Good morning!

Wolfson Microelectronics (LON:WLF)

This semiconductor maker has had a dismal few years, indeed it hasn't made a profit since 2008. I've been vaguely monitoring the shares for signs of a possible turnaround, as there can be exciting upside with this type of company if they develop new products that take off. Also it spends a remarkably high percentage of turnover on R&D, which can also be very positive.

Its Q1 results today look poor to me. However, of more importance is that an agreed cash takeover bid at 235p per share is also announced. So that's an instant 75% profit for shareholders, who have every right to be delighted at that outcome, given the poor performance of the company in recent years.

Utilitywise (LON:UTW)

It's moving out of my range now (I normally don't go much above £200m market cap, and this has reached nearly £243m at 335p per share), so this will probably be the last time I report on Utilitywise, the cost consultant for energy costs.

Very impressive interims are announced today, for the six months to 31 Jan 2014. Revenue is up 105% to £21m, and adjusted pre-tax profit is up 133% to £4.9m. Adjusted fully diluted EPS is 5.1p for the six months, so double that to annualise it (simplistically), and just over 10p per share. So a pretty racy PER of almost 33 times!

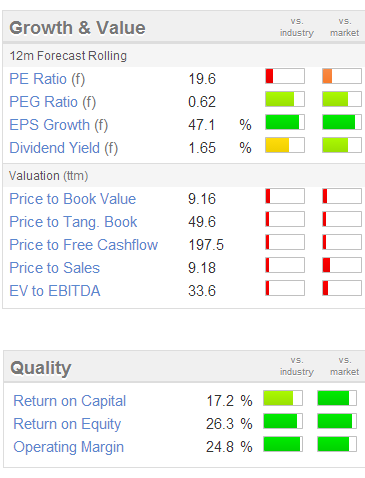

Although as you can see from the Stockopedia graphics on the right, the forecast PER drops to 19.6 allowing for future earnings growth (based on broker consensus forecasts). These graphics perfectly illustrate the high valuation, but strong earnings growth which has driven investors to give this share a high valuation.

Acquisitions have helped drive those numbers, but without acquisitions, like-for-like revenue still increased 65%, which is very impressive.

I'd be amazed if these profits are sustainable - it looks to me like a company that has found a sweet spot, but competitors will inevitably be drawn in by these bumper profit margins, one imagines. It might also be worth looking into their revenue recognition policy, as I note that there is a very unusual £11m in trade receivables shown in non-current assets, over and above £11.7m in trade receivables shown in current assets. That implies that some revenue (and hence profit) is being recognised more than 12-months in advance of the customers actually paying.

Note that cashflow is also poor, with a £5.4m operating cashflow for the six months to 31 Jan 2014 being more than consumed by a £6.8m increase in trade receivables. Ballooning debtors is without debt the worst possible red flag in any set of accounts, in my opinion. I am always very wary of any company that generates big profits, but has negative cashflow. The reason is that ballooning debtors can hide a multitude of sins, especially at rapid growth companies, and can often be a precursor to problems in the future with cash collection. I'm not suggesting anything is wrong here, just that it might be. So revenue recognition & ballooning debtors is certainly a red flag that needs investigating here.

That combined with the very high PER, means it is not one I would consider investing in. Mention also should be made of the bizarre Director share transactions. They offloaded huge amounts of shares at 75p and 100p (totalling over £27m!), yet more recently Directors have actually bought about nearly £4m of shares at much higher prices (204-260p). I cannot understand why Directors would be so keen to cash out on a huge scale at a quarter of the current price, and then be buyers at a much higher price. Although the main buyer had not previously been a seller.

Walker Greenbank (LON:WGB)

This is a luxury wallpaper company. So as you would expect, they are benefitting from improving economies in the UK and USA. Preliminary results for the year ended 31 Jan 2014 look good. Adjusted profit before tax is up 14.9% to £7.3m, on turnover up 3.6% to £78.4m.

