Good morning!

Hopefully a relaxing long weekend was had by all. The very changeable, and at times stormy weather over Easter won't have helped clothing retailers - as footfall on the High Street tends to be lower when the weather is inclement.

Although things are not so straightforward now, as retailers also sell online - in some cases it's a highly significant part of overall sales. So quieter shops may at least be partially offset by busier websites. The pure play online retailers, such as ASOS (LON:ASC) and Boohoo.Com (LON:BOO) should do considerably better when the weather hurts physical stores.

I have to say though, the best retailers tend to do well, whatever the weather. It's often used as an excuse by retailers who don't want to admit, even to themselves, that their products are not up to scratch.

Also, bear in mind that a lot of retailers' shares have already dropped a considerable amount - e.g. look at Next (LON:NXT) (in which I hold a long position) which is down 30% since December. Has the business really fallen in value by 30% in 4 months? I don't think so.

Similarly with Sports Direct (LON:SPD) (in which I also currently hold a long position) which has dropped a considerable amount as a result of various problems. However, as with Next, it's still a hugely cash generative business, and maybe "Mad Mike" is happy for there to be as much gloom as possible, in order to buy it back on the cheap? Of course I'm just speculating, but stranger things have happened.

So I think bombed-out retail shares are a good place to go hunting for value, and divis, at the moment. The macro picture is positive for consumer spending, with Living Wage, and pension drawdowns injecting progressively more cash into the pockets of consumers (although offset with cuts to state benefits).

Spaceandpeople (LON:SAL)

Share price: 60p (unchanged today)

No. shares: 19.5m

Market cap: £11.7m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - no surprises today, as the results for 2015 published today are consistent with the update given by the company on 1 Feb 2016, which I reported on here.

Revenue fell from £15.4m in 2014, to £13.8m in 2015 - mainly due to a large one-off (but low margin) contract in one division during 2014. Doesn't really matter - as an investor, I'm interested in profits, not revenues.

Operating profit (before non-recurring costs) fell a little from £1,135k to £1,089k, but it's in the same ballpark, and in line with expectations, so that's fine.

Note that there were no non-recurring costs this year, which is pleasing. So after non-recurring costs, operating profit actually rose from £744k to £1,089k.

EPS - initially I couldn't understand why basic EPS (before non-recurring costs) had risen from 3.91p in 2014, to 4.26p in 2015, when operating profit had fallen slightly. The penny has just dropped - it's due to minority interests being much smaller in 2015 than in 2014 - so the profit in 2015 was mainly earned in subsidiaries which are 100% owned by SAL. This is positive for SAL shareholders, so don't worry too much about understanding this point if you're a non-accountant!

Valuation - at 60p share price, and EPS of 4.26p, the PER is 14.1 - expensive? Not really, as PER is a blunt instrument at small caps where profits move about a lot. For various reasons, there should be good upside on earnings over the coming 2 years, so the market price is factoring in expectations of earnings rising from the low point of the last 2 years, after numerous problems hit the company in 2014. It is gradually recovering from those issues.

Cashflow - this was poor in 2015, with the culprit being a large reduction in creditors, from £5.8m to £4.5m. I queried this point with the FD this morning, who indicated that it was just timing differences - creditors had been stretched in 2014, but have returned to normal in 2015.

This is the big problem with balance sheets (and hence cashflow) - it's a snapshot on a particular day, so timing differences can greatly skew the year end figures. This is fine for one year, but I'll be looking closely to make sure that operating cashflow returns to normal in 2016.

Note that capex has increased to £690k, financed by an increase in bank loans of £500k. This is mainly for the expansion of the successful new MPKs (mobile promotional kiosks), of which there are now 56 operating. These are high margin additional sales, so it's good that growth is being achieved here.

Dividends - this company likes paying divis, and it's important to note that throughout a difficult patch in the last 2 years, the company continued to pay (reduced) divis. I like that. There is no interim divi, just a final divi each year, because the bulk of profits come from Xmas trade.

The divi has been raised from 2p to 2.2p. The trajectory of divis should continue to be upwards. Note that the divi peaked at 4.1p in 2013.

Admin costs - the company has demonstrated over the last 2 years that it can & does reduce costs if trading becomes difficult. This is important, as a variable cost base means that profit can be protected, or at least re-built after a time lag, if trade deteriorates.

Outlook - the company is making cautiously optimistic noises about 2016. Remember that management got badly burned by putting out overly-optimistic guidance in 2014, when a lot of things unexpectedly went wrong. So they're now much more cautious with outlook. Forecasts should therefore be exceeded in future, or met even if things go wrong.

The development of the MPK programme and the focus on product solutions as opposed to service solutions to UK and French venues in particular will be the key driver in 2016. The venues teams in Germany, UK and France have specific targets for rolling out MPKs and pop up retail solutions this year and this should make up the loss of the Whiterose Shopping Centre RMU contract. Although 2016 will see modest growth in profitability, the behind the scenes transformations the group is making will reposition and strengthen our offer which we believe will result in a more sustainable and growing business.

There are 4 key drivers of future growth, namely;

- Network Rail contract - which has started well, but should kick in meaningfully from mid-2016 onwards.

- Mobile Promotional Kiosk continued roll-out of this new, successful, and high margin kiosk design.

- French pilot operations - currently this is loss-making, but not huge numbers (c.£100k p.a.), but should generate profits from 2017 onwards.

- British Land contract win - takes time to get up & running, so again is expected to be a profit driver more in 2017 than 2016.

Brokers are forecasting an increase in profit from £1.0m to £1.3m for 2016, but the idea is that the bar is set low, so that hopefully the company can exceed this.

