, turnover was only up 11.5% against H1 last year, and turnover was well down on the sequential half year.

So investors are putting high hopes on their ability to make a commercial success of these products. I'm considering opening a short position on this one actually. The company recently raised £18m in a Placing at 140p, so they clearly have a convincing story to tell, sufficiently good that investors are prepared to totally disregard their trading performance to date.

Broker consensus is for a loss of £4.7m this year, and a smaller loss of £1.2m next year. So that £108.7m market cap rests entirely on hope of profits later in 2015 and beyond. Risk/reward there looks pretty awful to me, but we'll see. We're in a market where investors are increasingly prepared to ignore valuation, and just buy into stories - real late stage bull market stuff, although it hasn't yet reached the sort of extreme levels we saw in the late 1990s TMT boom, but I think we're getting towards that.

Renowned value investor Howard Marks has this week published a letter where he draws a lot of comparisons between conditions today, and the build up to the credit crunch in 2008. His conclusion is that we're close to getting into danger territory, but not there yet, which for what it's worth is my view too.

Loose credit conditions were created by the private sector in the run up to the 2008 crash, and now we have Governments creating loose credit conditions. That leads to misallocation of capital, into more & more risky products, with investors increasingly overpaying to continue generating returns, and then inevitably at some point there is at least a fierce correction, and at worst a meltdown.

That's why I refuse to overpay for anything right now, which is boring, and frustrating (as it depresses returns in the short term), but in the long run protecting capital will turn out to be more important than taking the increasingly reckless risks that we're seeing all around us in fashionable, over-priced shares.

Sooner or later, momentum buyers will get a very nasty wake-up call, and price moves down could be extremely rapid, as all those spread bets are automatically closed out, as we've seen with fashionable stocks before. That's not a game I want to play! I'd rather be the chap with some spare cash on the sidelines, picking up the bargains from distressed sellers in future.

Supplier of wood, James Latham (LON:LTHM) reports a solid set of interim figures for the six months to 30 Sep 2013. Turnover rose about 10% to £82.2m, and operating profit was up 8.7% to £4.6m. EPS was only a whisker higher than last year, at 16.9p, but last year's figures were flattered by a one-off profit on property disposal.

The winter H2 will be obviously quieter seasonally, but broker consensus of 28.6p EPS for this year ending 31 Mar 2014 looks like it should be at least met. There's a nice clear outlook statement, which sounds pretty positive;

The management accounts and information show growing revenue for October and the first half of November, at slightly improved margins. Bad debts have been below our expectations but will remain a concern over the next few months. We have a wide range of customers who are generally busier and more confident about future prospects than this time last year. The company is in a strong position to meet increasing demand.

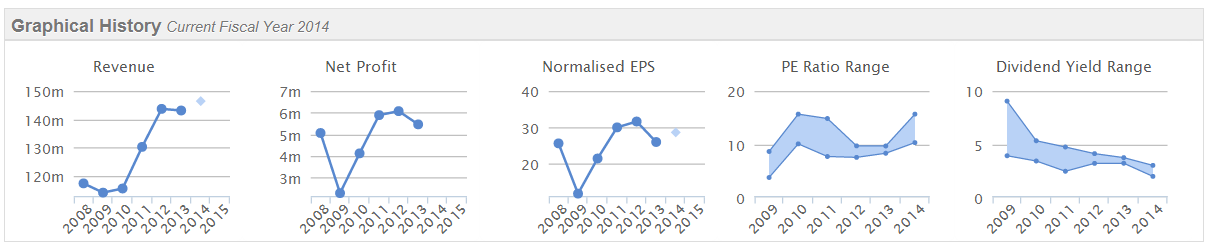

So at 392p the shares are therefore on a current year PER of 13.7, which looks about right to me - they've had a nice run up this year, and the price is probably up with events for the time being. That said, for long-term investors, I can see the argument for holding for further rises as trading is likely to improve as the economy recovers. Historically these shares have generally been fairly cheap, as you can see from the Stockopedia graphs below - especially the last two, where the current PER had edged up a bit, and the dividend yield has been steadily declining. So these shares are now not cheap any more, but given the economic backdrop is improving, that probably makes sense.

Going back to the theme above, this is exactly the type of company that I would be happy to buy on any short term market sell-off, or if they hit temporary problems and issued a profit warning.

Note that there is a pension deficit here, but it's not huge relative to the market cap, however I would want to find out what their annual overpayments are, in the 10-year recovery

I've now had time to look at Publishing Technology (LON:PTO), and to my mind it is a prime example of the risks involved with buying highly-rated, jam tomorrow shares. The market cap has crashed from about £50m to £30m today, on the publication of a statement which both warns on profit for the current (calendar) year, and extinguishes hopes of possible takeover approaches.

It says that results for 2013 will be below market expectations, and similar to last year. So looking back at last year's figures, revenue was £16.3m (itself only up 9% on 2011), and pre-tax profit before restructuring costs was £0.6m. They note that £3.3m of R&D costs were expensed in the year, but to my mind R&D is an ongoing requirement for software companies, so should be fully expensed every year by all companies, especially if the costs are internal employees, and not contract workers who will leave when the project is complete.

I don't fully understand what this company actually does, but it's something to do with publishing via the internet. They still sound confident about the prospects for 2014 though. I have no idea how to value this company, and would really need to get under the bonnet and understand the business & its markets before attempting to value it. So as a basic starting point, I'd need to see the latest broker forecasts after today's statement. I'm not generally that keen on this type of company, as the lifespan of new internet things is so short. They might have a couple of years as being the latest thing, but then something new comes along that makes it obsolete. So rather than applying a racy multiple for anticipated growth, personally I think companies like this should be valued at a discount until they actually deliver some profit & pay dividends.

There are also poor results from Character (LON:CCT) although this had been previously flagged by the company, and they say that 2014 results should be "substantially better".

See you again tomorrow.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in VNET and NGR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.