Good morning!

Flybe (LON:FLYB)

This is an interesting turnaround situation, although the Balance Sheet is not good, so it should be seen as high risk. Most of their cash is restricted, which from memory relates to deposits required by the debit/credit card merchant processing banks. There is also rather a lot of bank debt, although that is just to finance aircraft - the 2012/13 Annual Report shows in note 15 that of fixed assets totalling £165.4m, £140.4m relates to aircraft. Therefore the most recently reported net debt of £34m (at 30 Sep 2013) isn't too bad at all really, although the £45.1m restricted cash refered to above is included within that, so net debt rises to £79.1m if you adjust for that.

Net tangible assets was last reported at £36.9m, so at least that's positive. The current assets:current liabilities ratio is weak, at 72.5%, but if you take into account that, in common with nearly all travel companies, the business is funded through up-front deposits paid by customers, then a weak liquidity position can just keep rolling indefinitely - providing the aircraft can continue flying. The nightmare scenario for airlines is if there is an extended suspension of flying, e.g. if Iceland's dust cloud happens again, in which case they would be at the mercy of the goodwill of the bank manager as cash deposits unwound with no associated revenues coming in.

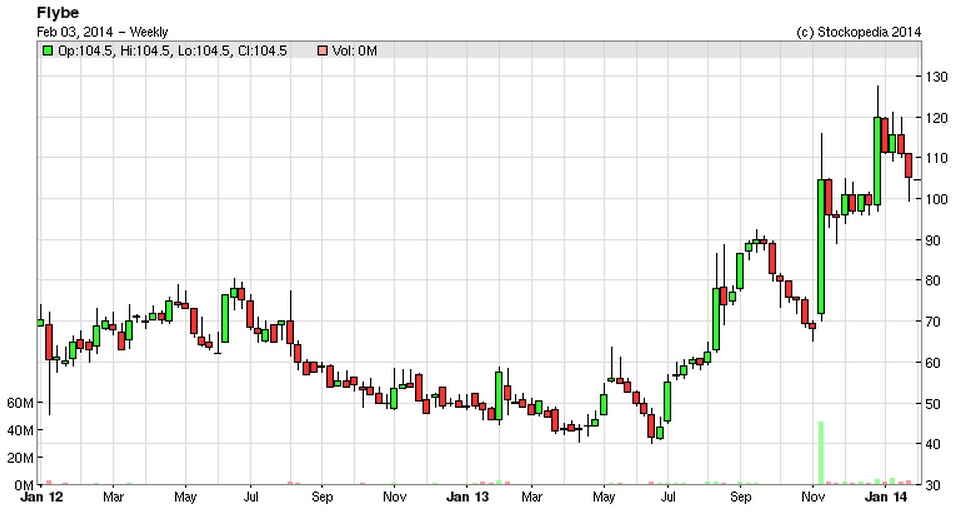

As you can see from the two year chart below, Flybe shares have been strong performers recently, this is on the back of new management (who have previous experience at EasyJet apparently) doing drastic cost-cutting in order to restore profitability.

Although it's higher risk than I usually consider, and this sector can be a nightmare for investors, someone persuaded me to take a small punt on these shares recently at 103p (Tweeted at the time). This morning's Q3 trading statement sounds pretty encouraging - which they say was in line with overall management expecations. They (i.e. management) seem to have stripped out an awful lot of costs, including 450 staff.

At about 105p per share the market cap is £79m, which looks low for a business that is forecast to deliver turnover of £619m this year (to 31 Mar 2014) and £503m next year, moving back into profit. Broker forecasts are for 2.37p this year, and 8.78p next year. So a PER of just under 12 based on next year's figures looks about right. However, if they get their profit margins up to anywhere near EasyJet (approaching 10% of turnover), then the share price would be multiples of the current level in my opinion.

Seeing as Flybe's new management come from Easyjet, then they already know how it's done. So quite an interesting, albeit speculative, situation in my view. As usual, it's essential to DYOR, and to consider the risks, which are always high with airlines (so many moving parts, such as fuel cost, safety, etc). Personally I make it a golden rule to only ever invest smallish amounts in higher risk situations, so that if something dreadful does happen, the losses don't really do much damage to my portfolio overall.

Sepura (LON:SEPU)

This company is a specialist radio maker, e.g. for the emergency services. A trading update today says;

Trading remains seasonally weighted to the second half of the year and the Group is seeing continued robust demand in the current quarter. This gives the Group confidence that it is on track to meet expectations for the full year ...

Sepura has a 29 March year end, so by this stage the full year figures should be pretty much in the bag. Note that the company reports in Euros, so converting broker consensus into sterling gives just over 7p this year, and about 8.1p next year. So at 133p the shares are on respective PERs of 19 and 16.4, which looks fully priced to me.

The dividend yield is unattractive, at forecast 1.3%. So I can't see anything exciting about these shares, unless you think there is strong growth in the pipeline which is not reflected in broker forecasts?

Creston (LON:CRE)

I can't make my mind up about this company. It's a marketing & PR group, with a focus on digital (obviously an area of growth). Let's see if their IMS this morning (covering the period from 1 Oct 2013 to date) helps clarify the outlook. It's a 31 March year end, so they are reporting on their Q3 period.

There are various details, but the key sentence says;

The Board is comfortable that the full year results will be in line with market expectations.