My opinion - I'm happy to hold for another year. The company is recovering well from numerous problems in 2014. Indeed, the UK business is actually doing really well - if you look at note 4 of today's account for the divisional split, Germany's profits have collapsed from £586k in 2014, to just £99k in 2015. Yet that shortfall has been almost entirely recouped by a much stronger performance from its UK operations.

It's an interesting niche business, has a good track record on dividend payments, and there are 4 clear growth drivers as noted above. Therefore my feeling is that we could be looking at a significantly more profitable group in say 2 years' time.

It takes time for the market to forgive and forget profit warnings, but at some point I think the market will focus more on the growth potential coming through, and possibly re-rate the shares back up to nearer 100p, than the current level of 60p. That's not going to happen overnight obviously (unless someone bids for it, which is very unlikely), but it's good potential upside, providing nothing major goes wrong in the meantime.

Management are doing a webinar for investors tomorrow (30 Mar 2016) at 1:15pm, you can register by clicking here.

I like the fact that management here are well aligned with shareholders, in that a considerable portion of the company (c.20%, from memory?) is owned by Directors & staff. The CEO also mentioned to me in 2014 that he'd taken the profit warning particularly hard, because so many of his friends & family are shareholders. Therefore we certainly have management which is highly motivated to get things back on track, both financially and as a matter of pride & personal reputation in their social circles. That's clearly a positive thing in my view.

Quartix Holdings (LON:QTX)

Share price: 372p (down 5.1% today)

No. shares: 47.3m

Market cap: £176.0m

AGM statement - an in line update today;

Quartix Holdings plc, a leading supplier of subscription-based vehicle tracking systems, software and services, announces a trading update to coincide with its Annual General Meeting this morning.

The Board is pleased to report that trading for the two month period to 29 February 2016 has been in line to deliver management's expectations for the full year.

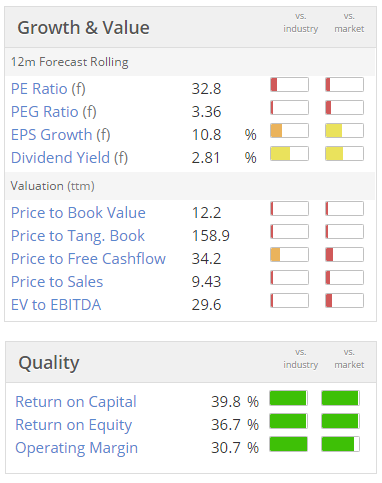

That's fine, but this share is on such a rich rating, that being in line may not be enough - the market may need ahead of expectations updates to sustain the current forward PER of over 30.

Broker consensus is for 11.6p EPS this year, up 10.5% on 2015. That's not enough earnings growth to justify a PER of 32 times, in my view. Perhaps investors expect earnings growth to accelerate in future years beyond 2016, I don't know?

It looks to me like a very nice company, but one whose share price has perhaps run away with itself on momentum, and hence personally I'd be banking profits at 372p, if I held at this level.

Note that the Stockopedia graphics instantly show you the high quality scores, but the very high valuation too;

Hayward Tyler (LON:HAYT)

Share price: 85p (unchanged today)

No. shares: 55.4m

Market cap: £47.1m

Property sale & leaseback - the freehold site of a recently acquired subsidiary is being put through a sale & leaseback, to raise cash;

Under the agreement, HPL has acquired the property for £7.5 million with Peter Brotherhood Ltd as the tenant and Hayward Tyler as the guarantor. Peter Brotherhood Ltd has signed a 15 year lease with a market rent of £575,000 per annum and subject to market reviews after 5 and 10 years. Hayward Tyler will prepay senior borrowings saving estimated interest costs of approximately £250,000 on an annual basis as a result of the sale and leaseback.

This is a bizarre explanation, as incurring annual rent of £575k p.a. is clearly a backward step, if it's only saving you £250k p.a. in interest! So why have they done it? Sale & leaseback is usually a move undertaken by businesses that are under financial pressure.

The reasons given are;

"We believe this transaction provides an excellent mechanism through which to further strengthen our balance sheet following the acquisition of Peter Brotherhood for £9.8 million last October. This agreement, combined with the additional revenues that Peter Brotherhood brings to the Group, further underlines the value of the acquisition to Hayward Tyler as we continue to develop our presence in the power generation, oil & gas, and industrial sectors."

Except that it's not really strengthening the balance sheet, but just effectively replacing cheap debt with more expensive quasi-debt (i.e. a property lease). Bear in mind that the rent will probably be going up too in the future, due to upward-only 5-yearly rent reviews.

Perhaps the company wants to free up its bank facilities to use for something else? Or perhaps the company just wanted to de-risk things? After all, normal bank facilities can be withdrawn, if covenants are breached. However, off balance sheet funding through property leases cannot be withdrawn. You have to pay the rent to retain the use of the property, but providing you pay the rent, then you're completely safe.

I think the company has not given an adequate explanation for why it has done this deal. Perhaps it was always the intention to use the acquired freehold property in this way? If any readers know more about this situation than me, then please feel welcome to post a comment in the comments, below.

EDIT: FinnCap make this comment today;

...The transaction had been flagged as a possibility at the time of the acquisition of Peter Brotherhood last October.

Reading the rest of their comments, the main motivation seems to be to de-risk the balance sheet, which I mused about above. So it will reduce profits by about £0.3m p.a., but makes the balance sheet less risky.

It's very quiet for results/trading updates today, so there's nothing else of interest in my universe of stocks. Therefore I'll sign off for the day.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.