Good morning!

Globo (LON:GBO)

Shares suspended.

(I hold a short position in this share)

Update - I wouldn't normally comment on a share where I hold a short position, but seeing as this one is suspended, probably for some time to come, then it's an exception.

Today's update doesn't really say a lot, other than;

- The company has reported the situation to the police in the UK, Greece, and Cyprus

- The FCA is investigating the situation

- Shares remain suspended

What everyone really wants to know, is whether there's any cash left? It should be possible to ascertain that within 24 hours, just by contacting the various banks where deposits and loans were held. So I don't understand the delay on this point.

Personally I'd be surprised if there is much cash remaining, if any, but time will tell.

My archive on Globo - I thought it would be interesting to recap on the history of this situation, and see what warning signs were known, and when. Therefore, I collated all my own posts on Globo here on Stockopedia over the last 3 years into one, easy-to-read 29-page document, which you can read in Google Docs here, should you wish.

What is striking, is how obvious (to me anyway) the warning signs were. Bear in mind also, that I'm not given to false negatives - i.e. historically when I've warned about dodgy accounts, I've been right in pretty much every case.

Another interesting aspect, is how there was an intense bear raid in Oct 2013, which ultimately came to nothing, and the company managed to continue for another 2 years before the fraud was finally exposed by QCM using evidence obtained from scrutinising Globo's supposed distributors, and interviewing former employees.

I think it's very important that private investors learn the lessons from this case. It's depressing to see how the same people on bulletin boards seem to turn up at all the dodgy companies, stridently shouting down any criticism of a company, and then losing their shirts when it all goes wrong.

At some point, when time permits, I'm going to create a new scoring system to identify companies which are highly likely to be frauds or semi-frauds - i.e. to formalise what I already do in my head to spot these situations early.

Utilitywise (LON:UTW)

Share price: 180.5p

No. shares: 76.6m

Market cap: £138.3m

(at the time of writing, I hold a long position in this share)

Final results y/e 31 Jul 2015 - these figures were announced yesterday, but due to travelling I didn't have time to review them, so have circled back today. There was an interesting discussion about the numbers in the comments section below yesterday's article, which is worth reading, with readers making some excellent points - in particular flagging the terrible cashflow for the year just reported.

The financial highlights look good (as you would expect), with revenue up 41%, adjusted profit before tax up a smaller percentage (so a worsening profit margin) at £16.7m (up 25%). Diluted EPS is up 28% at 17.9p - so a PER of about 10, which looks great value on the face of it, for a company that's growing strongly.

Questionable accounting - however, as I've covered numerous times before here, Utilitywise uses questionable accounting - the main issue being revenue recognition, where it books revenue (and hence profit) often well in advance of the cash being received.

The company mainly generates revenue from commissions paid out by the big utility companies. Companies like Utilitywise are effectively outsourced sales operations for the utility companies. Why is it outsourced like this? Presumably to create a third party intermediary who (supposedly) achieves the most competitive deal for its clients. Whether that actually happens is open to discussion, given that Utilitywise has a gigantic conflict of interest - in that it is financially incentivised to chase the highest commission, which may or may not be the best deal for the customer!

Normally I would avoid a stock like this, with dubious accounting, like the plague. So why did I pick up some shares in it? Well because this is an unusual situation, where yes the revenue recognition is aggressive, however there's not really any (or much) doubt that the vast bulk of the debtors/accrued income will actually turn into cash. There's just a delay on some of it.

That's very different from a Quindell (LON:QPP) or Globo (LON:GBO) type situation, where their dubious accounting centred around booking (partially) fictitious sales, where there was no chance of collecting in any cash. With QPP they booked NIHL claims revenue which was unlikely to ever be received, in order to grossly overstate profits. That has been admitted & corrected now. With Globo, they appear to have booked some completely fictitious sales through undisclosed connected third parties.