Adjusted EPS is up 20.1% to 11.3p. Basic EPS was 8.63p. The adjusting factors are the LTIP accounting charge (which is presumably the charge for employee/Director share options), and the pension scheme charge. Arguably both of those are legitimate costs, since both are forms of employee remuneration, so I'd be more inclined to value the business on a multiple of say 15 times basic EPS of 8.63p. That arrives at a share price of just under 130p. The shares are actually 189p, which looks about 45% overvalued in my opinion.

Note that it had net funds of £1.5m at the year end. The pension fund deficit increased from £8.2m to £9.2m, so it's noteworthy that these deficits are not melting away yet, although that might happen once interest rates rise. Overall though the Balance Sheet is strong, and if you can live with the pension deficit then the rest of it is fine. Note that capex was heavy last year, with the bulk of £5.9m operating cashflow being spent on capex (£4.7m).

So it's a good company, but the share price is too high, in my opinion. I'd rather buy this type of share after a profit warning, when everyone hates it, rather than when it's priced for perfection.

Lidco (LON:LID)

This company makes medical monitoring equipment, and falls into the cetegory of taking years to reach critical mass, but potentially exciting because the consumables are high margin. They seem to have possibly reached the positive tipping point in the last year. Results for the year ended 31 Jan 2014 are published today, and show a move into madien profit of £0.28m, on turnover up 20% to £8.6m.

The improved performance seems to have been caused by more NHS hospitals adopting their products. Such adoption can be painfully slow, taking years to achieve, but once you're in, you're in, and that can mean lucrative recurring revenues.

The only way to value this comany would be to do some in depth research on likely sales growth. At 23.5p per share, the market cap is currently about £45m, which is clearly already anticipating a considerable further increase in sales & profits. Bear in mind operational gearing though - i.e. that with high gross profit margins, increased sales will drop a large amount through to the bottom line.

Note that the UK surgical disposables sold rose by a very impressive 59% to 23,570 units.

So what growth rate to expect in future is key. The other key research to find out, is what competitor products there are, and what patent protection Lidco has, and whether its products have any technical superiority, and how they compare on price, etc. I see that today's results say that they have strong patent protection, which is good.

The outlook sounds upbeat, concluding;

We believe that LiDCO monitors have the potential to become the 21st century standard for the fluid and hemodynamic monitoring of high-risk patient populations in hospitals and we expect 2014 to be another strong year of growth for the Company.

Overall, it's probably a bit too pricey for me, but it certainly looks one of the more credible growth companies that I've seen for a while. Maybe paying a bit more for the stock now that the business model has been proven, might be a better proposition than buying any number of more speculative, earlier stage AIM stocks? The other thing is that when you buy a small growth company which has just moved into profit, you usually don't have to worry about further dilutive fundraisings.

Dillistone (LON:DSG)

Dillistone is a small software group, specialising in the headhunter niche of the recruitment market. Results for the 12 months to 31 Dec 2013 have been issued today. The reporting cycle seems very slow - having to wait five months after the year end, is at least two months longer than I would like.

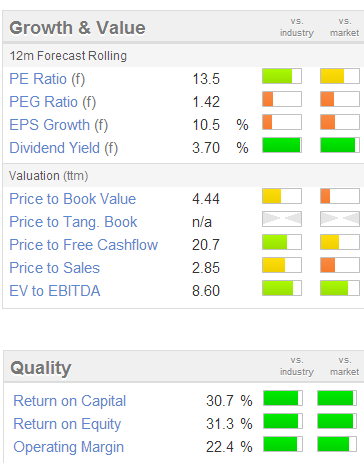

The figures look OK. Revenues are up 15% to £8.1m, of which 65% are recurring. Adjusted EPS rose 11% to 8.0p. The shares are currently down 4p to 110p at the time of writing, which puts them on a reasonable PER of 13.8 times 2013 adjuted EPS. The adjustments look sensible, being things like goodwill amortisation & changes in deferred consideration, which are non-trading items, so that's fine.

