Hi everyone - I'm planning to look at Game Digital (LON:GMD), Ab Dynamics (LON:ABDP) and Alliance Pharma (LON:APH) today.

Regards

Graham

Game Digital (LON:GMD)

Share price: 42.5p (+7%)

No. shares: 170.9m

Market cap: £73m

I was tempted to buy some of these today, as net cash is now £69 million, very near to the market cap even after a 7% increase in the share price.

However, I resisted the temptation, and will stay on the sidelines for the moment.

It's definitely an unusual situation, though: a large retailer which is still profitable and priced only a little over its net cash balance! (Edit: it also pays a dividend!)

And I did not expect the share price to get so low, so quickly - it is barely 20% the level it was at in December 2015.

It previously traded under the "GAME" ticker, and left shareholders with nothing when it went into administration in 2012.

It IPO'd again two years later with half the number of UK stores it had previously, and with no international operations outside Spain.

But sentiment has soured once again as investors are concerned that games will in the future be downloaded and/or streamed, making physical distributors irrelevant.

I think that's a bit overblown, since there are console sales and gifts for children, etc. where physical stores serve a purpose.

But there is no denying that Game will continue to face changes beyond its control.

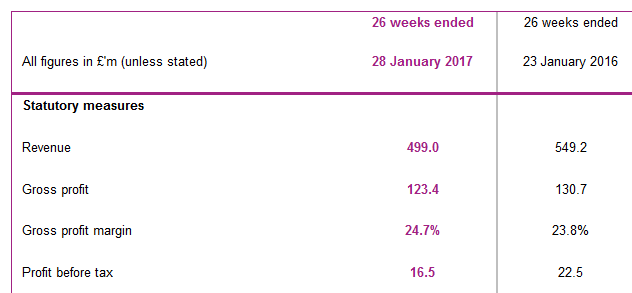

Results: A decent set of profit numbers, given the declining top line:

Note that Christmas sales are crucial and the spring/summer months then become very quiet. Last year, the PBT result for the full year was just £5 million.

Lease length: The average lease length of UK stores is 1.2 years, while the average lease length in Spain (where Game also has nearly 300 stores) is just 1 year.

That seems incredibly low, and perhaps means that the risk of investing here is not so great as it looks at first glance. If trading continued to deteriorate, perhaps the estate could be halved again, but without entering administration this time?

Outlook: A decent outlook statement. Management appear to be suggesting that the sales trend has turned the corner, at least in the short term:

The Group expects to deliver continued growth from digital and other new retail categories in the second half, as well as across Events, Esports and Digital, with these business areas delivering a growing contribution to Group gross profit. Furthermore, we currently anticipate an overall positive sales performance for the second half with the sales of Nintendo SwitchTM, together with our other sales initiatives to offset the declines expected in Xbox and PlayStation console markets.

My opinion: I'd like to continue researching this. Even if it's high-risk, maybe the potential upside is sufficiently large that it could be worth taking a small stake.

Ab Dynamics (LON:ABDP)

Share price: 612.5p (+2%)

No. shares: 19m

Market cap: £117m

Fairly simple update: revenue and adjusted operating profits for H1 are ahead of last year and in line with management expectations.

CEO comment:

"We have once again delivered excellent performance with a good pipeline of orders to take us into the next financial year. Our new HQ will enable us to reorganise our production and facilitate further growth."

This rapidly growing motor testing company had an oversubscribed placing and open offer in December, and raised £6.4 million.

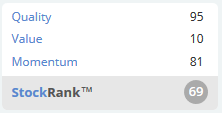

It scores really well on quality and looks set to ramp up its activities with the opening of its new factory HQ this year, plus investment in its international centres using fundraising proceeds.

Considering the direction it's going in, I don't see why any long-term investors would want to sell out of it at this juncture! Opening a new position at this level is a bit harder to justify, since it's obviously quite highly-rated now. But true high-quality stocks are few and far between, so it might be worth a closer look.

Alliance Pharma (LON:APH)

Share price: 47.625p (-0.3%)

No. shares: 472.7m

Market cap: £225m

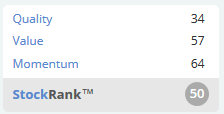

Pharmaceuticals aren't my specialism but this has a reasonable market cap for inclusion in this report, so I'm happy to cover it by request.

Revenues have now doubled at Alliance thanks to the December 2015 acquisition of products from Sinclair Pharma for £127.5 million.

EBITDA, PBT and free cash flow have all at least doubled, too (free cash flow up by 110%, to £13 million).

Alliance doesn't do its own R&D. Instead, it buys up rights from other companies, and then markets and distributes them.

The strategy appears to work well. Profitability has been sustained and on a broadly upward trajectory for approaching ten years, culminating in this transformational deal.

Diversification

The portfolio includes over 90 products, and only one of these is worth over £10 million in sales. So it looks very well diversified, and should not be too risky in the short-term. 70 of the products are said to deliver "stable and reliable sales without any significant promotional expenditure", mostly being prescription medicines which are "engrained into prescribing practice".

Gross margin is excellent at 56%, as you would hope for in this industry. 55-60% is the target range (59% was achieved last year).

Net debt finished the year at £76 million, and I do see a cause for potential concern here. The adjusted net debt/EBTIDA leverage ratio was 2.8x, which the company says is "comfortably below our banking covenant of 3.0 times".

93% utilisation of the banking covenant isn't normally comfortable to me! I guess Alliance must have a lot of confidence in the predictability of their revenue stream, which might well be justified:

We expect net debt and leverage to progressively reduce during 2017 driven by the Group's strong cash generation, including utilising our surplus US Dollar position, to service debt repayments.

In addition to this, £5 million will be paid from Sinclair to compensate Alliance for unexpectedly poor trading from one of the acquired products, and these payments have been earmarked for reduction in the bank loans.

So the debt is a bit too high for comfort right now, in my opinion, but will hopefully be back at a reasonable level soon.

My opinion

I don't usually have the confidence to invest in pharma, since the R&D and regulatory approval processes are too difficult for me to predict. But since Alliance don't do their own R&D, and are well-diversified, the risks could be manageable.

This is all I have time for today - thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.