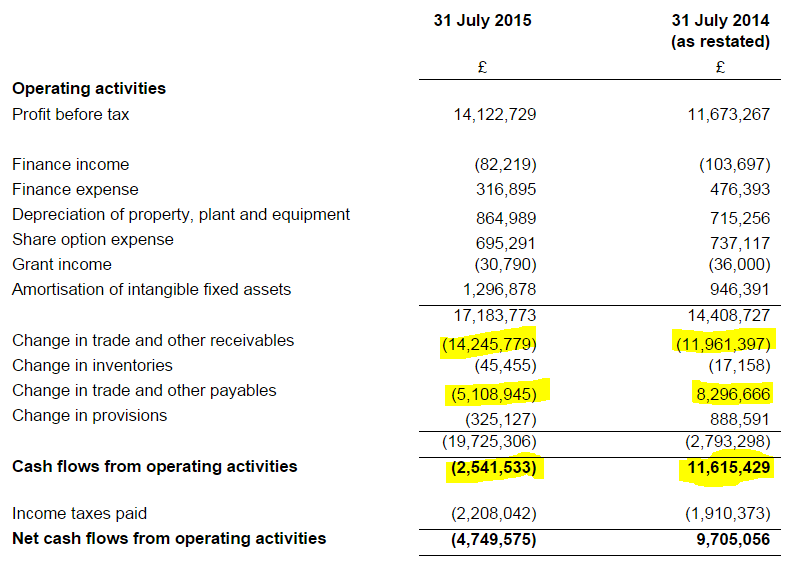

Cashflow - taking a look at the cashflow statement for Utilitywise, it looks absolutely horrendous;

I've highlighted some of the key figures. Look how debtors increased enormously both years, by about the same amount as the company's entire profit. Normally I would run a mile from a situation like this, as it looks like profits are being deliberately inflated.

However, this is a largely unique situation. If you think it through a bit more, the receivables are contracted amounts, with major utility companies. So there's no question about it - Utilitywise will get all or substantially all of that cash, they just have to wait to be paid at the end of the contracts for some of it.

Change in payment terms - this was a separate RNS yesterday, and is probably more important than the results for me, because it shows that the company is addressing the issue of poor cash conversion, by renegotiating payment terms.

At a stroke they have recovered 13% of all debtors, in a single deal with one key supplier. If this is replicated amongst the other suppliers, then its 2015/16 accounts should show a dramatic improvement in cashflow.

The announcement says;

Utilitywise plc (AIM:UTW), the leading independent utility cost management consultancy, is pleased to announce an important and immediate change to its existing payment terms with a key energy supplier.

Following ongoing discussions, the supplier has agreed to amend its terms such that any extension secured on a contract that has not expired receives the same payment terms as a new customer would, in this case 80% on the extension signing and 20%, subject to the normal reconciliation process at the end of that contract. We have also agreed that this change of terms will apply to historic accrued revenue balances and hence we have as of today received £3.6 million in cash from the supplier. This amount represents approximately 13% of the accrued revenue balance due within one year at 31 July and approximately 13% of the accrued revenue balance due after one year at the 31 July.

As a result of our strengthening supplier relationships and the prevailing energy price environment, the length of the contracts we are securing for our customers has increased. Whilst the Group remains focused on acquiring new customers to drive growth, we have also prioritized securing existing customers on longer contracts with their incumbent energy suppliers, either as renewals or extensions to the initial contract. Historically our supplier payment term for this contract revenue was delayed until the extended period had commenced and was booked to accrued revenue on the balance sheet.

Discussions are ongoing with all of our key energy suppliers to amend payment terms to reflect the changing way that we are doing business, with the aim of agreeing revised terms resulting in the receipt of payment for renewals and contract extensions in a similar way to the revised terms detailed above

My opinion - initially I too was horrified by the cashflow statement. However, the explanation given by the company, and more importantly the announcement above whereby they have just collected in 13% of all debtors in one go, shows to me that this issue is being addressed.

I don't like their aggressive accounting treatment, but I'm happy that the debtor & accrued income figures on the balance sheet are probably pretty watertight. Therefore in my view the correct way to view this share is that it should be on a relatively low PER to compensate for the aggressive accounting, but it's not a bargepole stock.

Divdends are often the litmus test. Companies which are fiddling the books don't usually pay generous, and growing divis over a number of years. This company does.

Neil Woodford has gone over the figures with a fine toothcomb, as I reported here, and he's been a strong public supporter of this share. So if I have got it wrong, then am at least in good company. His funds own 26% of the company, so a serious vote of confidence there.

I believe that the accounting issues are well known, have been discussed here and elsewhere for several years, and are hence already in the price. To my mind this stock is more likely to re-rate upwards somewhat, and personally I've pencilled in a target price of about 50% above where we are today, so approximately 270p. In practice, I would probably sell at 250p, as it's not the type of stock that I would feel comfortable holding long-term.

So to summarise, I don't like it, but think it's cheap & likely to rise in price, which is why I own a few. The 4% divi yield whilst we wait isn't bad either.

Plexus Holdings (LON:POS)

Share price: 162p (up 4.8% today)

No. shares: 89.4m

Market cap: £144.8m

(at the time of writing, I hold a long position in this share)

Results y/e 30 Jun 2015 - this is a very interesting company, which describes itself as, "...owner of the proprietary POS-GRIP® method of wellhead engineering" - so if I understand it correctly, this product is sold or rented to oil producers, for use on oil rigs, and it seems to provide superior sealing of the wellhead, by using hydraulic clamps which squeeze the outer casing against the inner tube.