I like the dividend yield here. A total of 3.85p dividends pertain to 2013, which gives a healthy (and growing) yield of 3.5%. The company has been a consolidator in a fragmented space, and more of that is likely. The company has decided to invest more in product development, so that has resulted in a mild profit warning for the current year, where they say H1 profits are expected to be below the prior year period. It's sensible to manage expectations down now, and with only a 4p share price drop today, the market has taken this is its stride.

Note also that the full year outlook is more positive;

However, taking the year as a whole, the Group expects to make positive progress in 2014, the scale of which will become clearer as the year evolves.

Management here struck me as straightforward and competent, at a meeting last year. Also I found some user groups online, where recruitment consultants were discussing various software, and the Dillistone product had overwhelmingly positive user feedback.

Overall, I like the mix of reasonable valuation, good dividend yield, continued product development, and occasional bolt on acquisitions here.

It's not the most exciting share out there, but I am happy with a small quantity being tucked away in my long term portfolio. DYOR as usual.

There's probably not any immediate upside on the shares, but over a number of years I hope for steady capital appreciation, as well as attractive dividends.

EDIT: Note that Dillistone are organising a results Webinar today at 3pm, for anyone interested in hearing more about the company from the horses' mouths. Details below. I am very keen on Webinars, as they are a highly efficient way of virtually meeting management, without all the hassle & time of travelling into London

M Winkworth (LON:WINK)

This is a small, high end estate agent mainly focussed on London. They are making bumper profits, as you would expect, from a London property market that detached from reality a long time ago, and is now in the realms of fantasy.

Audited figures for 2013 are published today, and show turnover up 15% to £4.94m, and profit before tax of £1.7m. That gives basic EPS of 10.05p (up 69% on 2012). Who knows how long the party will last, but at 158p the shares are on a PER of 15.7 times, which doesn't strike me as a bargain.

It has paid decent divis since 2010, with 5.39p being forecast for this year, giving a forecast yield of 3.4% based on a 158p share price.

Incidentally, if you haven't seen it, there is a hilarious fly on the wall series on BBC2 at the moment about estate agents, called "Under Offer". Highly recommended. The MD of Beauchamp Estates is featured in it, and is, errrr, quite a character!!

incadea (LON:INCA)

This is a software company, serving over 2,400 car dealerships in 87 countries. The headline bullet points look strong, with revenue up 23% to E36m, and a focus on EBITDA. However, they capitalise a lot of development spend, so EBITDA is meaningless.

Looking at the proper figures on the P&L itself, operating profit actually fell, from E4.5m in 2012 to E3.9m in 2013. Exchange differences of E433k are the main factor for the increased finance charge of E705k. The cashflow statement shows that they capitalised E3.1m in development costs. The Balance Sheet looks OK, with year end cash offsetting almost all of the bank debt.

The narrative talks a lot about growth, and it sounds like an ambitious company. I'm not really sure how to value it. Based on these historic figures, it doesn't jump out at me as being good value. The market cap is £65m at 108p per share. Note that revenues in Russia dropped by about two thirds in 2013, which is said to be due to deferral of contract roll-outs with BMW. Maybe revenues are lumpy from licences? I think it would need a lot more research to properly understand this company, and assess its prospects.

Christie (LON:CTG)

This is a services provider to the retail, leisure, and care sectors. They do things like stock-taking, valuation, surveying, etc. This business has always looked pretty marginal to me, eking out a small profit in good years.

The company has put out a positive trading statement today, so maybe it's worth another look?

As a consequence, results for the first half will be positive (2013 £300k loss). Assuming no materially adverse economic changes or political unrest in our core markets, the Board believes that results for the year to 31 December 2014 will be substantially ahead of the current market forecast.

Stockopedia shows 2014 forecast turnover of £57.2m, and a £0.9m underlying profit, or 5.6p normalised EPS. So perhaps they might be heading towards nearer 10p EPS? The shares are up 15% to 113p today, so that suggests a PER of around 11 perhaps, which is probably about right.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in DSG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.