Sounds alright. Although this company reports in a way which I find opaque, as they present so many different versions of profitability, adjusting for this that & the other, that it ends up in a confusing jumble in my head. So if you're not really sure which figures represent the most reliable indicator of true performance, how can you value it?

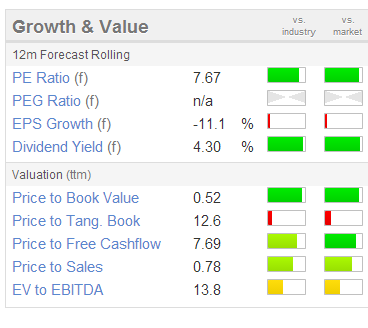

Having said that, if you accept the company & broker definitions of adjusted profit, then it looks cheap on a forward PER of 7.67, and with a decent dividend yield of 4.3% too (see right for Stockopedia graphic).

Having said that, if you accept the company & broker definitions of adjusted profit, then it looks cheap on a forward PER of 7.67, and with a decent dividend yield of 4.3% too (see right for Stockopedia graphic).

The company boosted its cash position by taking a large reverse premium from their landlord, which is expedient in the short term, but has to be paid back in the longer term through higher rental cash outflows. In my experience rental deals that are done to boost short term cash, usually end up having a nasty sting in the tail.

It will be interesting to see how new management develops this company. It's pretty high on my watch list, but on balance I probably want to see the next set of results in detail before taking the plunge here again. Although I have found it's a share that can be successfully traded by buying around 80p, and then banking a 20-25% gain within a few weeks, which I've done a couple of times in the last year.

Their outlook comments seem a bit tentative, which is surprising given that the economy is meant to be recovering strongly;

We remain cautious with regard to the ongoing impact of the volatility in some of our clients' marketing budgets but are reassured by the successful pitching for new business in the Period and by the outlook captured in yet another positive recent IPA Bellwether report in terms of increased marketing spend.

Investor Forum Tomorrow

Just to let you know that there is an interesting-sounding event tomorrow, Tue 4 Feb, being held at the Islington Design Centre, organised by Cenoks & Shares magazine. There are loads of growth companies presenting there, and for once it's not the boring junior resource sector companies that usually populate these events, with tumbleweed rolling past their stands!

I shall try to pop along, as this type of event provides valuable access to company management, which personally I find useful.

The event is now closed for tickets, but after making enquiries via Twitter, I have secured VIP entry (which is exactly the same as normal entry, technically!) for readers of this report - you can book yourselves in to attend by emailing the organiser.

Murgitroyd (LON:MUR)

European Patent & Trade Mark attorneys, Murgitroyd announces it interim results for the six months to 30 Nov 2013. Turnover is up 9% to £19.2m, but profit is only up 1% to £2.3m. Basic EPS is a whisker down at 18.6p. The interim dividend has been held at 3.75p, so that's covered 5 times by earnings, which seems a lot - if I were a shareholder, I'd be pushing for a more generous divi.

The Chairman's comments mention a price sensitive marketplace, which is a bit concerning - are profits going to come under increasing pressure from competition?

Broker forecasts are for 38.3p EPS this year (ending 31 May 2014), and 40.6p EPS next year, so at 645p the shares are priced on PERs of 16.8, and 15.9 respectively. That's too high a price for me. This type of business would only interest me at a PER of about 12-13, and even then only if it paid a 4-5% dividend yield, as opposed to the 2% it actually pays. I don't really see the logic for the move from 500p to 645p in the last two months, unless there is something I've missed.

The outlook statement says that current trading is in line with market expectations.

Michelmersh Brick Holdings (LON:MBH)

This company today issues a trading update for 2013, saying that Q4 was strong, and they therefore expect to report a profit for 2013. Errr, OK. Making a profit is basically the whole point of being in business, so that's not massively reassuring! How much is profit going to be? They don't say.

The company reiterates the fairly obvious point that net debt has come down significantly, after a £9.6m Placing in Nov 2013.

Anpario (LON:ANP)

Also updating on trading for calendar 2013, is Anpario, a natural feeds additive business. It says that the year has produced results in line with market expectations.

It also mentions strong sales growth. There was no debt, and cash of £4.8m at the end of 2013.

The outlook statement sounds good;

The Company is greatly encouraged by the number of new opportunities opening up in existing and new markets as customers become increasingly aware of the performance enhancing value of Anpario’s product portfolio. Customers recognise the benefit of Anpario’s natural products that are increasingly replacing the traditional use of antibiotics. The Company’s investment in developing its product ranges backed by experienced sales teams has placed it in a strong position to maintain its growth record.

The share price got well ahead of itself in recent months, and has corrected back down sharply of late. Although it's still not cheap. Broker consensus forecast for 2013 is 12.6p EPS, which they have just confirmed being in line with, so at 261p it's priced on a pretty aggressive multiple of 20.7 times 2013 earnings.

2014 EPS forecast is for a modest increase to 13.6p (for a PER of 19.2), which personally I don't find an attractive valuation at all. There would need to be considerably faster growth to justify this price in my view, but maybe holders of the shares believe that the company will outperform current forecasts? It might well do - the outlook statement certainly sounds interesting.

I reviewed their interim results here, and liked the look of the company at 197p, but didn't buy any unfortunately. I'm not minded to chase it up in price at 261p now, so will put it on the watch list, and perhaps might revisit it if the valuation comes down to a more modest level of say 15 times earnings, which looks about right to me, which would equate to about the 200p level.

All done for today, see you as usual tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.