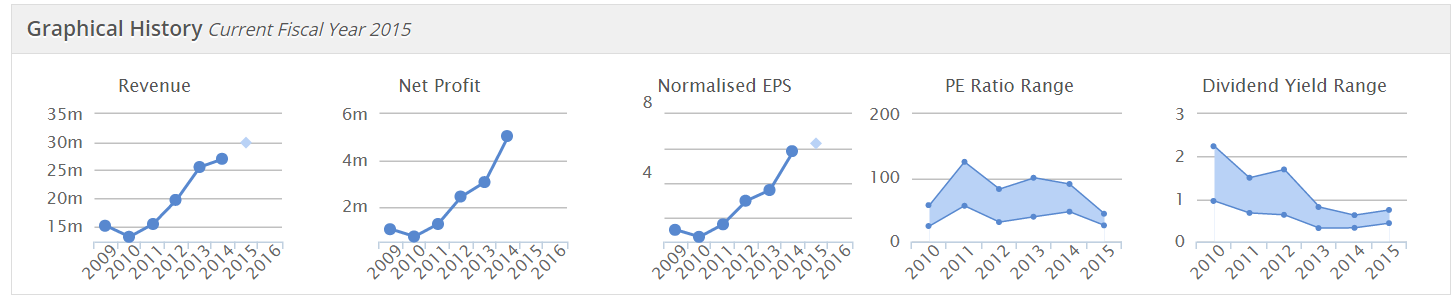

I've been very impressed with the historic performance of the company, as you can see from the usual Stockopedia graphics below. Note also that the PER used to be stratospheric, but has come down considerably - hardly surprising, given the problems in the oil sector at the moment;

There's no less than 32 pages of narrative with today's results, so I'm really struggling to motivate myself to read all of that. So just a quick review of the main numbers, and the outlook here.

Revenue up 5.6% to £28.5m

Operating profit down 4.9% to £5.0m (note the excellent profit margin of 17.6% - so this is a business with clear pricing power (its products are patented)

Profit before tax is up 10.5% to £5.9m, although that seems to have have benefited from a £352k gain on disposal, and a big jump in the "finance income" line (I have highlighted these items), plus a more favourable tax charge vs last year, see below;

Therefore it looks to me as if the improvement in basic EPS from 5.44p to 6.40p is mainly driven by the above factors, rather than by a real improvement in performance.

That said, remember this is an oil services company, and there is complete carnage in the sector, so to be reporting figures up on last year at all, is remarkable. If Plexus can trade like this when the sector is in chaos, then it strikes me they have something special.

Balance sheet - looks decent to me.

NAV is £38.5m, which drops to £24.5m once intangibles are written off, so still a sound position at the NTAV level.

The balance sheet was strengthened further post year-end with the issue of 4,468,537 new shares at 180p to Jereh International (A Chinese oil services group), as part of a licence agreement. Details here.

Overall, it's fine, nothing to worry about here.

Note however that profits are heavily assisted by the company capitalising £3.5m of development costs into intangible assets, which is markedly higher than the £454k amortisation charge - see note 7 to today's accounts.

Outlook - an extremely detailed outlook statement (probably the longest I've ever read!) can be edited down to these two key parts;

Notwithstanding our year on year growth and indeed record FY 2015 financial results, FY 2016 trading conditions are more challenging given the significant reduction in the oil price and related on-going economic pressures which surround the oil and gas industry and the support services underpinning it, and this cannot be ignored. This is especially the case in the UK North Sea which traditionally has been an important market for us...

For the reasons outlined in my statement, despite widely reported on-going challenges for the industry I am confident of Plexus' long term future prospects and our ability to deliver significant shareholder value from our patented POS-GRIP technology.

My opinion - how on earth do you value it? PER isn't particularly helpful, given that the company is serving a sector which is enduring a very low oil price - which must have some negative impact on Plexus.

Longer term, I think its products sound very exciting, and this could be a super-stock in the making, in my view. Once the oil price is stronger and exploration activity is increasing again, then who knows how rapidly revenue and earnings could rise here?

Overall, I think it's entirely possible that this share could drop more, maybe considerable more, who knows? But personally I'm happy to hold it for the long-term, as it's impossible to time the exact low, and I'm fairly convinced this company is a big potential winner in the long run. It seems to have something special in terms of technology, and that is evidence by existing growth & profits, and interesting collaboration deals focussed on China, and elsewhere.

Speculative to a certain extent, but a very interesting share for the long term, in my view.

No more time left today, so I have to leave it there.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in UTW & POS, and a short position in GBO. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are personal opinions only, and never recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.